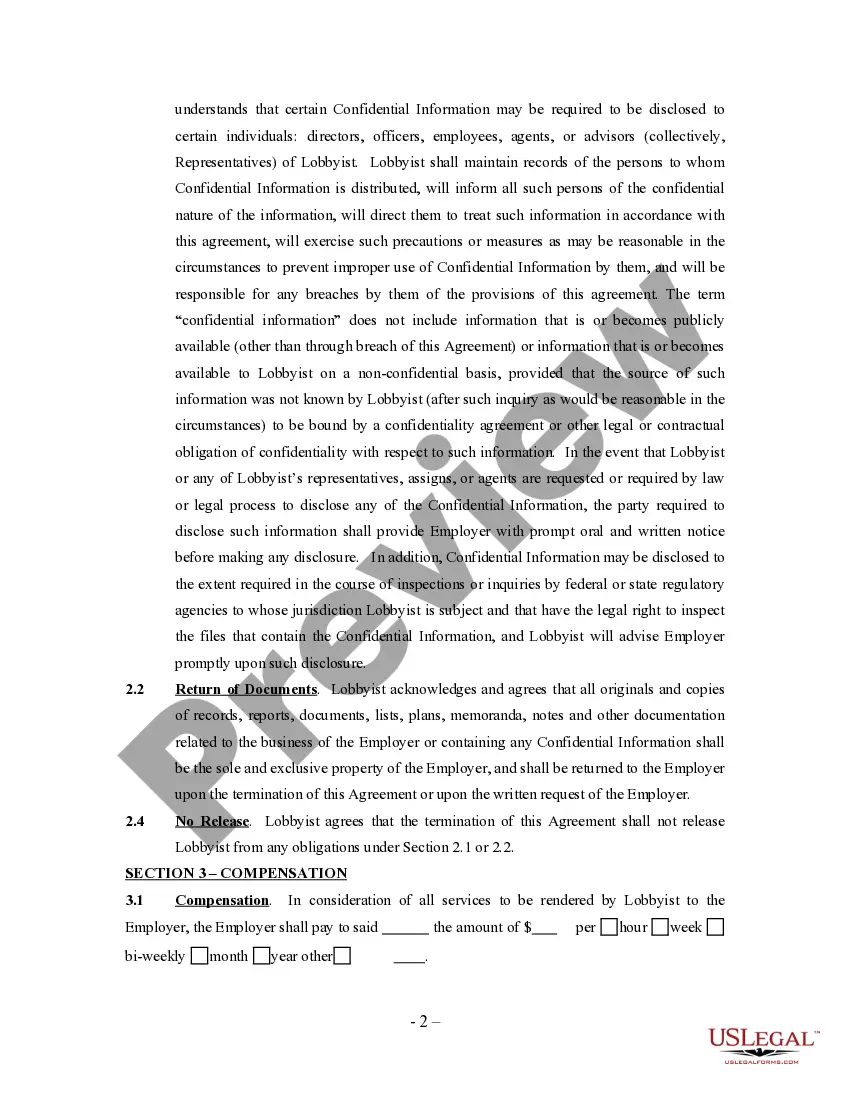

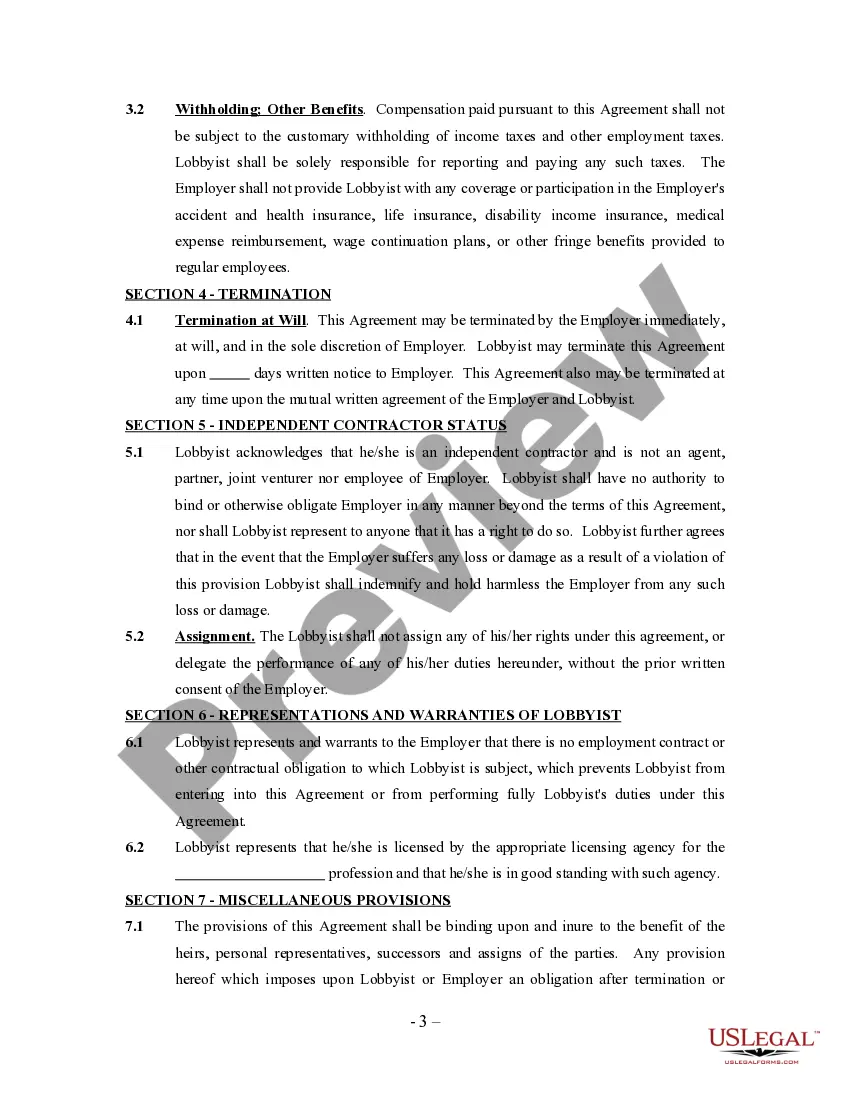

California Lobbyist Agreement - Self-Employed Independent Contractor

Description

How to fill out California Lobbyist Agreement - Self-Employed Independent Contractor?

Are you inside a situation in which you need to have files for sometimes company or individual uses just about every day? There are a lot of authorized file web templates accessible on the Internet, but discovering versions you can rely isn`t straightforward. US Legal Forms gives a huge number of develop web templates, much like the California Lobbyist Agreement - Self-Employed Independent Contractor, which are published to fulfill federal and state specifications.

In case you are previously familiar with US Legal Forms website and possess an account, just log in. Following that, it is possible to obtain the California Lobbyist Agreement - Self-Employed Independent Contractor design.

Should you not have an accounts and wish to begin using US Legal Forms, abide by these steps:

- Discover the develop you need and ensure it is for your proper city/area.

- Use the Preview button to review the form.

- Read the explanation to ensure that you have chosen the right develop.

- When the develop isn`t what you`re trying to find, use the Research discipline to get the develop that meets your requirements and specifications.

- Whenever you find the proper develop, click on Buy now.

- Pick the pricing strategy you would like, fill in the specified information to produce your account, and pay money for the transaction with your PayPal or charge card.

- Choose a handy document file format and obtain your backup.

Locate each of the file web templates you have bought in the My Forms menus. You can aquire a further backup of California Lobbyist Agreement - Self-Employed Independent Contractor at any time, if required. Just select the needed develop to obtain or printing the file design.

Use US Legal Forms, the most considerable collection of authorized kinds, to save lots of time and stay away from mistakes. The assistance gives appropriately made authorized file web templates that can be used for a variety of uses. Create an account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

