California Self-Employed Tennis Professional Services Contract

Description

How to fill out Self-Employed Tennis Professional Services Contract?

If you require to total, download, or create legitimate document templates, utilize US Legal Forms, the largest collection of legal forms that are accessible online.

Employ the site's user-friendly and efficient search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords. Utilize US Legal Forms to locate the California Self-Employed Tennis Professional Services Contract in a few clicks.

Every legal document template you obtain is yours permanently. You will have access to every form you acquired within your account. Select the My documents section and choose a form to print or download again.

Compete and download, and print the California Self-Employed Tennis Professional Services Contract with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click on the Download button to acquire the California Self-Employed Tennis Professional Services Contract.

- You can also access forms you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

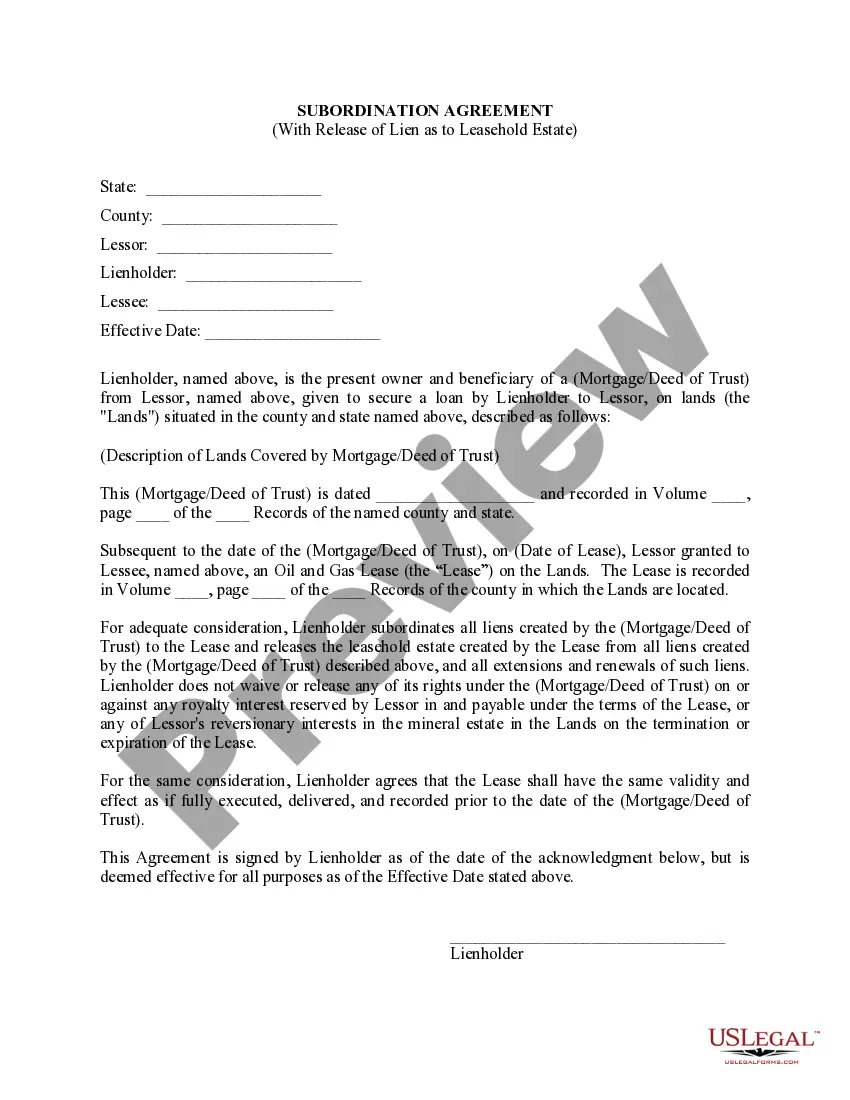

- Step 2. Utilize the Review option to examine the form's content. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. After you have located the form you need, click on the Get now button. Select the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the California Self-Employed Tennis Professional Services Contract.

Form popularity

FAQ

A PLLC is specifically designed for licensed professionals, allowing them to provide professional services under the protections of limited liability. In contrast, a standard LLC does not offer this option and is generally not permitted to provide licensed services. If you are a tennis professional, understanding this difference is vital when creating your California Self-Employed Tennis Professional Services Contract to ensure you are operating within the law.

If you are offering services as a self-employed tennis professional, you likely need to register as an independent contractor. This registration helps you comply with tax laws and protects both you and your clients under contractual agreements. Ensure that your California Self-Employed Tennis Professional Services Contract clearly outlines your status to avoid any confusion.

In California, certain businesses cannot operate as LLCs, including banks, insurance companies, and some professional services like those provided by lawyers or doctors. These entities must adhere to specific licensing and operational standards. As a tennis professional, it's crucial to understand these distinctions when forming your business and drafting a California Self-Employed Tennis Professional Services Contract.

An LLC can provide professional services in some states, but in California, this is typically limited to PLLCs. A standard LLC is not permitted to offer services that require a professional license. To navigate this, review your specific needs and consider drafting a California Self-Employed Tennis Professional Services Contract that aligns with state requirements.

Generally, an LLC cannot provide professional services in California unless it is specifically designed as a professional limited liability company (PLLC). This type of entity allows licensed professionals to operate under the LLC structure while adhering to state laws. If you are a tennis professional, consider this distinction when preparing your California Self-Employed Tennis Professional Services Contract.

In California, certain professional services, such as legal or medical services, cannot be provided by a limited liability company (LLC). This restriction exists because the state wants to ensure that licensed professionals are held to certain standards of practice. Therefore, if you are considering a California Self-Employed Tennis Professional Services Contract, it is essential to choose the right business structure that complies with state regulations.

Yes, most independent contractors in California need a business license to operate legally. The specific requirements can vary by city or county, so it is important to check local regulations. Having a California Self-Employed Tennis Professional Services Contract can also support your application for a business license by demonstrating your professional engagement.

Yes, having a contract is crucial if you are self-employed. A contract protects both you and your clients by clearly outlining the terms of your services. Utilizing a well-defined California Self-Employed Tennis Professional Services Contract can help ensure that you establish professional boundaries and expectations.

Several services are exempt from sales tax in California, including certain professional services like health care and some educational services. However, the specifics can be complex, so it is wise to review your California Self-Employed Tennis Professional Services Contract to determine if any exemptions apply to your services.

Yes, professional services can be taxable in California. The tax applicability can vary based on the type of service and how it is described in your contract. It is advisable to ensure that your California Self-Employed Tennis Professional Services Contract clearly outlines the nature of your services to facilitate proper tax treatment.