Title: California Sample Mortgage Loan Purchase Agreement Between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC Introduction: The California Sample Mortgage Loan Purchase Agreement discussed here outlines the terms and conditions of a transaction between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC. This agreement facilitates the purchase of mortgage loans, providing a comprehensive framework for the parties involved to govern their legal rights and obligations. Keywords: California, sample mortgage loan purchase agreement, Credit Suisse First Boston Mortgage Securities Corp., Credit Suisse First Boston Mortgage Capital, LLC. Types of California Sample Mortgage Loan Purchase Agreements: 1. Traditional Mortgage Loan Purchase Agreement: In a traditional California Mortgage Loan Purchase Agreement, Credit Suisse First Boston Mortgage Securities Corp. seeks to acquire mortgage loans from Credit Suisse First Boston Mortgage Capital, LLC. This agreement outlines the specific terms, conditions, and responsibilities of each party involved, ensuring a smooth transaction that is compliant with California regulations. 2. Bulk Mortgage Loan Purchase Agreement: A Bulk Mortgage Loan Purchase Agreement refers to a scenario where Credit Suisse First Boston Mortgage Securities Corp. intends to purchase a large portfolio of mortgage loans from Credit Suisse First Boston Mortgage Capital, LLC. This type of agreement is typically employed when dealing with a significant volume of loans in a single transaction, streamlining the process and reducing paperwork. 3. California Sample Mortgage Loan Purchase Agreement with Servicing Rights: This type of agreement outlines the purchase of mortgage loans by Credit Suisse First Boston Mortgage Securities Corp. from Credit Suisse First Boston Mortgage Capital, LLC, while also transferring the servicing rights to the purchasing entity. The agreement includes provisions related to loan servicing responsibilities, rights, and conditions, ensuring proper management of the loan portfolio. Key Components of the Agreement: 1. Definitions: The agreement includes a section that clearly defines all the key terms and phrases relevant to the transaction to avoid any ambiguity. 2. Representations and Warranties: Both parties make certain representations and warranties regarding the accuracy and completeness of the mortgage loans being sold and purchased, protecting the interests of the acquiring party. 3. Purchase Price and Payment Terms: The agreement stipulates the purchase price of the mortgage loans and the timeframe within which the payment should be made, ensuring transparency and facilitating financial arrangements. 4. Delivery and Acceptance: The agreement specifies the conditions and procedures for the delivery and acceptance of the mortgage loans, including required documentation and timing expectations. 5. Conditions Precedent and Termination: Various conditions precedent, such as regulatory approvals or the absence of material adverse changes, are listed, ensuring the agreement is valid and enforceable. Termination provisions cover events that may lead to the cancellation or termination of the agreement. Conclusion: The California Sample Mortgage Loan Purchase Agreement is an essential legal document that establishes the framework for the purchase of mortgage loans between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC. Understanding the various types of agreements and the key components they encompass is crucial for ensuring a smooth transaction and compliance with California laws and regulations.

California Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC

Description

How to fill out California Sample Mortgage Loan Purchase Agreement Between Credit Suisse First Boston Mortgage Securities Corp. And Credit Suisse First Boston Mortgage Capital, LLC?

