This document addresses the question of Bankruptcy in pre-1989 agrements, stating specifically that the granting of relief under the Bankruptcy Code to any Party to this Agreement as debtor, this Agreement should be held to be an executory contract under the Bankruptcy Code, then any remaining Party shall be entitled to a determination by debtor or any trustee for debtor within thirty (30) days.

California Bankruptcy Pre 1989 Agreements

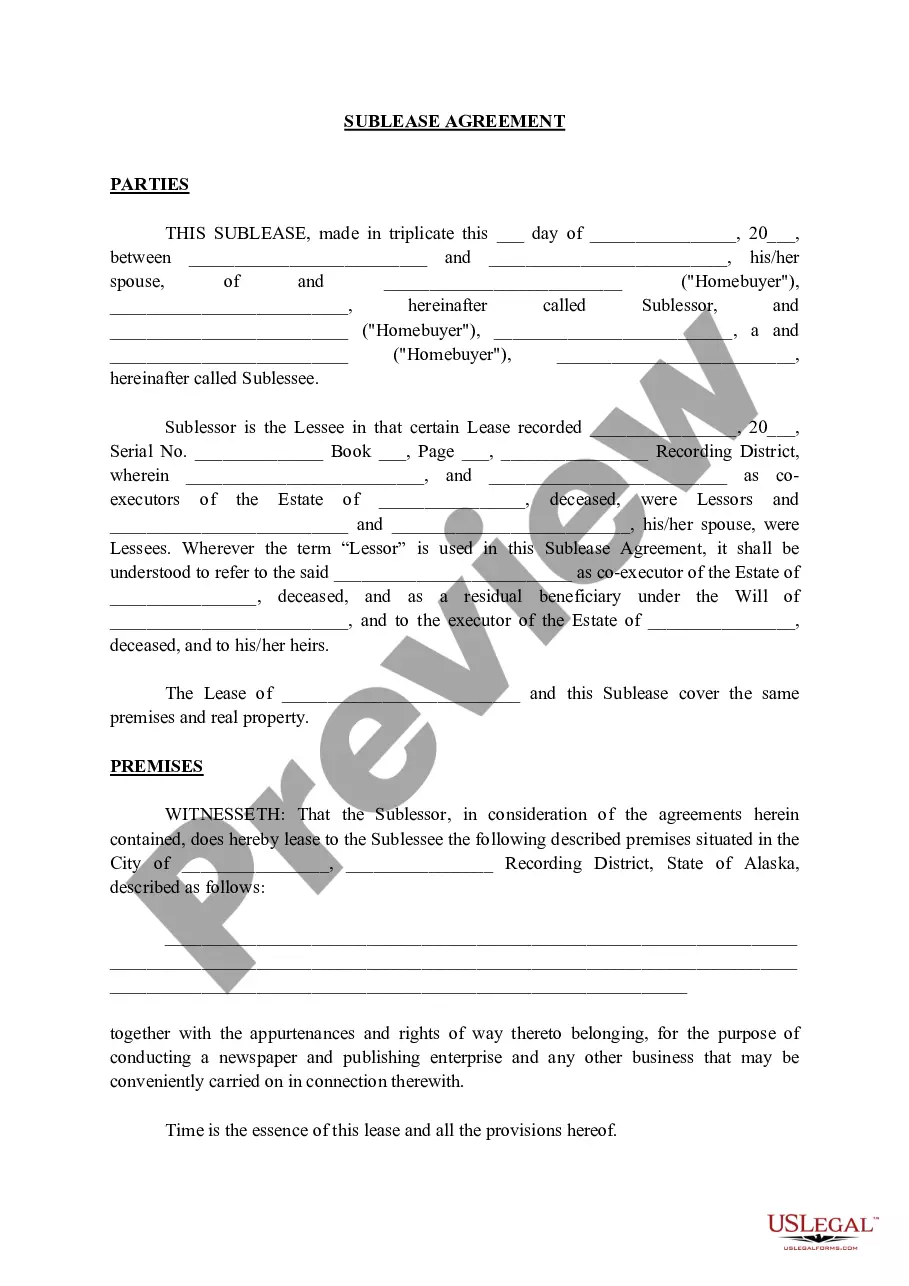

Description

How to fill out Bankruptcy Pre 1989 Agreements?

Discovering the right legitimate document design can be quite a struggle. Obviously, there are a lot of templates available on the Internet, but how will you obtain the legitimate form you will need? Make use of the US Legal Forms web site. The assistance offers 1000s of templates, including the California Bankruptcy Pre 1989 Agreements, that you can use for enterprise and personal requirements. All of the kinds are examined by specialists and fulfill state and federal specifications.

In case you are already signed up, log in to the accounts and click the Down load switch to have the California Bankruptcy Pre 1989 Agreements. Make use of your accounts to search through the legitimate kinds you have bought formerly. Check out the My Forms tab of your own accounts and have an additional copy of the document you will need.

In case you are a new end user of US Legal Forms, allow me to share simple recommendations for you to stick to:

- Initial, ensure you have chosen the appropriate form for your personal city/county. You can look through the shape making use of the Review switch and browse the shape information to ensure it is the right one for you.

- In case the form is not going to fulfill your preferences, take advantage of the Seach industry to get the proper form.

- When you are certain the shape would work, click the Purchase now switch to have the form.

- Select the pricing prepare you want and type in the needed details. Create your accounts and purchase an order making use of your PayPal accounts or credit card.

- Choose the file structure and down load the legitimate document design to the system.

- Full, change and print and indicator the received California Bankruptcy Pre 1989 Agreements.

US Legal Forms is the biggest local library of legitimate kinds where you can find numerous document templates. Make use of the service to down load appropriately-made documents that stick to condition specifications.

Form popularity

FAQ

§ 704.100 A policy with no cash value is totally exempt. The maximum exemption for the cash value of a policy is $13,975, or doubled if married. Benefits from matured life insurance or annuity policies are exempt to the extent reasonably necessary for the support of the debtor and his or her spouse or dependents.

California 704 Personal Property Exemptions Household items and personal effects - 704.020. Residential building materials to repair or improve home up to $3,825 - 704.030. Jewelry, heirlooms, and works of art up to $9,525 - 704.040. Health aids - 704.050.

If you are a party to a lease or contract and the other party files for bankruptcy, you must continue performing your obligations while the debtor determines whether to assume or reject your contract.

California Bankruptcy Exemptions ? Section 704 protection: Vehicle-Allows you to protect up to $3325 in the value of any number of vehicles. Jewelry-Allows you to protect Jewelry, heirlooms and works of art up to $8725.

Wildcard ? Up to $1,550 in any property you own, plus you can use any unused portion of the homestead protection as a wildcard. This means that if you have no home or equity in your home, you can use the $29,725 from the homestead to protect any asset or property you own.

Section 704.730. 704.730. (a) The amount of the homestead exemption is the greater of the following: (1) The countywide median sale price for a single-family home in the calendar year prior to the calendar year in which the judgment debtor claims the exemption, not to exceed six hundred thousand dollars ($600,000).

Code Section 703 is generally utilized where there is no equity or minimal equity in a home. Code Section 703 provides a wildcard protection amount that can be utilized to protect any asset, if that wildcard is not utilized to protect your homestead.