California Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease In the state of California, the Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease is an important legal document that establishes the rights and responsibilities of both the mineral owner and the lessee in relation to the exploration and extraction of oil, gas, and minerals. This agreement ensures that the mineral owner is protected and fairly compensated for the use of their land, while also providing the lessee with the necessary authority to conduct mining or drilling operations. The California Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease can have various types depending on the specific terms and conditions agreed upon by the parties involved. These types include: 1. Surface Lease: This lease type allows the lessee to access and use the surface of the land for exploration and production purposes. It typically includes provisions for compensation to the mineral owner for any damages or disturbances caused during operations. 2. Subsurface Lease: This type of lease grants the lessee exclusive rights to explore and extract oil, gas, and minerals from beneath the surface of the land. It may also include provisions for compensating the mineral owner based on the quantity or value of the resources extracted. 3. Royalty Lease: Under this lease, the mineral owner receives a percentage of the revenue generated from the sale of oil, gas, or minerals extracted from their land. This type of agreement provides a steady stream of income to the mineral owner, regardless of market fluctuations. 4. Bonus Lease: A bonus lease involves the payment of a lump sum amount to the mineral owner at the signing of the lease agreement. This upfront payment, also known as a bonus, is provided in exchange for granting the lessee the right to explore and extract resources on the land. 5. Paid-Up Lease: A Paid-Up Lease requires the lessee to make a one-time payment, often a substantial sum, to the mineral owner. This payment is typically made upfront and covers the lease for the entire term, eliminating the need for any additional rental or royalty payments. It provides the lessee with the assurance of uninterrupted access to the resources, while granting the mineral owner a significant financial benefit. It is crucial for both the mineral owner and the lessee to carefully review and understand the terms and conditions of the California Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease before signing the agreement. Seeking legal advice and conducting due diligence can ensure that the rights and interests of both parties are adequately protected.

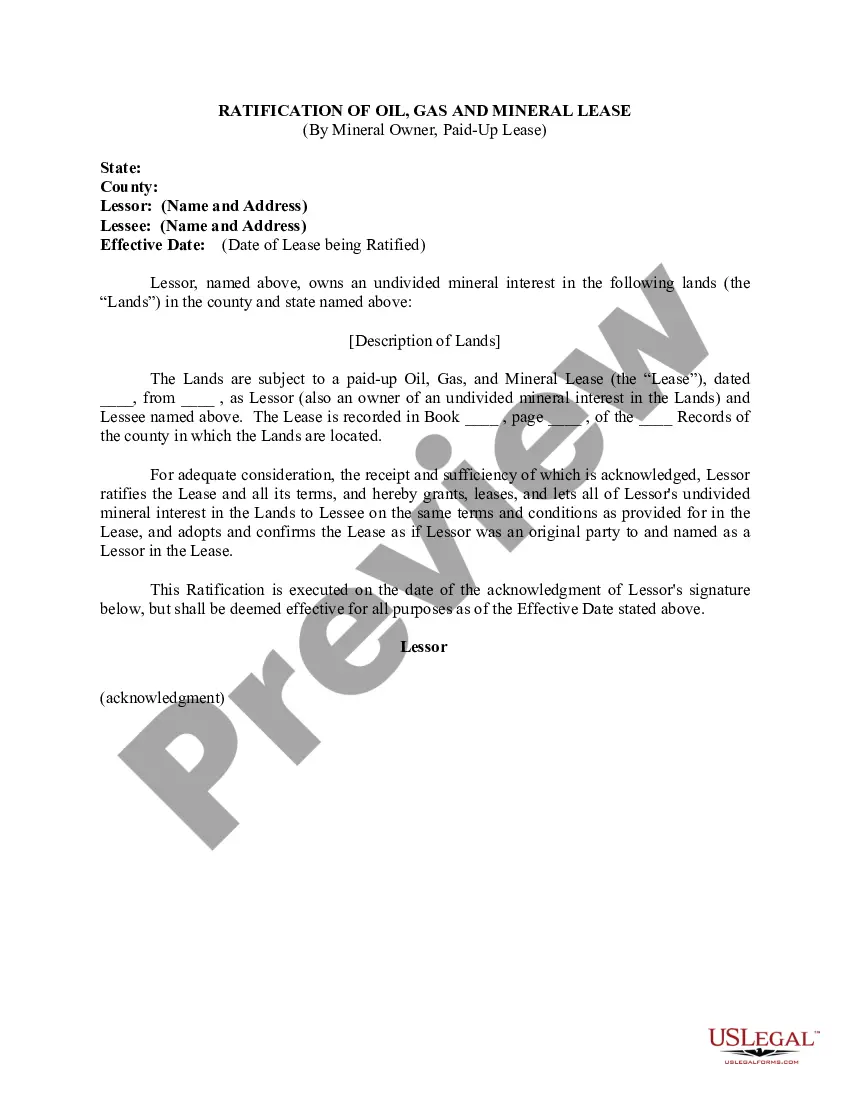

California Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease

Description

How to fill out California Ratification Of Oil, Gas And Mineral Lease By Mineral Owner, Paid-Up Lease?

Discovering the right legal record template can be quite a battle. Needless to say, there are tons of themes available on the Internet, but how will you find the legal form you will need? Use the US Legal Forms internet site. The service gives a huge number of themes, like the California Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease, that can be used for business and personal needs. Each of the forms are examined by professionals and meet federal and state demands.

When you are currently registered, log in for your profile and click on the Down load option to find the California Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease. Use your profile to check throughout the legal forms you may have purchased earlier. Check out the My Forms tab of the profile and get one more version from the record you will need.

When you are a brand new user of US Legal Forms, listed here are straightforward directions so that you can stick to:

- Very first, be sure you have selected the correct form for the metropolis/region. You are able to look over the form utilizing the Preview option and read the form information to guarantee it is the best for you.

- When the form does not meet your preferences, use the Seach area to find the right form.

- When you are positive that the form is suitable, click on the Acquire now option to find the form.

- Pick the pricing prepare you want and enter in the needed information and facts. Build your profile and pay money for the order with your PayPal profile or credit card.

- Opt for the document file format and download the legal record template for your gadget.

- Comprehensive, modify and printing and sign the attained California Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease.

US Legal Forms may be the largest collection of legal forms where you can see different record themes. Use the service to download appropriately-produced documents that stick to status demands.