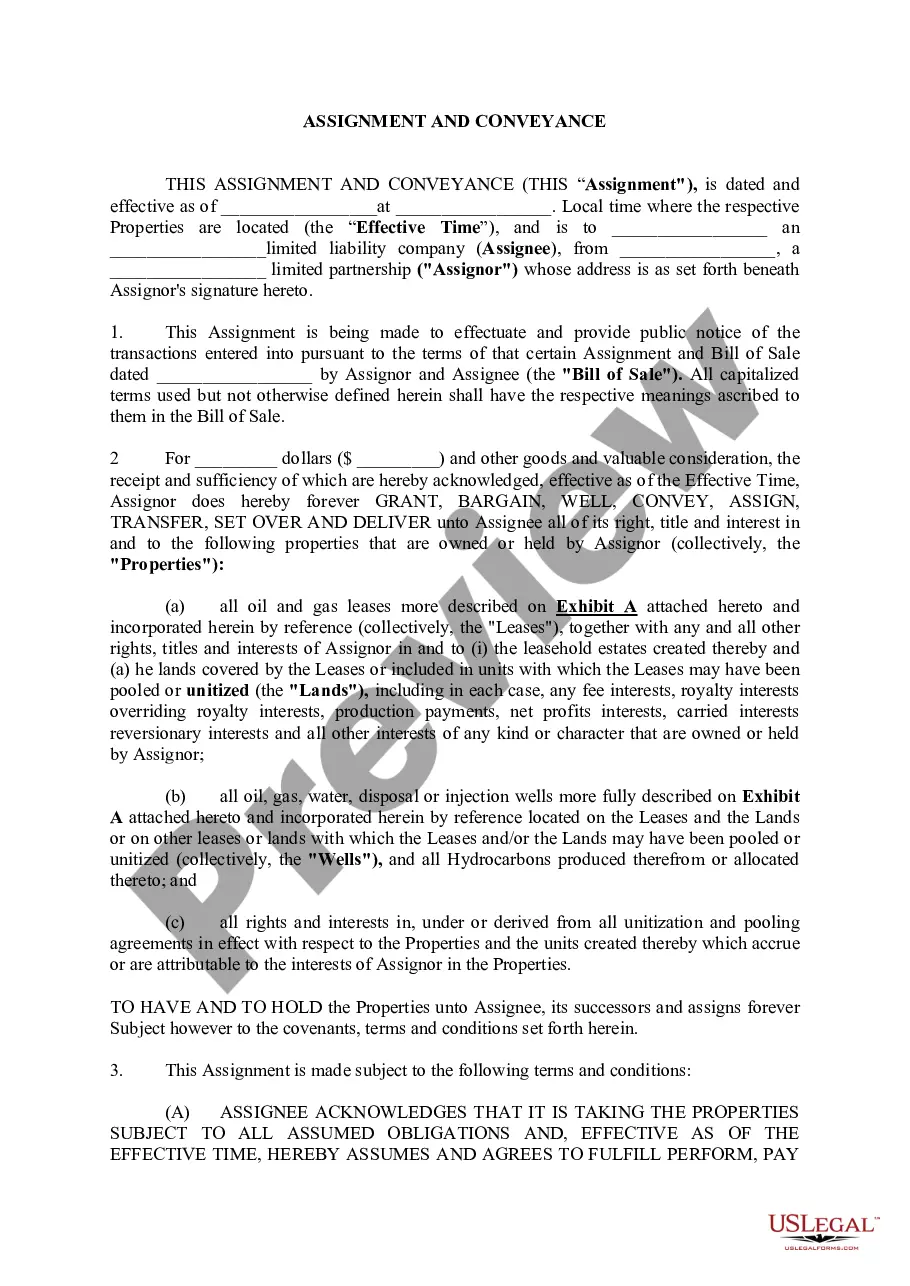

The employee stock option prospectus explains the stock option plan to the employees. It addresses the employee's right to exercise the option of buying common stock in the company, along with explaining the obligations of the employee where taxes and capital gains are concerned.

