Title: Exploring the California Lease Agreement for Office Building Leased by Ryan South bank II, LLC and Mind spring Enterprises, Inc. Introduction: In this article, we will delve into the details of the California Lease Agreement between Ryan South bank II, LLC and Mind spring Enterprises, Inc. Specifically focusing on their lease of an office building, we'll discuss the essential components, important considerations, and potential variations of this agreement. Read on to gain an understanding of the various types of lease agreements relevant to this arrangement. 1. Understanding the California Lease Agreement: The California Lease Agreement is a legally binding contract that outlines the terms and conditions governing the lease of an office building. It provides a comprehensive framework and serves as a consensus between Ryan South bank II, LLC (the lessor) and Mind spring Enterprises, Inc. (the lessee) to ensure a mutually beneficial and transparent leasing agreement. 2. Key Components of the Lease Agreement: a. Lease Term: The agreement specifies the duration of the lease, including the start and end dates. b. Rental Payments: It outlines the agreed-upon monthly or annual rental amount, payment due dates, accepted payment methods, and details regarding any additional charges or late fees. c. Security Deposit: The agreement highlights the agreed-upon security deposit amount, its purpose, conditions for its return, and deductions. d. Maintenance and Repairs: It explains the responsibilities of the lessor and lessee in terms of maintaining and repairing the office building, including any cost-sharing arrangements. e. Permitted Use: The agreement defines the approved business activities authorized within the leased premises. f. Alterations and Improvements: This section specifies the conditions under which the lessee can make alterations to the office building, and if so, who bears the associated costs. g. Termination and Renewal: It outlines the procedures, notice period, and conditions for the termination or renewal of the lease agreement. h. Insurance and Indemnification: The agreement details the specific insurance requirements for both parties and clarifies responsibility for any damages or liabilities that may arise during the lease term. 3. Variations of California Lease Agreements: a. Gross Lease Agreement: A type of lease agreement where the lessor covers all or most of the property expenses (utilities, maintenance, taxes), and the lessee pays a fixed rent amount. b. Net Lease Agreement: In this type of lease, the lessee is responsible for not only rent but also a proportionate share of specified property expenses, such as maintenance, insurance, and taxes. c. Modified Gross Lease Agreement: It combines elements of both gross and net leases, with certain expenses divided between the lessor and lessee separately. Conclusion: Having explored the California Lease Agreement between Ryan South bank II, LLC and Mind spring Enterprises, Inc., it is evident that meticulous attention to detail is essential when entering into such a contract. Understanding the specifics of the lease agreement, its critical components, and possible variations will help both parties establish a transparent and harmonious business relationship.

