California Social Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out California Social Worker Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the biggest libraries of lawful types in the States - provides a variety of lawful file web templates you are able to acquire or produce. Using the web site, you may get a large number of types for enterprise and personal reasons, sorted by groups, states, or search phrases.You can get the latest variations of types such as the California Social Worker Agreement - Self-Employed Independent Contractor within minutes.

If you already have a subscription, log in and acquire California Social Worker Agreement - Self-Employed Independent Contractor from the US Legal Forms collection. The Acquire switch can look on each kind you perspective. You get access to all previously downloaded types within the My Forms tab of the profile.

If you want to use US Legal Forms the very first time, listed here are straightforward directions to help you began:

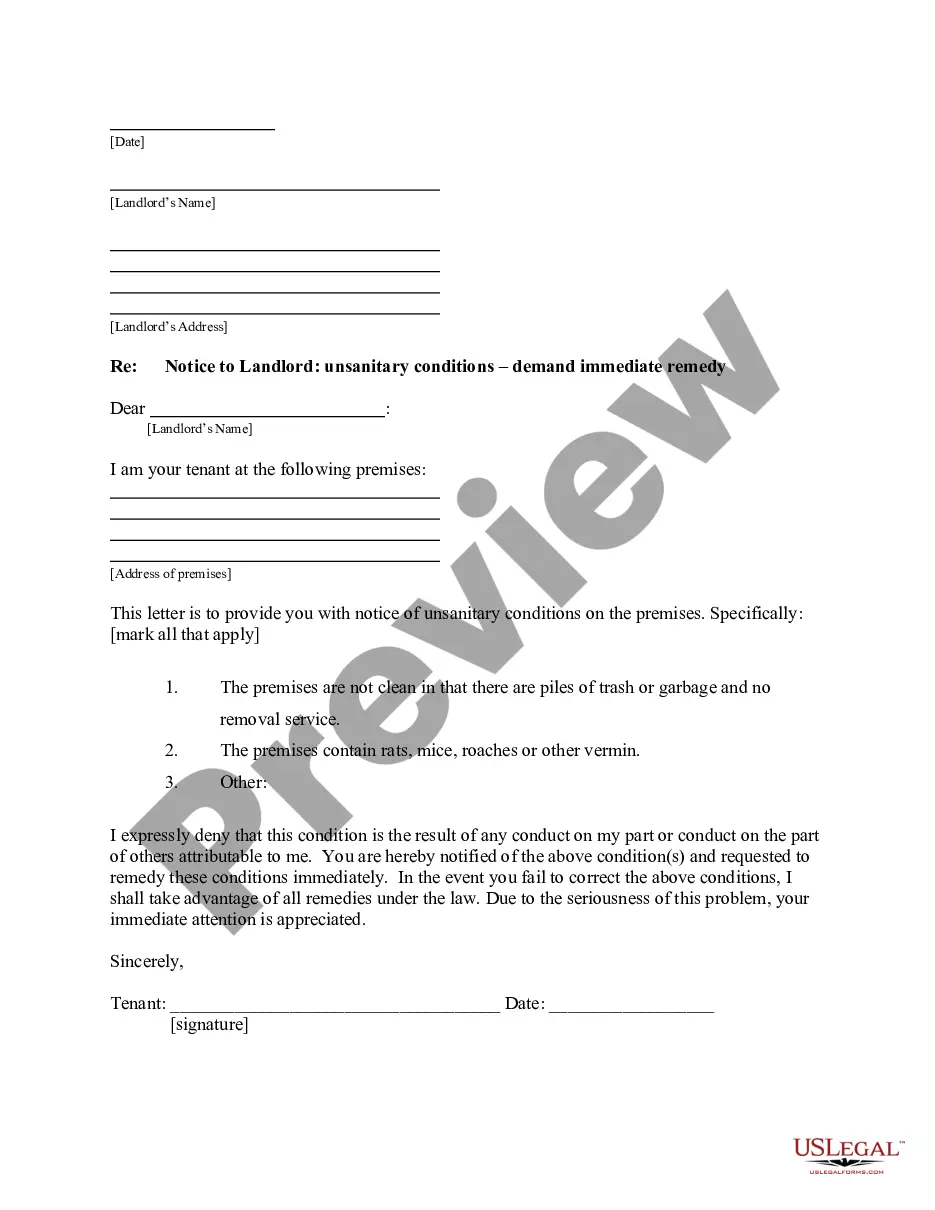

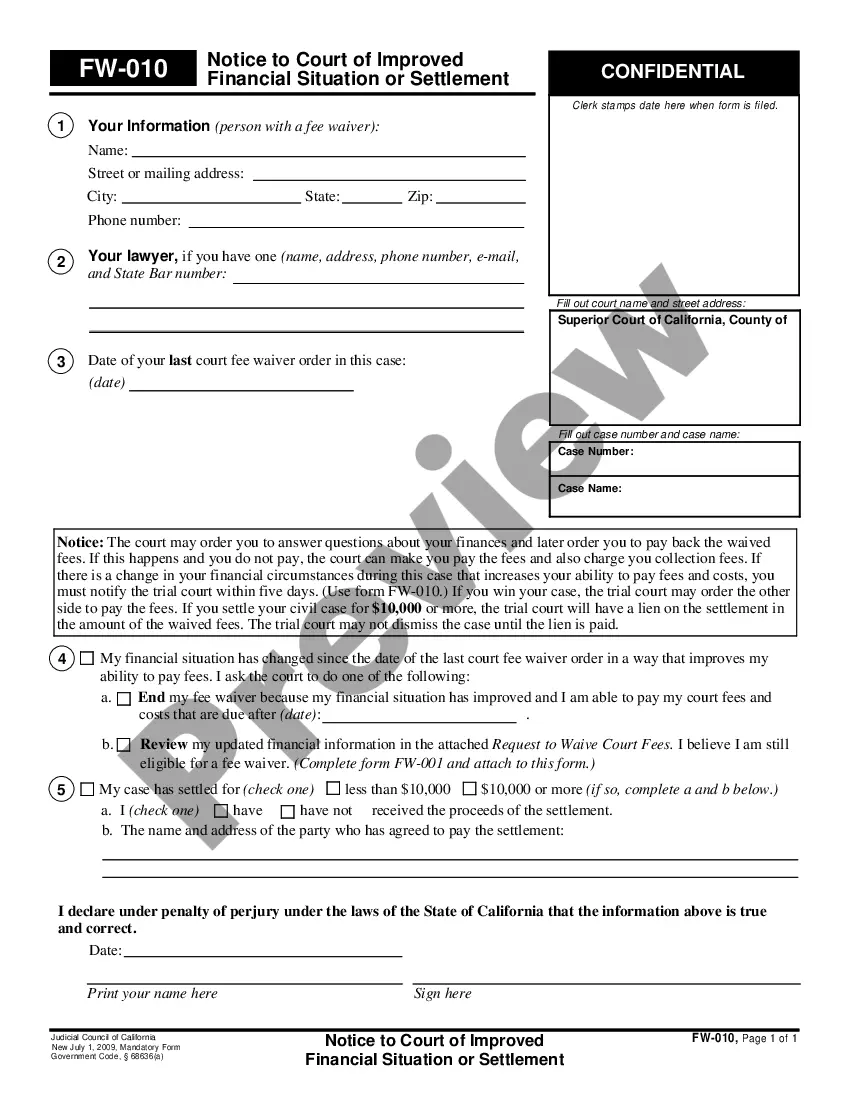

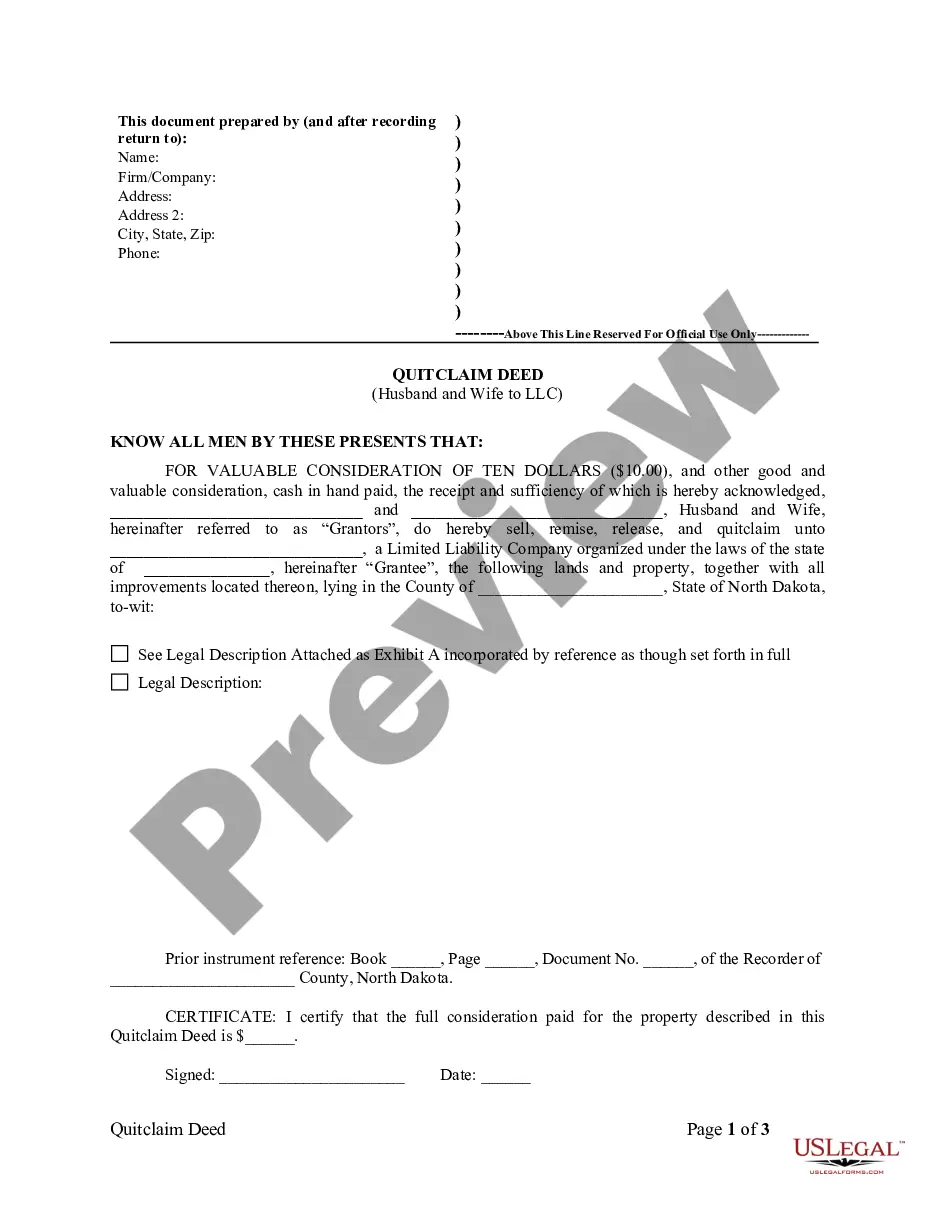

- Be sure to have picked out the proper kind to your town/area. Click on the Preview switch to analyze the form`s articles. Browse the kind description to ensure that you have chosen the proper kind.

