California Affidavit of Heirship - Descent

Description

How to fill out Affidavit Of Heirship - Descent?

It is possible to commit several hours on the Internet looking for the lawful papers web template that meets the state and federal demands you need. US Legal Forms supplies a huge number of lawful varieties that are analyzed by specialists. It is possible to download or print out the California Affidavit of Heirship - Descent from our support.

If you already possess a US Legal Forms accounts, you are able to log in and click the Down load button. Afterward, you are able to total, modify, print out, or indicator the California Affidavit of Heirship - Descent. Each and every lawful papers web template you purchase is yours permanently. To obtain another duplicate of the purchased kind, check out the My Forms tab and click the corresponding button.

If you work with the US Legal Forms website initially, stick to the easy directions under:

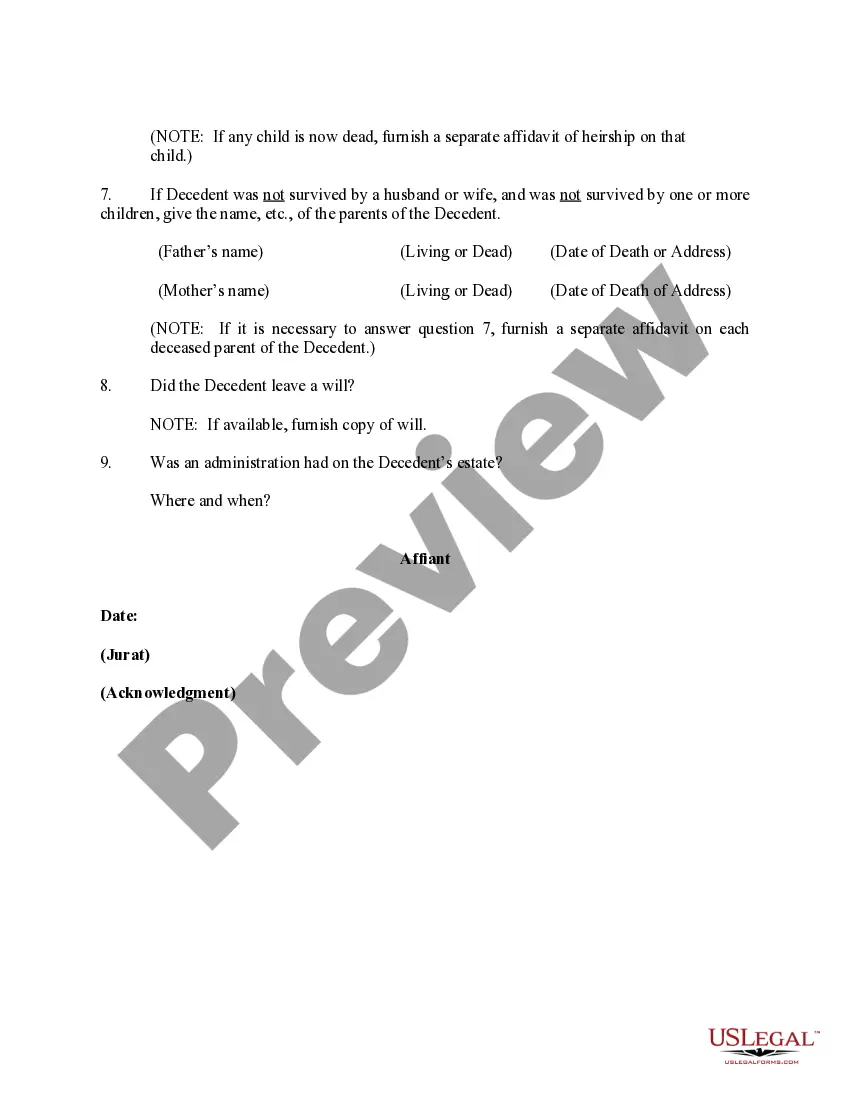

- Very first, make sure that you have chosen the proper papers web template for that county/metropolis of your liking. Look at the kind information to ensure you have selected the appropriate kind. If offered, utilize the Review button to check from the papers web template too.

- If you wish to discover another edition of the kind, utilize the Research area to get the web template that meets your needs and demands.

- After you have identified the web template you desire, just click Buy now to continue.

- Choose the prices prepare you desire, type your references, and sign up for an account on US Legal Forms.

- Full the transaction. You can use your credit card or PayPal accounts to fund the lawful kind.

- Choose the file format of the papers and download it to the system.

- Make alterations to the papers if needed. It is possible to total, modify and indicator and print out California Affidavit of Heirship - Descent.

Down load and print out a huge number of papers layouts utilizing the US Legal Forms site, which provides the greatest selection of lawful varieties. Use professional and state-specific layouts to take on your company or person needs.

Form popularity

FAQ

If probate has started, a personal representative of the estate has to agree in writing to the use of this informal settlement process. The affidavit doesn't have to be filed with the court. To use it, the person claiming the assets presents it to the bank, brokerage or another holder of the asset.

Any assets that do not qualify for a simple transfer process will likely have to go through formal probate. And, if the dead person's property is worth more than $166,250, none of the exceptions apply. You must go to court and start a probate case.

To establish heir status in California, you may file an ?affidavit of heirship? in the Superior Court of the county where your deceased family member's property is located. California family code states that the petition must include the heir's basic information including a description of the property you are claiming, ...

Proving Heirship The affidavit of heirship requires that the person filing the document include the heir's basic information along with a description of the property being claimed. Basic information includes your name, age, and the names and information of any other possible heirs if known.

In California, when a parent dies without a will, their child's inheritance is determined by intestate laws. Assets not allocated to a surviving spouse or domestic partner go to the children. Each child gets an equal portion.

How long does probate take? California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.

You must wait at least 40 days after the person dies. What if I need help? Or, read the law on property transfers. See California Probate Code, §§ 13100-13115.