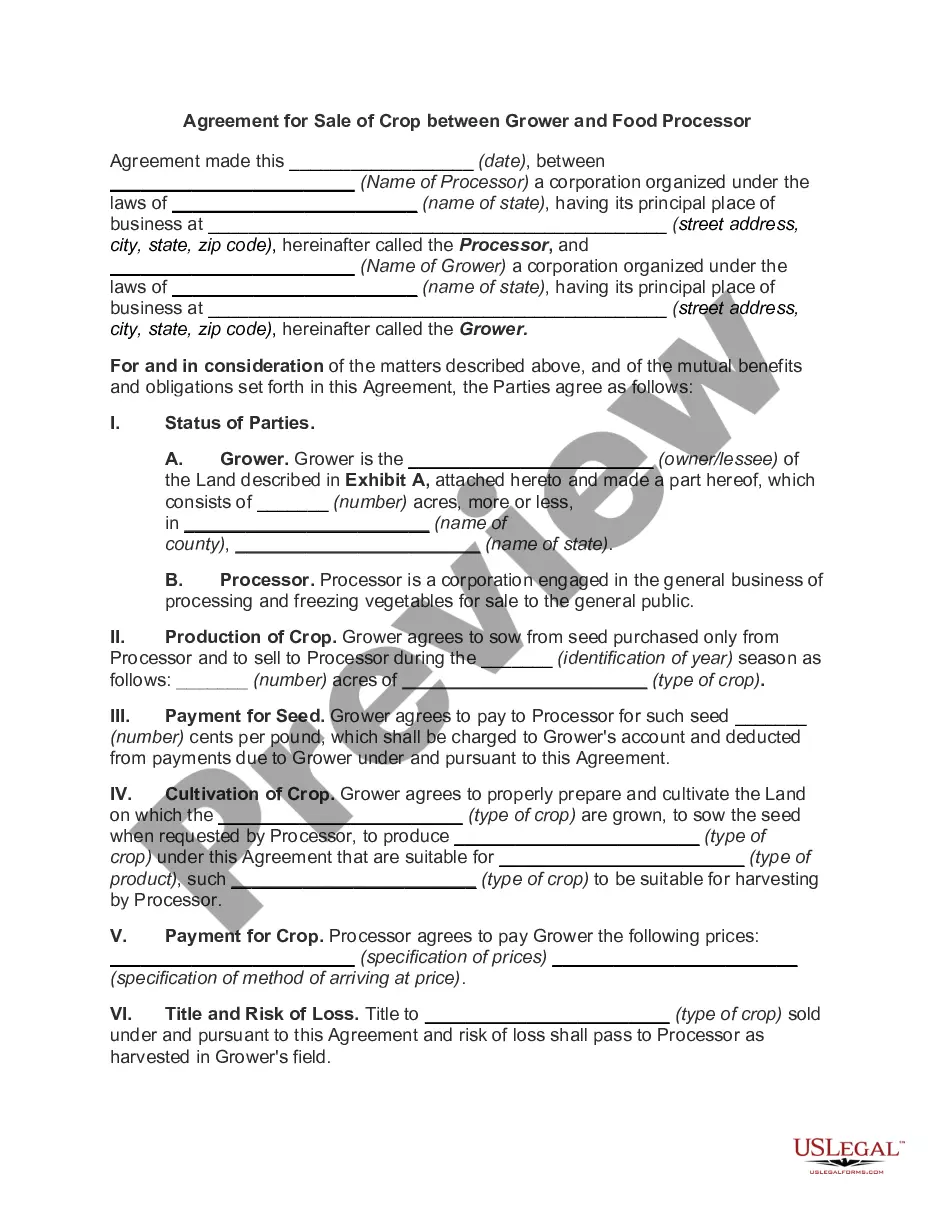

California Lease Agreement regarding lease of office building between Ryan Southbank II, LLC and Mindspring Enterprises, Inc.

Description

How to fill out California Lease Agreement Regarding Lease Of Office Building Between Ryan Southbank II, LLC And Mindspring Enterprises, Inc.?

If you need to comprehensive, download, or produce authorized document layouts, use US Legal Forms, the biggest variety of authorized forms, that can be found on the web. Make use of the site`s easy and hassle-free search to discover the files you will need. Various layouts for organization and specific reasons are sorted by groups and suggests, or keywords. Use US Legal Forms to discover the California Lease Agreement regarding lease of office building between Ryan Southbank II, LLC and Mindspring Enterprises, Inc. within a handful of clicks.

In case you are previously a US Legal Forms consumer, log in for your accounts and click the Down load button to get the California Lease Agreement regarding lease of office building between Ryan Southbank II, LLC and Mindspring Enterprises, Inc.. Also you can gain access to forms you previously acquired from the My Forms tab of the accounts.

If you are using US Legal Forms initially, follow the instructions listed below:

- Step 1. Make sure you have selected the form for the appropriate metropolis/region.

- Step 2. Utilize the Review option to examine the form`s information. Do not overlook to see the explanation.

- Step 3. In case you are not satisfied together with the form, make use of the Research field near the top of the monitor to get other versions of your authorized form web template.

- Step 4. After you have found the form you will need, click the Buy now button. Opt for the rates strategy you favor and add your accreditations to sign up to have an accounts.

- Step 5. Method the financial transaction. You should use your credit card or PayPal accounts to finish the financial transaction.

- Step 6. Select the format of your authorized form and download it on your own device.

- Step 7. Comprehensive, edit and produce or indicator the California Lease Agreement regarding lease of office building between Ryan Southbank II, LLC and Mindspring Enterprises, Inc..

Each and every authorized document web template you acquire is your own property forever. You possess acces to every form you acquired in your acccount. Click on the My Forms portion and decide on a form to produce or download yet again.

Be competitive and download, and produce the California Lease Agreement regarding lease of office building between Ryan Southbank II, LLC and Mindspring Enterprises, Inc. with US Legal Forms. There are many expert and state-particular forms you can use for your organization or specific needs.