California Clauses Relating to Venture Ownership Interests refer to specific contractual agreements or provisions that govern the ownership and control of venture capital investments in California. These clauses aim to regulate various aspects related to the ownership, transferability, and governance of ownership interests in venture capital ventures located within the state. There are several types of California Clauses Relating to Venture Ownership Interests, including: 1. Transfer Restrictions: These clauses outline the conditions and restrictions surrounding the transfer of ownership interests in the venture. They may specify whether the transfer requires approval from other venture owners or the company itself, ensuring that any potential transfers align with the overall objectives and strategic direction of the venture. 2. Tag-Along Rights: Tag-along rights clauses protect minority investors by allowing them to "tag along" with majority investors during the sale of their ownership interests. This provision ensures that minority owners have the option to sell their shares on the same terms and conditions as the majority investors, providing them with fair treatment during exit opportunities. 3. Drag-Along Rights: Conversely, drag-along rights clauses grant majority investors the ability to "drag along" minority investors in the event of a sale or exit. This provision allows majority investors to compel minority owners to sell their ownership interests alongside them, ensuring a unified approach to exit strategies and potential liquidity events. 4. Preemptive Rights: Preemptive rights, also known as rights of first refusal, give existing investors the option to maintain their ownership percentage by having the first opportunity to purchase additional shares or ownership interests when the company issues new equity. These clauses promote fairness and protect existing investors from dilution by allowing them to maintain their proportional ownership in the venture. 5. Anti-Dilution Clauses: Anti-dilution clauses are designed to provide protection to investors in case the company issues additional equity at a price lower than the original investment price. They ensure that existing investors are granted additional ownership interests or receive compensation to mitigate the dilution effect caused by future fundraising rounds at lower valuations. 6. Board Representation: Some California Clauses Relating to Venture Ownership Interests may address board representation. These clauses may specify the rights and obligations of the different classes of ownership interests and their corresponding representation on the board of directors. They ensure that owners have a say in the strategic decision-making processes and governance of the venture. It is crucial for venture capital investors and entrepreneurs in California to carefully consider and negotiate these clauses to protect their rights, align interests, and establish a fair framework for ownership and control within their venture capital investments. Note that the exact clauses and their implications may vary in different contractual agreements and based on the specific circumstances of each venture.

California Clauses Relating to Venture Ownership Interests

Description

How to fill out Clauses Relating To Venture Ownership Interests?

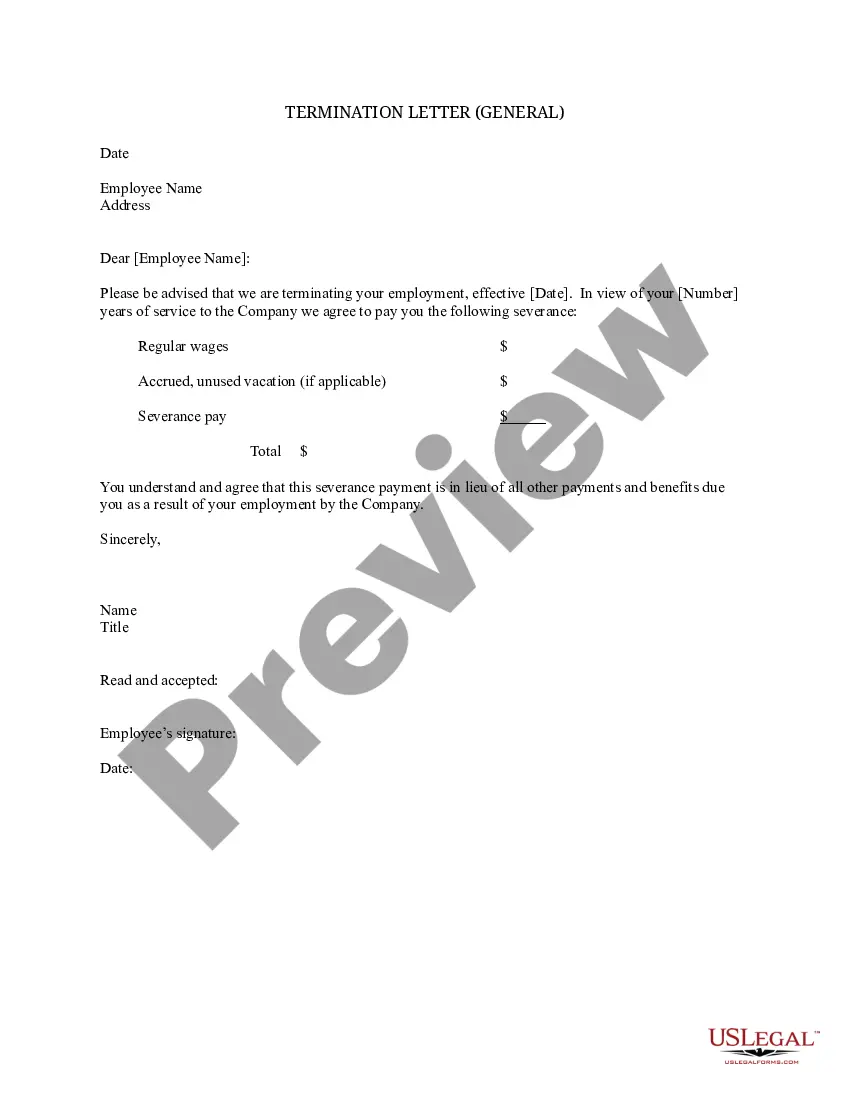

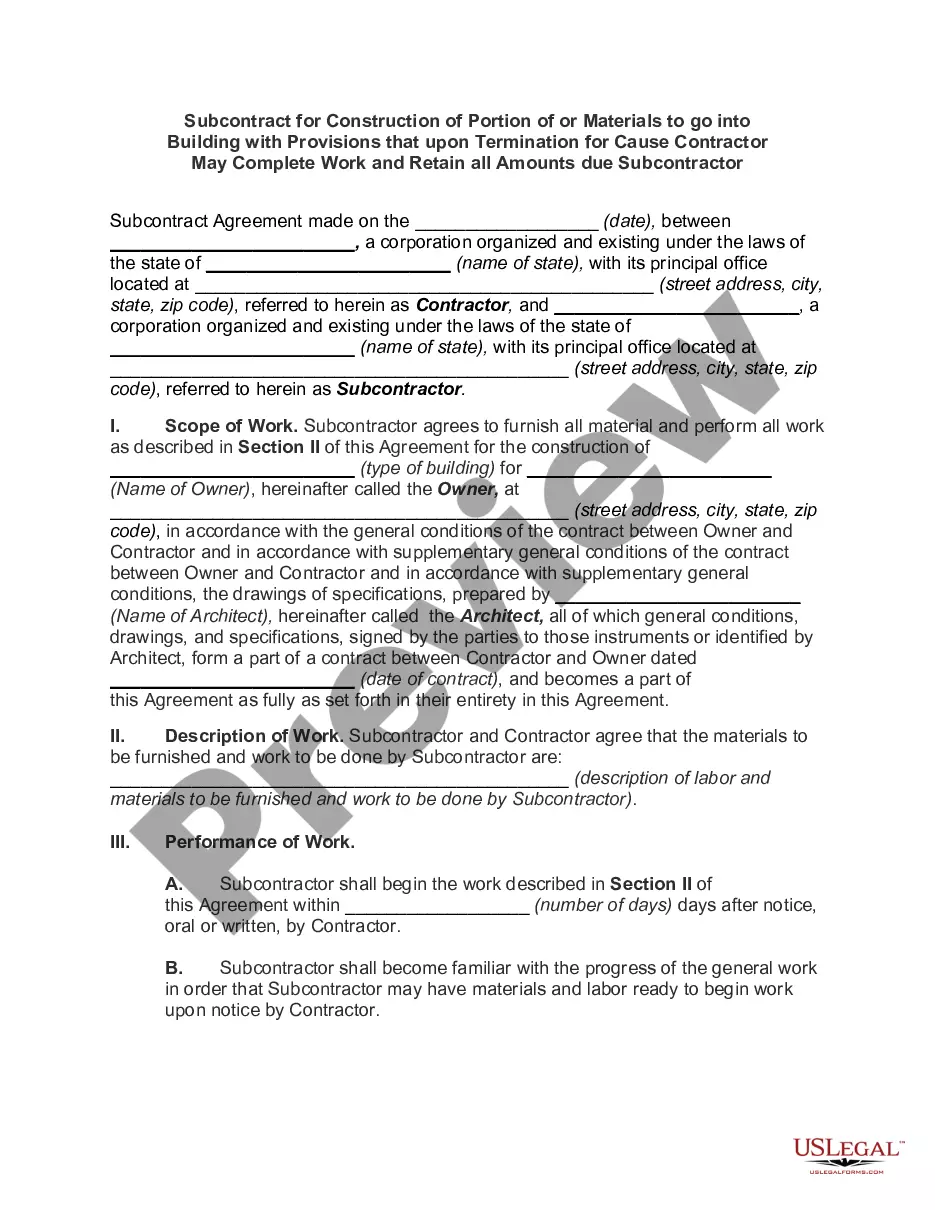

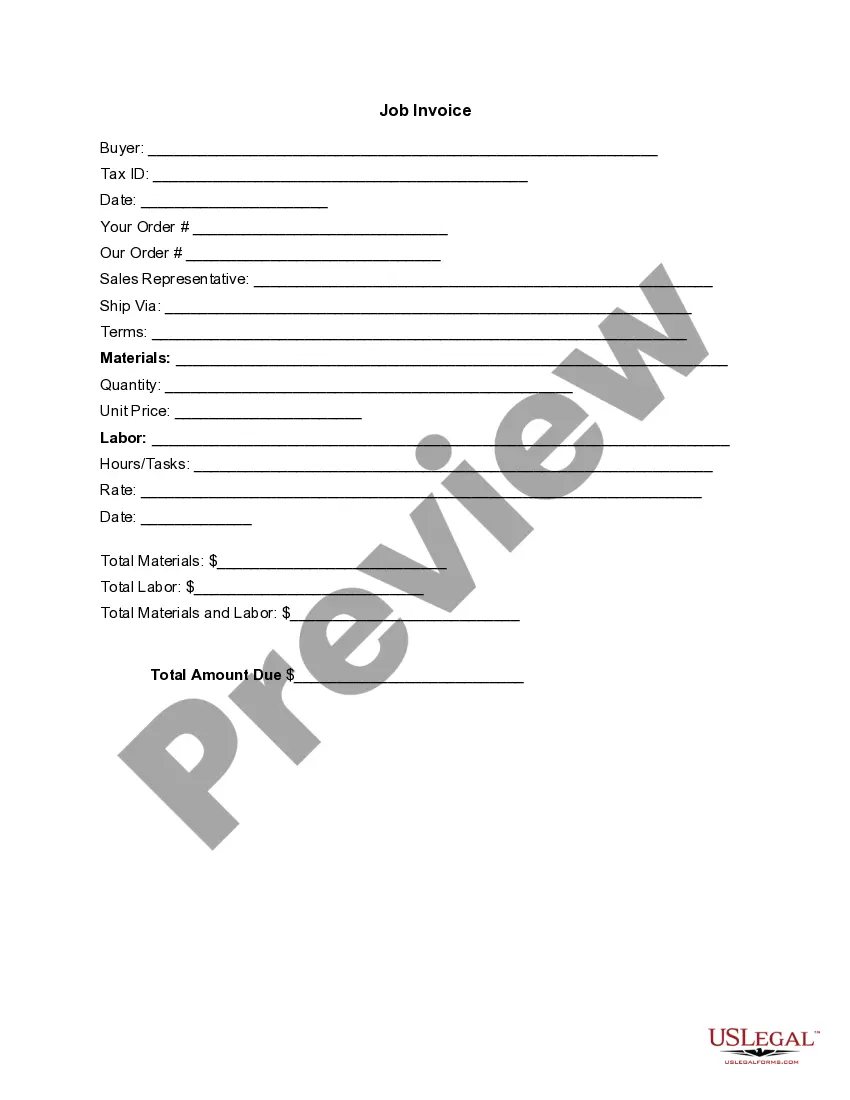

You may spend hours online attempting to find the legal record design that fits the federal and state requirements you need. US Legal Forms gives 1000s of legal varieties which are reviewed by professionals. It is possible to obtain or printing the California Clauses Relating to Venture Ownership Interests from our service.

If you currently have a US Legal Forms account, it is possible to log in and click on the Down load switch. Following that, it is possible to total, edit, printing, or signal the California Clauses Relating to Venture Ownership Interests. Each and every legal record design you acquire is the one you have for a long time. To get an additional copy associated with a purchased kind, proceed to the My Forms tab and click on the corresponding switch.

If you are using the US Legal Forms web site for the first time, stick to the straightforward instructions beneath:

- Initially, ensure that you have selected the right record design to the county/area of your liking. See the kind information to make sure you have picked out the appropriate kind. If offered, make use of the Preview switch to search throughout the record design at the same time.

