If you have to comprehensive, obtain, or print out lawful record themes, use US Legal Forms, the biggest assortment of lawful varieties, that can be found on the Internet. Make use of the site`s easy and hassle-free research to get the papers you want. Numerous themes for company and individual uses are categorized by types and says, or key phrases. Use US Legal Forms to get the California Personal Property Inventory Questionnaire in just a handful of clicks.

If you are presently a US Legal Forms buyer, log in to your account and then click the Obtain key to get the California Personal Property Inventory Questionnaire. Also you can entry varieties you in the past acquired within the My Forms tab of your respective account.

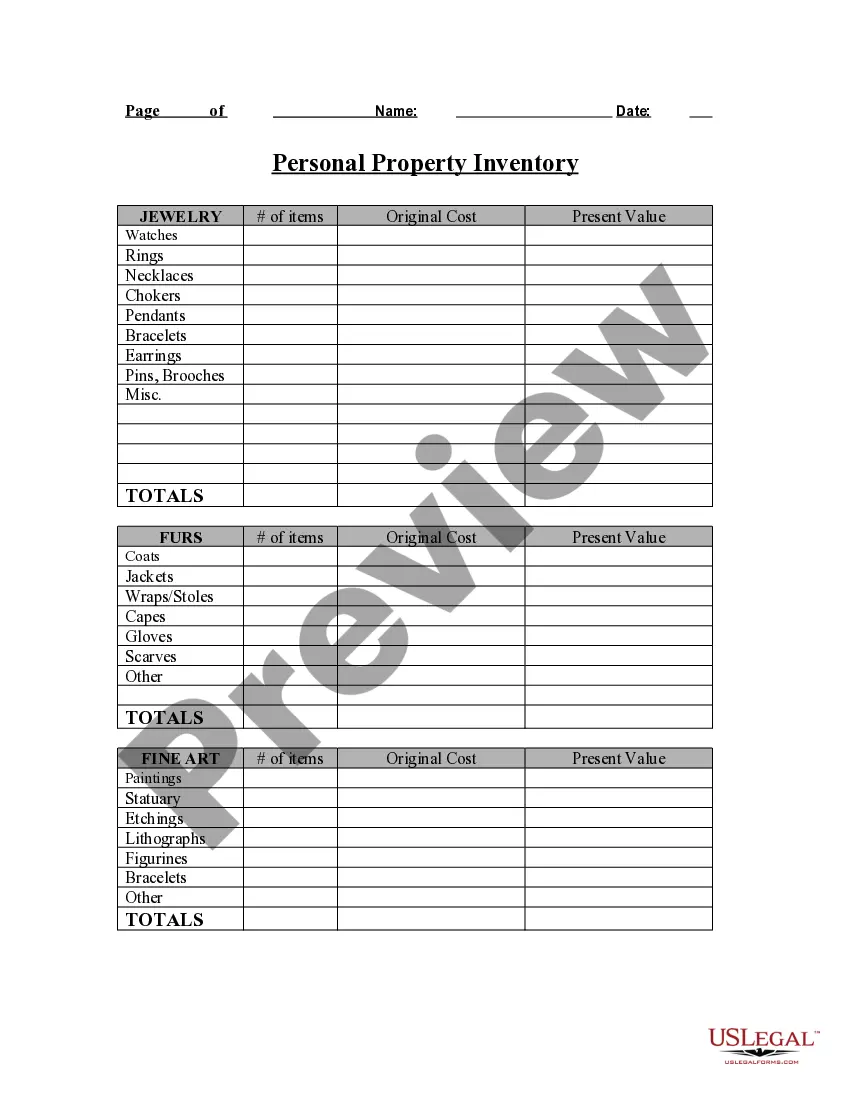

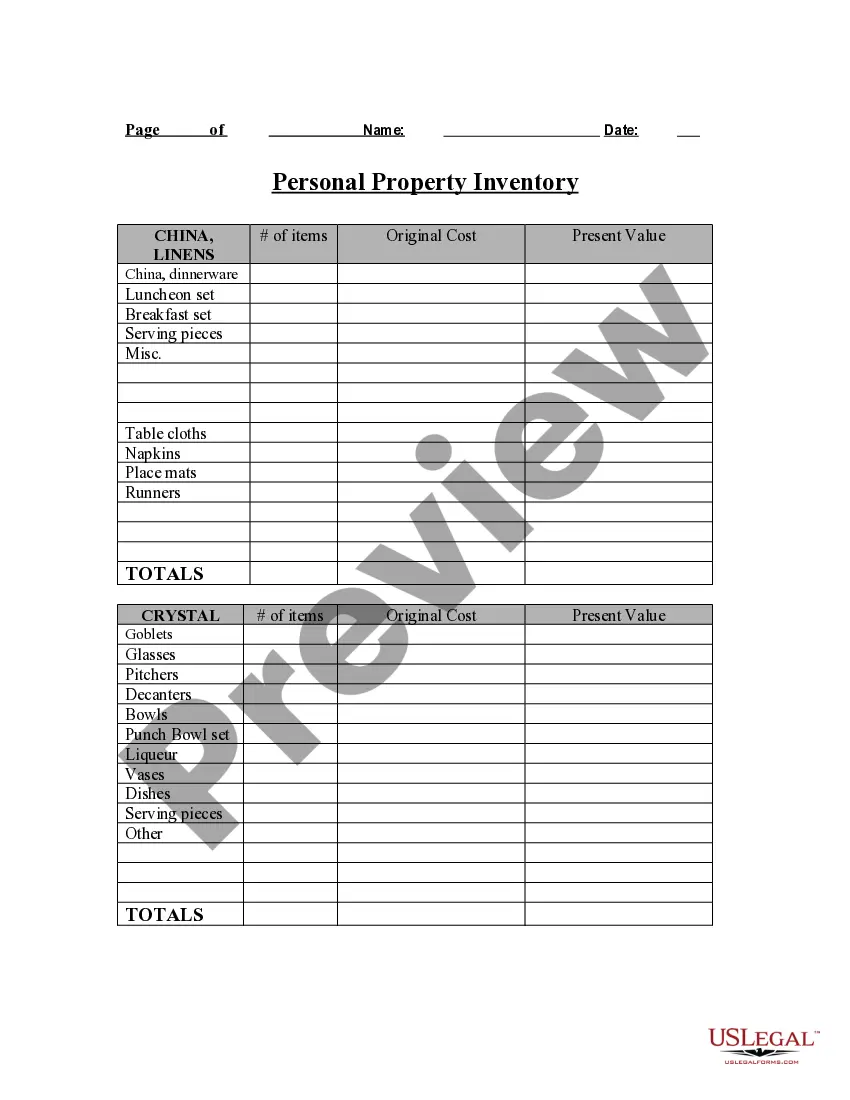

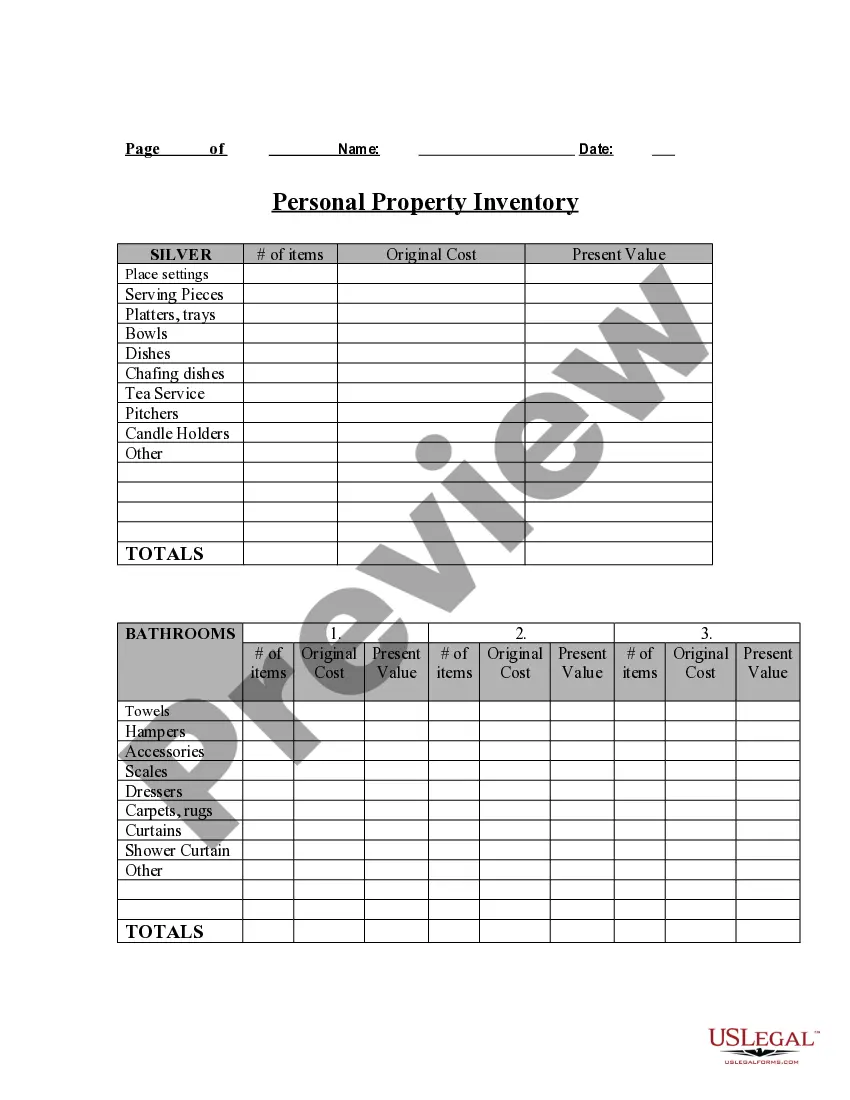

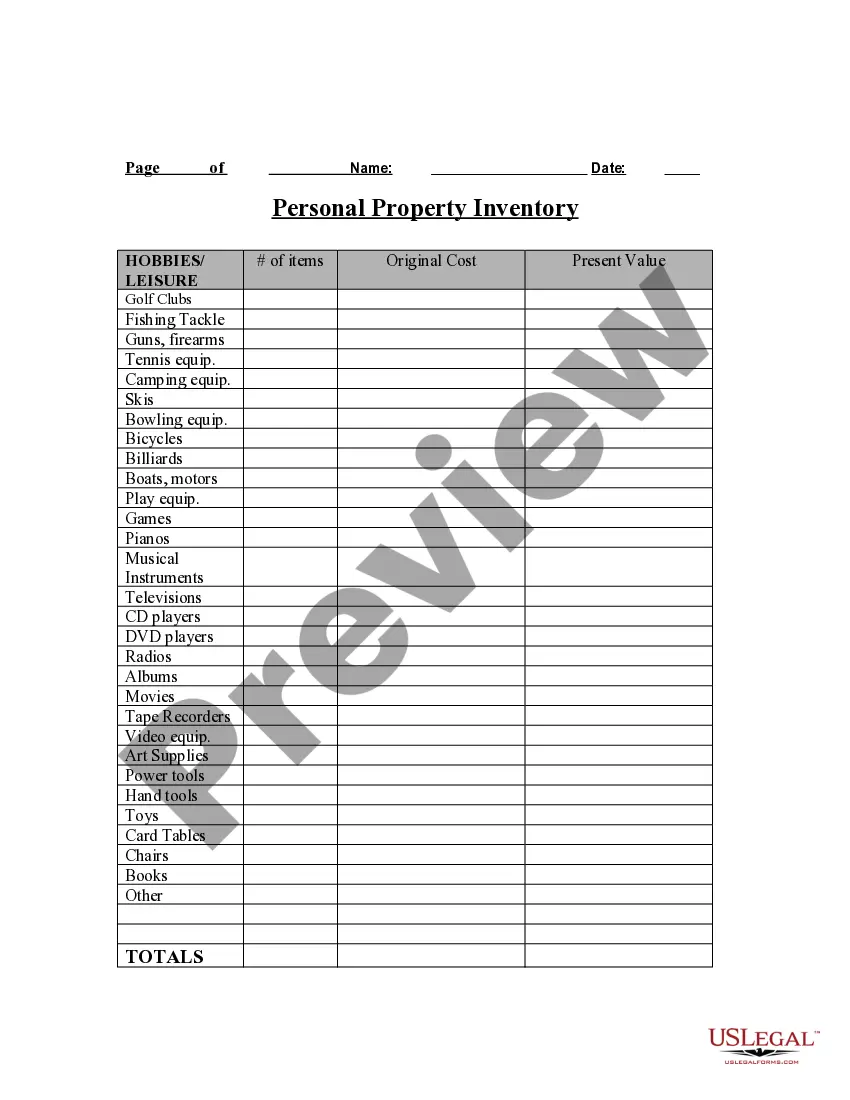

If you use US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for the correct area/country.

