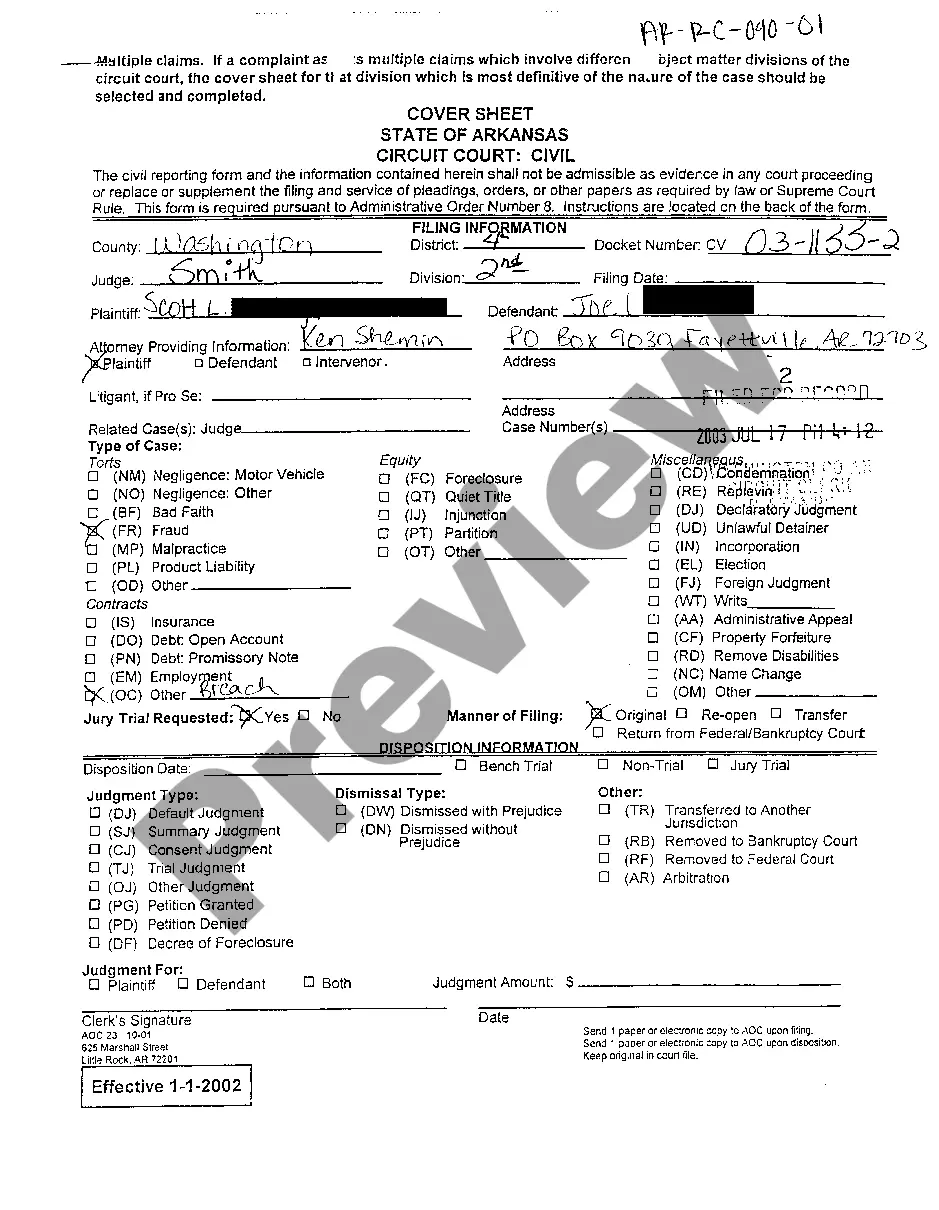

California Stock Agreement between PCSupport.com and CGTF, Inc.

Description

How to fill out Stock Agreement Between PCSupport.com And CGTF, Inc.?

You can devote hours on-line looking for the legal file template that suits the federal and state requirements you need. US Legal Forms offers a huge number of legal kinds that are reviewed by experts. You can easily download or print the California Stock Agreement between PCSupport.com and CGTF, Inc. from my services.

If you have a US Legal Forms profile, it is possible to log in and click on the Down load switch. After that, it is possible to comprehensive, edit, print, or sign the California Stock Agreement between PCSupport.com and CGTF, Inc.. Each and every legal file template you acquire is yours forever. To obtain one more version associated with a purchased type, proceed to the My Forms tab and click on the related switch.

If you work with the US Legal Forms website the very first time, keep to the basic directions listed below:

- Initially, ensure that you have chosen the correct file template to the state/area of your choice. Browse the type information to ensure you have picked out the proper type. If available, make use of the Preview switch to check with the file template too.

- If you wish to discover one more version in the type, make use of the Look for discipline to find the template that fits your needs and requirements.

- Once you have identified the template you desire, click Buy now to move forward.

- Select the pricing strategy you desire, enter your references, and register for a free account on US Legal Forms.

- Total the financial transaction. You should use your Visa or Mastercard or PayPal profile to purchase the legal type.

- Select the file format in the file and download it in your product.

- Make changes in your file if required. You can comprehensive, edit and sign and print California Stock Agreement between PCSupport.com and CGTF, Inc..

Down load and print a huge number of file web templates while using US Legal Forms web site, that offers the largest assortment of legal kinds. Use specialist and express-specific web templates to deal with your small business or individual needs.