California Issuer - Underwriter - Oriented Sample Stored Value Product Agreement and Disclosures

Description

How to fill out Issuer - Underwriter - Oriented Sample Stored Value Product Agreement And Disclosures?

If you wish to full, obtain, or printing authorized file themes, use US Legal Forms, the largest selection of authorized types, which can be found on the web. Make use of the site`s easy and practical search to obtain the paperwork you require. Numerous themes for company and individual functions are categorized by groups and states, or key phrases. Use US Legal Forms to obtain the California Issuer - Underwriter - Oriented Sample Stored Value Product Agreement and Disclosures within a couple of mouse clicks.

When you are previously a US Legal Forms buyer, log in to the accounts and then click the Acquire key to have the California Issuer - Underwriter - Oriented Sample Stored Value Product Agreement and Disclosures. You can even gain access to types you in the past saved from the My Forms tab of your own accounts.

If you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Make sure you have chosen the shape for your proper metropolis/country.

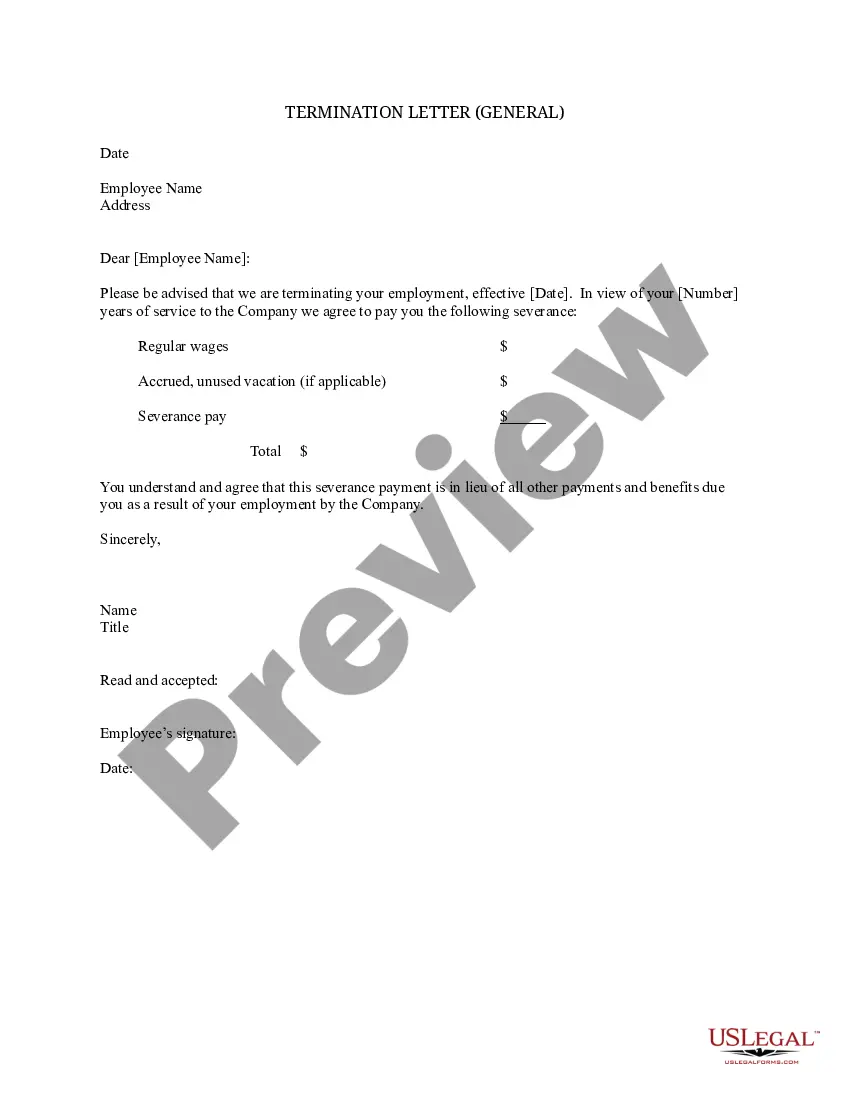

- Step 2. Use the Review choice to examine the form`s content material. Do not overlook to read the information.

- Step 3. When you are unsatisfied using the form, utilize the Lookup industry at the top of the screen to locate other versions in the authorized form web template.

- Step 4. Upon having located the shape you require, click the Get now key. Opt for the prices strategy you favor and add your accreditations to sign up for an accounts.

- Step 5. Method the transaction. You can utilize your charge card or PayPal accounts to complete the transaction.

- Step 6. Choose the format in the authorized form and obtain it on your gadget.

- Step 7. Full, edit and printing or sign the California Issuer - Underwriter - Oriented Sample Stored Value Product Agreement and Disclosures.

Every single authorized file web template you buy is your own property for a long time. You possess acces to every form you saved with your acccount. Click the My Forms segment and decide on a form to printing or obtain again.

Contend and obtain, and printing the California Issuer - Underwriter - Oriented Sample Stored Value Product Agreement and Disclosures with US Legal Forms. There are thousands of skilled and status-specific types you may use for the company or individual requirements.