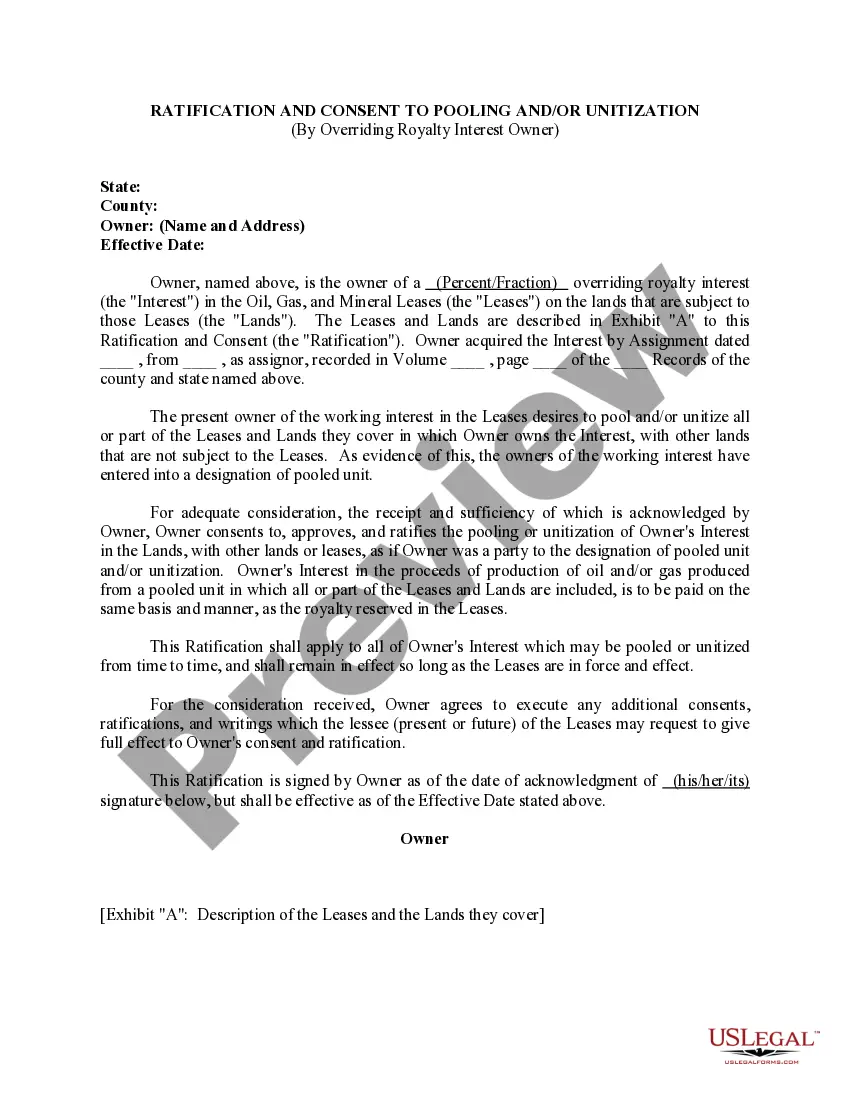

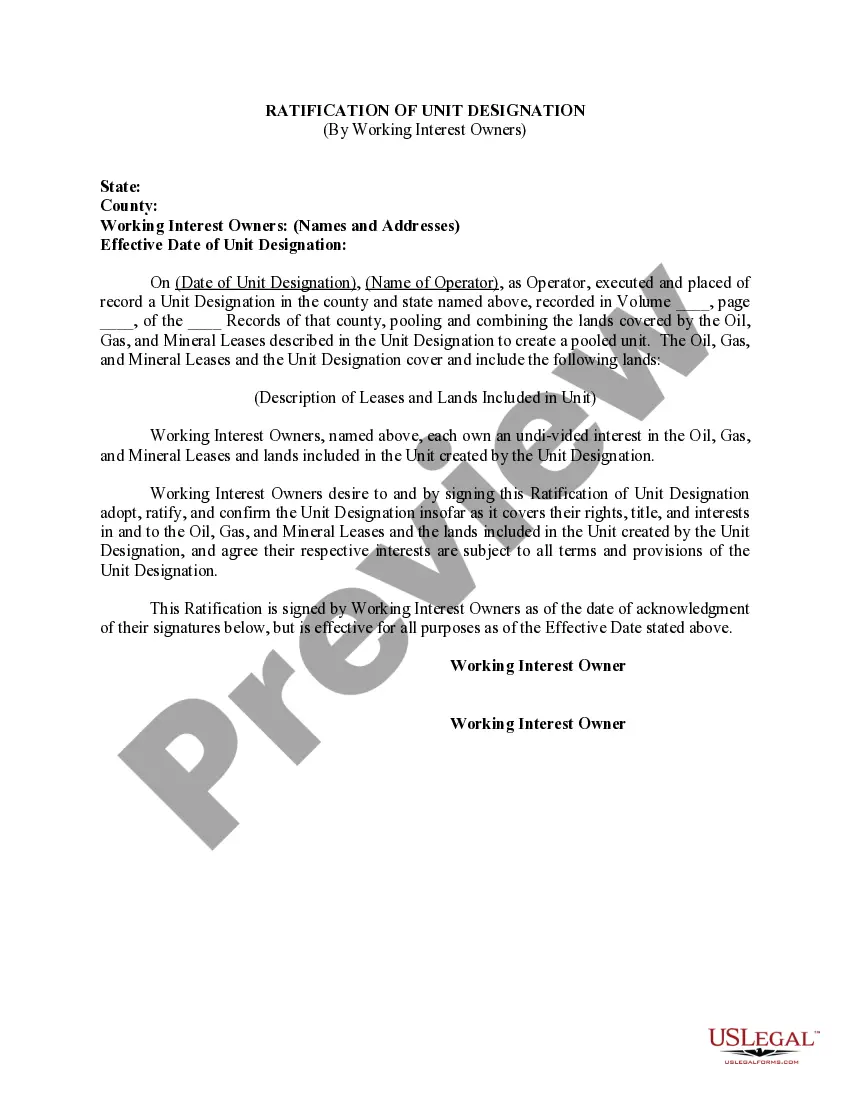

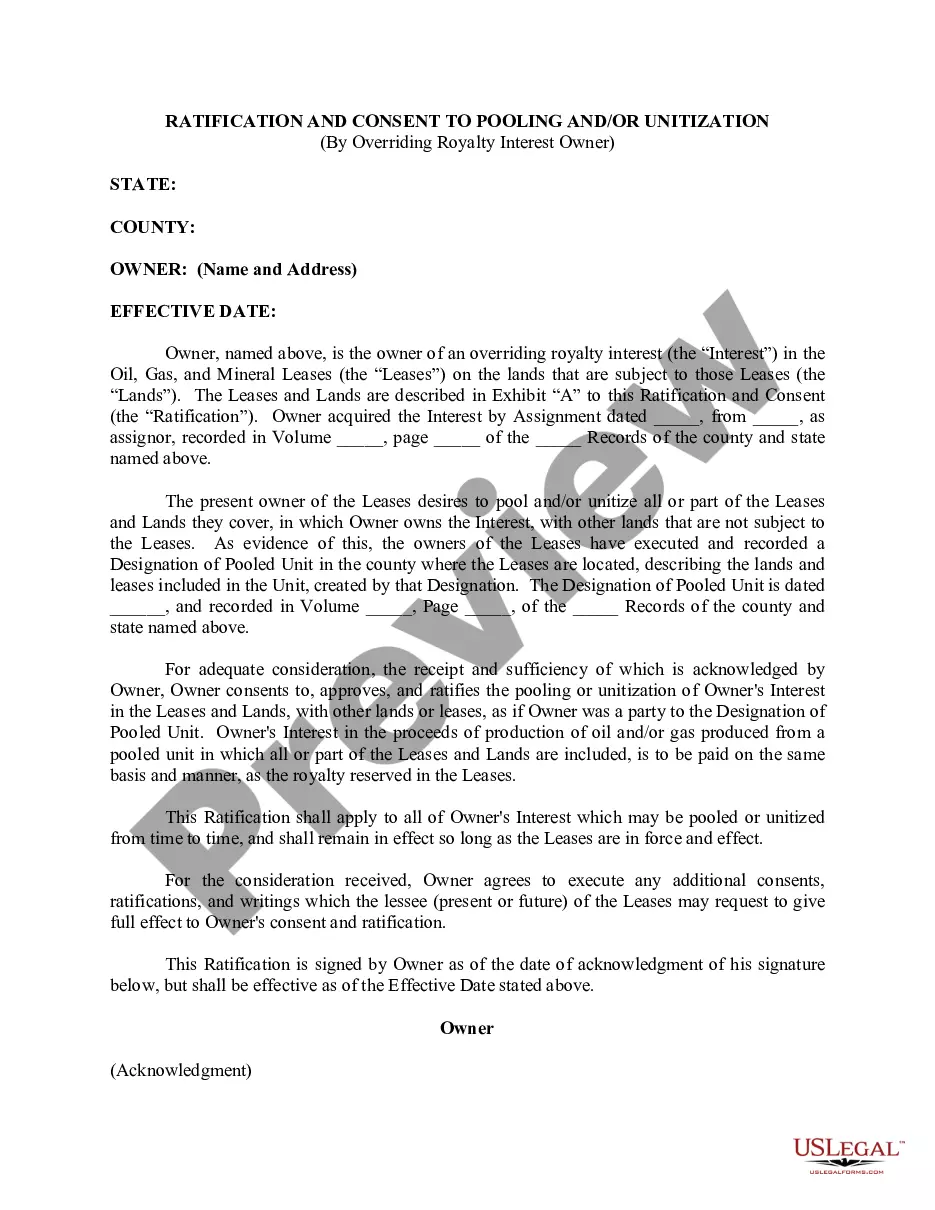

California Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner

Description

How to fill out Ratification Of Pooled Unit Designation By Overriding Royalty Or Royalty Interest Owner?

Discovering the right legitimate papers design could be a have a problem. Of course, there are a variety of layouts accessible on the Internet, but how would you obtain the legitimate type you will need? Make use of the US Legal Forms internet site. The services offers a large number of layouts, including the California Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner, that you can use for business and private requires. All of the types are checked by specialists and meet up with state and federal needs.

In case you are currently authorized, log in to your accounts and then click the Down load switch to get the California Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner. Make use of your accounts to appear from the legitimate types you might have bought in the past. Visit the My Forms tab of your respective accounts and have yet another copy from the papers you will need.

In case you are a whole new end user of US Legal Forms, listed here are basic recommendations that you can stick to:

