California Second Amendment to Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company

Description

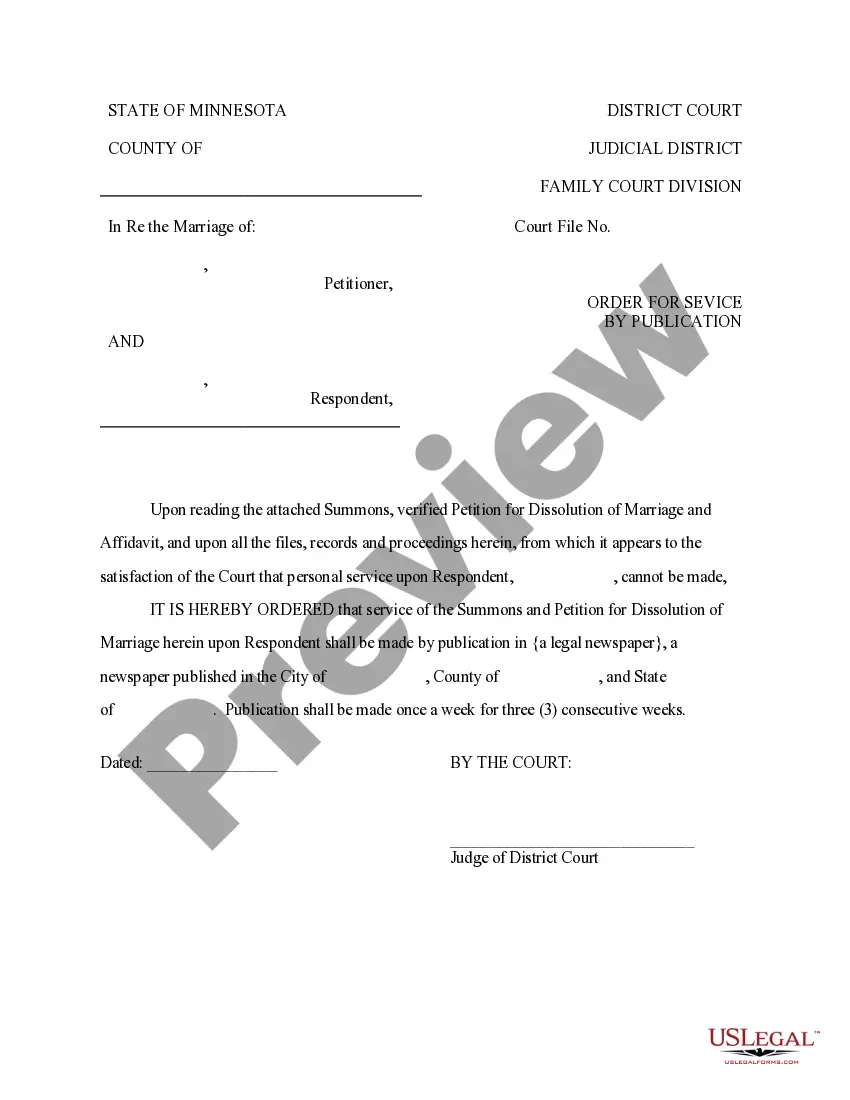

How to fill out Second Amendment To Trust Agreement Between Polaris Industries, Inc. And Fidelity Management Trust Company?

US Legal Forms - among the most significant libraries of legitimate types in the USA - provides a wide range of legitimate document themes you may acquire or print. Utilizing the website, you can find 1000s of types for business and person reasons, sorted by categories, states, or keywords and phrases.You can find the most up-to-date variations of types such as the California Second Amendment to Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company within minutes.

If you have a subscription, log in and acquire California Second Amendment to Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company in the US Legal Forms catalogue. The Acquire switch can look on each and every kind you view. You have access to all in the past saved types from the My Forms tab of your respective account.

If you want to use US Legal Forms the first time, here are basic directions to help you started off:

- Be sure to have chosen the right kind to your metropolis/county. Select the Review switch to analyze the form`s articles. Browse the kind outline to actually have chosen the proper kind.

- If the kind doesn`t suit your specifications, take advantage of the Research industry near the top of the display screen to get the one which does.

- If you are satisfied with the form, validate your option by clicking the Acquire now switch. Then, select the rates plan you want and supply your accreditations to sign up for the account.

- Procedure the financial transaction. Make use of your charge card or PayPal account to perform the financial transaction.

- Pick the formatting and acquire the form on your own system.

- Make modifications. Load, modify and print and indicator the saved California Second Amendment to Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company.

Every single design you included with your money does not have an expiry day and is the one you have for a long time. So, if you wish to acquire or print another backup, just check out the My Forms section and click on about the kind you need.

Gain access to the California Second Amendment to Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company with US Legal Forms, the most considerable catalogue of legitimate document themes. Use 1000s of professional and status-specific themes that meet up with your company or person demands and specifications.