California Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc.

Description

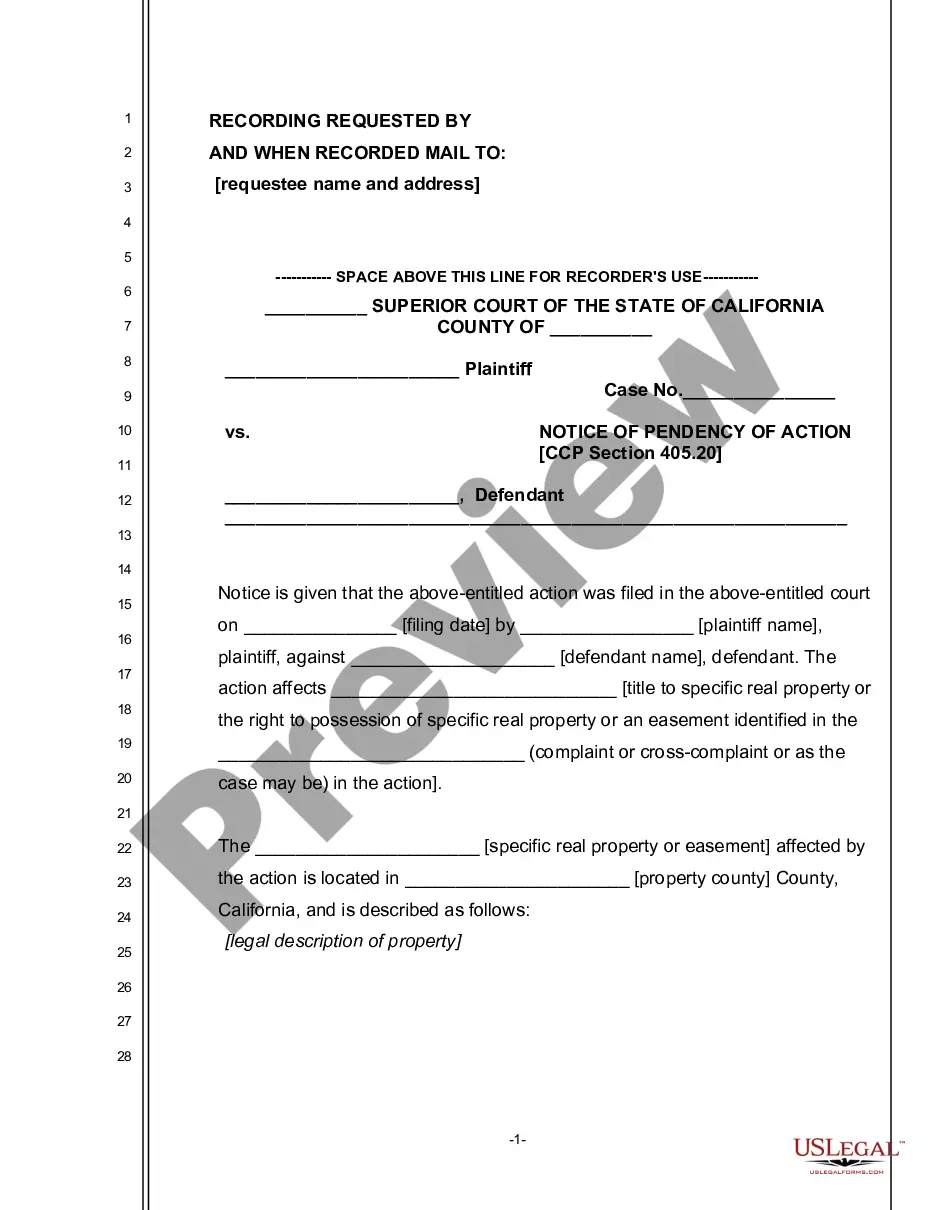

How to fill out Plan Of Merger Between WIT Capital Group, Inc., WIS Merger Corporation And Soundview Technology Group, Inc.?

If you want to full, acquire, or print out lawful file web templates, use US Legal Forms, the biggest variety of lawful types, that can be found on the Internet. Utilize the site`s easy and hassle-free look for to find the papers you require. A variety of web templates for business and personal uses are categorized by types and says, or search phrases. Use US Legal Forms to find the California Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc. with a couple of click throughs.

When you are presently a US Legal Forms consumer, log in in your bank account and click the Obtain switch to have the California Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc.. You may also access types you in the past acquired in the My Forms tab of the bank account.

If you are using US Legal Forms initially, follow the instructions listed below:

- Step 1. Make sure you have selected the form for your appropriate city/land.

- Step 2. Make use of the Preview choice to look through the form`s content material. Never neglect to learn the information.

- Step 3. When you are not happy with all the kind, make use of the Look for area near the top of the display screen to get other versions of the lawful kind web template.

- Step 4. When you have located the form you require, select the Purchase now switch. Choose the prices program you like and add your accreditations to register for the bank account.

- Step 5. Method the deal. You may use your Мisa or Ьastercard or PayPal bank account to complete the deal.

- Step 6. Choose the file format of the lawful kind and acquire it on the device.

- Step 7. Total, revise and print out or signal the California Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc..

Each and every lawful file web template you purchase is your own property eternally. You possess acces to every kind you acquired in your acccount. Go through the My Forms segment and decide on a kind to print out or acquire again.

Contend and acquire, and print out the California Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc. with US Legal Forms. There are many skilled and express-particular types you can use for your business or personal demands.