California Medical Representative Agreement - Self-Employed Independent Contractor

Description

How to fill out California Medical Representative Agreement - Self-Employed Independent Contractor?

If you have to comprehensive, down load, or produce legitimate file layouts, use US Legal Forms, the most important assortment of legitimate forms, that can be found on-line. Make use of the site`s basic and hassle-free research to obtain the paperwork you need. A variety of layouts for enterprise and personal uses are sorted by types and says, or search phrases. Use US Legal Forms to obtain the California Medical Representative Agreement - Self-Employed Independent Contractor within a handful of click throughs.

Should you be presently a US Legal Forms buyer, log in to your account and then click the Obtain switch to get the California Medical Representative Agreement - Self-Employed Independent Contractor. You can even gain access to forms you previously delivered electronically in the My Forms tab of your account.

Should you use US Legal Forms initially, follow the instructions beneath:

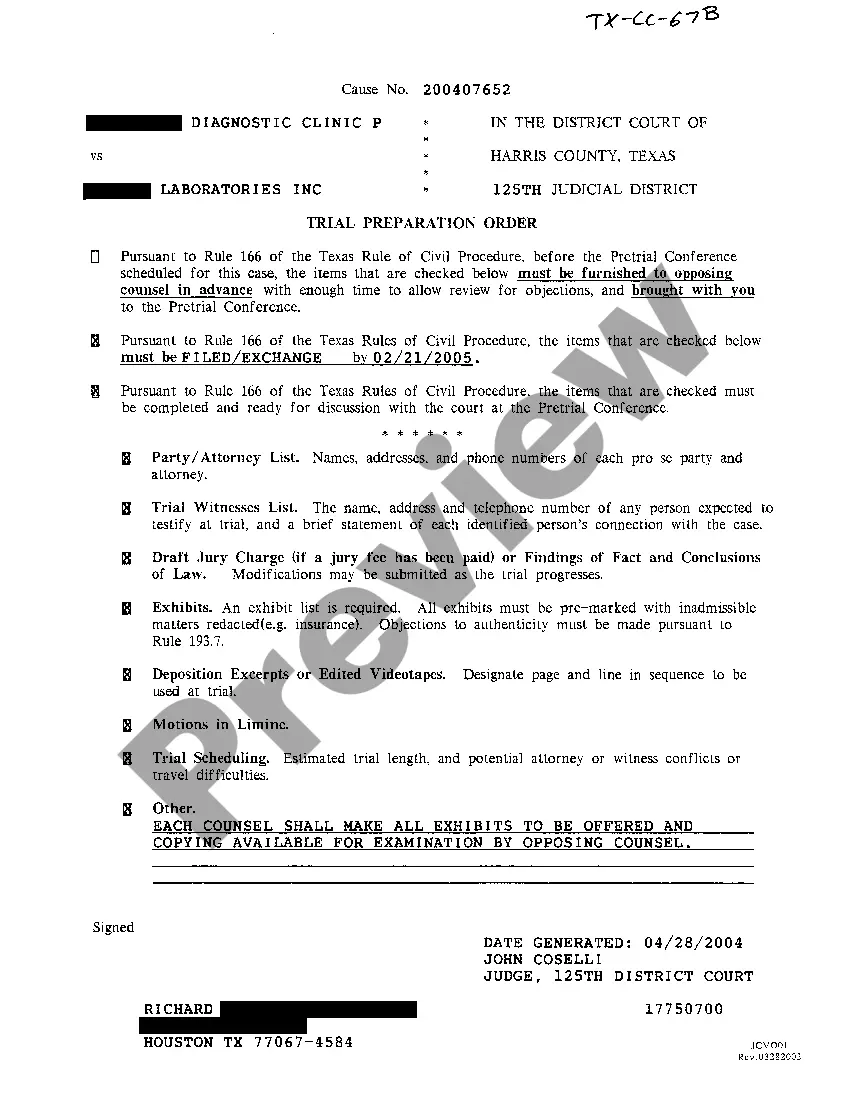

- Step 1. Be sure you have chosen the shape to the right town/region.

- Step 2. Utilize the Preview option to examine the form`s content material. Do not overlook to read through the description.

- Step 3. Should you be unhappy with all the develop, take advantage of the Research field towards the top of the monitor to locate other versions of the legitimate develop format.

- Step 4. When you have located the shape you need, click on the Buy now switch. Pick the costs prepare you prefer and put your references to register for an account.

- Step 5. Process the purchase. You may use your bank card or PayPal account to finish the purchase.

- Step 6. Pick the structure of the legitimate develop and down load it on the system.

- Step 7. Full, modify and produce or signal the California Medical Representative Agreement - Self-Employed Independent Contractor.

Every legitimate file format you purchase is yours forever. You might have acces to every single develop you delivered electronically in your acccount. Select the My Forms area and select a develop to produce or down load once more.

