The California Trust Agreement of Ameriquest Mortgage Securities, Inc. is a legal document that governs the creation and operation of a trust established by Ameriquest Mortgage Securities, Inc. in the state of California. This agreement outlines the terms and conditions under which mortgage-backed securities are issued and managed. Keywords: California Trust Agreement, Ameriquest Mortgage Securities, Inc., trust, legal document, mortgage-backed securities. The California Trust Agreement of Ameriquest Mortgage Securities, Inc. is designed to ensure compliance with state laws and regulations concerning mortgage-backed securities. It serves as a framework for the creation of a trust that holds a pool of mortgage loans, which are then securitized and sold to investors. By entering into this trust agreement, Ameriquest Mortgage Securities, Inc. undertakes to act as the trustee of the mortgage-backed securities trust. The trustee is responsible for managing the assets held by the trust, ensuring the proper distribution of principal and interest payments to investors, and facilitating the transfer of mortgage loans into and out of the trust. This trust agreement sets forth the rights and responsibilities of various parties involved. These include the trustee, Ameriquest Mortgage Securities, Inc., the investors who purchase the mortgage-backed securities, and the services responsible for collecting mortgage payments and managing the loans in the trust. It is important to note that the California Trust Agreement of Ameriquest Mortgage Securities, Inc. may have different types, depending on the specific characteristics and features of the mortgage-backed securities being offered. Examples of these different types could include: 1. Residential mortgage-backed securities (RMBS) trust agreement: This type of trust agreement pertains to mortgage-backed securities created from residential mortgages, such as loans issued to finance single-family homes or condominiums. 2. Commercial mortgage-backed securities (CMOS) trust agreement: This type of trust agreement applies to mortgage-backed securities that are backed by commercial real estate loans, such as mortgages on office buildings, retail centers, or industrial properties. 3. Collateralized mortgage obligations (CMO) trust agreement: This type of trust agreement may govern the issuance of mortgage-backed securities that are structured as collateralized debt obligations, whereby the mortgage pool is divided into different tranches with varying levels of risk and return. These are just hypothetical examples of the potential types of California Trust Agreements of Ameriquest Mortgage Securities, Inc., as the specific agreements and their categorizations would depend on the offerings and needs of the respective mortgage securities transactions in question.

California Trust Agreement of Ameriquest Mortgage Securities, Inc.

