California Private Placement Subscription Agreement

Description

How to fill out Private Placement Subscription Agreement?

You may devote several hours on-line trying to find the legal file template which fits the federal and state specifications you will need. US Legal Forms supplies a large number of legal varieties that are evaluated by experts. It is possible to down load or produce the California Private Placement Subscription Agreement from my assistance.

If you have a US Legal Forms profile, it is possible to log in and click the Download option. After that, it is possible to total, revise, produce, or indication the California Private Placement Subscription Agreement. Every legal file template you get is your own property forever. To obtain an additional backup of any purchased type, visit the My Forms tab and click the related option.

Should you use the US Legal Forms website the very first time, keep to the straightforward recommendations under:

- First, be sure that you have selected the correct file template for that state/city of your choosing. Look at the type explanation to make sure you have selected the correct type. If accessible, take advantage of the Preview option to check through the file template too.

- If you wish to locate an additional variation in the type, take advantage of the Search area to discover the template that meets your needs and specifications.

- After you have discovered the template you want, simply click Buy now to move forward.

- Find the rates program you want, type your references, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You may use your charge card or PayPal profile to purchase the legal type.

- Find the formatting in the file and down load it to your product.

- Make adjustments to your file if possible. You may total, revise and indication and produce California Private Placement Subscription Agreement.

Download and produce a large number of file web templates making use of the US Legal Forms Internet site, which offers the greatest variety of legal varieties. Use skilled and condition-certain web templates to tackle your company or individual demands.

