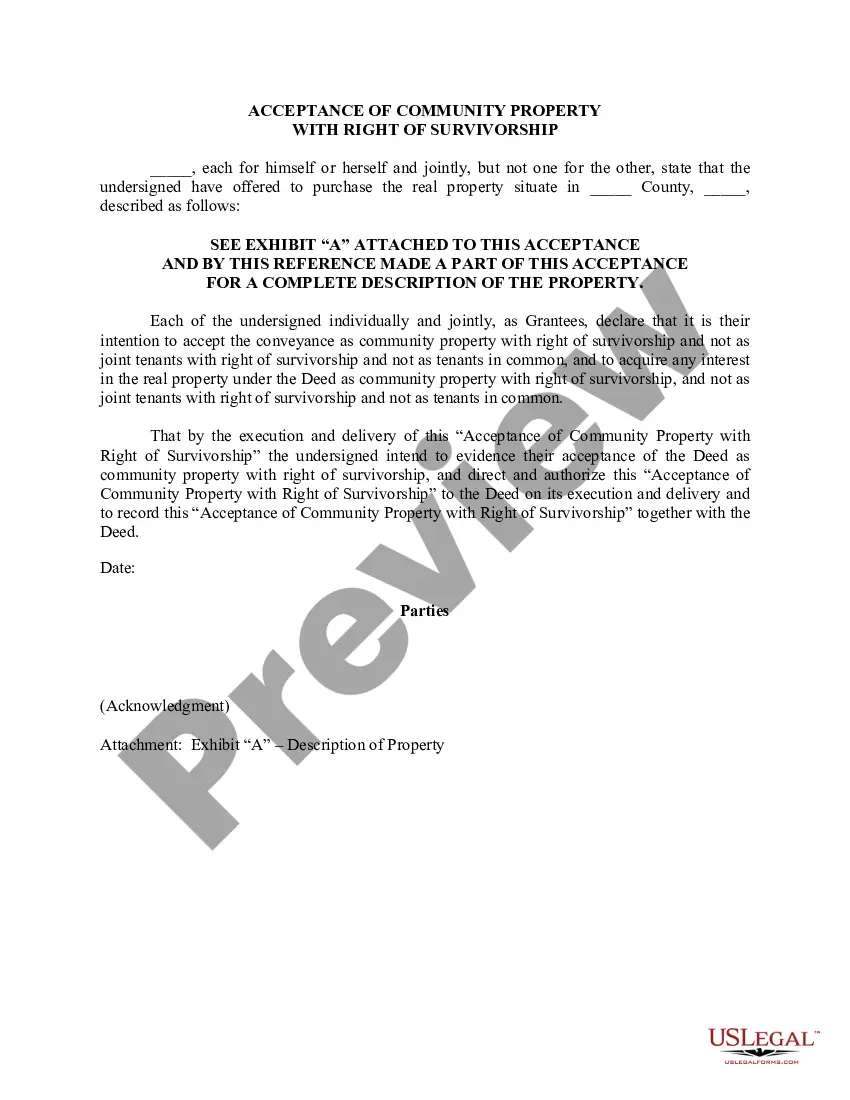

California Deed (Including Acceptance of Community Property with Right of Survivorship)

Description

How to fill out Deed (Including Acceptance Of Community Property With Right Of Survivorship)?

You may spend several hours online looking for the lawful file web template that suits the state and federal demands you require. US Legal Forms provides thousands of lawful forms which can be evaluated by pros. You can actually obtain or produce the California Deed (Including Acceptance of Community Property with Right of Survivorship) from my services.

If you already have a US Legal Forms profile, it is possible to log in and then click the Down load button. Following that, it is possible to comprehensive, edit, produce, or indicator the California Deed (Including Acceptance of Community Property with Right of Survivorship). Each and every lawful file web template you purchase is your own property for a long time. To acquire an additional duplicate for any obtained type, proceed to the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms internet site initially, follow the easy directions below:

- Initial, be sure that you have selected the correct file web template to the county/area that you pick. Look at the type description to ensure you have selected the proper type. If readily available, utilize the Preview button to search from the file web template as well.

- If you wish to discover an additional model in the type, utilize the Lookup discipline to find the web template that meets your requirements and demands.

- Once you have found the web template you want, simply click Purchase now to proceed.

- Pick the prices plan you want, key in your references, and sign up for a free account on US Legal Forms.

- Total the transaction. You should use your credit card or PayPal profile to cover the lawful type.

- Pick the structure in the file and obtain it for your system.

- Make alterations for your file if necessary. You may comprehensive, edit and indicator and produce California Deed (Including Acceptance of Community Property with Right of Survivorship).

Down load and produce thousands of file templates utilizing the US Legal Forms web site, which provides the greatest collection of lawful forms. Use professional and state-distinct templates to deal with your business or specific requirements.

Form popularity

FAQ

Ways To Hold Title For Married Couples In California Tenants In Common. ... Joint Tenancy. ... Community Property With Right of Survivorship. Trustees Of A Trust. It is usually most beneficial for a married couple in California to hold title in their revocable trust.

Joint tenancy is a way for two or more people to own property in equal shares so that when one of the joint tenants dies, the property can pass to the surviving joint tenant(s) without having to go through probate court.

In other cases, intestate succession allows people in lower categories to inherit property. For example, if a spouse and parents survive but there are no children, the spouse and parents would each receive one-half of the decedent's property, including a house held solely in the decedent's name.

Here is the breakdown of how much a spouse can receive when there is no will: The spouse receives the entirety of the estate when there are no other living family members. The spouse receives half of the separate property when the deceased is survived by a spouse and one child or grandchild.

Disadvantages of community property with a right of survivorship: If a spouse dies having willed a piece of property titled as community property with a right of survivorship to someone other than their spouse, their gift may be deemed invalid.

Community property with right of survivorship is a legal distinction that allows two spouses to equally share assets through marriage as well as pass on assets to the other spouse upon death without going through probate.

9 Financial Steps to Take After the Death of a Spouse Obtain Certified Copies of the Death Certificate. ... Gather Essential Documents. ... Contact Social Security. ... Notify Insurance Companies. ... Address Financial Accounts. ... Review Bills and Payment Due Dates. ... Plan for Short-Term Expenses. ... Avoid Identity Theft.

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).