California Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp

Description

How to fill out Agreement And Plan Of Merger Between Fidelity National Financial, Inc. And Chicago Title Corp?

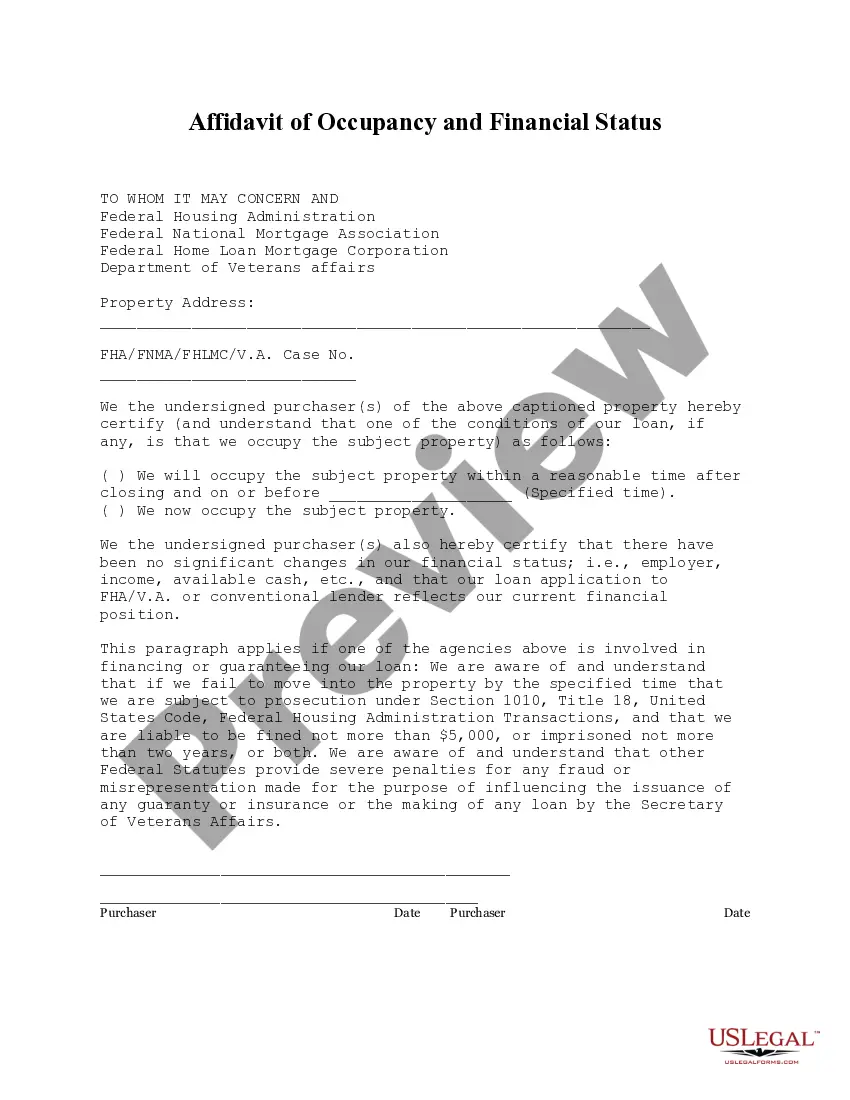

You can spend several hours on the Internet searching for the legal record format that fits the federal and state needs you require. US Legal Forms provides thousands of legal varieties that happen to be evaluated by specialists. It is simple to acquire or print the California Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp from the services.

If you already have a US Legal Forms account, you are able to log in and click the Obtain switch. Following that, you are able to total, revise, print, or indicator the California Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp. Every single legal record format you buy is yours forever. To acquire one more backup for any obtained develop, check out the My Forms tab and click the related switch.

If you are using the US Legal Forms internet site for the first time, adhere to the easy directions below:

- First, make certain you have selected the correct record format to the area/town of your choosing. See the develop explanation to make sure you have picked the correct develop. If accessible, take advantage of the Preview switch to appear through the record format at the same time.

- If you would like find one more version of your develop, take advantage of the Look for area to get the format that meets your needs and needs.

- After you have identified the format you would like, click on Get now to carry on.

- Find the rates program you would like, type in your qualifications, and register for a free account on US Legal Forms.

- Complete the financial transaction. You should use your bank card or PayPal account to fund the legal develop.

- Find the formatting of your record and acquire it to your product.

- Make changes to your record if necessary. You can total, revise and indicator and print California Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp.

Obtain and print thousands of record layouts while using US Legal Forms web site, which offers the largest variety of legal varieties. Use specialist and status-distinct layouts to tackle your company or person needs.

Form popularity

FAQ

SEC Form S-4 is filed by a publicly traded company with the Securities and Exchange Commission (SEC). It is required to register any material information related to a merger or acquisition. In addition, the form is also filed by companies undergoing an exchange offer, where securities are offered in place of cash.

Merger: The SEC must clear the proxy materials to be disseminated to the shareholders of the target company. If the consideration includes securities of the acquiring company, the SEC must declare effective the registration statement relating to such securities.

Public company mergers require filing a variety of public disclosure documents. In the United States, the companies make public filings of these materials with the Securities and Exchange Commission (SEC). Merger Disclosures Required by the SEC: An Overview carpenterwellington.com ? post ? merger-disclosu... carpenterwellington.com ? post ? merger-disclosu...

Business Source Complete, ABI/INFORM, Mergent Online, and Nexis Uni (formerly LexisNexis) will provide news articles on recent mergers and acquisitions, as well as industry reports. These industry reports may indicate whether an industry is consolidating or growing industry.

Use SEC filings to find details about a company's merger or acquisition. Both the target and acquirer will file reports.

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax. What Are Merger and Acquisition Contracts? - Ironclad ironcladapp.com ? journal ? merger-and-acquisiti... ironcladapp.com ? journal ? merger-and-acquisiti...