California Letter to Debt Collector - Only Contact My Attorney

Description

How to fill out Letter To Debt Collector - Only Contact My Attorney?

Have you been inside a place the place you need papers for sometimes business or personal functions virtually every day time? There are a lot of authorized file layouts available on the Internet, but finding versions you can rely is not easy. US Legal Forms gives a huge number of type layouts, such as the California Letter to Debt Collector - Only Contact My Attorney, which can be written to satisfy federal and state specifications.

Should you be previously familiar with US Legal Forms site and get a free account, simply log in. Afterward, you may acquire the California Letter to Debt Collector - Only Contact My Attorney design.

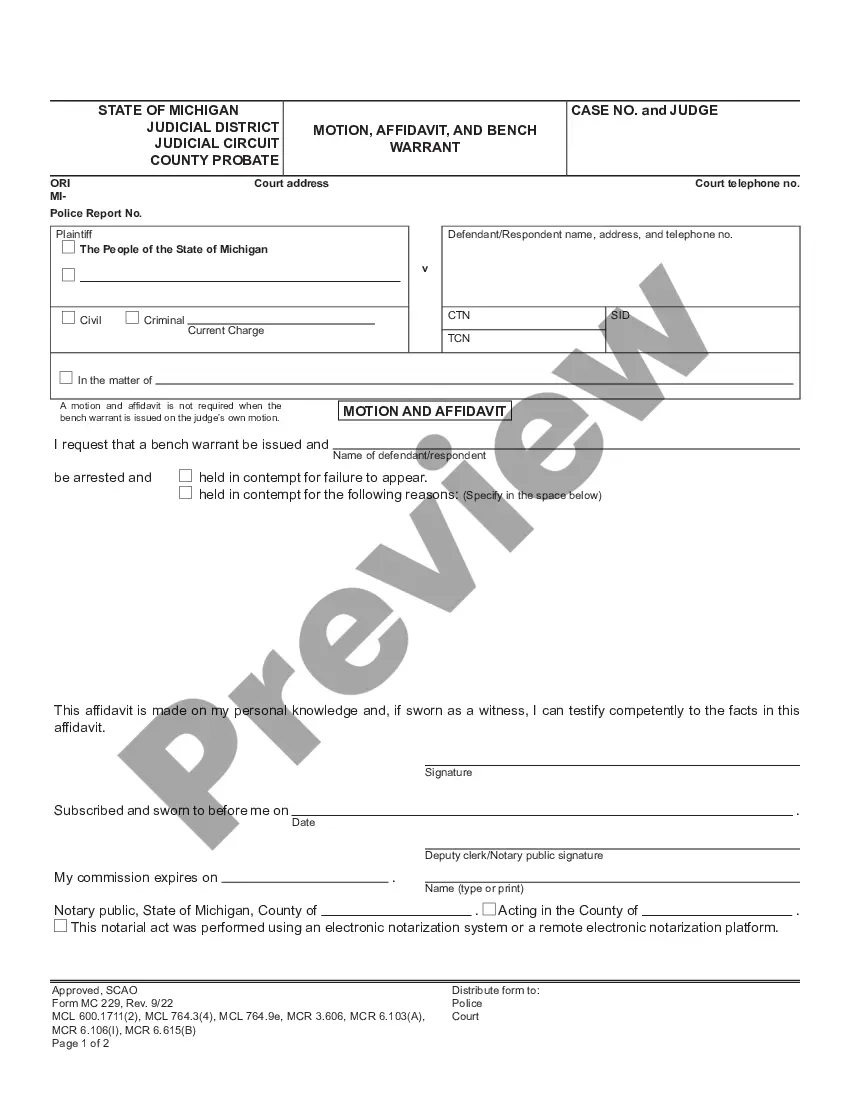

Unless you provide an bank account and want to begin to use US Legal Forms, follow these steps:

- Discover the type you require and make sure it is for that right town/county.

- Utilize the Review button to check the form.

- Look at the outline to actually have selected the appropriate type.

- In case the type is not what you`re searching for, take advantage of the Lookup discipline to find the type that meets your requirements and specifications.

- When you get the right type, click Buy now.

- Opt for the costs strategy you would like, complete the desired details to produce your bank account, and pay money for the order with your PayPal or bank card.

- Choose a hassle-free document structure and acquire your version.

Find all of the file layouts you might have bought in the My Forms food list. You can obtain a further version of California Letter to Debt Collector - Only Contact My Attorney at any time, if necessary. Just click the required type to acquire or produce the file design.

Use US Legal Forms, the most substantial selection of authorized kinds, to conserve some time and prevent faults. The support gives professionally created authorized file layouts which you can use for a selection of functions. Generate a free account on US Legal Forms and commence creating your way of life a little easier.

Form popularity

FAQ

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

To further establish as evidence the date and fact that you sent the debt collector a DV letter, it's a good idea to have someone else mail your DV letter along with an "Affidavit of Mailing". This signed and notarized affidavit by a third party will firmly establish your evidence of mailing the DV letter.

While debt validation requests can be a useful tool, they are not effective at resolving the issue. In most cases, creditors and collection agencies are able to provide the necessary documentation to prove the validity of the debt.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

Request to Validate Medical Debt Please provide breakdown of fees including any collection costs and medical charges. Provide a copy of my signature with the provider of service to release my medical information to you. Cease any credit bureau reporting until the debt has been validated by me.

If you're not sure that the debt is yours, write the debt collector and dispute the debt or ask for more information. If the debt is yours, don't worry. Decide on the total amount you are willing to pay to settle the entire debt and negotiate with the debt collector for the rest to be forgiven.

Although you can ask for many details, debt collectors are only required to provide information on the original creditor, the balance owed and the name of the person who owes the debt before resuming collection efforts.

California Coerced Debt: California SB 975, for debts incurred after July 1, 2023, requires a collector to cease collection until it completes a review when the debtor provides documentation and a sworn statement that the debt was coerced. A person who coerces a debt is civilly liable.