This guide provides an overview of the Fair Credit and Reporting Act Red Flags rule and gives step-by-step guidance on how businesses may develop a program to comply with the law's requirements. Links to additional resources for developing an Identity Theft Prevention Program are included.

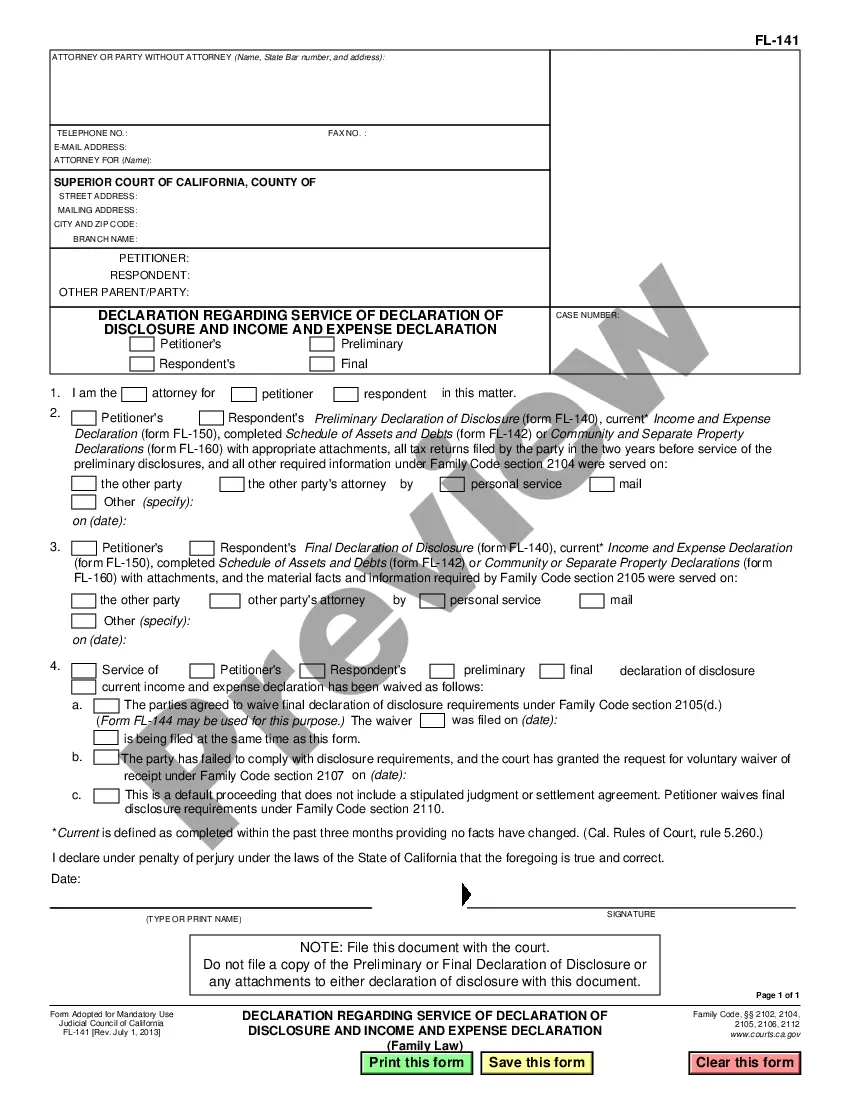

Note: The preview only shows the 1st two pages of the document.