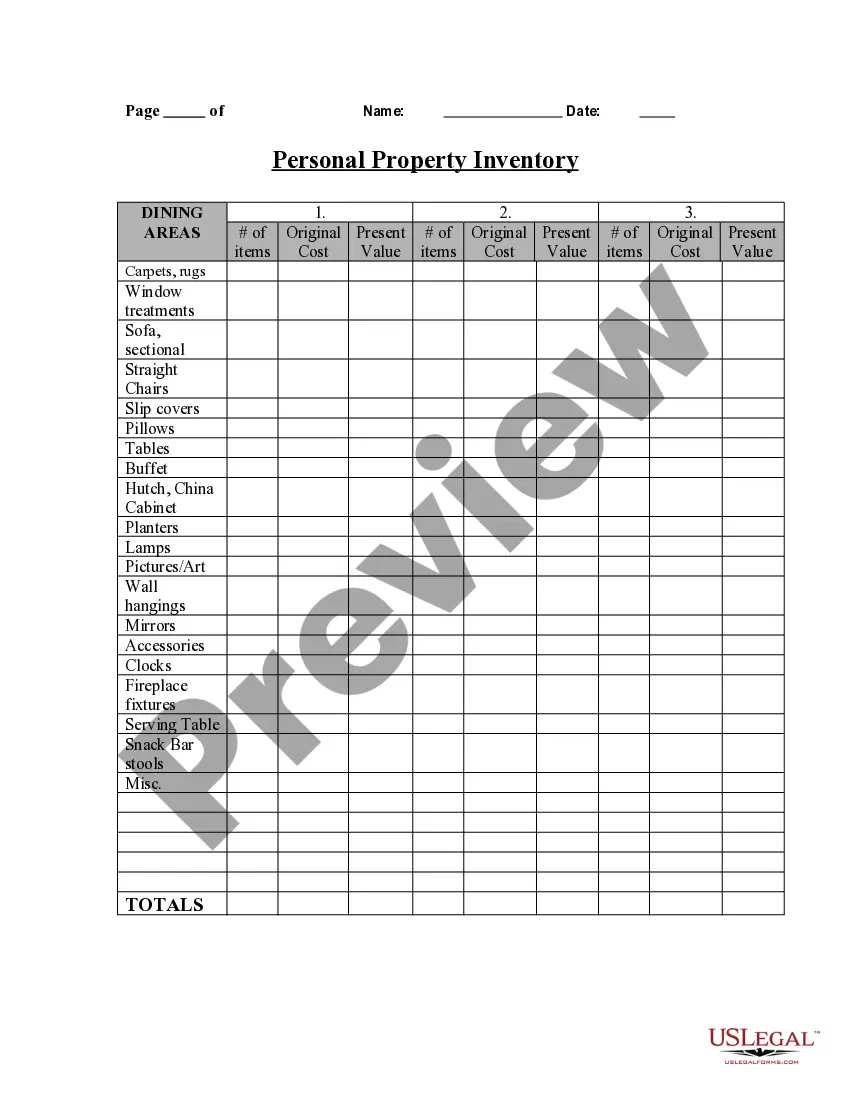

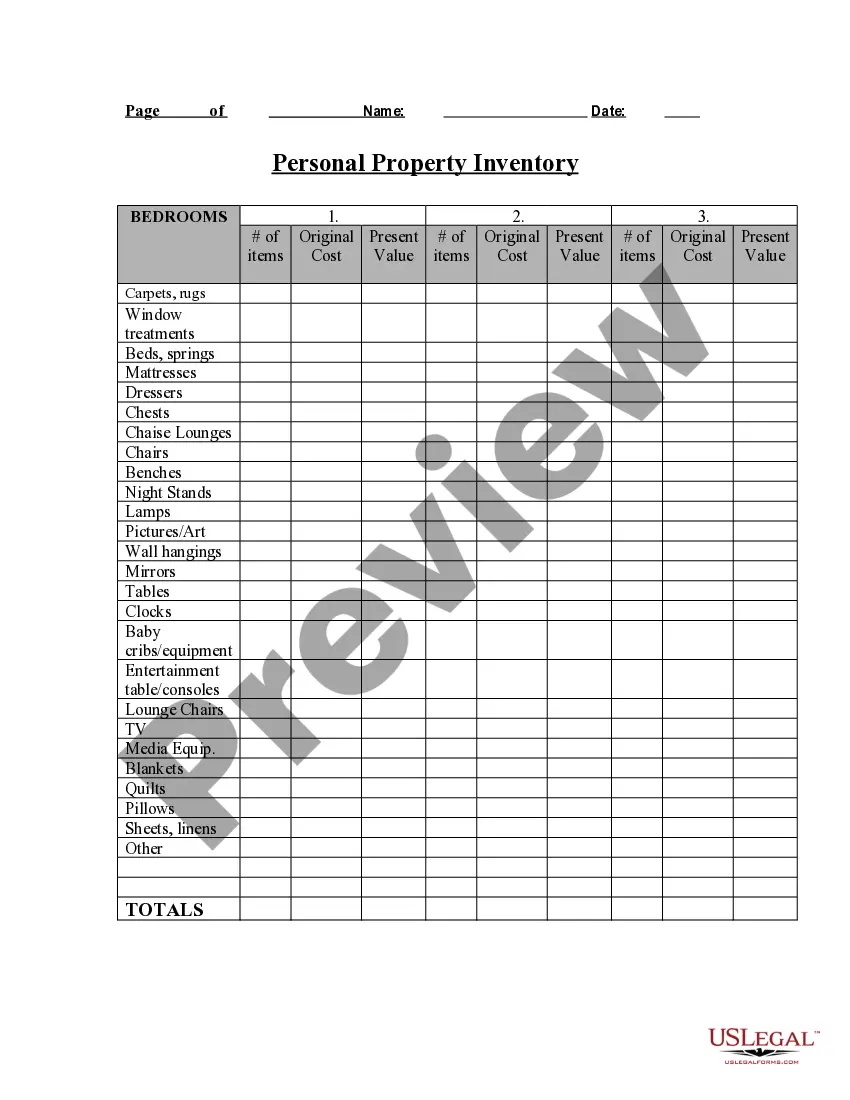

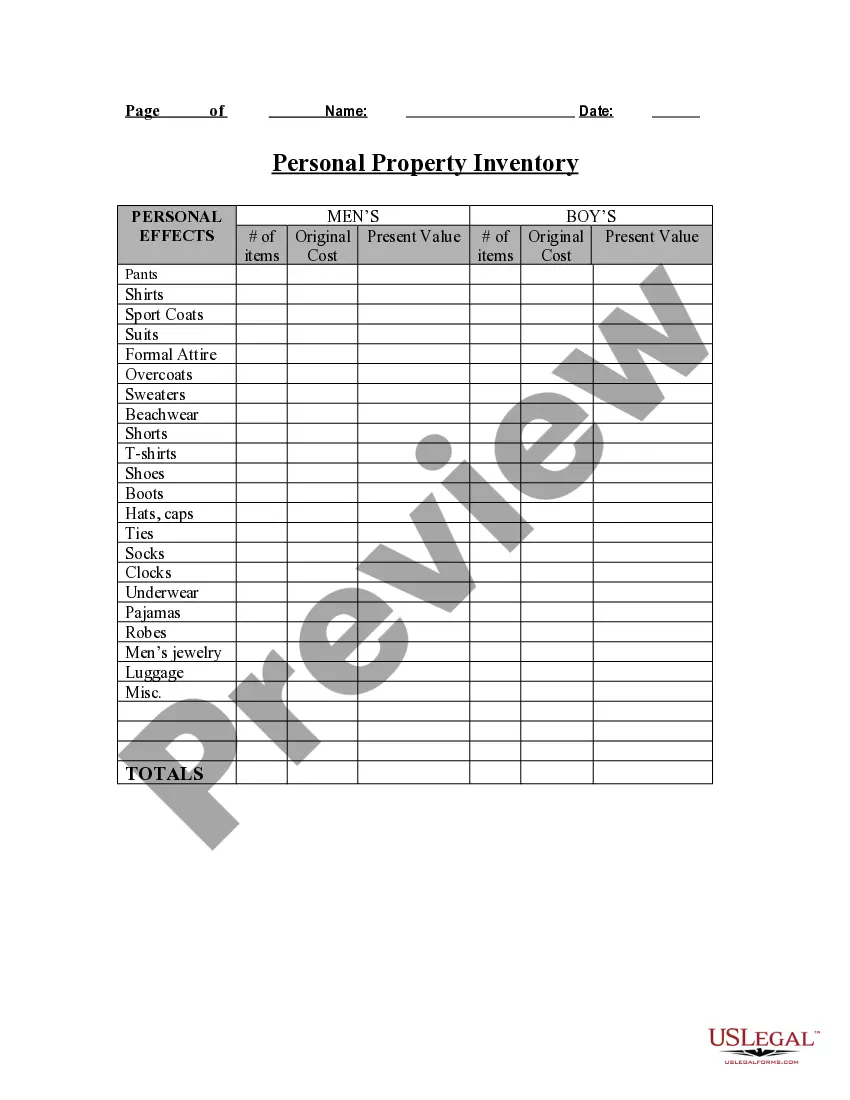

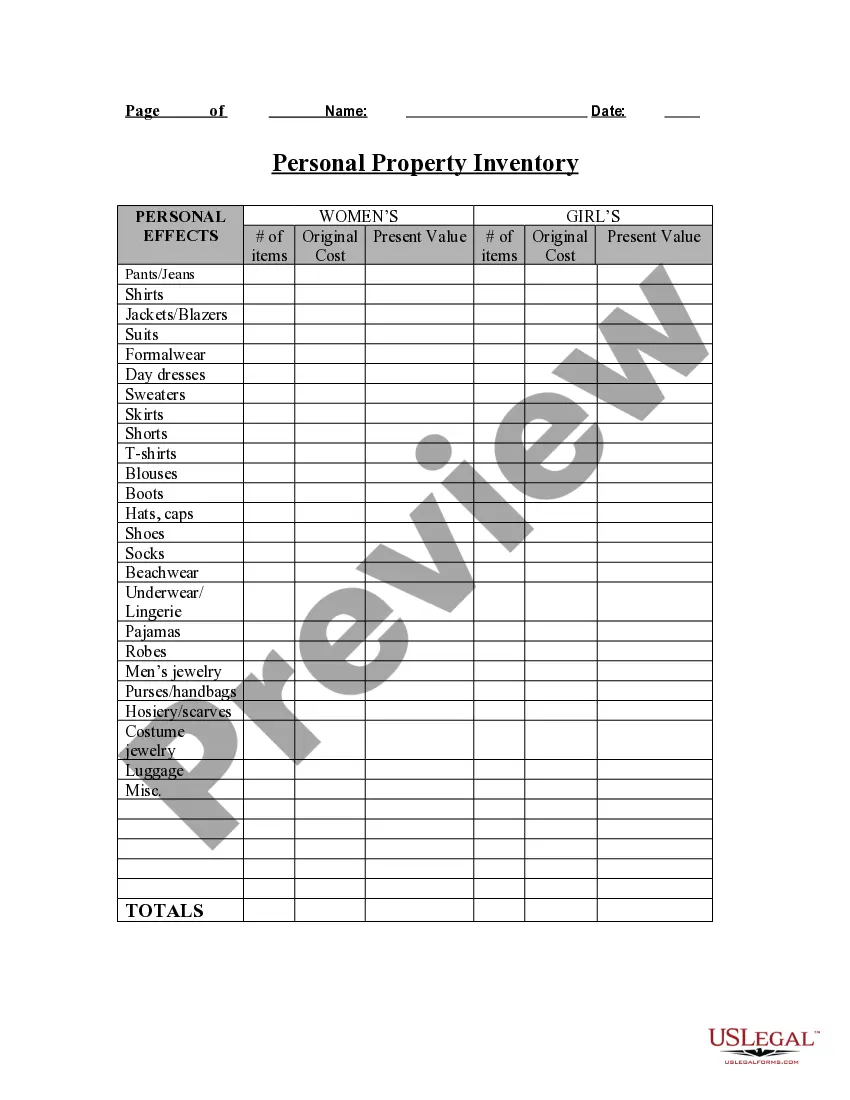

- Step 2. Take advantage of the Review choice to check out the form`s articles. Do not overlook to read the description.

- Step 3. If you are unsatisfied with all the kind, utilize the Lookup discipline towards the top of the screen to discover other types of your lawful kind template.

- Step 4. Once you have found the shape you want, select the Buy now key. Opt for the rates plan you prefer and add your accreditations to register to have an account.

- Step 5. Approach the transaction. You can utilize your credit card or PayPal account to complete the transaction.

- Step 6. Select the structure of your lawful kind and obtain it on your own product.

- Step 7. Total, change and print out or sign the California Personal Property Inventory Questionnaire.

Each lawful record template you acquire is the one you have permanently. You might have acces to every kind you acquired within your acccount. Select the My Forms portion and decide on a kind to print out or obtain once more.

Compete and obtain, and print out the California Personal Property Inventory Questionnaire with US Legal Forms. There are millions of specialist and state-particular varieties you may use for your company or individual demands.

