Title: Understanding California's Response to Notice of Title Defect by Seller to Buyer Keywords: California, response, notice, title defect, seller, buyer Introduction: When buying or selling real estate in California, it is crucial to understand the process involved in addressing any potential title defects. As a seller, it is your responsibility to respond to any notice of title defect raised by the buyer. In this article, we will discuss California's response to notice of title defect by the seller to the buyer. Let us explore the different types of response options available. 1. Response by Curing the Title Defect: In some cases, the seller may acknowledge the title defect and take appropriate actions to cure it before the completion of the transaction. Examples of curing a title defect may include obtaining a release of a lien, correcting an incorrect legal description, or resolving boundary disputes. This response aims to rectify the issue and provide a clear title to the buyer. 2. Response by Providing Title Insurance: In situations where curing the title defect may not be feasible or practical, the seller may choose to provide the buyer with an enhanced title insurance policy. This type of response offers financial protection to the buyer against any future claims or losses related to the identified title defect. The insurance policy ensures that the buyer's investment in the property remains secure. 3. Response by Negotiating a Price Reduction: If the title defect has a significant impact on the property's value, the seller may offer a price reduction to the buyer. This response acknowledges the existence of the defect, but instead of curing or insuring it, the seller and buyer mutually agree on a reduced price to compensate for the defect's effects on the property's market value. 4. Response by Rejecting the Notice of Title Defect: In some instances, the seller may dispute or reject the notice of title defect, asserting that it is unfounded or invalid. This response may trigger further legal proceedings or negotiations between the parties involved to resolve the dispute. However, rejecting the notice of title defect should only be done after thorough examination and consultation with legal professionals. Conclusion: When faced with a notice of title defect as a seller, understanding California's response options is essential. You may respond by curing the defect, providing title insurance, negotiating a price reduction, or rejecting the notice. Each response approach has its own implications and potential consequences, so it is crucial to carefully assess the situation and seek professional advice to ensure a smooth transaction. Remember, addressing title defects promptly and effectively is vital for both sellers and buyers to protect their interests and investments in California real estate.

California Response to Notice of Title Defect by Seller to Buyer in Response to Notice