Title: California How-To Guide for Fighting Fraud and Identity Theft With the FCRA and FACT Red Flags Rule: A Comprehensive Overview Intro: California How-To Guide for Fighting Fraud and Identity Theft With the FCRA and FACT Red Flags Rule provides invaluable insights and steps on how individuals and businesses can protect themselves from fraudulent activities and identity theft. This guide will cover the various aspects of combating fraud in compliance with the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT) Red Flags Rule. Dive into this comprehensive guide to gain a thorough understanding of these regulations and learn effective strategies for safeguarding your financial security. 1. Understanding the FCRA and FACT Red Flags Rule: Begin by understanding the foundational concepts of the FCRA and the FACT Red Flags Rule, as they serve as the legal framework for combating fraud. Explore the scope, purpose, and obligations imposed by these regulations in California. 2. Identifying Red Flags: Discover the various red flags of potential fraud and identity theft to remain vigilant in detecting suspicious activities. This section will provide an in-depth analysis of common warning signs, such as unauthorized account access, unusual changes in personal information, or suspicious transactions. Learn how to identify and act upon these red flags promptly. 3. Compliance Requirements for Businesses: Explore the specific compliance requirements set forth by the FCRA and FACT Red Flags Rule for businesses operating in California. Understand the obligations of various industries (e.g., financial institutions, healthcare providers, creditors) and learn to implement effective fraud prevention programs tailored to your business. 4. Reporting Suspected Fraud: Learn how to report suspected fraudulent activities and identity theft incidents to the appropriate authorities. Familiarize yourself with the process of filing complaints with law enforcement agencies, credit bureaus, and the Federal Trade Commission (FTC). Discover the necessary documentation and details needed to initiate an effective investigation. 5. Proactive Measures for Individuals: Equip yourself with practical strategies to protect your personal information from falling into the wrong hands. This section covers measures such as monitoring credit reports, using strong passwords, avoiding phishing scams, employing encryption software, and secure disposal of sensitive documents. Empower yourself with the knowledge and tools to proactively safeguard your identity. 6. Responding to Identity Theft: Uncover the steps required to navigate through the challenging aftermath of identity theft. From reporting the incident and freezing credit files to disputing fraudulent charges and restoring your identity, this section will guide you through the necessary actions to mitigate the damage caused by identity theft. Types of California How-To Guides for Fighting Fraud and Identity Theft With the FCRA and FACT Red Flags Rule: 1. California How-To Guide for Businesses: Compliance and Best Practices 2. California How-To Guide for Consumers: Protecting Your Identity & Financial Security 3. California How-To Guide for Healthcare Providers: Protecting Patient Information from Fraud 4. California How-To Guide for Financial Institutions: Strengthening Fraud Detection and Prevention Measures Conclusion: This California How-To Guide for Fighting Fraud and Identity Theft With the FCRA and FACT Red Flags Rule provides a comprehensive resource for individuals and businesses seeking to bolster their defense against fraudulent activities. By understanding the legal requirements, recognizing red flags, and implementing proactive measures, you can effectively combat fraud and ensure the security of your financial information. Stay informed, stay prepared, and safeguard your future.

Title: California How-To Guide for Fighting Fraud and Identity Theft With the FCRA and FACT Red Flags Rule: A Comprehensive Overview Intro: California How-To Guide for Fighting Fraud and Identity Theft With the FCRA and FACT Red Flags Rule provides invaluable insights and steps on how individuals and businesses can protect themselves from fraudulent activities and identity theft. This guide will cover the various aspects of combating fraud in compliance with the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT) Red Flags Rule. Dive into this comprehensive guide to gain a thorough understanding of these regulations and learn effective strategies for safeguarding your financial security. 1. Understanding the FCRA and FACT Red Flags Rule: Begin by understanding the foundational concepts of the FCRA and the FACT Red Flags Rule, as they serve as the legal framework for combating fraud. Explore the scope, purpose, and obligations imposed by these regulations in California. 2. Identifying Red Flags: Discover the various red flags of potential fraud and identity theft to remain vigilant in detecting suspicious activities. This section will provide an in-depth analysis of common warning signs, such as unauthorized account access, unusual changes in personal information, or suspicious transactions. Learn how to identify and act upon these red flags promptly. 3. Compliance Requirements for Businesses: Explore the specific compliance requirements set forth by the FCRA and FACT Red Flags Rule for businesses operating in California. Understand the obligations of various industries (e.g., financial institutions, healthcare providers, creditors) and learn to implement effective fraud prevention programs tailored to your business. 4. Reporting Suspected Fraud: Learn how to report suspected fraudulent activities and identity theft incidents to the appropriate authorities. Familiarize yourself with the process of filing complaints with law enforcement agencies, credit bureaus, and the Federal Trade Commission (FTC). Discover the necessary documentation and details needed to initiate an effective investigation. 5. Proactive Measures for Individuals: Equip yourself with practical strategies to protect your personal information from falling into the wrong hands. This section covers measures such as monitoring credit reports, using strong passwords, avoiding phishing scams, employing encryption software, and secure disposal of sensitive documents. Empower yourself with the knowledge and tools to proactively safeguard your identity. 6. Responding to Identity Theft: Uncover the steps required to navigate through the challenging aftermath of identity theft. From reporting the incident and freezing credit files to disputing fraudulent charges and restoring your identity, this section will guide you through the necessary actions to mitigate the damage caused by identity theft. Types of California How-To Guides for Fighting Fraud and Identity Theft With the FCRA and FACT Red Flags Rule: 1. California How-To Guide for Businesses: Compliance and Best Practices 2. California How-To Guide for Consumers: Protecting Your Identity & Financial Security 3. California How-To Guide for Healthcare Providers: Protecting Patient Information from Fraud 4. California How-To Guide for Financial Institutions: Strengthening Fraud Detection and Prevention Measures Conclusion: This California How-To Guide for Fighting Fraud and Identity Theft With the FCRA and FACT Red Flags Rule provides a comprehensive resource for individuals and businesses seeking to bolster their defense against fraudulent activities. By understanding the legal requirements, recognizing red flags, and implementing proactive measures, you can effectively combat fraud and ensure the security of your financial information. Stay informed, stay prepared, and safeguard your future.