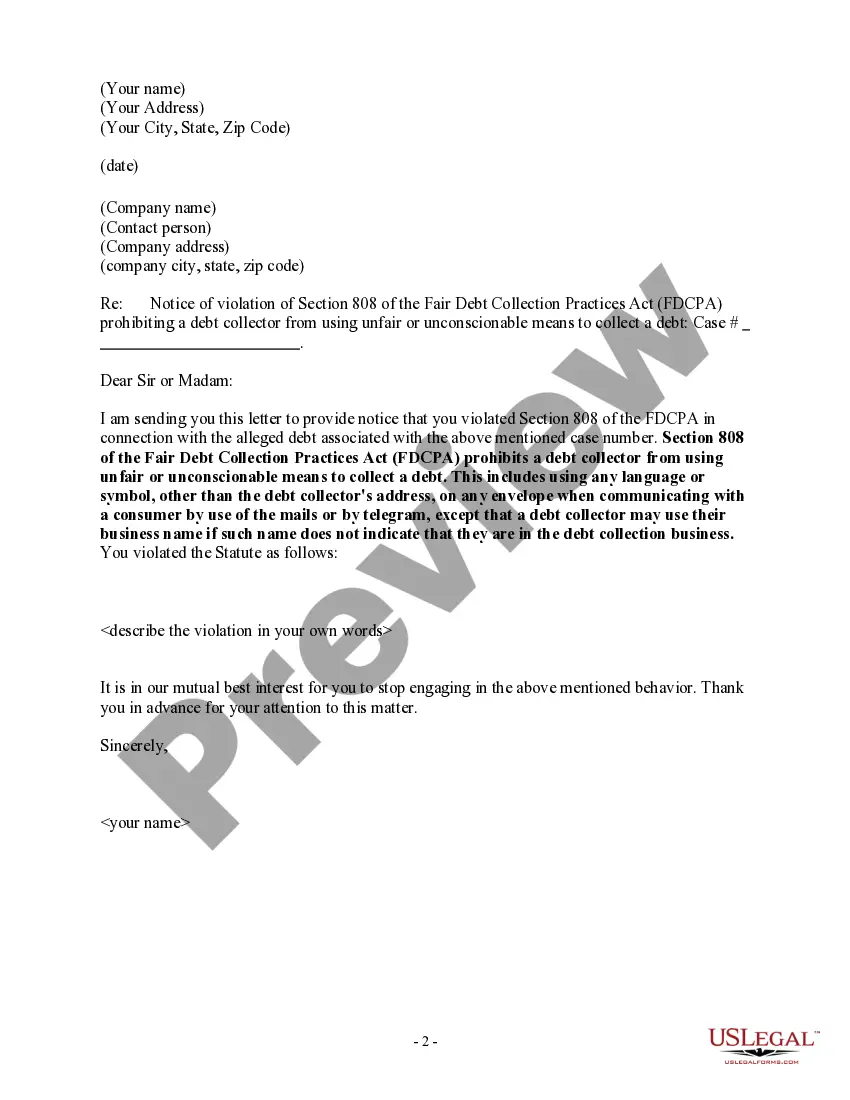

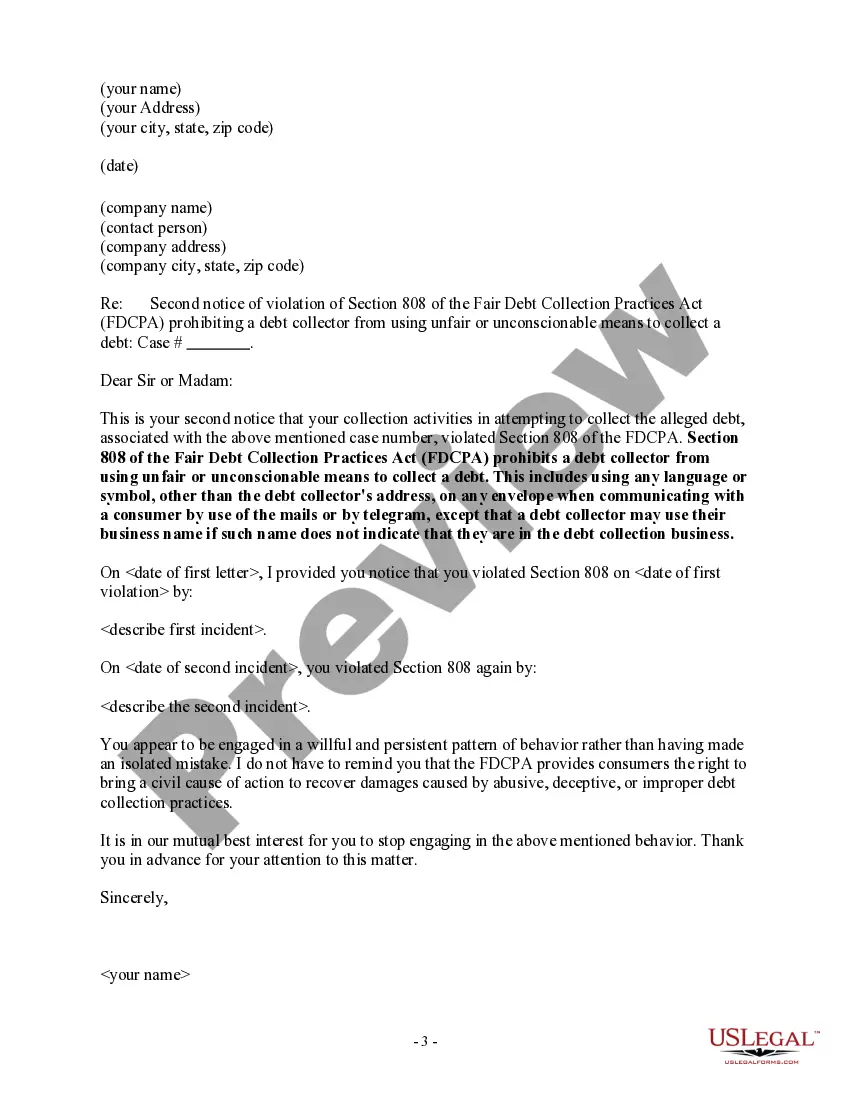

California Notice of Violation of Fair Debt Act — Improper Document Appearance is a legal document that informs debtors of a violation related to the appearance or formatting of debt collection documents. This notice is issued to debt collectors or creditors who fail to comply with the Fair Debt Collection Practices Act (FD CPA) or other similar laws in California. Debt collectors must follow strict guidelines when attempting to collect debts from consumers. The FD CPA was enacted to protect consumers from unfair and deceptive practices by debt collectors. One aspect of this act is that debt collection documents, including notices, letters, and statements, must be clear, truthful, and properly formatted. When a debt collection document does not meet the required standards, it constitutes a violation of the fair debt act. The California Notice of Violation of Fair Debt Act — Improper Document Appearance serves as a formal notification to the debt collector or creditor that they have failed to comply with the formatting requirements outlined in the FD CPA or other relevant laws in California. This notice typically includes details of the violation, such as the specific document that was improperly formatted, the date it was received by the debtor, and how it deviates from the legal requirements. The notice may also include warnings of potential legal action if the violation is not rectified promptly. There may be different types of California Notices of Violation of Fair Debt Act — Improper Document Appearance, depending on the specific violations identified. These variations can include: 1. Font and Spacing Violation: This occurs when the document's font size, font type, or spacing fails to meet the requirements specified in the FD CPA or related state laws. 2. False Representation Violation: This violation happens when the document misrepresents the creditor, collection agency, or the amount owed by the debtor. 3. Incomplete Disclosure Violation: This violation occurs when the debt collection document fails to provide the necessary information required by law, such as the debtor's rights, the original creditor's information, or the collection agency's contact details. 4. Misleading Format Violation: This violation relates to the overall appearance of the document, making it appear as if it is an official court document, government communication, or endorsed by a government agency when it is not. The California Notice of Violation of Fair Debt Act — Improper Document Appearance serves as a warning to debt collectors or creditors to rectify their errors and adhere to the legal requirements in order to avoid potential legal consequences. It empowers consumers to assert their rights under the Fair Debt Collection Practices Act and ensures that debt collection practices are fair, transparent, and compliant with the law.