Description

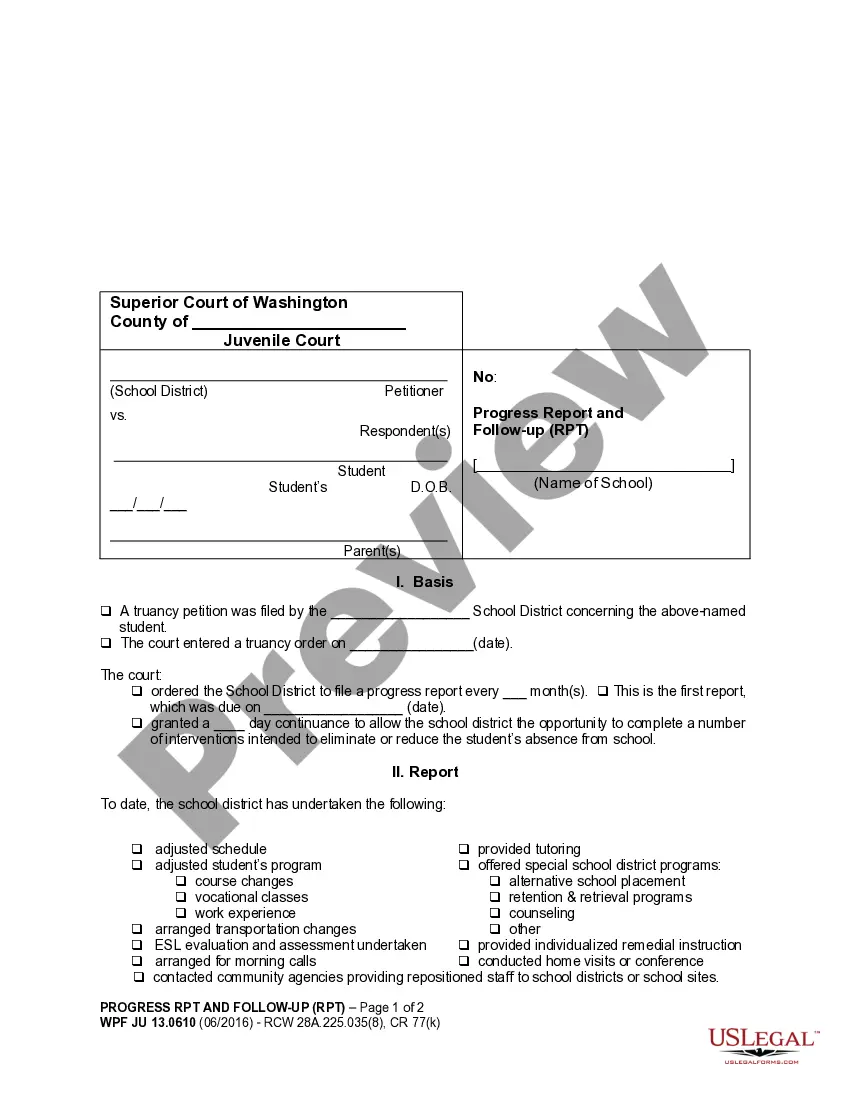

How to fill out California Response To Notice Of Title Defect By Seller To Buyer In Response To Notice?

US Legal Forms - one of many biggest libraries of legitimate kinds in the USA - delivers a wide range of legitimate papers templates you may obtain or printing. Making use of the site, you can get 1000s of kinds for enterprise and specific purposes, categorized by types, claims, or search phrases.You can get the most recent variations of kinds like the California Response to Notice of Title Defect by Seller to Buyer in Response to Notice within minutes.

If you have a monthly subscription, log in and obtain California Response to Notice of Title Defect by Seller to Buyer in Response to Notice from your US Legal Forms local library. The Download key can look on each form you see. You gain access to all previously saved kinds from the My Forms tab of your own account.

If you want to use US Legal Forms the very first time, allow me to share basic directions to get you started out:

- Be sure you have selected the proper form for your area/county. Click on the Review key to check the form`s content. Read the form information to actually have selected the proper form.

- When the form doesn`t satisfy your needs, make use of the Research industry towards the top of the monitor to obtain the one which does.

- If you are content with the shape, affirm your selection by clicking on the Buy now key. Then, select the prices prepare you like and provide your references to sign up for the account.

- Approach the deal. Utilize your Visa or Mastercard or PayPal account to accomplish the deal.

- Pick the structure and obtain the shape on your device.

- Make adjustments. Load, revise and printing and indication the saved California Response to Notice of Title Defect by Seller to Buyer in Response to Notice.

Every design you included in your money does not have an expiration day and is also the one you have for a long time. So, if you would like obtain or printing another version, just go to the My Forms portion and click in the form you will need.

Obtain access to the California Response to Notice of Title Defect by Seller to Buyer in Response to Notice with US Legal Forms, the most extensive local library of legitimate papers templates. Use 1000s of expert and state-certain templates that meet up with your small business or specific requirements and needs.

Form popularity

FAQ

Hear this out loud PauseThe 3-year statute of limitations for injury to real property in California, Code of Civil Procedure § 338(b) is another critically important statute of limitation which would apply to situations where there an injury or damage to real property occurs, as is the case where defects exist which cause damage to the ...

Every seller of real property has a duty of disclosure. Failing to disclose defects can result in significant consequences to the seller of real property. Understanding the requirements can help individuals avoid legal problems associated with defects on the property.

Hear this out loud PauseA notice to perform is an official document that requires either a real estate buyer or seller to take certain actions by a specific date to avoid the deal's cancellation. Some states require that either party issue a notice to perform before canceling a deal.

Hear this out loud PauseThe buyer is in breach of the contract. If the buyer is ?failing to perform? ? a legal term meaning that they're not holding up their side of the contract ? the seller can likely get out of the contract.

Hear this out loud PauseCompensatory Damages: The sellers could be forced to pay compensatory damages, to compensate you for any out-of-pocket costs associated with the concealed defect. These could include the cost of repair and any diminution in property value resulting from the defect.