The California Investors Rights Agreement is a legal document that outlines the rights and protections of investors in the state of California. This agreement is designed to safeguard the interests of both individual and institutional investors who invest in various securities, such as stocks, bonds, and mutual funds. One key component of the California Investors Rights Agreement is the disclosure requirements. Companies issuing securities must provide investors with detailed information about their financial health, business operations, risks associated with investments, and any other material facts that may affect investment decisions. This disclosure is essential for investors to make informed choices and evaluate the potential risks and rewards of their investments. Another crucial aspect that the agreement addresses is the protection of minority investors. In cases where a majority shareholder or a controlling person seeks to take actions that may harm the interests of minority investors, the agreement provides safeguards to ensure fair treatment. These provisions often include anti-dilution clauses, preemptive rights, and tag-along rights. These mechanisms help prevent the minority shareholders from being unfairly marginalized or excluded from important decisions. Additionally, the California Investors Rights Agreement may also specify rules regarding the transferability of securities. It may outline restrictions on transfers, such as requiring a shareholder to offer the securities to existing shareholders before selling them to outsiders. These provisions help maintain the stability and control of the company while providing a fair opportunity for existing shareholders to participate in any ownership changes. It's worth noting that there can be different types or variations of the California Investors Rights Agreement, depending on the specific circumstances and needs of the parties involved. For example, companies at different stages of growth or different sectors may have unique requirements and may tailor the agreement accordingly. Some common types of California Investors Rights Agreement include: 1. Founders' Agreement: This agreement is often executed between the founders of a startup and the company's early investors. It addresses the rights and obligations of both parties, including issues such as vesting of shares, governance, and potential future funding rounds. 2. Preferred Stock Purchase Agreement: This type of agreement is typically used when a company seeks funding from venture capitalists or private equity investors. It outlines the terms of the investment, including the rights and preferences attached to the preferred shares being issued. 3. Shareholders Agreement: This agreement is entered into by all shareholders of a company and sets out the rights and obligations of the shareholders towards each other and the company. It covers matters such as governance, voting rights, and dispute resolution mechanisms. Overall, the California Investors Rights Agreement is a crucial legal framework that protects investors and ensures a fair and transparent investment environment in the state. By promoting disclosure, minority shareholder protection, and fair transferability rules, this agreement helps maintain investor confidence and fosters the growth of businesses in California.

California Investors Rights Agreement

Description

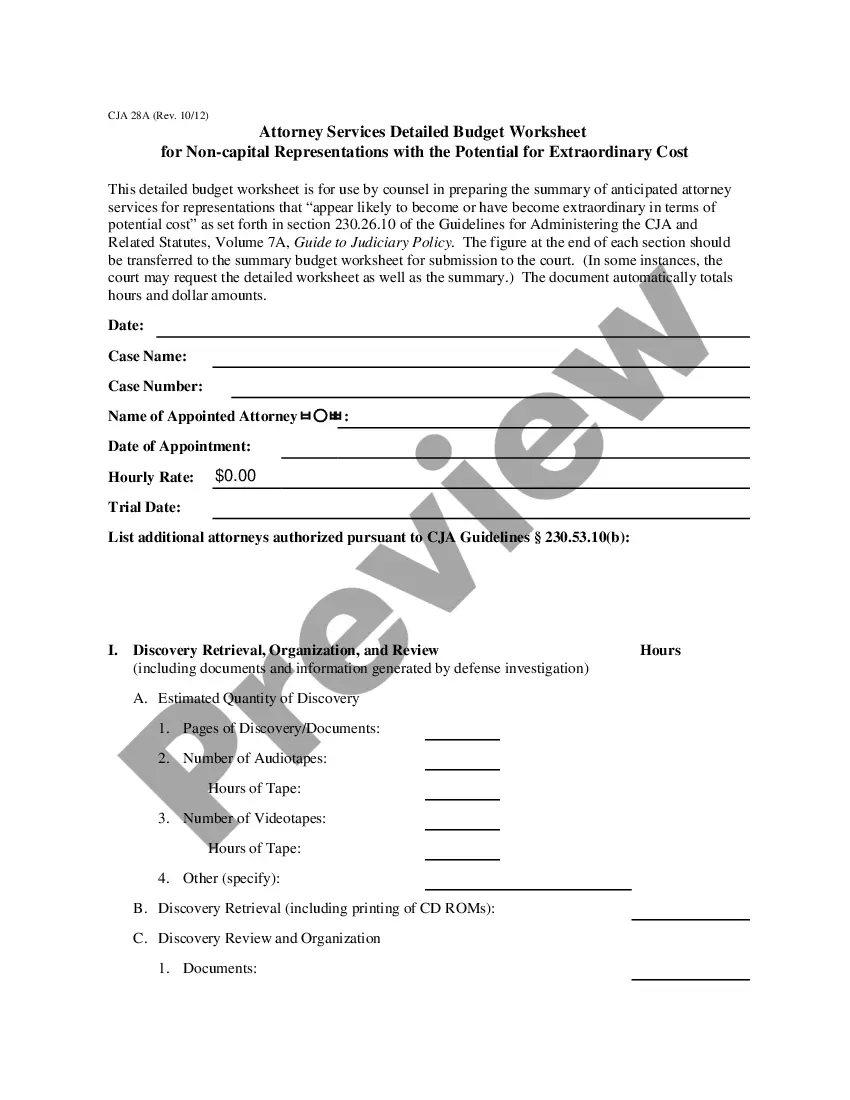

How to fill out California Investors Rights Agreement?

If you have to full, acquire, or printing legitimate papers themes, use US Legal Forms, the biggest collection of legitimate varieties, that can be found online. Take advantage of the site`s easy and practical lookup to discover the files you will need. Numerous themes for business and individual reasons are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to discover the California Investors Rights Agreement in just a handful of click throughs.

When you are already a US Legal Forms consumer, log in to your profile and then click the Obtain button to find the California Investors Rights Agreement. Also you can access varieties you earlier delivered electronically from the My Forms tab of your profile.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the shape for your correct town/country.

- Step 2. Make use of the Preview solution to examine the form`s articles. Don`t overlook to learn the description.

- Step 3. When you are not satisfied with all the form, take advantage of the Lookup industry towards the top of the display screen to find other versions in the legitimate form template.

- Step 4. When you have identified the shape you will need, click the Acquire now button. Choose the costs program you choose and include your accreditations to register to have an profile.

- Step 5. Approach the deal. You can utilize your credit card or PayPal profile to finish the deal.

- Step 6. Select the formatting in the legitimate form and acquire it on your gadget.

- Step 7. Total, edit and printing or sign the California Investors Rights Agreement.

Every legitimate papers template you acquire is your own property eternally. You may have acces to every single form you delivered electronically within your acccount. Click on the My Forms section and select a form to printing or acquire yet again.

Be competitive and acquire, and printing the California Investors Rights Agreement with US Legal Forms. There are many skilled and state-specific varieties you can use for the business or individual needs.