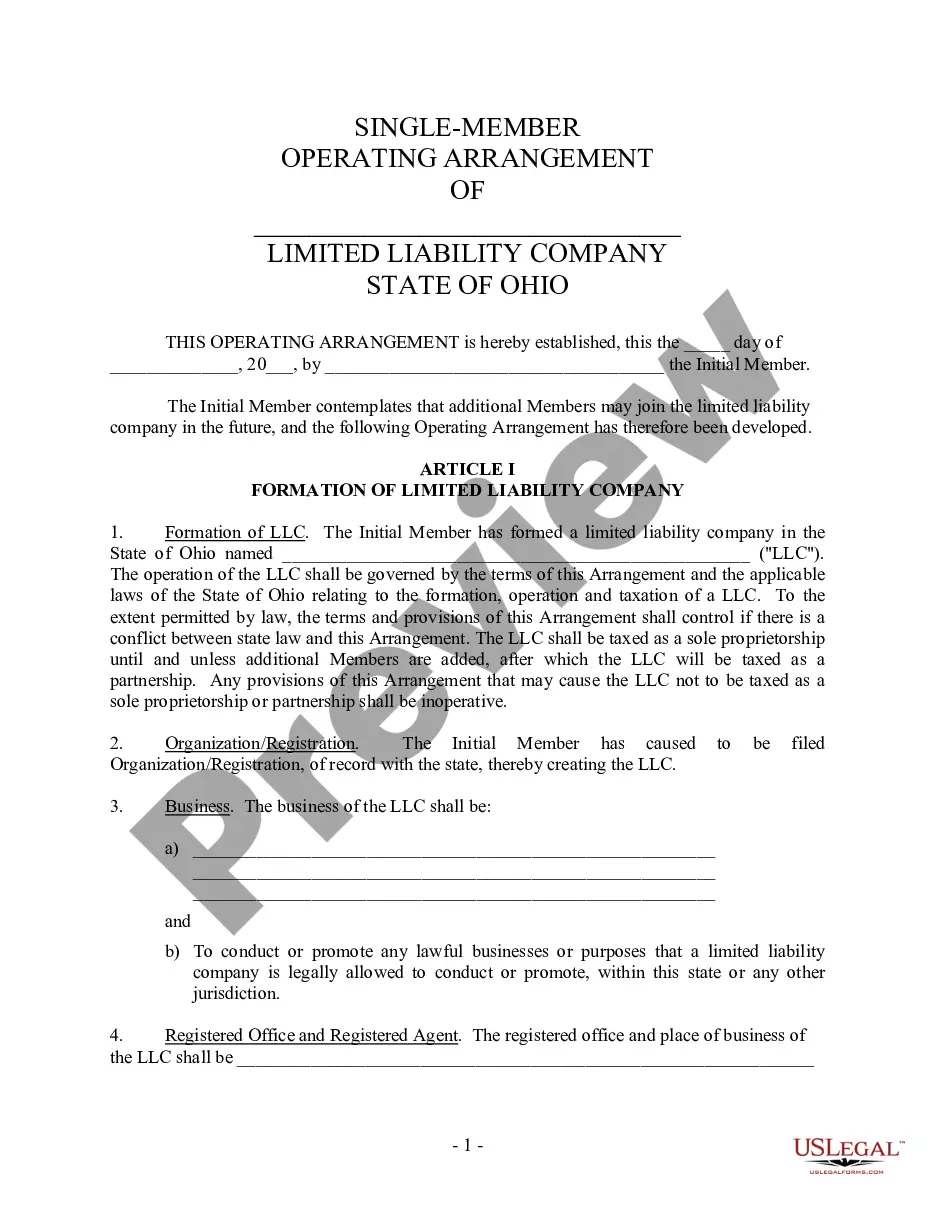

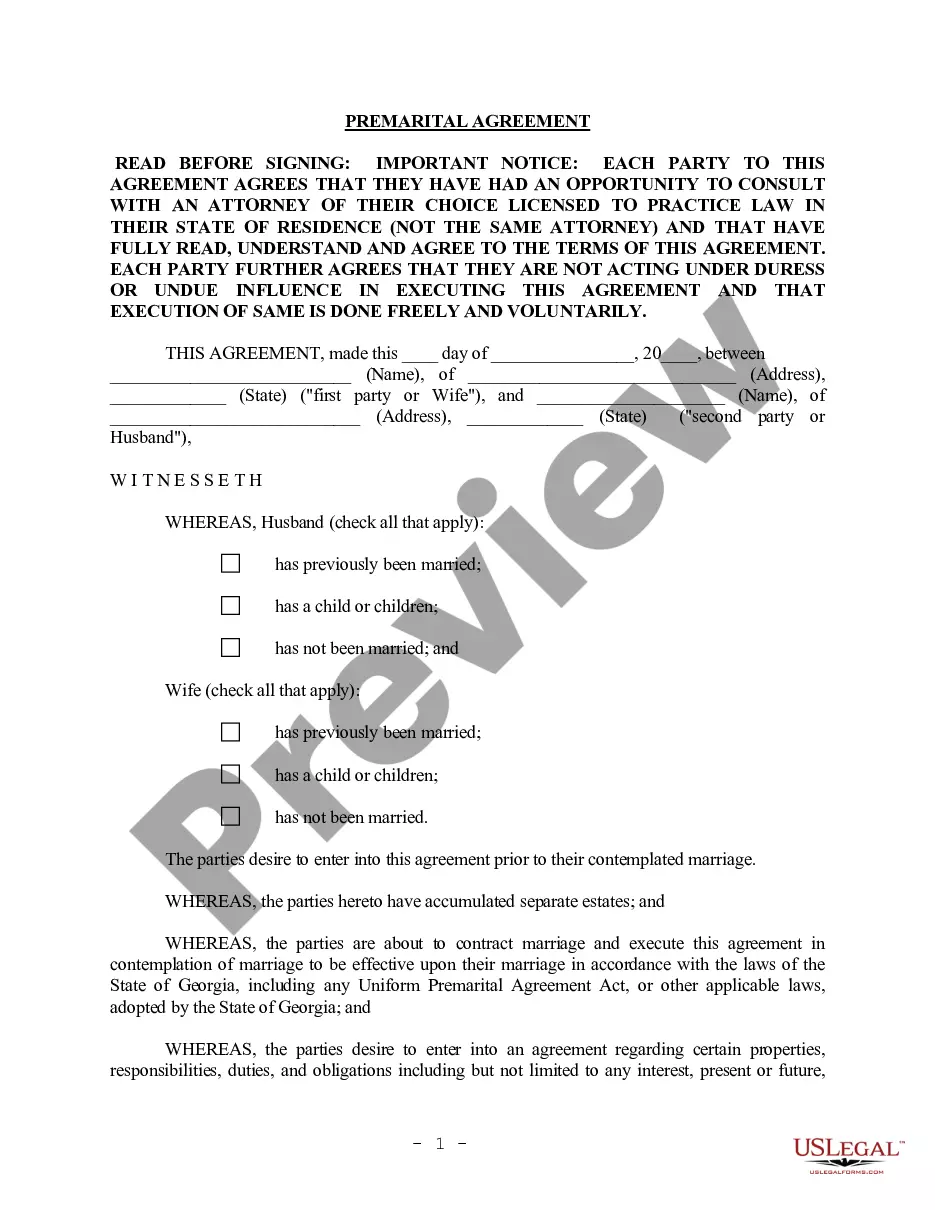

Have you been inside a situation in which you will need paperwork for sometimes enterprise or specific uses nearly every day? There are plenty of lawful file layouts available on the Internet, but finding ones you can rely on is not effortless. US Legal Forms provides 1000s of develop layouts, much like the California Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC, that are published to satisfy state and federal demands.

When you are previously informed about US Legal Forms website and also have a merchant account, just log in. Afterward, it is possible to download the California Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC template.

If you do not offer an accounts and want to begin using US Legal Forms, follow these steps:

- Find the develop you require and make sure it is for your right town/state.

- Make use of the Review option to check the form.

- Look at the outline to ensure that you have chosen the proper develop.

- When the develop is not what you`re seeking, take advantage of the Research industry to obtain the develop that meets your requirements and demands.

- Once you get the right develop, click on Purchase now.

- Opt for the pricing prepare you would like, fill in the necessary information and facts to make your bank account, and pay for the order using your PayPal or charge card.

- Select a convenient paper structure and download your backup.

Locate each of the file layouts you might have bought in the My Forms food selection. You can get a more backup of California Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC any time, if necessary. Just select the required develop to download or print the file template.