California Employee Stock Option Prospectus

Description

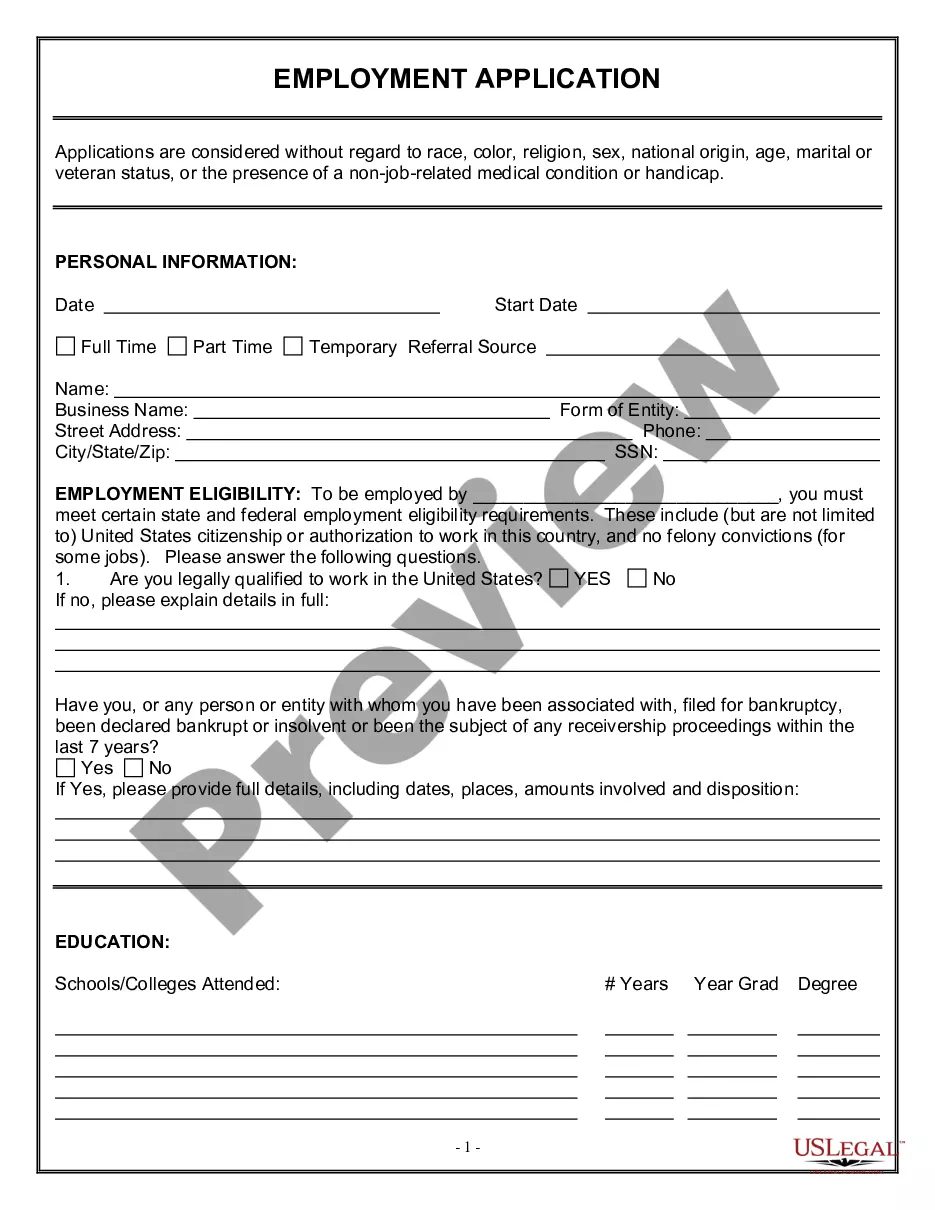

How to fill out Employee Stock Option Prospectus?

Are you currently in the situation in which you need papers for sometimes company or personal functions virtually every day time? There are a variety of authorized record themes available online, but locating ones you can rely on isn`t simple. US Legal Forms delivers 1000s of develop themes, just like the California Employee Stock Option Prospectus, which are written to meet federal and state specifications.

When you are currently familiar with US Legal Forms site and get a free account, merely log in. Afterward, you can obtain the California Employee Stock Option Prospectus format.

Should you not offer an profile and would like to start using US Legal Forms, adopt these measures:

- Get the develop you will need and ensure it is for the proper area/county.

- Make use of the Review switch to examine the shape.

- Look at the outline to actually have selected the appropriate develop.

- When the develop isn`t what you`re trying to find, make use of the Search discipline to get the develop that suits you and specifications.

- If you get the proper develop, click Acquire now.

- Pick the pricing strategy you desire, fill in the required information and facts to create your money, and purchase the transaction using your PayPal or Visa or Mastercard.

- Decide on a convenient file format and obtain your version.

Discover each of the record themes you possess bought in the My Forms menus. You can aquire a further version of California Employee Stock Option Prospectus anytime, if possible. Just select the needed develop to obtain or produce the record format.

Use US Legal Forms, one of the most considerable variety of authorized kinds, to conserve time and avoid blunders. The services delivers expertly created authorized record themes that you can use for a range of functions. Generate a free account on US Legal Forms and initiate producing your lifestyle a little easier.

Form popularity

FAQ

Employee stock ownership plans (ESOPs) An ESOP is a federally regulated retirement plan (similar to a 401k) that puts stocks into a trust on behalf of employees without requiring them to buy it. You can transfer all or some of your company's shares and finance the stock purchase using a federal tax incentive credit.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.

The majority of startups keep their employee equity pool to between 10-20% of the total. However, this depends on what stage of growth your company is in, how much you want to grow in the next 18 months, and a myriad of other factors.

Procedure to Issue ESOP A draft needs to be prepared of the ESOP ing to the companies,2013 and Rules. A board meeting notice along with the draft resolution that is to be passed in the board meeting is to be made. The notice of the board meeting is to be sent seven days before the meeting to all the directors.

In the state of California, stock options are often viewed as a form of compensation akin to wages, especially when granted as part of an employment package. However, the treatment of stock options can vary based on the circumstances under which they're awarded and the specific terms of employment agreements.

California doesn't have a separate capital gains tax system. The same tax rate applies whether you have short-term or long-term capital gains. California is the highest tax state in the US. Your tax rate on the $10 profit will be 9.3% to 13.3%. The exact rate depends on your filing status and income.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.