California Investor Relations Agreement: A Comprehensive Overview Regarding Advisor for a Program of Financial Communications and Investor Relations Keywords: Investor Relations Agreement, Advisor, Program of Financial Communications, Investor Relations, California Introduction: The California Investor Relations Agreement is a legal contract that establishes the relationship between a company and an advisor who specializes in providing support and guidance in the field of financial communications and investor relations. This agreement outlines the responsibilities, obligations, and rights of both parties involved, ensuring a mutually beneficial and transparent working relationship. The agreement helps companies in California effectively communicate with investors, manage their reputations, and foster investor confidence. Types of California Investor Relations Agreements: 1. Full-Service Investor Relations Agreement: This type of agreement encompasses a comprehensive range of investor relations services. The advisor acts as the primary point of contact between the company and its investors, providing support in crafting communication strategies, managing investor expectations, and organizing investor meetings or conferences. 2. Limited Scope Investor Relations Agreement: For companies that require specific assistance in targeted areas of financial communication and investor relations, a limited scope agreement may be executed. This allows the advisor to focus on particular aspects of the investor relations program, such as earnings announcements, investor presentations, or shareholder meetings. Agreement Components: 1. Objective and Scope: This section defines the purpose and specific goals of the investor relations program, highlighting the areas in which the advisor will provide their expertise. It clarifies the scope of work, ensuring both parties are aligned with the objectives. 2. Roles and Responsibilities: This section outlines the responsibilities of each party involved. The company is responsible for providing relevant financial data, corporate information, and timely updates, while the advisor assumes the duty of developing and executing investor communication strategies, managing stakeholders, and monitoring market trends. 3. Communication Channels: The agreement specifies the preferred channels and frequency of communication between the advisor and the company. This may include weekly or monthly progress reports, conference calls, in-person meetings, or email correspondence. 4. Confidentiality: To protect sensitive financial and strategic information, the agreement includes a confidentiality clause. This ensures that both parties maintain strict confidentiality regarding any non-public information shared during the course of their engagement. 5. Compensation and Termination: Details regarding the compensation structure, invoicing, and payment terms of the advisor's services are delineated. Additionally, the agreement outlines the conditions under which either party may terminate the agreement, ensuring a mutually agreed-upon notice period. Conclusion: The California Investor Relations Agreement provides a framework for companies seeking to enhance their financial communications and investor relations capabilities. By engaging an experienced advisor, businesses can strategically manage their relationship with shareholders, improve transparency, and ultimately enhance their overall market positioning.

California Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations

Description

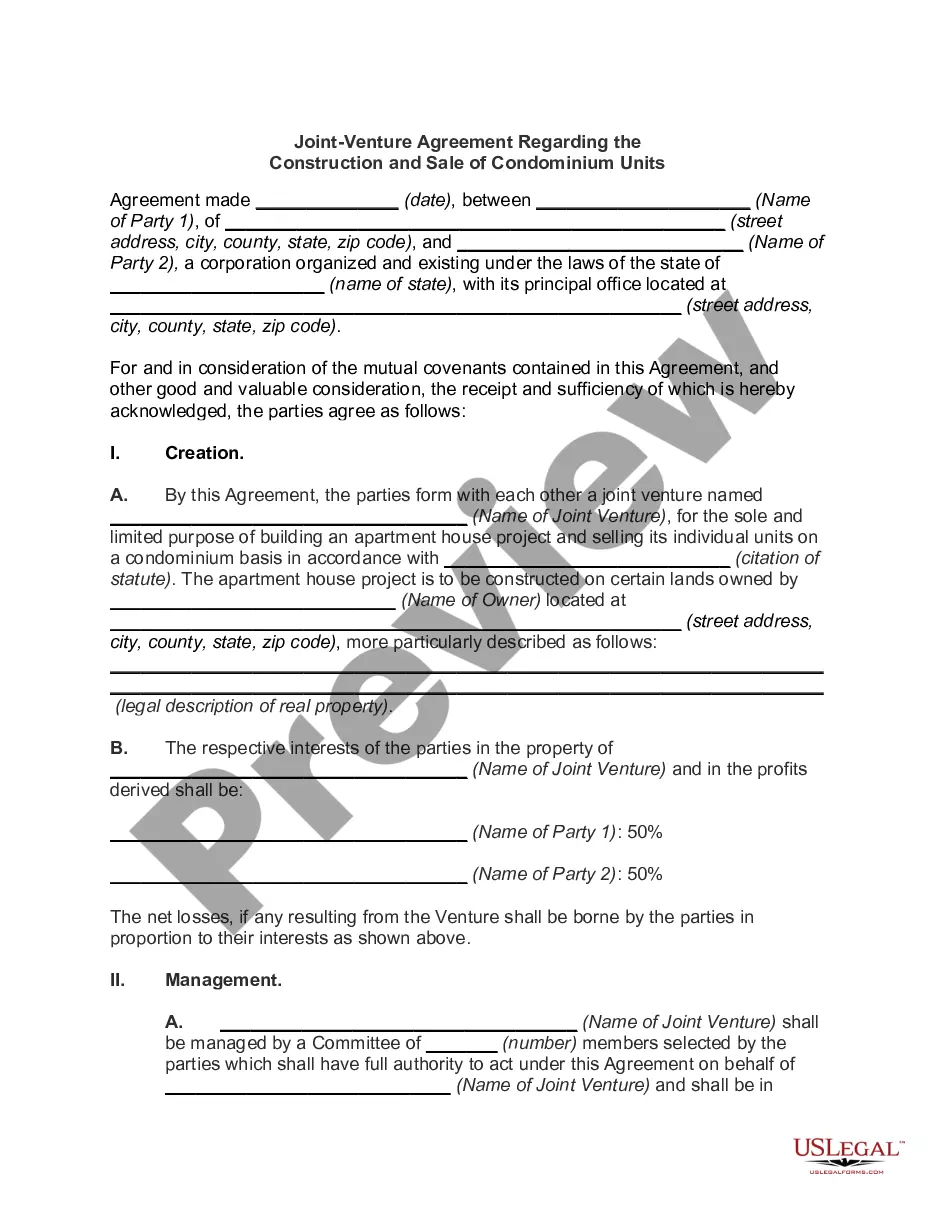

How to fill out California Investor Relations Agreement Regarding Advisor For A Program Of Financial Communications And Investor Relations?

If you need to full, acquire, or produce lawful record layouts, use US Legal Forms, the most important collection of lawful types, that can be found on-line. Use the site`s simple and hassle-free look for to obtain the paperwork you need. A variety of layouts for enterprise and specific uses are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to obtain the California Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations in a handful of clicks.

If you are already a US Legal Forms consumer, log in for your profile and click on the Down load key to find the California Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations. Also you can gain access to types you previously acquired from the My Forms tab of the profile.

If you work with US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the form for that right metropolis/nation.

- Step 2. Make use of the Review solution to check out the form`s content. Do not neglect to learn the explanation.

- Step 3. If you are not satisfied with the type, use the Look for industry on top of the monitor to discover other variations of your lawful type format.

- Step 4. When you have identified the form you need, click the Purchase now key. Pick the costs program you like and put your accreditations to register on an profile.

- Step 5. Procedure the financial transaction. You may use your charge card or PayPal profile to finish the financial transaction.

- Step 6. Select the format of your lawful type and acquire it on your own system.

- Step 7. Comprehensive, modify and produce or sign the California Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations.

Each lawful record format you purchase is yours eternally. You have acces to every single type you acquired with your acccount. Go through the My Forms section and select a type to produce or acquire again.

Remain competitive and acquire, and produce the California Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations with US Legal Forms. There are many specialist and state-specific types you may use for the enterprise or specific demands.