The California Pooling and Servicing Agreement (PSA) is a legal contract between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One. This agreement governs the pooling and servicing of mortgage loans in California and outlines the responsibilities and rights of each party involved. Under the PSA, Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One collaborate to create a mortgage-backed security (MBS) by pooling a specified group of residential mortgage loans. These loans are then sold to investors in the form of securities, with the pooled cash flows being distributed among the investors. Keywords: California Pooling and Servicing Agreement, Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., Bank One, mortgage loans, pooling, servicing, legal contract, responsibilities, rights, mortgage-backed security (MBS), residential mortgage loans, investors, securities, pooled cash flows. Different types of California Pooling and Servicing Agreements between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One may include: 1. Standard PSA: This is the typical agreement that establishes the primary terms and conditions for pooling and servicing mortgage loans in California. It includes provisions related to loan origination, payment processing, investor reporting, default management, and loan modification procedures. 2. Enhanced PSA: An enhanced PSA might include additional features or terms tailored to specific types of mortgage loans or investor preferences. It could involve customization of default management procedures, prepayment penalties, or special provisions for non-conforming loans. 3. Seasoned Loan Pool PSA: This type of PSA specifically addresses the pooling and servicing of mortgage loans that have a longer payment history, typically referred to as seasoned loans. The agreement may contain provisions related to loan delinquencies, workout options, and potential loan modifications. 4. Sub-servicing Agreement: In some cases, Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One may enter into a sub-servicing agreement. This agreement allows a designated third-party service to handle loan administration and processing tasks on behalf of the parties involved. The sub-series's responsibilities are outlined in this type of PSA. Each of these agreements serves to provide legal and operational guidelines to ensure the smooth pooling and servicing of mortgage loans in California while protecting the rights and interests of all parties involved.

California Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One

Description

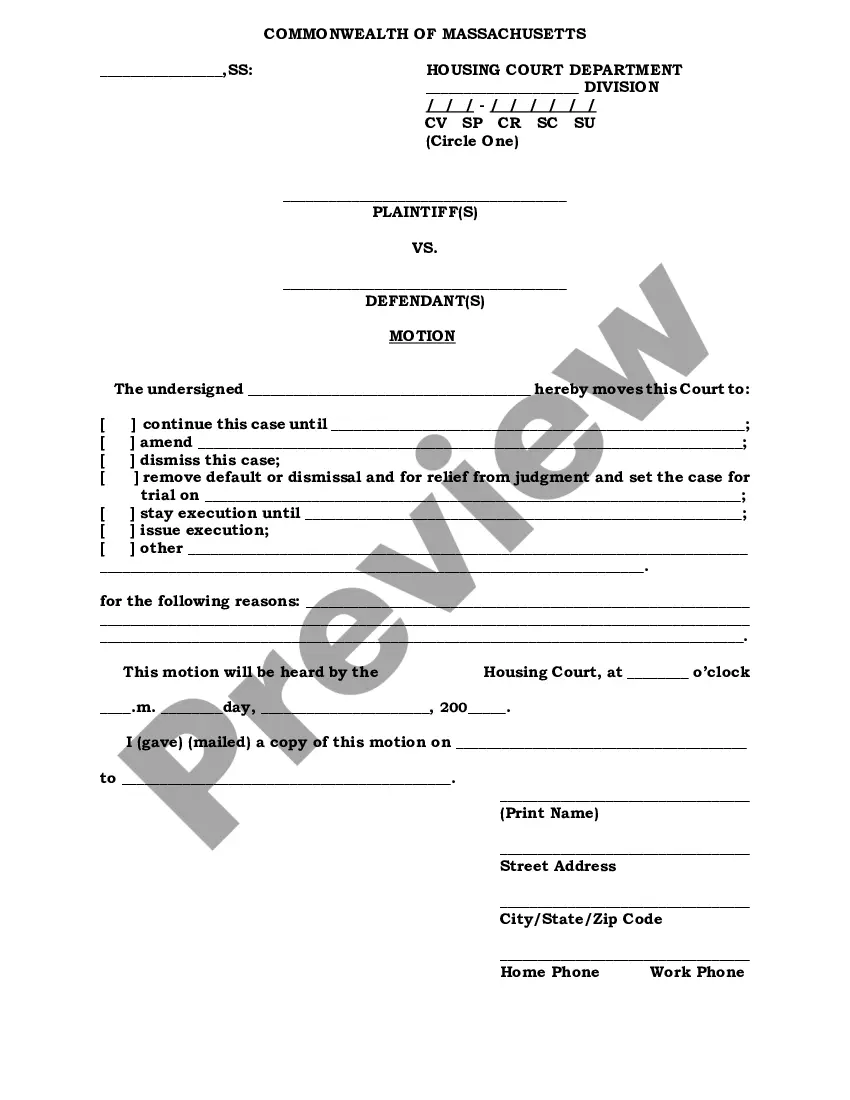

How to fill out California Pooling And Servicing Agreement Between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. And Bank One?

If you want to complete, down load, or printing authorized record themes, use US Legal Forms, the biggest assortment of authorized types, which can be found on the Internet. Take advantage of the site`s simple and easy handy search to find the files you want. Different themes for enterprise and individual reasons are sorted by types and suggests, or keywords. Use US Legal Forms to find the California Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One in a number of click throughs.

In case you are currently a US Legal Forms customer, log in to the bank account and click on the Acquire option to find the California Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One. You can also entry types you in the past downloaded within the My Forms tab of the bank account.

If you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have selected the shape for the appropriate area/country.

- Step 2. Make use of the Review solution to check out the form`s content material. Don`t overlook to read the description.

- Step 3. In case you are unhappy with the form, use the Look for area towards the top of the display screen to find other models from the authorized form design.

- Step 4. When you have identified the shape you want, go through the Buy now option. Opt for the rates strategy you choose and put your accreditations to register to have an bank account.

- Step 5. Approach the financial transaction. You may use your bank card or PayPal bank account to finish the financial transaction.

- Step 6. Choose the formatting from the authorized form and down load it on your gadget.

- Step 7. Full, modify and printing or sign the California Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One.

Each authorized record design you get is your own permanently. You might have acces to each form you downloaded with your acccount. Go through the My Forms area and choose a form to printing or down load yet again.

Compete and down load, and printing the California Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One with US Legal Forms. There are many expert and state-certain types you can use for your personal enterprise or individual requirements.