Form popularity

FAQ

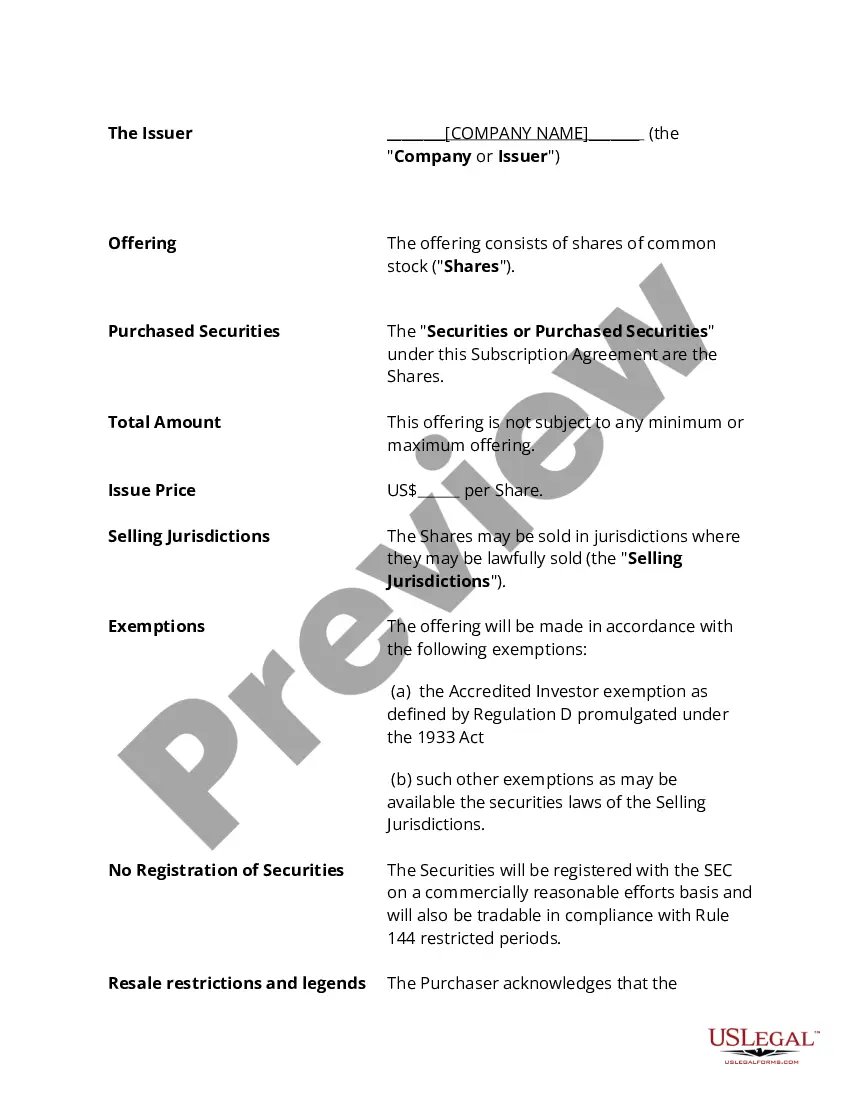

Use this as a basic checklist for what must be in a PPM: Notice of Offering. Executive Summary. Description of the Investment. Investment objectives and Criteria. Terms of Offer. Investment Structure. Financial Information. Use of Funds.

The Private Placement Memorandum (PPM) itself doesn't represent the actual ?offering.? Instead, it serves as a disclosure document that comprehensively describes the offering, encompassing its structure, strategies, regulation, financing, use of funds, business plan, services, risks, and management.

