California Form of Parent Guaranty

Description

How to fill out Form Of Parent Guaranty?

If you need to total, obtain, or printing authorized file themes, use US Legal Forms, the greatest assortment of authorized varieties, that can be found online. Make use of the site`s easy and handy look for to find the files you need. Different themes for organization and person functions are sorted by groups and suggests, or key phrases. Use US Legal Forms to find the California Form of Parent Guaranty in just a handful of clicks.

If you are currently a US Legal Forms buyer, log in to the account and click the Obtain button to get the California Form of Parent Guaranty. Also you can access varieties you earlier acquired from the My Forms tab of the account.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Make sure you have chosen the shape for your proper town/land.

- Step 2. Make use of the Preview solution to look through the form`s information. Don`t forget to read the outline.

- Step 3. If you are not satisfied with all the type, utilize the Research discipline on top of the display to locate other types of the authorized type template.

- Step 4. Upon having found the shape you need, select the Buy now button. Opt for the pricing plan you prefer and add your accreditations to sign up to have an account.

- Step 5. Approach the transaction. You may use your Мisa or Ьastercard or PayPal account to complete the transaction.

- Step 6. Find the formatting of the authorized type and obtain it on your own system.

- Step 7. Full, revise and printing or indication the California Form of Parent Guaranty.

Every single authorized file template you acquire is your own permanently. You possess acces to every type you acquired with your acccount. Click the My Forms section and decide on a type to printing or obtain once more.

Contend and obtain, and printing the California Form of Parent Guaranty with US Legal Forms. There are millions of specialist and express-particular varieties you can use for your personal organization or person requirements.

Form popularity

FAQ

All guarantees must be in writing A guarantee has to be in writing and signed by the guarantor or some party authorised by the guarantor (Statute of Frauds 1677). It is often thought that more formality is required, but in fact the formal requirements are few.

Yes, a personal guarantee needs to be witnessed. The law requires a witness to be there when the personal guarantee is signed as a deed. When electronic signatures are used, the witnesses must be there physically to witness.

A personal guarantee is a provision a lender puts in a business loan agreement that requires owners to be personally responsible for their company's debt in case of default. Lenders often ask for personal guarantees because they have concerns over the credit history, age or financial stability of your business.

Personal guarantees are binding contracts, and from the moment the guarantee is in writing it becomes legally enforceable. There is no set time period during which a guarantee can be valid - it depends on the specifics set out in the particular guarantee.

Answer and Explanation: Yes, a personal guarantee has to be notarized. The individual involved in notarizing the pledge acts as a witness for the contract. Therefore, if the individual who signed in to be the guarantor fails, the creditor can use it against them, which calls for a court case.

The "guarantor" is the person guarantying the debt while the party who originally incurred the debt is the "principle" and the creditor is the "guaranteed party." Under California law, if properly drafted, a guaranty is a fully enforceable obligation which allows the guaranteed party to proceed directly against the ...

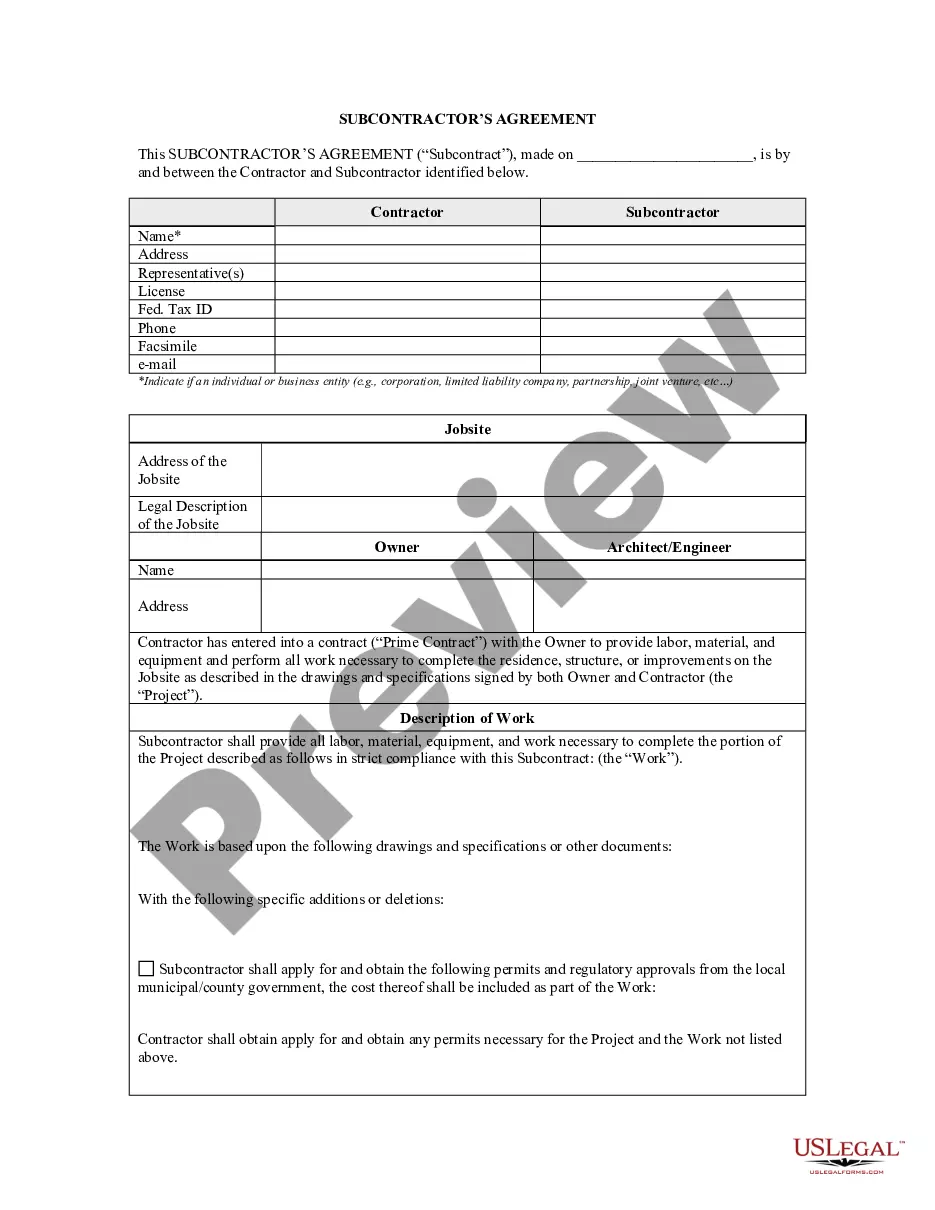

A form of guaranty whereby a parent, as guarantor, assumes the responsibility for the payment or performance of an action or obligation of its subsidiary by agreeing to compensate the beneficiary in the event of such non-payment or performance.

Whether the personal guarantee loan agreement must be witnessed or notarized will be determined by the lender's requirements, and possibly by state law. If the loan covers real estate, the agreement will most likely need to be witnessed and notarized in the same manner as required for a deed.