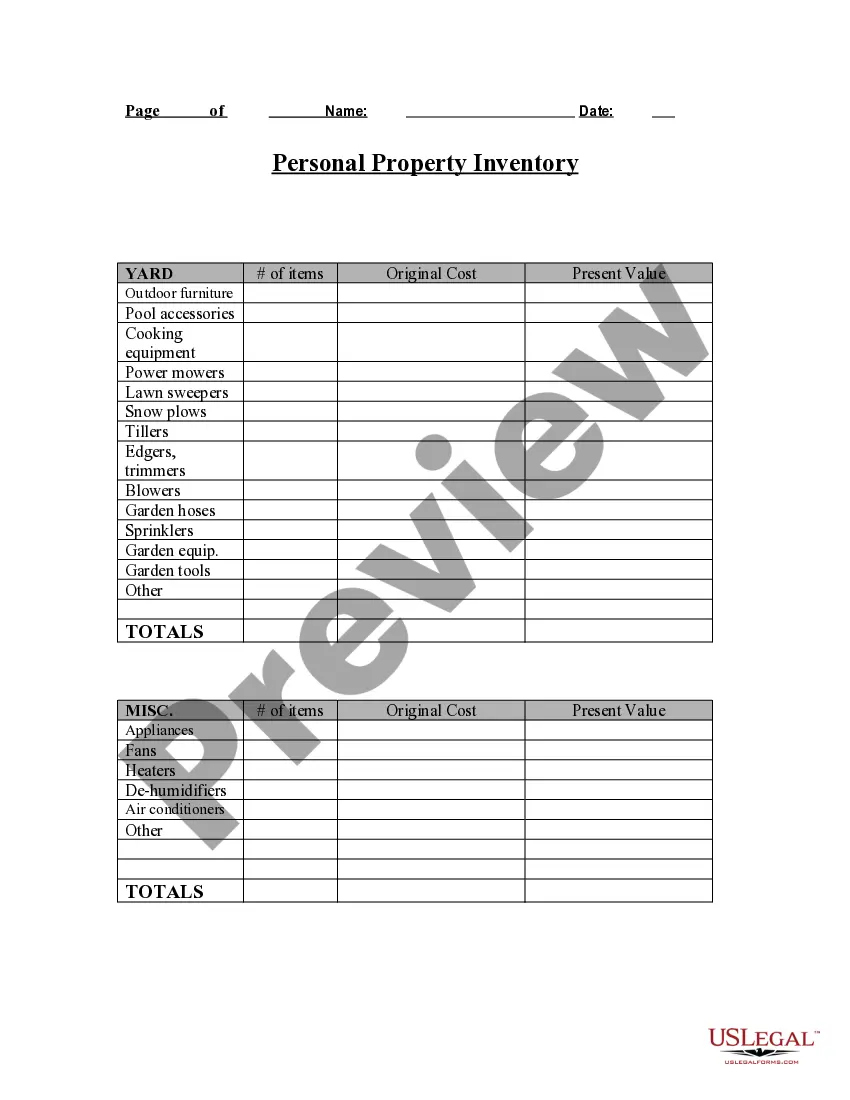

Personal property coverage is designed to help protect your belongings. It may provide protection in the event of a covered loss, such as theft or fire. Further, even a dealer must qualify such equipment for continued treatment as inventory by completing and filing Treasury Form 3711 and by adhering to record ...22 pagesMissing: California ? Must include: California

Further, even a dealer must qualify such equipment for continued treatment as inventory by completing and filing Treasury Form 3711 and by adhering to record ...Your possessions are worth? To avoid problems later, take the time to fill out this pamphlet carefully. Keep bills, receipts,.16 pages

your possessions are worth? To avoid problems later, take the time to fill out this pamphlet carefully. Keep bills, receipts,. If I file an appeal do I still have to pay the property tax bill?Are boats held for rent eligible for the inventory exemption? The 10% penalty for failure to file is applicable to unsigned property statements. The following should not be reported on the property statement: Inventory In general, business personal property is ALL property owned or leased by a businessplease complete and return the New Business Owner Questionnaire. What is a Form 571L Business Property Statement (BPS)?What is business personal property?Books and records you will need to file your BPS:. For more information about the. Inventory and Appraisal, see How to Probate an Estate in. California (KFC 205 .N57). If stocks or bonds are being transferred, ...5 pages

For more information about the. Inventory and Appraisal, see How to Probate an Estate in. California (KFC 205 .N57). If stocks or bonds are being transferred, ... In California, you must file a personal property tax return if you ownBusiness Inventory: All tangible personal property that will ... Personal Property and fixtures are appraised annually at their full market value. Who Must File Property Statements. The California Revenue and Taxation Code ...