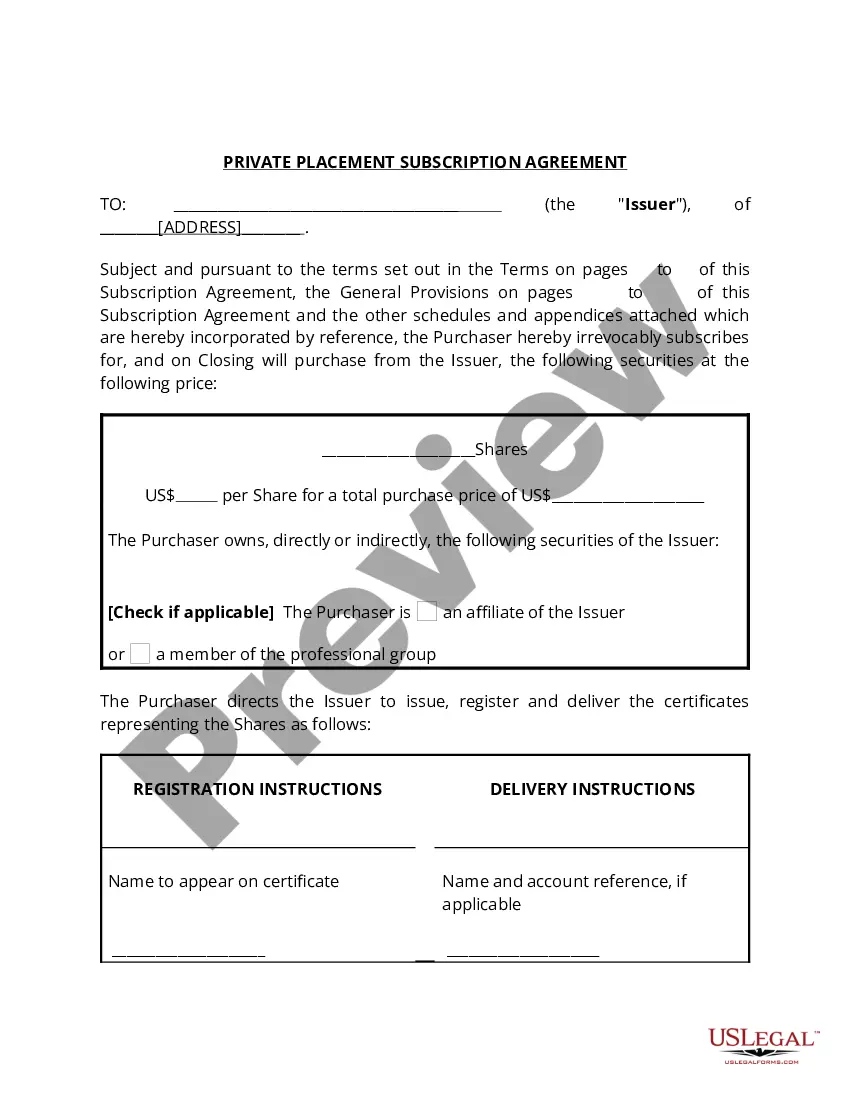

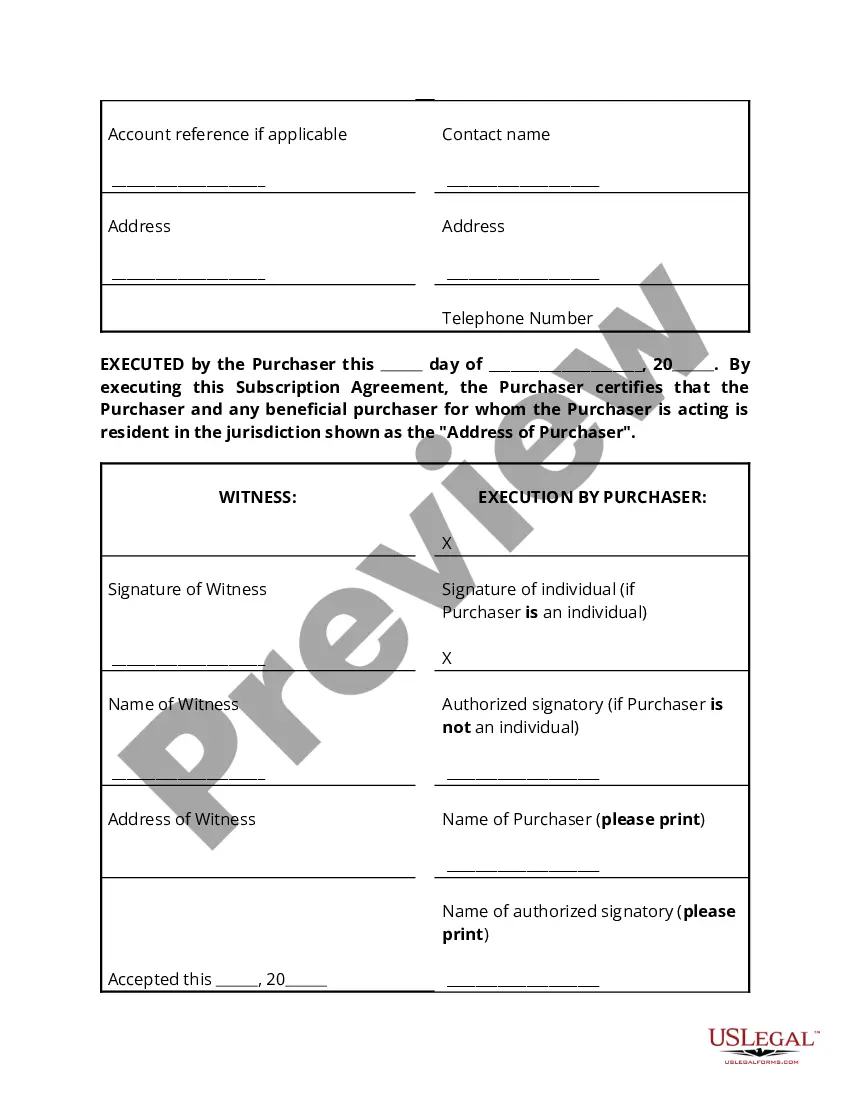

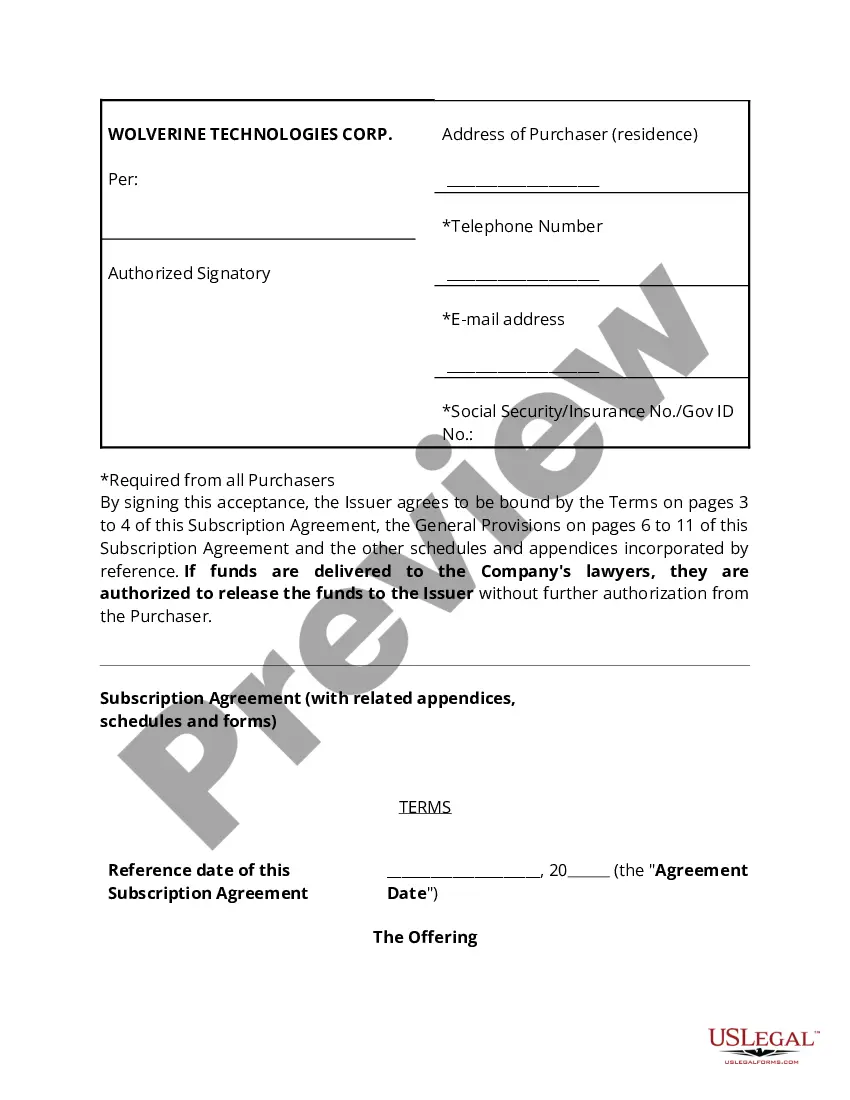

A well organized and well-structured subscription agreement will include the details about the transaction, the number of shares being sold and the price per share, and any legally binding confidentiality agreements and clauses.

An offering memorandum, also known as a private placement memorandum (PPM), is used by business owners of privately held companies to attract a specific group of outside investors. For these select investors, an offering memorandum is a way for them to understand the investment vehicle.

How is a Subscription Agreement different from a Private Placement Memorandum (PPM)? The PPM goes into the specifics of the offering, whereas the Subscription Agreement acts as the purchase agreement to acquire interests in the offering.

In investment finance, an offering memorandum is a kind of a detailed business plan that highlights information required by an investor to understand the business. It provides details on the terms of engagement, potential risks associated with the business, and a detailed description of the operations of the business.

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

To calculate ppm, you must first determine the mass or volume of solute per unit volume of solution, then multiply that amount by 1 million. For example, if you had 5g of salt dissolved in 500ml of water, you would divide 5g/500ml to get 0.01g/ml and then multiply 0.01g/mL by 1 million to calculate 10,000PPM.