Description

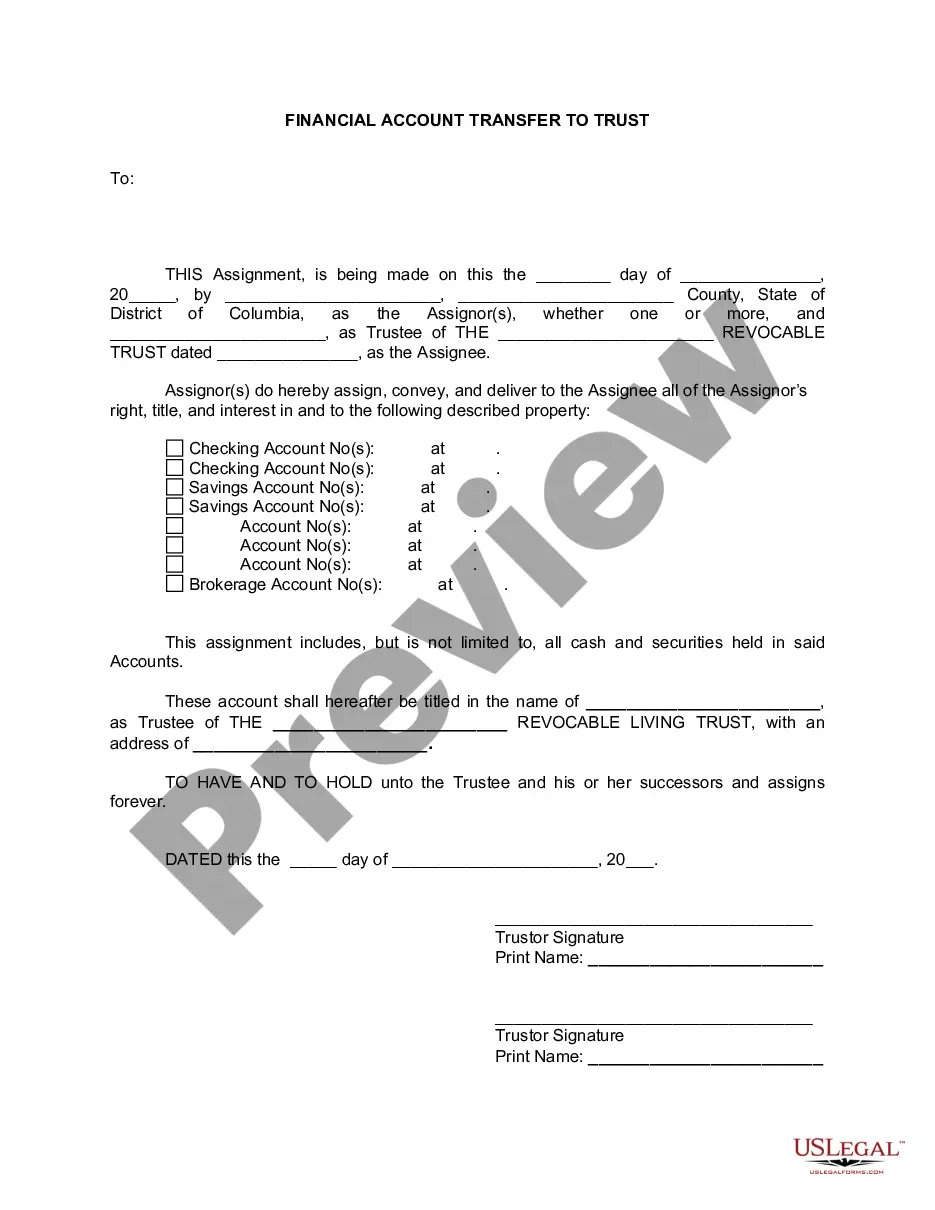

How to fill out California Trust Agreement Of Ameriquest Mortgage Securities, Inc.?

Are you presently within a place the place you will need paperwork for sometimes business or personal functions nearly every day? There are a lot of lawful file templates accessible on the Internet, but finding versions you can depend on isn`t easy. US Legal Forms provides thousands of develop templates, just like the California Trust Agreement of Ameriquest Mortgage Securities, Inc., which can be published in order to meet federal and state specifications.

In case you are currently familiar with US Legal Forms web site and also have your account, merely log in. Following that, you are able to obtain the California Trust Agreement of Ameriquest Mortgage Securities, Inc. design.

Should you not come with an accounts and would like to begin using US Legal Forms, abide by these steps:

- Discover the develop you require and make sure it is to the proper town/region.

- Use the Preview key to check the shape.

- See the description to ensure that you have chosen the correct develop.

- If the develop isn`t what you are searching for, utilize the Search discipline to get the develop that meets your requirements and specifications.

- If you get the proper develop, just click Get now.

- Select the costs program you need, fill out the specified information to produce your bank account, and purchase the transaction making use of your PayPal or Visa or Mastercard.

- Pick a convenient paper structure and obtain your backup.

Locate every one of the file templates you may have purchased in the My Forms menus. You can obtain a additional backup of California Trust Agreement of Ameriquest Mortgage Securities, Inc. anytime, if required. Just go through the needed develop to obtain or produce the file design.

Use US Legal Forms, by far the most considerable variety of lawful forms, to conserve time as well as steer clear of faults. The support provides professionally manufactured lawful file templates that can be used for a selection of functions. Generate your account on US Legal Forms and begin creating your way of life a little easier.

Form popularity

FAQ

Citigroup On September 1, 2007, Citigroup completed its acquisition of Argent Mortgage and AMC Mortgage Services, shutting down Ameriquest Mortgage. Ameriquest Mortgage - Wikipedia wikipedia.org ? wiki ? Ameriquest_Mortgage wikipedia.org ? wiki ? Ameriquest_Mortgage

Status: CLOSED. Long Beach was closed by Washington Mutual in 2007. History: Originally a California-based savings and loan, founded in 1979, Long Beach Bank became a federally chartered thrift institution in 1990. In October 1994, it became Long Beach Mortgage Co.

The "lender" is the financial institution that loaned you the money. The lender owns the loan and is also called the "note holder" or "holder." Sometime later, the lender might sell the mortgage debt to another entity, which then becomes the new loan owner (holder).

On September 9, 2007, Argent Mortgage was sold to Citi for an undisclosed amount. Argent was renamed Citi Residential Lending. Citi Residential Lending operated for several months before it was shut down. On September 10, 2007, Ameriquest stopped accepting loan applications.

Employer Identification No.) 1100 TOWN & COUNTRY ROAD, SUITE 1100 ORANGE, CALIFORNIA 92868 (Address of principal executive offices) (Zip Code) Registrant's Telephone Number, Including Area Code: (714) 541-9960 Item 5.