Use US Legal Forms, the most comprehensive assortment of lawful varieties, in order to save time and steer clear of mistakes. The services provides skillfully made lawful file layouts that you can use for a variety of uses. Produce a merchant account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

Mortgage backed securities (MBS) come in two main varieties; commercial mortgage backed securities (CMBS) and residential mortgage backed securities (RMBS). While CMBS are backed by large commercial loans, referred to as CMBS or conduit loans, RMBS are backed by residential mortgages, generally for single family homes.

The biggest difference between agency and non-agency MBS is that non-agency MBS are not guaranteed by the U.S. government or any government-sponsored enterprise.

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you've borrowed plus interest. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own.

There are two common types of MBSs: pass-throughs and collateralized mortgage obligations (CMO). 5 Pass-throughs are structured as trusts in which mortgage payments are collected and passed through to investors. They typically have stated maturities of five, 15, or 30 years.

Types of Mortgage-Backed Securities There are two basic types of mortgage-backed security: pass-through mortgage-backed security and collateralized mortgage obligation (CMO).

With MBSs, the bank acts as the middleman between the homeowners and investors. Individual mortgages are closed by banks and sold as conventional loans. From there, they are added to a pool of similar mortgages and packaged as a mortgage-backed security. The banks then sell those mortgages on the bond market.