California Notice of Violation of Fair Debt Act — Improper Document Appearance is a legal document that informs debtors of a violation related to the appearance or formatting of debt collection documents. This notice is issued to debt collectors or creditors who fail to comply with the Fair Debt Collection Practices Act (FD CPA) or other similar laws in California. Debt collectors must follow strict guidelines when attempting to collect debts from consumers. The FD CPA was enacted to protect consumers from unfair and deceptive practices by debt collectors. One aspect of this act is that debt collection documents, including notices, letters, and statements, must be clear, truthful, and properly formatted. When a debt collection document does not meet the required standards, it constitutes a violation of the fair debt act. The California Notice of Violation of Fair Debt Act — Improper Document Appearance serves as a formal notification to the debt collector or creditor that they have failed to comply with the formatting requirements outlined in the FD CPA or other relevant laws in California. This notice typically includes details of the violation, such as the specific document that was improperly formatted, the date it was received by the debtor, and how it deviates from the legal requirements. The notice may also include warnings of potential legal action if the violation is not rectified promptly. There may be different types of California Notices of Violation of Fair Debt Act — Improper Document Appearance, depending on the specific violations identified. These variations can include: 1. Font and Spacing Violation: This occurs when the document's font size, font type, or spacing fails to meet the requirements specified in the FD CPA or related state laws. 2. False Representation Violation: This violation happens when the document misrepresents the creditor, collection agency, or the amount owed by the debtor. 3. Incomplete Disclosure Violation: This violation occurs when the debt collection document fails to provide the necessary information required by law, such as the debtor's rights, the original creditor's information, or the collection agency's contact details. 4. Misleading Format Violation: This violation relates to the overall appearance of the document, making it appear as if it is an official court document, government communication, or endorsed by a government agency when it is not. The California Notice of Violation of Fair Debt Act — Improper Document Appearance serves as a warning to debt collectors or creditors to rectify their errors and adhere to the legal requirements in order to avoid potential legal consequences. It empowers consumers to assert their rights under the Fair Debt Collection Practices Act and ensures that debt collection practices are fair, transparent, and compliant with the law.