California Specialty Services Contact - Self-Employed

Description

How to fill out California Specialty Services Contact - Self-Employed?

US Legal Forms - one of the greatest libraries of authorized varieties in America - provides a wide range of authorized file layouts you may download or produce. Using the internet site, you may get a huge number of varieties for organization and individual reasons, sorted by groups, states, or key phrases.You can find the most up-to-date types of varieties like the California Specialty Services Contact - Self-Employed within minutes.

If you already possess a monthly subscription, log in and download California Specialty Services Contact - Self-Employed in the US Legal Forms local library. The Download switch can look on every develop you perspective. You gain access to all previously delivered electronically varieties in the My Forms tab of your own profile.

If you would like use US Legal Forms initially, listed here are basic guidelines to get you started out:

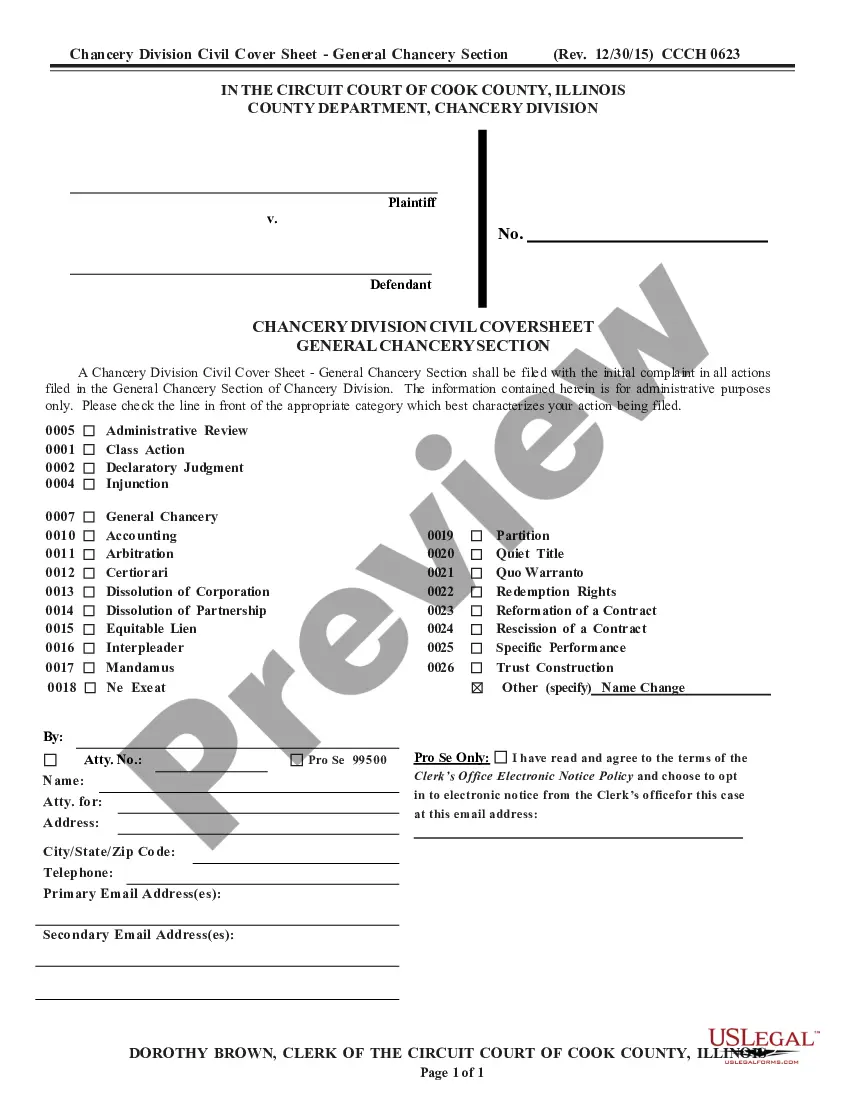

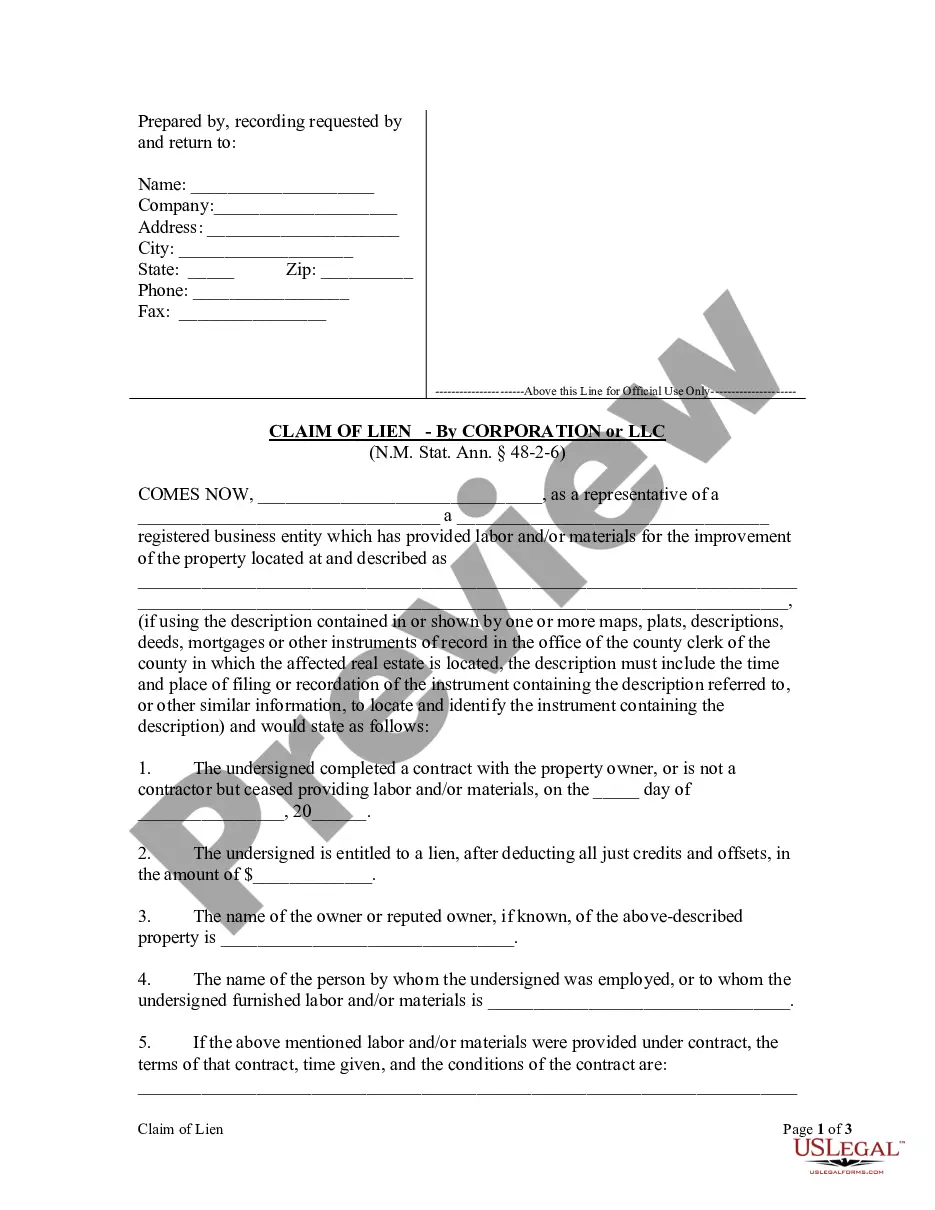

- Make sure you have selected the best develop for your personal area/area. Click the Review switch to analyze the form`s articles. See the develop outline to actually have chosen the appropriate develop.

- If the develop doesn`t satisfy your specifications, make use of the Search discipline towards the top of the display screen to find the one which does.

- When you are content with the form, validate your decision by clicking the Get now switch. Then, choose the pricing plan you want and supply your credentials to sign up for an profile.

- Procedure the financial transaction. Utilize your charge card or PayPal profile to complete the financial transaction.

- Select the file format and download the form on your device.

- Make changes. Complete, change and produce and signal the delivered electronically California Specialty Services Contact - Self-Employed.

Every format you included with your account does not have an expiration particular date and is the one you have forever. So, if you would like download or produce an additional backup, just visit the My Forms segment and click on about the develop you require.

Get access to the California Specialty Services Contact - Self-Employed with US Legal Forms, the most extensive local library of authorized file layouts. Use a huge number of professional and state-particular layouts that fulfill your business or individual requirements and specifications.