Compete and down load, and produce the California Medical Representative Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of professional and state-certain forms you may use for your enterprise or personal requirements.

Form popularity

FAQ

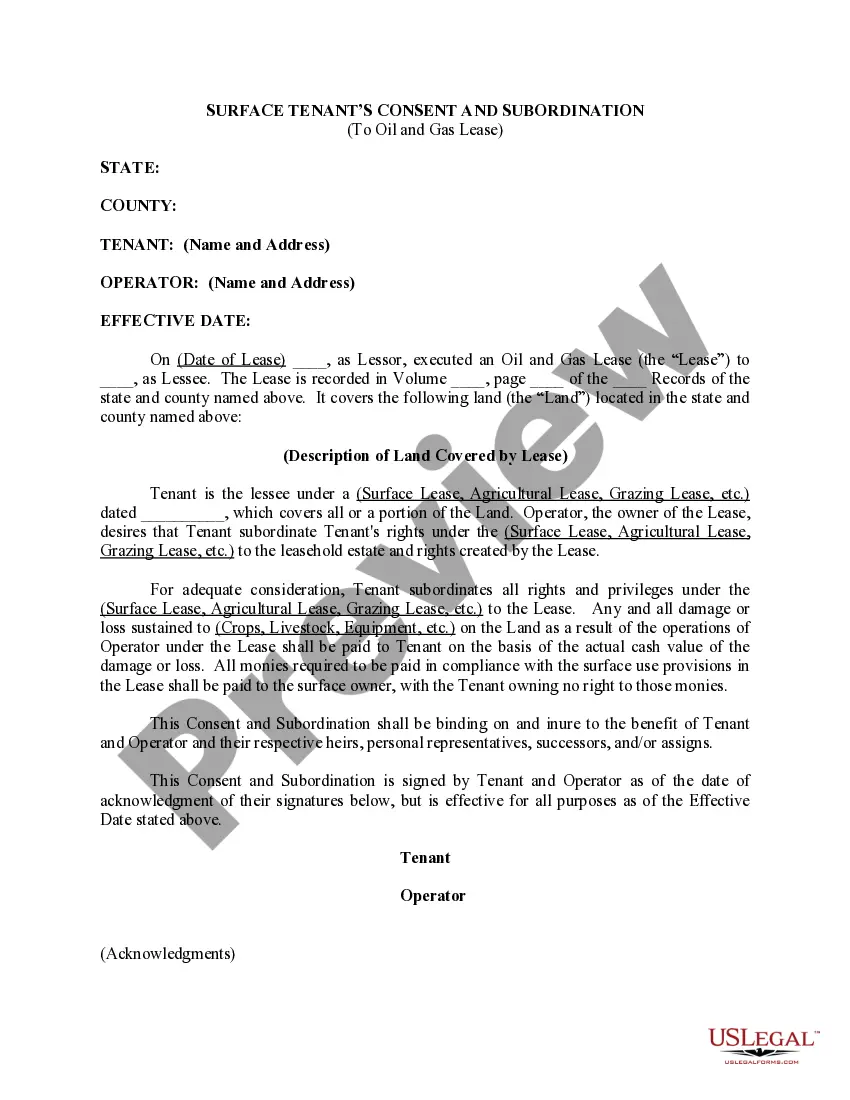

The salesperson can be a common law employee, an independent contractor, an employee by specific statute, or an excluded employee by specific statute.

Independent contractors are not covered by California's overtime and other wage and hour laws. However, employers cannot get around California wage and hour laws by simply declaring that an employee is an independent contractor, or by making the employee sign an agreement stating that s/he is an independent contractor.

The conclusion is that under the California law, a direct salesperson is one who sells. directly to consumer and not to a retail or wholesale establishment.

Independent contractors use 1099 forms. In California, workers who report their income on a Form 1099 are independent contractors, while those who report it on a W-2 form are employees. Payroll taxes from W-2 employees are automatically withheld, while independent contracts are responsible for paying them.

Because dentists and doctors are exempt from the ABC Test, they must meet the common law requirements to be classified as independent contractors in California. These requirements are similar in many other states across the country as well.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The new law was effective on January 1, 2020. AB 5 requires companies to reclassify independent contractors as employees with a few exceptions to the rule. The bill was designed to increase regulation over companies that hire gig workers in large numbers, including DoorDash, Shipt, Postmates, Uber, and Lyft.

One way of ensuring maximum results out of your sales force is hiring them as independent contractors. Independent 1099 sales representatives earn their income through commissions only. For some small businesses, this can mean the difference between survival and having to close the business.

It is even possible that a worker can be considered an independent contractor for purposes of IRS tax filing, but they are considered an employee under California's wage and hours laws.

California's contractor laws state that an independent contractor is a person or business who provides a specific service to another company in exchange for compensation. It further says that the independent contractor is under managerial control for results and not how he or she accomplishes the work.