California Term Sheet — Series A Preferred Stock Financing of a Company is a legal contract outlining the terms and conditions of an investment agreement between a company seeking funding and potential investors. This financing arrangement is specifically applicable in the state of California and encompasses various clauses and provisions important for both parties involved. The Series A Preferred Stock Financing of a Company term sheet serves as a preliminary document that acts as a blueprint for the eventual creation of formal legal agreements. It includes key financial and operational details that govern the investment, protecting the interests of both the company and the investor. The term sheet typically covers the following crucial aspects: 1. Investment details: The term sheet specifies the total amount of investment sought by the company and the number of shares of preferred stock being offered to the investor. It also outlines the purchase price per share, indicating the valuation of the company at this stage. 2. Preferred stock rights: The term sheet defines the specific rights and privileges associated with the preferred stock being offered to the investor. This may include liquidation preferences, anti-dilution provisions, dividend rights, voting rights, and rights of conversion into common stock. These privileges determine the investor's position in the event of a liquidation, acquisition, or an IPO. 3. Board representation and control: In some cases, the term sheet may address board representation for the investor. It can specify the number of board seats or observer rights granted to the investor, thereby allowing them to actively participate in the company's decision-making process. 4. Vesting and lock-up agreements: The term sheet may include vesting provisions for key employees or founders, outlining the conditions under which their stock options or shares will be vested. It may also require a lock-up period during which the investor, company insiders, or key stakeholders may not sell any shares. 5. Anti-dilution protection: The term sheet may incorporate anti-dilution provisions to safeguard the investor's stake in case of future down-round financing at a lower valuation. This ensures that the investor's ownership percentage is preserved. Different types of California Term Sheet — Series A Preferred Stock Financing of a Company may vary depending on specific circumstances. Some variations include: 1. Simple term sheets: These term sheets typically outline the basic investment terms without extensive elaboration, often pertinent in straightforward funding scenarios. 2. Comprehensive term sheets: These documents provide in-depth details regarding corporate governance, investor rights, protective provisions, and other legal and financial complexities. 3. Founder-friendly term sheets: These term sheets are structured to offer favorable terms for company founders while still attracting potential investors. They may prioritize founder control and limit investor influence. 4. Investor-friendly term sheets: Conversely, these term sheets may favor investors by providing more protective provisions, extensive control mechanisms, and higher degrees of liquidation preferences. It is crucial to consult legal counsel while negotiating and finalizing a specific California Term Sheet — Series A Preferred Stock Financing of a Company as they are complex legal documents with significant implications for both the company and investors.

California Term Sheet - Series A Preferred Stock Financing of a Company

Description

How to fill out California Term Sheet - Series A Preferred Stock Financing Of A Company?

US Legal Forms - one of many most significant libraries of lawful kinds in America - provides an array of lawful papers themes you may down load or print. Using the internet site, you can find thousands of kinds for company and individual purposes, categorized by categories, suggests, or search phrases.You will find the latest versions of kinds such as the California Term Sheet - Series A Preferred Stock Financing of a Company within minutes.

If you currently have a subscription, log in and down load California Term Sheet - Series A Preferred Stock Financing of a Company through the US Legal Forms local library. The Acquire switch will appear on every form you look at. You gain access to all in the past delivered electronically kinds within the My Forms tab of the profile.

If you wish to use US Legal Forms for the first time, listed here are easy guidelines to obtain started out:

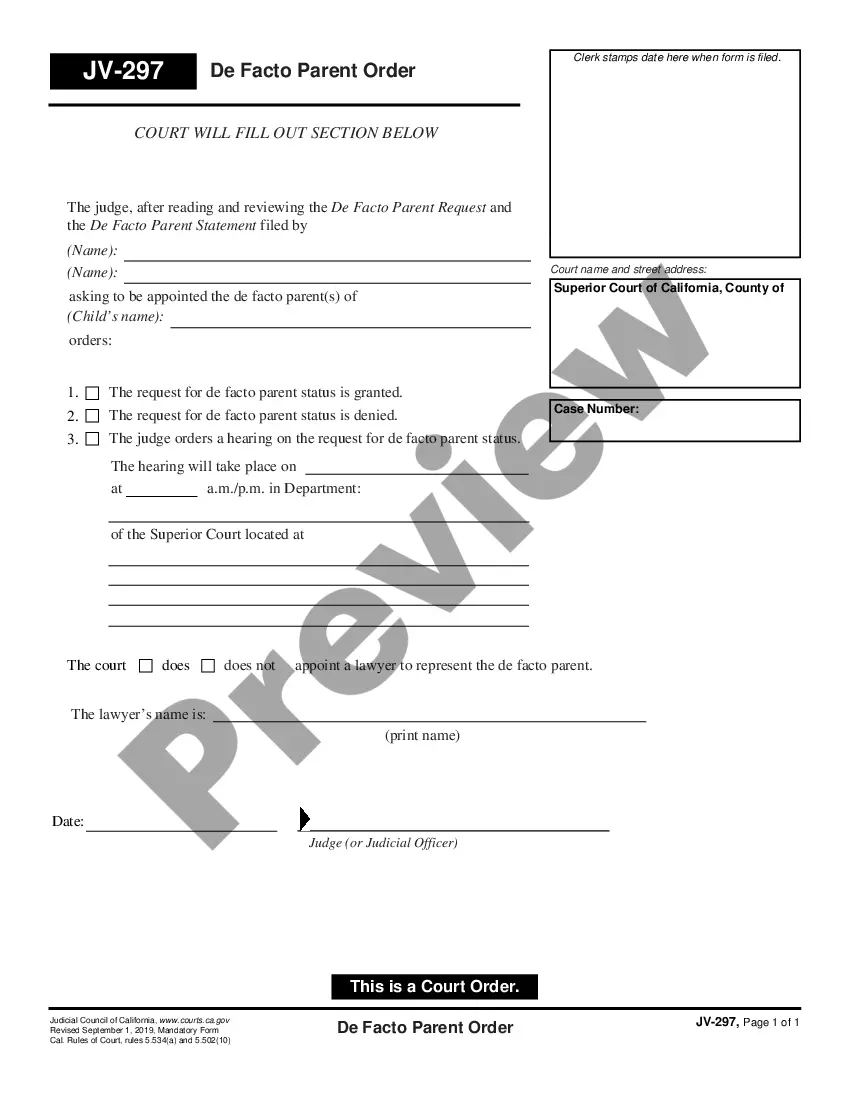

- Make sure you have selected the proper form for the city/county. Select the Preview switch to analyze the form`s information. Read the form outline to actually have chosen the correct form.

- If the form does not satisfy your needs, make use of the Lookup industry at the top of the screen to find the the one that does.

- In case you are content with the form, verify your choice by clicking the Acquire now switch. Then, select the pricing program you like and offer your accreditations to register to have an profile.

- Approach the transaction. Utilize your credit card or PayPal profile to perform the transaction.

- Choose the formatting and down load the form in your product.

- Make adjustments. Load, edit and print and indicator the delivered electronically California Term Sheet - Series A Preferred Stock Financing of a Company.

Every web template you put into your account lacks an expiry day and it is your own for a long time. So, if you want to down load or print yet another copy, just visit the My Forms area and click in the form you require.

Obtain access to the California Term Sheet - Series A Preferred Stock Financing of a Company with US Legal Forms, one of the most extensive local library of lawful papers themes. Use thousands of professional and status-certain themes that meet your company or individual requirements and needs.