California Minister Agreement - Self-Employed Independent Contractor

Description

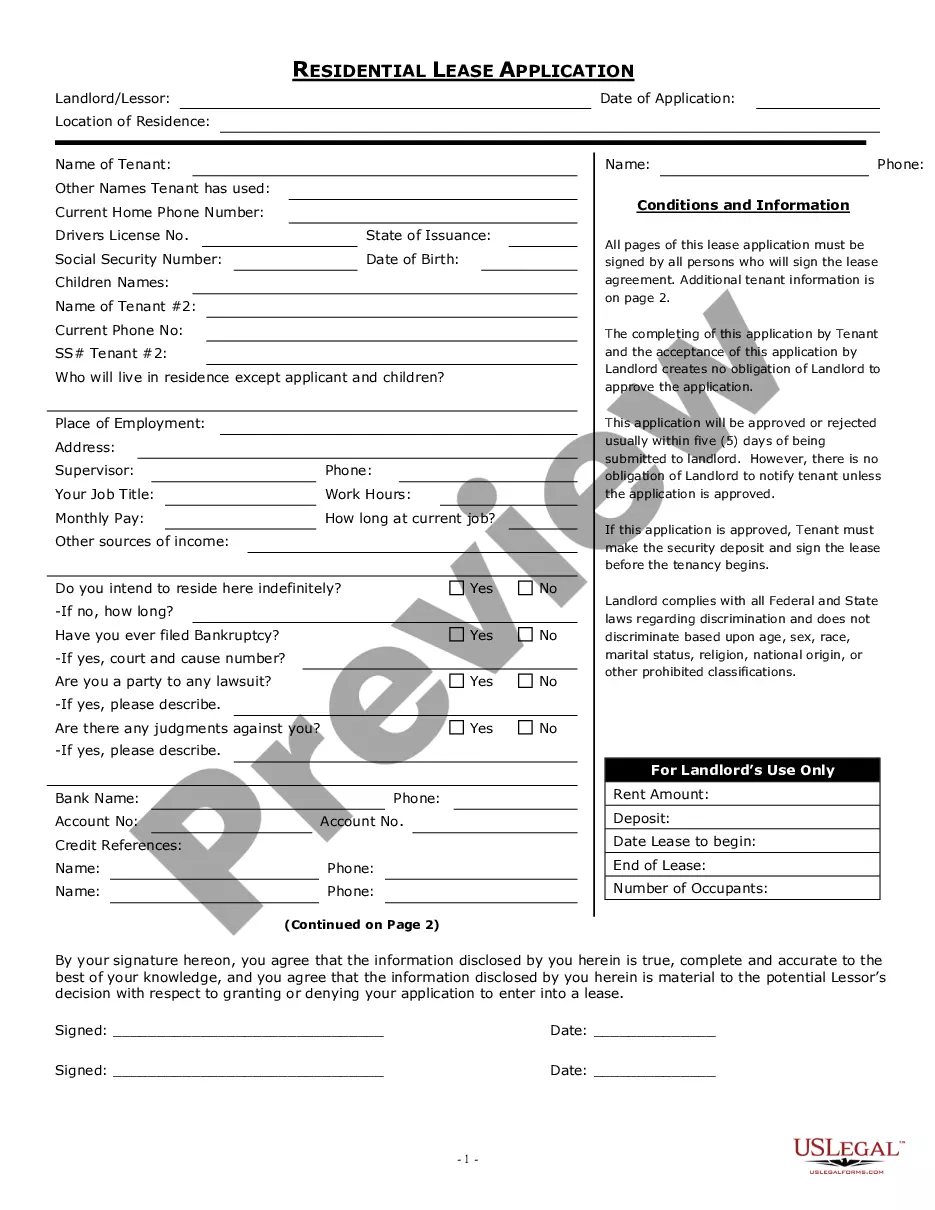

How to fill out California Minister Agreement - Self-Employed Independent Contractor?

If you want to total, acquire, or print out legal document web templates, use US Legal Forms, the most important assortment of legal types, which can be found on the web. Take advantage of the site`s simple and convenient research to obtain the documents you want. Numerous web templates for business and personal functions are categorized by types and says, or search phrases. Use US Legal Forms to obtain the California Minister Agreement - Self-Employed Independent Contractor with a few clicks.

When you are presently a US Legal Forms consumer, log in to the accounts and click on the Obtain switch to have the California Minister Agreement - Self-Employed Independent Contractor. You can even accessibility types you formerly downloaded from the My Forms tab of your accounts.

If you work with US Legal Forms initially, follow the instructions under:

- Step 1. Make sure you have chosen the shape for the appropriate metropolis/country.

- Step 2. Utilize the Review choice to check out the form`s information. Never neglect to learn the outline.

- Step 3. When you are not satisfied with the develop, make use of the Research discipline near the top of the display screen to locate other variations of your legal develop design.

- Step 4. After you have identified the shape you want, select the Get now switch. Select the prices prepare you choose and add your accreditations to register for an accounts.

- Step 5. Process the deal. You may use your Мisa or Ьastercard or PayPal accounts to accomplish the deal.

- Step 6. Pick the format of your legal develop and acquire it in your gadget.

- Step 7. Complete, change and print out or sign the California Minister Agreement - Self-Employed Independent Contractor.

Every legal document design you purchase is the one you have eternally. You have acces to each develop you downloaded inside your acccount. Go through the My Forms section and decide on a develop to print out or acquire once more.

Be competitive and acquire, and print out the California Minister Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of skilled and state-particular types you may use to your business or personal requires.

Form popularity

FAQ

The answer is both. Ministers have what is commonly referred to as dual tax status. For federal income tax purposes, a minister is generally treated as a common-law employee. For payments into Social Security, the minister is always self-employed.

In September of 2019, Governor Newsom signed Assembly Bill (AB) 5 into law. The new law addresses the employment status of workers when the hiring entity claims the worker is an independent contractor and not an employee.

The new law was effective on January 1, 2020. AB 5 requires companies to reclassify independent contractors as employees with a few exceptions to the rule. The bill was designed to increase regulation over companies that hire gig workers in large numbers, including DoorDash, Shipt, Postmates, Uber, and Lyft.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

California Assembly Bill 5 (AB5) extends employee classification status to some gig workers. Under AB5, companies must use a three-pronged test to prove workers are independent contractors, not employees. 1. AB5 was designed to regulate companies that hire gig workers in large numbers, such as Uber, Lyft, and DoorDash.

Independent contractors are not covered by California's overtime and other wage and hour laws. However, employers cannot get around California wage and hour laws by simply declaring that an employee is an independent contractor, or by making the employee sign an agreement stating that s/he is an independent contractor.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Under the ABC test, a worker is an IC only if he or she meets all of the following: (A) The worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact.

The new law was effective on January 1, 2020. AB 5 requires companies to reclassify independent contractors as employees with a few exceptions to the rule. The bill was designed to increase regulation over companies that hire gig workers in large numbers, including DoorDash, Shipt, Postmates, Uber, and Lyft.