California Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association

Description

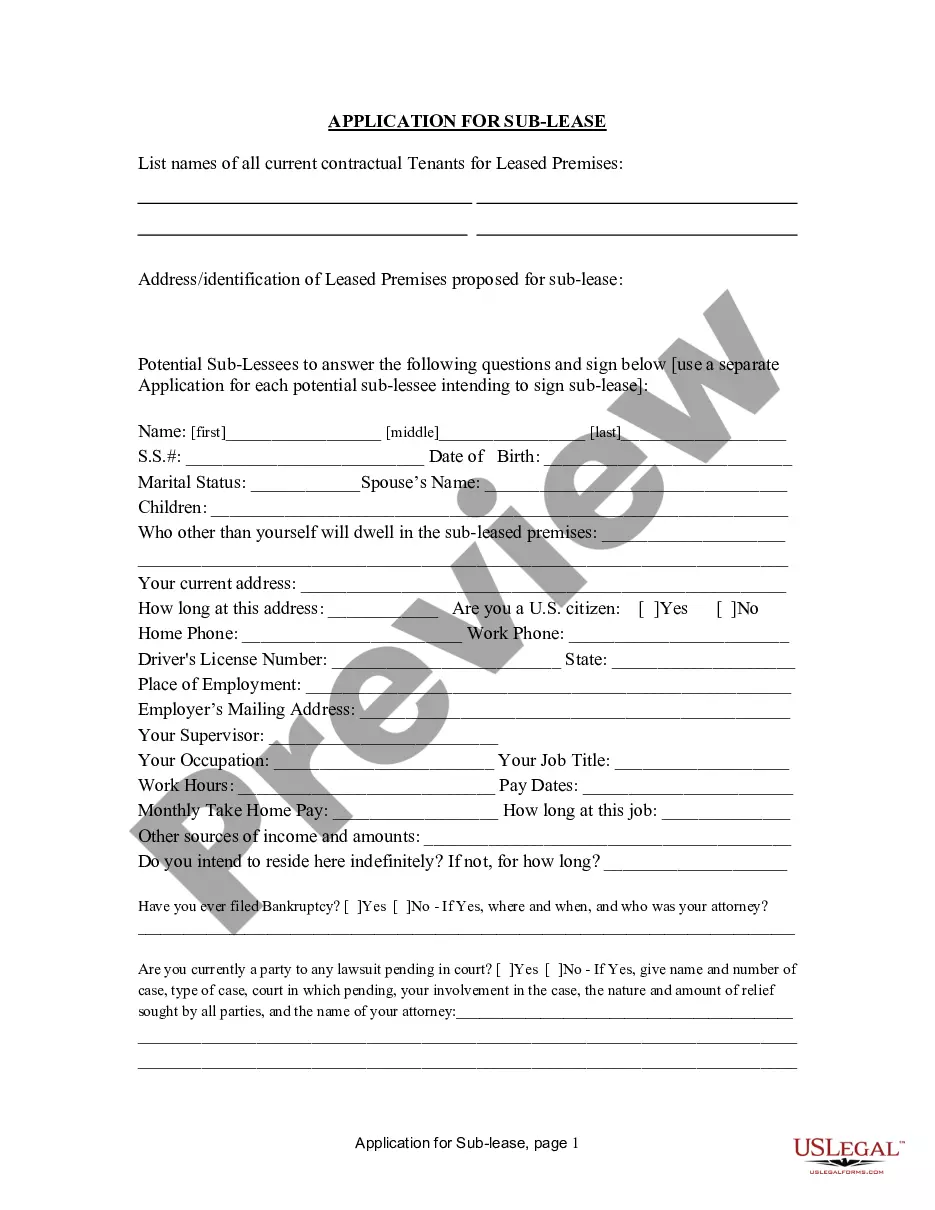

How to fill out Pooling And Servicing Agreement Between Greenpoint Credit, LLC And Bank One, National Association?

If you need to comprehensive, obtain, or printing authorized document layouts, use US Legal Forms, the largest assortment of authorized forms, which can be found on-line. Utilize the site`s basic and hassle-free search to obtain the paperwork you will need. Different layouts for business and individual purposes are categorized by types and says, or key phrases. Use US Legal Forms to obtain the California Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association in a few mouse clicks.

In case you are previously a US Legal Forms consumer, log in in your bank account and click the Obtain switch to find the California Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association. Also you can entry forms you previously downloaded from the My Forms tab of your respective bank account.

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape to the appropriate town/region.

- Step 2. Take advantage of the Review option to examine the form`s content. Do not forget to read through the information.

- Step 3. In case you are not happy together with the kind, utilize the Research area at the top of the display to find other models of your authorized kind web template.

- Step 4. Upon having found the shape you will need, click on the Buy now switch. Pick the pricing prepare you prefer and put your references to register to have an bank account.

- Step 5. Approach the financial transaction. You can utilize your charge card or PayPal bank account to complete the financial transaction.

- Step 6. Choose the structure of your authorized kind and obtain it on the product.

- Step 7. Comprehensive, change and printing or indication the California Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association.

Each and every authorized document web template you purchase is your own property permanently. You possess acces to every kind you downloaded within your acccount. Select the My Forms section and select a kind to printing or obtain yet again.

Be competitive and obtain, and printing the California Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association with US Legal Forms. There are many skilled and express-certain forms you may use for your personal business or individual demands.

Form popularity

FAQ

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.

When rates rise, there are fewer people who benefit from a new mortgage. Lenders and servicers adjust. Servicers looking to raise cash may make part or all of their portfolio available for sale to other servicers. Interested servicers may see this as an opportunity to grow their portfolio. Mortgage Servicing Transferred? Here's What You Should Know rocketmortgage.com ? learn ? mortgage-ser... rocketmortgage.com ? learn ? mortgage-ser...

Homeowners are often transferred to SPS once they become delinquent on their mortgage payments. Many lenders try to protect their brand when it comes to foreclosing on homeowners. stop select portfolio servicing foreclosure Keep Your Keys ? selectportfolioservicing Keep Your Keys ? selectportfolioservicing

Homeowners are often transferred to SPS once they become delinquent on their mortgage payments. Many lenders try to protect their brand when it comes to foreclosing on homeowners.

In 2005, Select Portfolio Servicing was purchased by Credit Suisse, a financial services company, headquartered in Zurich, Switzerland. Select Portfolio Servicing - Wikipedia wikipedia.org ? wiki ? Select_Portfolio_Servici... wikipedia.org ? wiki ? Select_Portfolio_Servici...

SPS is a mortgage servicer, which means we manage your account on behalf of the note holder. FrequentlyAskedQuestions - Select Portfolio Servicing Select Portfolio Servicing ? StaticDetails ? Help Select Portfolio Servicing ? StaticDetails ? Help

What is a Loan Servicing Agreement? A loan servicing agreement is a legal agreement between a lender and a third party, the servicer, that outlines the terms and conditions for which that third party will provide loan servicing services.