Form popularity

FAQ

For Small Business Owners, Self-Employed and Independent Contractors. If you are covered by Disability Insurance Elective Coverage (DIEC), you may be eligible for Disability Insurance (DI) and Paid Family Leave (PFL) benefits to protect against a loss of income.

The EDD offers an optional Disability Insurance Elective Coverage (DIEC) program. The program is for self-employed individuals or independent contractors who do not pay into State Disability Insurance (SDI) but want Paid Family Leave (PFL) and Disability Insurance benefits.

Are independent contractors eligible for CASDI? If you or your worker is self-employed or work as an independent contractor, you have the option of paying into the EDD's Disability Insurance Elective Coverage (DIEC) program.

Generally, you are self employed if: You are in business for yourself (including a part-time business) You work as a sole proprietor or an independent contractor. You are a partner of a partnership that carries on a trade or business.

Self-employed individuals are only covered by the SDI program if they have enrolled in Disability Insurance Elective Coverage with EDD and paid the premiums. Usually you become eligible for benefits after six months of elective coverage.

The following were eligible for PUA: Business owners. Self-employed workers. Independent contractors.

Call the Taxpayer Assistance Center at 1-888-745-3886 to obtain a form. Create your own form with all of the required information. Visit your nearest Employment Tax Office.

If you are out of work or had your hours reduced, you may be eligible to receive unemployment benefits from California's Employment Development Department (EDD). First register or log in at Benefit Programs Online, then apply for unemployment benefits on UI Online2120.

The majority of California employees, approximately 12 million workers, are covered by the SDI program. Some employees are exempt from SDI; for example, railroad employees, some employees of non-profit agencies, employees who claim religious exemptions, and most government employees.

"Whether you're in the gig economy, whether you're an independent contractor, everyone who is out of work is eligible for unemployment insurance," said Rep.