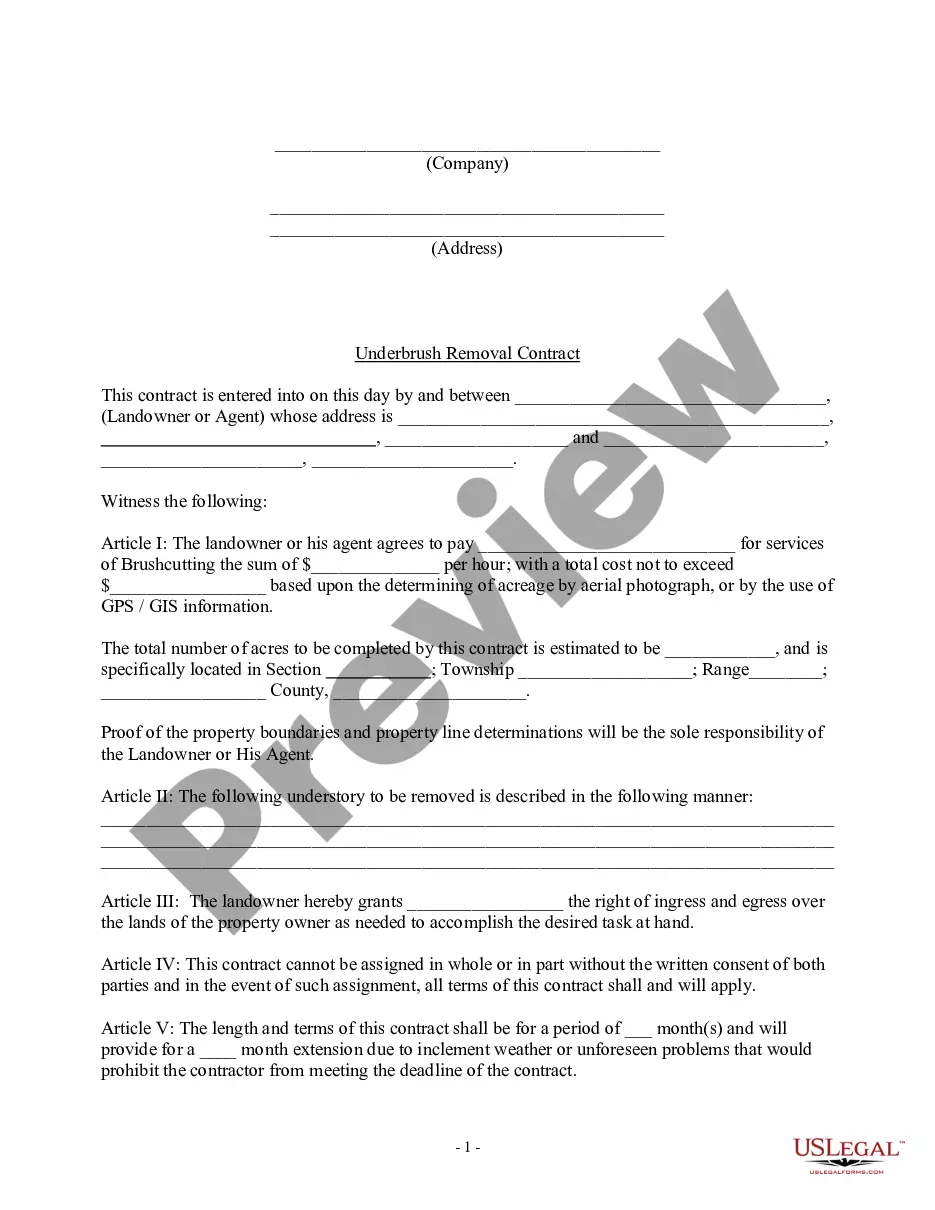

- Initially, be sure you have chosen the correct type for your personal town/state. You are able to look through the form while using Review switch and study the form information to make sure it will be the right one for you.

- When the type fails to meet up with your needs, take advantage of the Seach field to get the proper type.

- Once you are certain that the form is proper, go through the Buy now switch to get the type.

- Pick the rates strategy you want and enter in the required information. Create your accounts and buy your order using your PayPal accounts or Visa or Mastercard.

- Select the file format and down load the legitimate papers design to your gadget.

- Comprehensive, change and print and signal the attained California Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner.

US Legal Forms is definitely the biggest local library of legitimate types for which you will find numerous papers layouts. Make use of the company to down load skillfully-made papers that stick to express needs.

Form popularity

FAQ

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding Royalty Interest (ORRI) A royalty in excess of the royalty provided in the Oil & Gas Lease. Usually, an override is added during an intervening assignment. ORRIs are created out of the working interest in a property and do not affect mineral owners.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement.