California Clauses Relating to Venture Interests are provisions or clauses included in legal documents, particularly contracts or agreements, that pertain to investments in newly established businesses or startups in the state of California. These clauses offer specific protections, rights, and criteria for investors engaging in venture capital or other similar investment activities. Here are some relevant keywords associated with California Clauses Relating to Venture Interests: 1. Investor Protection: — California Venture Capital Claus— - Investor Safeguards — Risk Mitigation Measure— - Investor Representation — Protective Provision— - Anti-dilution Rights 2. Preferred Stock: — California Preferred Stock Claus— - Preferred Stockholder Rights — Liquidation Preference— - Dividend Accrual 3. Board of Directors: — California Board Representation Clause — Board SeaAllocationio— - Investor Director Appointment — Voting Right— - Protective Voting Provisions 4. Information Rights: — California Information Rights Claus— - Access to Financials and Reports — Timely Reporting Obligation— - Inspection Rights — Audit Rights 5. Co-sale or Tag-along Rights: — California Co-sale Claus— - Co-sale or Tag-along Agreements — Investor's Right to Sell Shares Concurrently — Sale Participation Rights Different Types of California Clauses Relating to Venture Interests: 1. Protective Clauses: These clauses put measures in place to protect the investors' interests, such as requiring unanimous investor approval for certain actions or providing veto rights on critical matters. 2. Anti-dilution Clauses: Anti-dilution clauses adjust the investor's ownership percentage in case of future equity issuance, protecting their investment from dilution if the company issues new shares at a lower price per share. 3. Information Rights Clauses: These clauses provide investors with the right to access financial statements, reports, and other relevant information to monitor the progress and financial health of the invested company. 4. Co-sale or Tag-along Clauses: Co-sale or tag-along clauses give minority investors the right to sell their shares concurrently with majority shareholders, ensuring they can exit the investment on the same terms and conditions. It's important to consult legal professionals for accurate interpretation and understanding of California Clauses Relating to Venture Interests as they can vary based on specific contracts and agreements.

California Clauses Relating to Venture Interests

Description

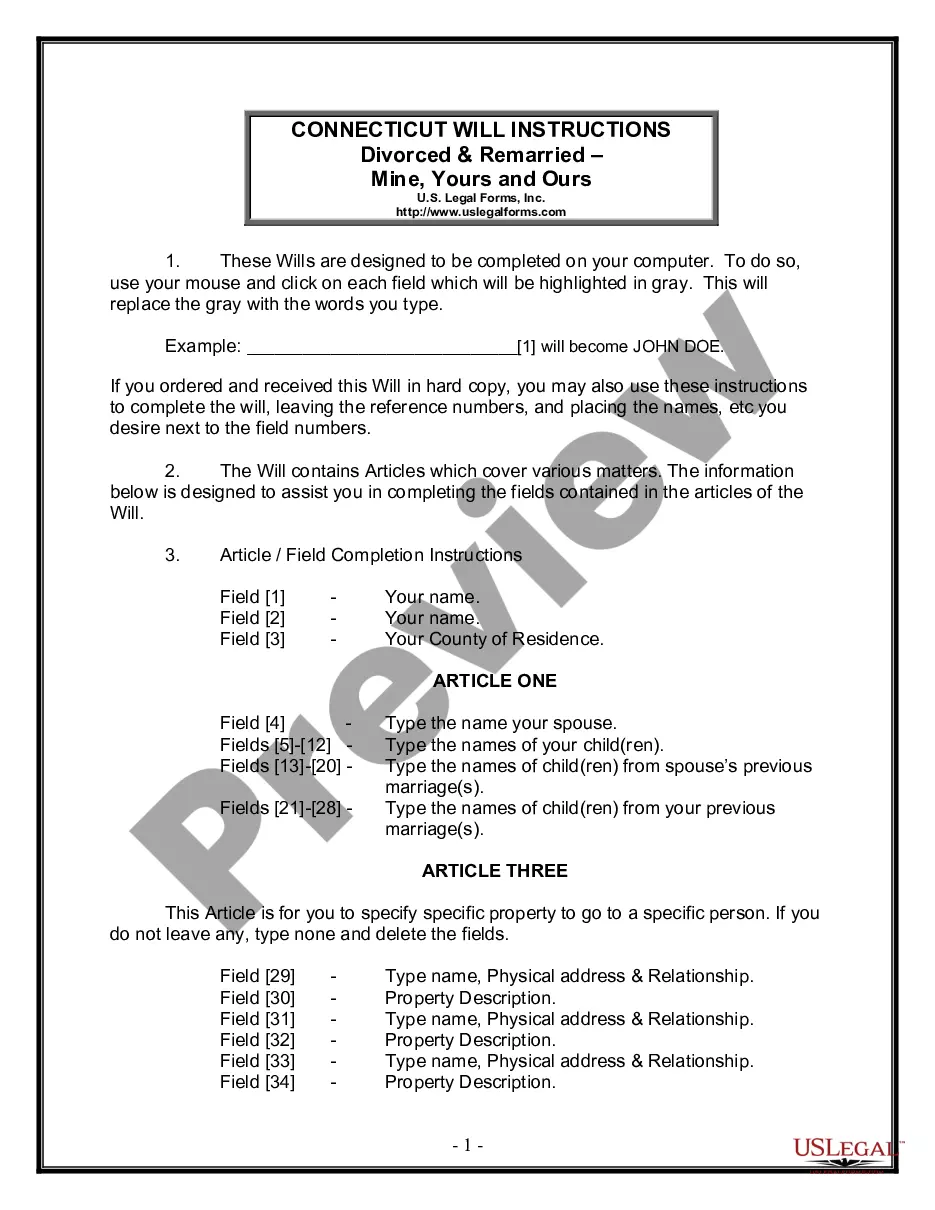

How to fill out California Clauses Relating To Venture Interests?

It is possible to spend hours online searching for the legitimate document web template that suits the federal and state specifications you require. US Legal Forms supplies thousands of legitimate forms which can be examined by professionals. It is simple to download or produce the California Clauses Relating to Venture Interests from the services.

If you already possess a US Legal Forms accounts, you may log in and then click the Download button. After that, you may comprehensive, edit, produce, or signal the California Clauses Relating to Venture Interests. Every legitimate document web template you get is your own eternally. To have another duplicate for any acquired develop, visit the My Forms tab and then click the related button.

If you use the US Legal Forms web site initially, keep to the basic instructions under:

- Initial, ensure that you have chosen the correct document web template for the county/town of your choosing. Browse the develop outline to ensure you have picked the proper develop. If offered, make use of the Review button to search with the document web template as well.

- If you would like get another model from the develop, make use of the Search field to get the web template that suits you and specifications.

- Once you have found the web template you need, click on Purchase now to move forward.

- Find the prices prepare you need, key in your qualifications, and register for a free account on US Legal Forms.

- Total the purchase. You should use your charge card or PayPal accounts to pay for the legitimate develop.

- Find the format from the document and download it for your product.

- Make changes for your document if needed. It is possible to comprehensive, edit and signal and produce California Clauses Relating to Venture Interests.

Download and produce thousands of document layouts using the US Legal Forms website, that provides the greatest selection of legitimate forms. Use skilled and status-particular layouts to tackle your organization or personal demands.

Form popularity

FAQ

The common elements necessary to establish the existence of a joint venture are an express or implied contract, which includes the following elements: (1) a community of interest in the performance of the common purpose; (2) joint control or right of control; (3) a joint proprietary interest in the subject matter; (4) ...

Structuring A Joint Venture Agreement: 8 Important Elements 8 Key Elements in a Joint Venture Agreement. ... The identity of the businesses involved. ... The purpose of the joint venture. ... Resources to be shared. ... Sharing of profits and losses. ... Rights and duties. ... Dispute resolution. ... Governance.

A Joint Venture Agreement is a contract between two or more parties who want to do business together for a period of time, without creating a formal partnership or new legal entity. Usually, both parties have an equal stake in the venture, and will both reap the benefits.

?A joint venture has been defined as an undertaking by two or more persons jointly to carry out a single business enterprise for profit with its existence dependent upon the intention of the parties as shown by an express agreement or by inference from their acts and conduct. ( Lasry v.

Joint venture An agreement (written or oral) between the parties manifesting their intent to associate as joint venturers. Mutual contributions by the parties to the joint venture. Some degree of joint control over the single enterprise or project. A mechanism or provision for the sharing of profits or losses.

Since the joint venture is not a legal entity, it does not enter into contracts, hire employees, or have its own tax liabilities. These activities and obligations are handled through the co-venturers directly and are governed by contract law.

Although a JV is a partnership in the colloquial sense of the word, it can be formed using any legal structure: Corporations, partnerships, limited liability companies (LLCs), and other business entities can all be employed.

A partnership will usually be a business that operates for a fixed or indefinite period of time. On the other hand, a joint venture is created for the sole purpose of revolving around one business transaction.