California Writ of Execution

Description

How to fill out Writ Of Execution?

Are you presently in the place in which you require papers for possibly enterprise or individual functions almost every time? There are plenty of legal record layouts available on the Internet, but finding types you can rely isn`t effortless. US Legal Forms provides thousands of develop layouts, like the California Writ of Execution, that happen to be published to fulfill state and federal needs.

In case you are previously knowledgeable about US Legal Forms web site and have a free account, just log in. Next, you may download the California Writ of Execution format.

Should you not come with an profile and need to start using US Legal Forms, adopt these measures:

- Discover the develop you need and ensure it is for that proper town/state.

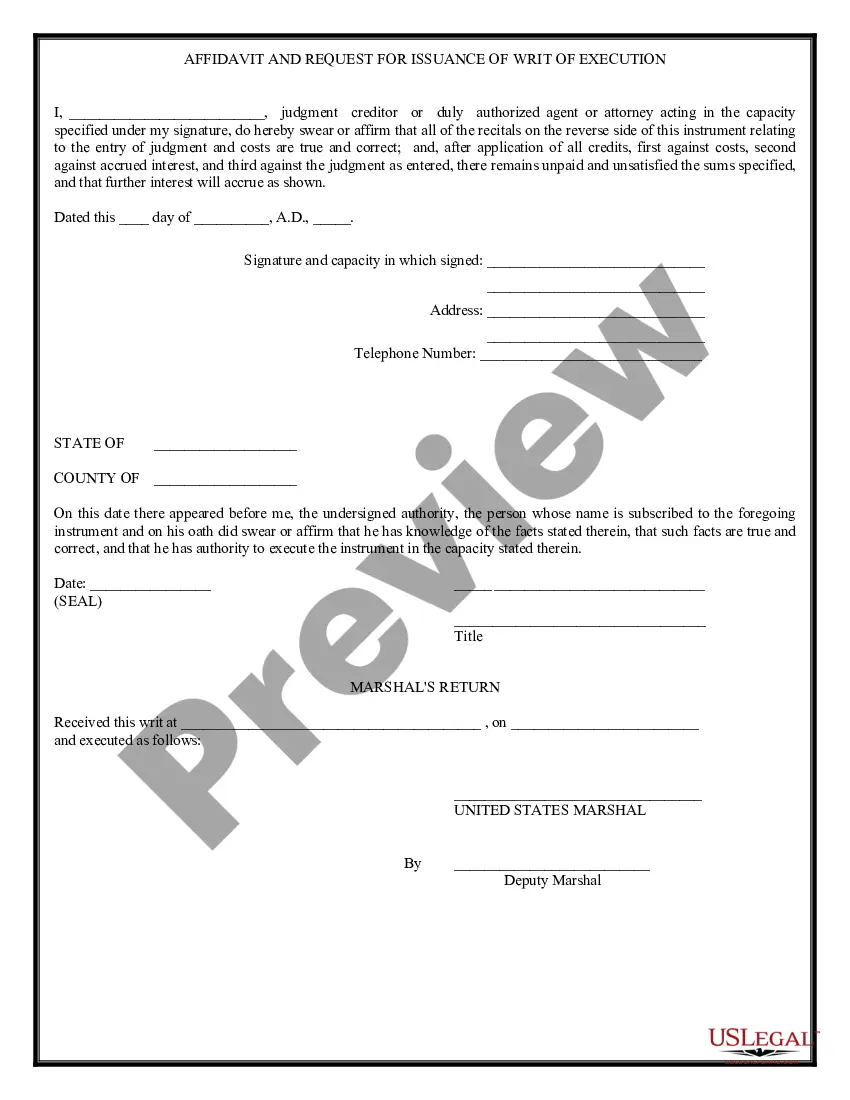

- Take advantage of the Review switch to examine the shape.

- Browse the explanation to ensure that you have selected the proper develop.

- In case the develop isn`t what you are seeking, make use of the Look for field to find the develop that meets your needs and needs.

- Once you find the proper develop, click on Buy now.

- Opt for the pricing strategy you want, fill out the required information and facts to make your money, and pay money for the transaction with your PayPal or Visa or Mastercard.

- Decide on a hassle-free data file format and download your backup.

Discover all of the record layouts you possess bought in the My Forms food selection. You can obtain a more backup of California Writ of Execution any time, if required. Just select the essential develop to download or print the record format.

Use US Legal Forms, by far the most considerable collection of legal types, to save lots of some time and prevent errors. The assistance provides appropriately manufactured legal record layouts that can be used for a selection of functions. Create a free account on US Legal Forms and start making your lifestyle easier.

Form popularity

FAQ

Abstract of judgement refers to a copy or summary of a court's judgement. Some common uses of the term ?abstract of judgement? include: In the context of a civil case, abstract of judgement is a document disclosing a monetary award issued by the court in favor of a judgement creditor against a judgement debtor.

Complete a Writ of Execution (EJ-130) . Have it issued by the clerk and pay the issuance fee by submitting it to the court location where your case was filed or you may also submit the document by eFile. Complete an Application for Earnings Withholding Order (WG-001) . Complete a Sheriff Instruction form.

The writ of execution expires 180 days after the issuance. Manner of Service Personal Service. Proof of Service A proof of service is not issued. Instead, a return detailing the Sheriff's actions is prepared which accompanies the writ of execution when it is returned to the court.

Write the name and last known address of the judgment debtor in the space provided. You may also include any known aliases used by the judgment debtor. Fill in the last 4 digits of the judgment debtor's driver license number and state where it was issued, if you know them.

An Abstract of Support Judgment is a court document that allows a claimant (the creditor) to establish a lien on another person's real property (the debtor). a relatively short extract that gives the details of a judgment for spousal or child support. The abstract of support judgment is filed with the County Recorder.

To do this, fill out an EJ-001 Abstract of Judgment form and take it to the clerk's office. After the clerk stamps it, record it at the County Recorder's Office in the county where the property is located. Place a lien on a business.

To file a petition for a writ in the appellate division, you must bring or mail the original petition, including the supporting documents, and the proof of service to the clerk for the appellate division of the superior court that took the action or issued the ruling you are challenging.

On your Memorandum of Costs After Judgment (MC-012), you must include the exact amount of all allowable costs, the payments credited toward the principal and interest, and the amount of accrued interest. This means you are responsible for calculating these amounts.