- In case the kind does not satisfy your specifications, utilize the Search discipline near the top of the screen to obtain the one that does.

- When you are satisfied with the form, validate your selection by clicking on the Acquire now switch. Then, choose the pricing strategy you like and supply your credentials to register to have an profile.

- Method the financial transaction. Use your charge card or PayPal profile to complete the financial transaction.

- Choose the file format and acquire the form in your system.

- Make changes. Fill out, revise and produce and sign the downloaded California Social Worker Agreement - Self-Employed Independent Contractor.

Each and every design you added to your bank account does not have an expiry particular date and is also your own property eternally. So, if you wish to acquire or produce another backup, just proceed to the My Forms section and click on on the kind you will need.

Gain access to the California Social Worker Agreement - Self-Employed Independent Contractor with US Legal Forms, the most substantial collection of lawful file web templates. Use a large number of expert and condition-specific web templates that meet your business or personal demands and specifications.

Form popularity

FAQ

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

For example, while licensed psychologists are exempted as professionals, other licensed professionals who provide mental health therapy (such as licensed marriage and family therapists, social workers, professional clinical counselors, and educational psychologists) were not excluded.

California Labor Code section 3353 defines an Independent contractor as a person who renders service for a specified recompense for a specified result, under the control of his principal as to the result of his work only and not as to the means by which such result is accomplished." The label itself, however, is not

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

In the workplace, many LCSWs work as an independent contractor with several different non-profits or therapy groups to provide their services. This may be especially true for LCSWs who have a specialty, such as working with the victims of domestic violence.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

There may be some factors suggesting a California worker is an employee and others suggesting he or she is an independent contractor. It is even possible that a worker can be considered an independent contractor for purposes of IRS tax filing, but they are considered an employee under California's wage and hours laws.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.