California Contract Administrator Agreement - Self-Employed Independent Contractor

Description

How to fill out California Contract Administrator Agreement - Self-Employed Independent Contractor?

Finding the right legal record format can be a struggle. Of course, there are plenty of web templates available on the net, but how will you get the legal form you require? Use the US Legal Forms site. The services delivers 1000s of web templates, such as the California Contract Administrator Agreement - Self-Employed Independent Contractor, that you can use for enterprise and private needs. Every one of the kinds are checked by specialists and fulfill state and federal requirements.

Should you be currently listed, log in to the account and click the Acquire button to get the California Contract Administrator Agreement - Self-Employed Independent Contractor. Make use of your account to appear through the legal kinds you have acquired previously. Proceed to the My Forms tab of your respective account and obtain an additional version from the record you require.

Should you be a fresh end user of US Legal Forms, listed here are straightforward guidelines for you to comply with:

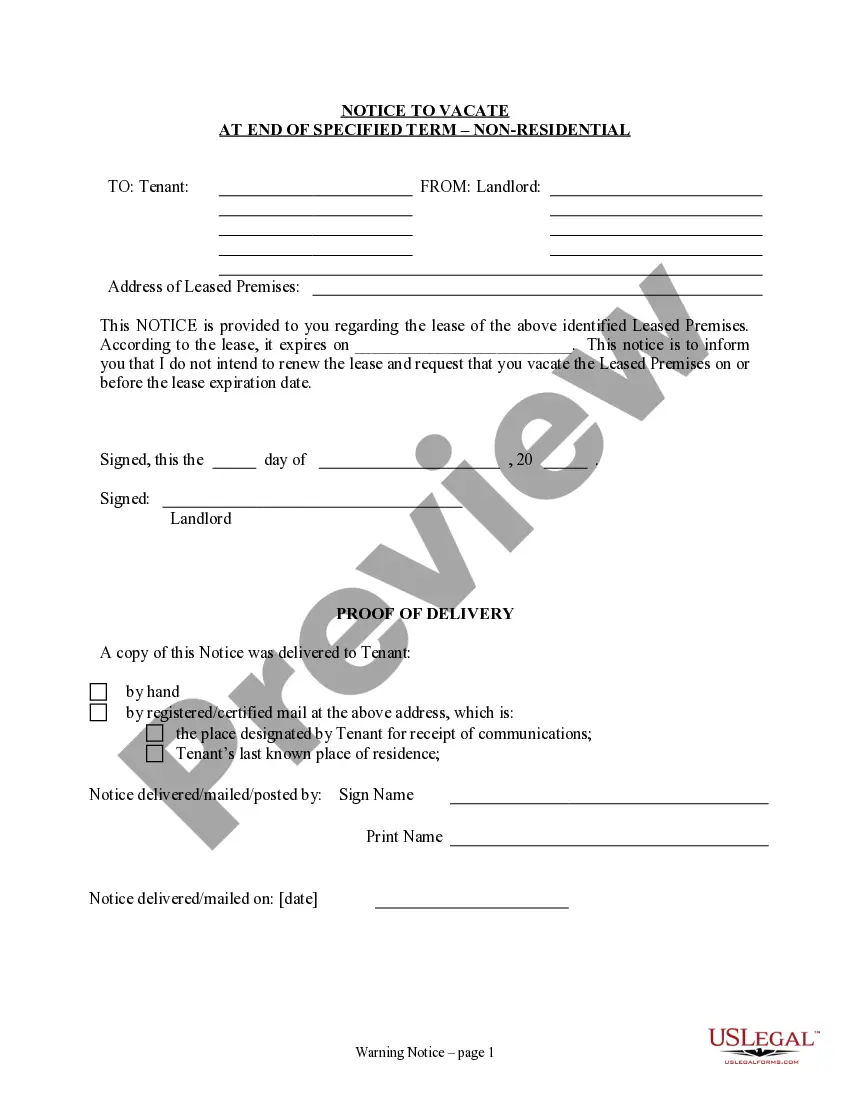

- Initially, make sure you have selected the correct form to your area/county. You can examine the form making use of the Review button and look at the form outline to ensure this is basically the right one for you.

- When the form does not fulfill your expectations, make use of the Seach discipline to get the appropriate form.

- Once you are sure that the form is acceptable, click on the Purchase now button to get the form.

- Opt for the prices plan you need and enter the required info. Create your account and purchase your order making use of your PayPal account or bank card.

- Opt for the document formatting and down load the legal record format to the system.

- Total, change and produce and indicator the received California Contract Administrator Agreement - Self-Employed Independent Contractor.

US Legal Forms will be the greatest collection of legal kinds for which you will find a variety of record web templates. Use the company to down load professionally-made files that comply with status requirements.

Form popularity

FAQ

The new law was effective on January 1, 2020. AB 5 requires companies to reclassify independent contractors as employees with a few exceptions to the rule. The bill was designed to increase regulation over companies that hire gig workers in large numbers, including DoorDash, Shipt, Postmates, Uber, and Lyft.

Independent contractors are not covered by California's overtime and other wage and hour laws. However, employers cannot get around California wage and hour laws by simply declaring that an employee is an independent contractor, or by making the employee sign an agreement stating that s/he is an independent contractor.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

Independent contractors use 1099 forms. In California, workers who report their income on a Form 1099 are independent contractors, while those who report it on a W-2 form are employees. Payroll taxes from W-2 employees are automatically withheld, while independent contracts are responsible for paying them.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

In September 2019, Gov. Gavin Newsom signed new state legislation, Assembly Bill 5 (AB5), into law. Effective January 1, 2020, AB5 affects independent contractors throughout California, radically changing 30 years of worker classification and reclassifying millions as employees.

A business may pay an independent contractor and an employee for the same or similar work, but there are important legal differences between the two. For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes.

A true independent contractor has no protection under the provisions of the Labour Relations Act and section 83A does not apply to persons who earns in excess of the amount determined by the Minister. It is for this reason that many employers will prefer to employ someone as an independent contractor.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

More info

Register Now In the first step you need to register for the job postings. In the second step, you need to sign in. When you successfully register and sign in, an e-mail address and password will be sent to the e-mail address and/or password you used during registration. Please remember the password. How to Search for Your Dream Job? Our platform consists of over 20 million profiles and millions of open jobs across 100s of industries.