California Mortgage Demand Letter is a legal document typically sent by a lender to a borrower during a mortgage foreclosure process. It serves as a formal notice demanding the immediate payment of past-due mortgage payments, penalties, and fees. The letter is an essential step in the foreclosure process and acts as a means for lenders to communicate with borrowers regarding their default mortgage payment. The California Mortgage Demand Letter includes various crucial details and should be drafted according to specific legal requirements to ensure its validity. It usually begins with the lender's name, address, and contact information, followed by the borrower's details, including their name, address, loan number, and property description. Key elements that must be addressed in the California Mortgage Demand Letter include: 1. Outstanding Amount: The letter clearly specifies the total amount due, including the principal mortgage amount, interest, late fees, and any other charges incurred due to the borrower's default. 2. Default Information: The demand letter highlights the specific reason for default, such as missed payments, failure to abide by the terms and conditions of the mortgage agreement, or any other violation. It may also outline the number of missed payments, their due dates, and the total amount outstanding. 3. Deadline for Payment: The letter provides a deadline for the borrower to bring the mortgage payments up to date. This deadline is typically set within a specific timeframe, allowing the borrower a reasonable amount of time to rectify the default. 4. Remedial Actions: In some cases, the demand letter may inform the borrower of potential legal actions or further steps the lender may take if the payment is not made within the provided timeframe. This can include initiating foreclosure proceedings or pursuing legal remedies to recover the outstanding debt. Different types of California Mortgage Demand Letters may vary based on the specific stage of the foreclosure process. Some commonly identified types include: 1. Pre-Foreclosure Demand Letter: Typically sent when the borrower misses one or a few mortgage payments, this letter serves as a formal notice that the borrower is in default and requires immediate payment to prevent further legal actions. 2. Notice of Default Demand Letter: This type of letter is sent after the lender has filed a Notice of Default (NOD) with the county recorder's office. It demands the borrower to cure the default by paying the entire outstanding balance or risk proceeding to the next stage of foreclosure. 3. Notice of Intent to Accelerate Demand Letter: Sent after the borrower fails to cure the default within the specified timeframe, this letter notifies the borrower that the full outstanding balance of the mortgage is now due and payable immediately. In conclusion, the California Mortgage Demand Letter is a vital communication tool used in the foreclosure process to inform borrowers of their default and demand payment. It plays a significant role in outlining the outstanding debt, specifying a deadline for payment, and indicating potential legal actions if the default is not rectified promptly. Different types of demand letters exist based on the stage of the foreclosure process, including pre-foreclosure demand letters, notice of default demand letters, and notice of intent to accelerate demand letters.

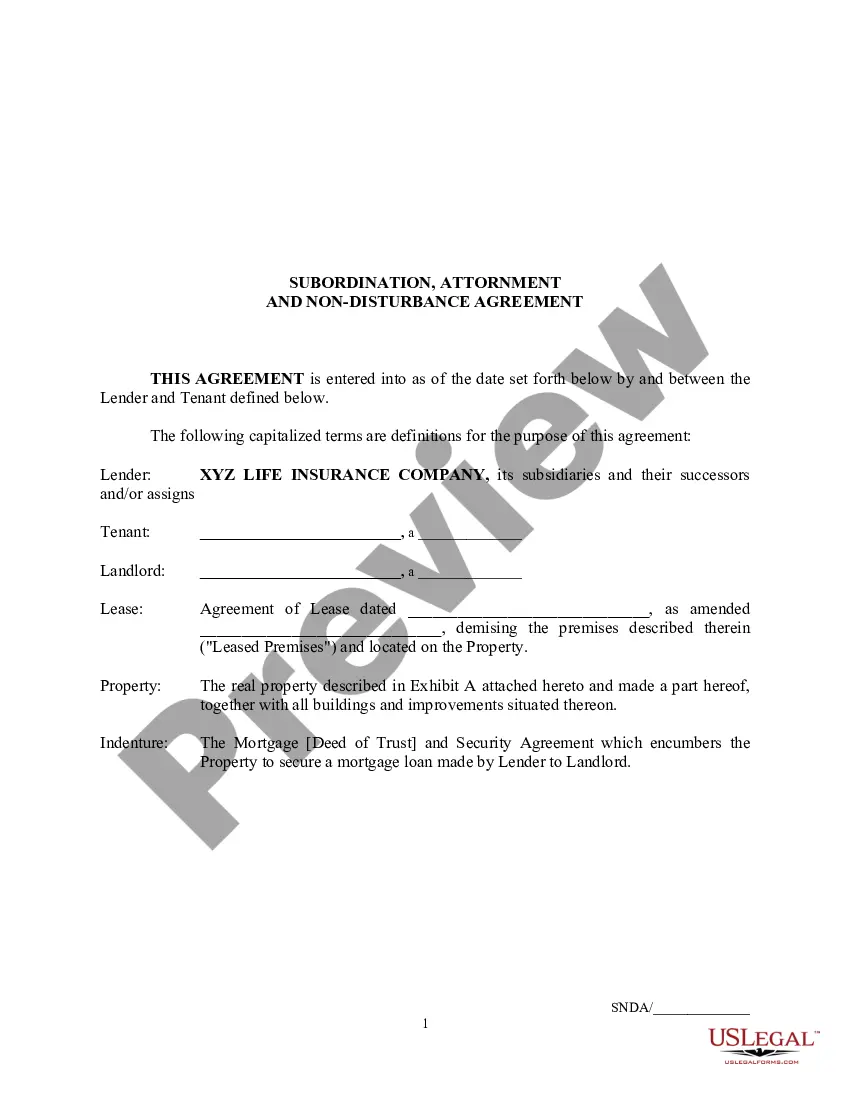

California Mortgage Demand Letter

Description

How to fill out California Mortgage Demand Letter?

Are you presently within a placement where you will need files for possibly organization or specific functions nearly every time? There are a lot of lawful file templates available online, but finding versions you can depend on is not effortless. US Legal Forms provides thousands of kind templates, such as the California Mortgage Demand Letter, which are published to fulfill state and federal needs.

If you are presently informed about US Legal Forms web site and have an account, simply log in. After that, you are able to down load the California Mortgage Demand Letter template.

Should you not have an account and wish to begin using US Legal Forms, adopt these measures:

- Get the kind you need and make sure it is for that appropriate town/county.

- Take advantage of the Preview button to analyze the shape.

- Read the explanation to ensure that you have chosen the proper kind.

- If the kind is not what you are searching for, utilize the Look for field to find the kind that fits your needs and needs.

- When you obtain the appropriate kind, simply click Acquire now.

- Choose the rates strategy you would like, complete the necessary details to generate your account, and pay money for your order utilizing your PayPal or charge card.

- Pick a practical data file format and down load your version.

Find every one of the file templates you might have bought in the My Forms menu. You may get a further version of California Mortgage Demand Letter any time, if possible. Just go through the required kind to down load or print the file template.

Use US Legal Forms, probably the most substantial variety of lawful forms, to save time as well as steer clear of blunders. The support provides skillfully manufactured lawful file templates which can be used for a variety of functions. Generate an account on US Legal Forms and start creating your way of life a little easier.