- If you wish to find an additional variation of your kind, make use of the Look for field to obtain the design that fits your needs and requirements.

- After you have located the design you desire, just click Buy now to carry on.

- Select the pricing prepare you desire, enter your credentials, and sign up for an account on US Legal Forms.

- Complete the deal. You can utilize your bank card or PayPal account to purchase the legal kind.

- Select the formatting of your record and obtain it for your gadget.

- Make alterations for your record if necessary. You may total, edit and signal and printing California Clauses Relating to Venture Ownership Interests.

Down load and printing 1000s of record web templates while using US Legal Forms Internet site, which provides the most important selection of legal varieties. Use skilled and state-particular web templates to deal with your company or specific requirements.

Form popularity

FAQ

The California Vehicle Code (often abbreviated as VC or CVC) is the set of statutes that regulate the operation, registration, and ownership of motor vehicles (as well as bicycles and other devices) used to move people, animals and goods along the state's roadways.

Venture capital law is the law that pertains to funding early-stage startup companies. Investors put money into startup businesses that they believe are going to be successful. Various laws and regulations govern how individuals and firms can make these investments.

On Oct. 8, 2023, California Governor Gavin Newsom signed Senate Bill 54, a law that mandates VC firms to release annual reports regarding the number of diverse founders they're investing in ? making it the inaugural law focused on increasing diversity in VC funding in the U.S. ? TechCrunch reports.

The Vehicle Code's "Rules of the Road" generally apply to operating vehicles, bicycles, and animals on a public roadway, except for provisions which by their very nature can have no application.

toplay provision is a term in a term sheet that incentivizes existing investors in a company to participate in a new financing round. Paytoplay provisions are typically structured as punitive to investors who decide not to participate, or beneficial to investors who opt to invest.

Venture capital (VC) is generally used to support startups and other businesses with the potential for substantial and rapid growth.

California Adopts New Law Requiring VC Companies to Collect Diversity Data From Portfolio Company Founders. California's governor recently signed into law SB 54, a bill intended to increase transparency regarding diversity of founding teams in the venture capital (VC) industry.

Key provisions of a VC term sheet include: investment structure, key economic terms, shareholder agreements, due diligence, exclusivity and closing.