Key Takeaways. California Assembly Bill 5 (AB5) extends employee classification status to some gig workers. AB5 was designed to regulate companies that hire gig workers in large numbers, such as Uber, Lyft, and DoorDash.

AB5 Exemptions AB5 also exempts business-to-business contractors that meet 12 specific requirements and referral agencies that meet 10 specific requirements. However, these business-to-business contractor exemptions require a carefully planned strategy to achieve compliance with all of the various requirements.

If you're a business (which can be a sole proprietor, partnership, LLC, or corporation) and contract with other businesses, then you may be exempt. Unlike the other exemptions, this one can be used by anybody. It's not limited to workers performing specific types of services.

The exemption included in AB5 for contracts between business service providers and businesses is expanded to include public agencies, quasi-public corporations, and a few other arts-related industries.

The new law was effective on January 1, 2020. AB 5 requires companies to reclassify independent contractors as employees with a few exceptions to the rule. The bill was designed to increase regulation over companies that hire gig workers in large numbers, including DoorDash, Shipt, Postmates, Uber, and Lyft.

In September of 2019, Governor Newsom signed Assembly Bill (AB) 5 into law. The new law addresses the employment status of workers when the hiring entity claims the worker is an independent contractor and not an employee.

In 2019, California enacted Assembly Bill 5 (AB 5), which codified a new legal test to classify California workers tilted heavily against independent contracting. Canvassers, who were typically independent contractors under the old legal test, would now be employeesif anyone could afford to hire them.

Occupation Exemptions: Under AB 5, certain occupations were excluded from the ABC test, including doctors, lawyers, dentists, licensed insurance agents, accountants, architects and engineers, private investigators, real estate agents, and hairstylists.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

The new law was effective on January 1, 2020. AB 5 requires companies to reclassify independent contractors as employees with a few exceptions to the rule. The bill was designed to increase regulation over companies that hire gig workers in large numbers, including DoorDash, Shipt, Postmates, Uber, and Lyft.