California Self-Employed Awning Services Contract

Description

How to fill out California Self-Employed Awning Services Contract?

It is possible to invest hours on-line trying to find the legitimate papers web template which fits the state and federal specifications you require. US Legal Forms offers 1000s of legitimate forms that are evaluated by experts. You can actually acquire or print the California Self-Employed Awning Services Contract from my assistance.

If you have a US Legal Forms accounts, you can log in and click on the Acquire option. After that, you can complete, change, print, or indication the California Self-Employed Awning Services Contract. Each and every legitimate papers web template you buy is your own property permanently. To get one more backup of the purchased form, check out the My Forms tab and click on the corresponding option.

Should you use the US Legal Forms site the very first time, adhere to the straightforward guidelines below:

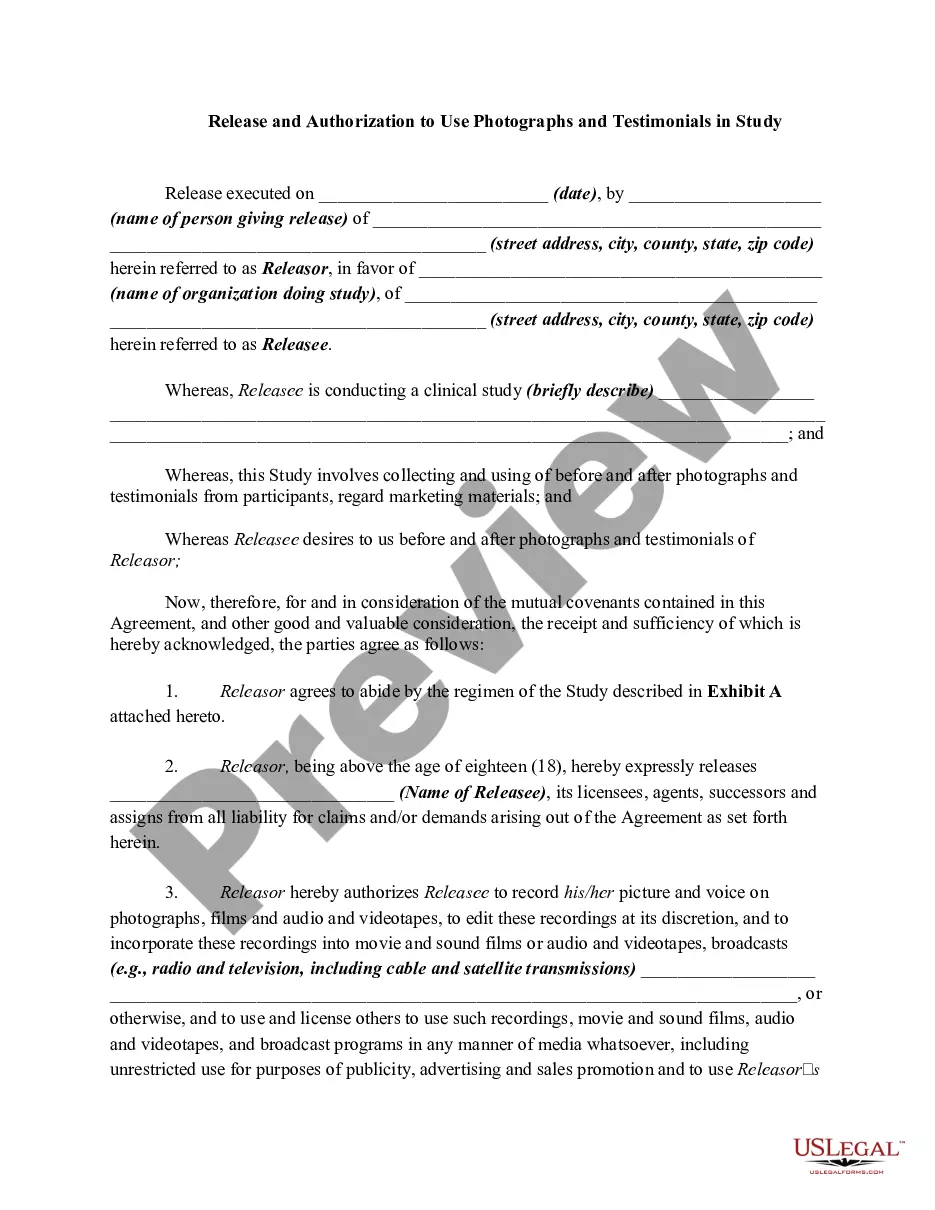

- Very first, be sure that you have selected the best papers web template to the region/area of your choice. See the form outline to make sure you have selected the appropriate form. If readily available, make use of the Review option to check throughout the papers web template at the same time.

- If you wish to locate one more edition in the form, make use of the Look for field to find the web template that suits you and specifications.

- When you have discovered the web template you want, simply click Purchase now to move forward.

- Select the costs prepare you want, type in your accreditations, and register for your account on US Legal Forms.

- Total the transaction. You should use your charge card or PayPal accounts to fund the legitimate form.

- Select the formatting in the papers and acquire it to your device.

- Make alterations to your papers if required. It is possible to complete, change and indication and print California Self-Employed Awning Services Contract.

Acquire and print 1000s of papers themes making use of the US Legal Forms web site, which provides the largest collection of legitimate forms. Use expert and express-certain themes to deal with your organization or personal requires.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The contract itself must include the following:Offer.Acceptance.Consideration.Parties who have the legal capacity.Lawful subject matter.Mutual agreement among both parties.Mutual understanding of the obligation.

Five Things Your Contracts Should IncludeGet it in Writing. The most important part of every contract is that it must be in writing.Be Specific in Your Terms. Your contract should be specific in its terms.Dictate Terms for Contract Termination.Confidentiality Matters.

An Independent Contractor Agreement is a legal contract that outlines the scope, payment schedule, and deadlines for freelance work. Signed by both the contractor and the client, this agreement can help to set expectations and reduce the risk of conflicts.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.