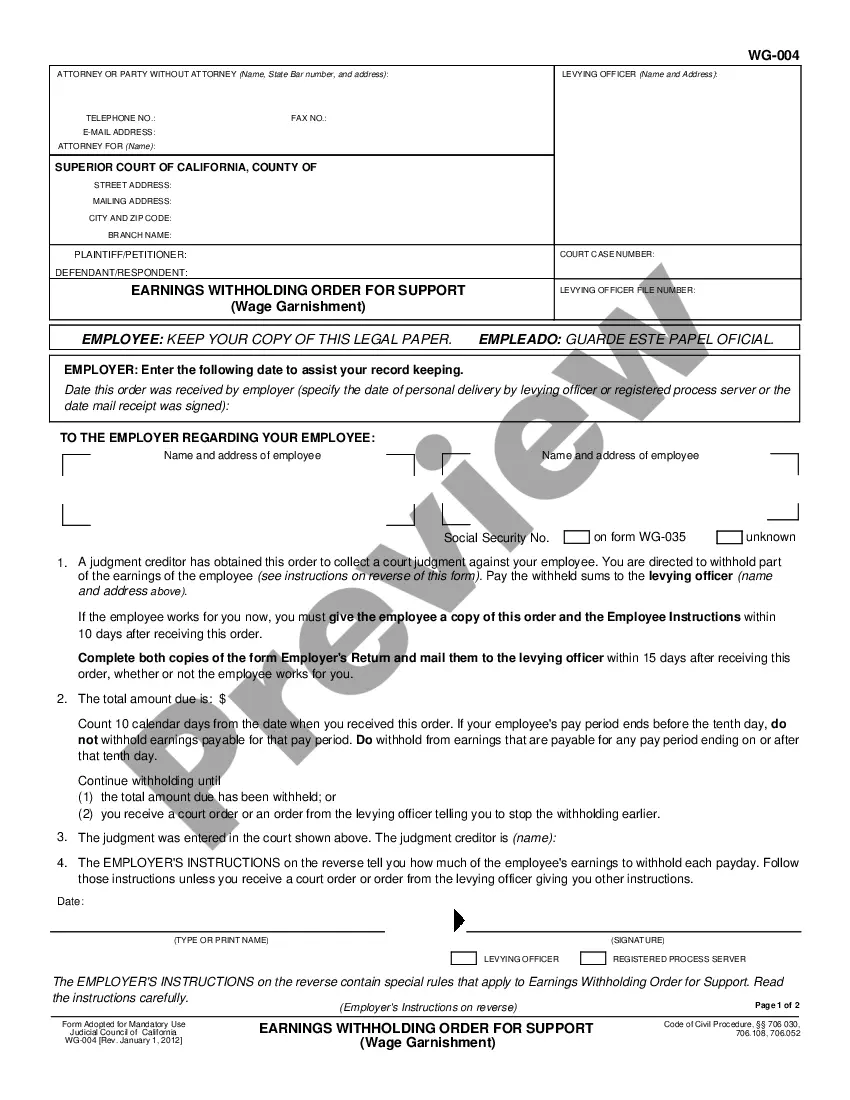

Earnings Withholding Order: An Earnings Withholding Order is issued by the Court, stating that the wages of the Judgment Debtor are to be garnished until he/she satifies the judgment against him/her.

California Earnings Withholding Order - Wage Garnishment

Description

How to fill out California Earnings Withholding Order - Wage Garnishment?

If you are searching for accurate California Earnings Withholding Order - Wage Garnishment duplicates, US Legal Forms is what you require; find documents crafted and validated by state-recognized legal experts.

Using US Legal Forms not only prevents issues related to legal documents, but also saves you time, effort, and money! Acquiring, printing, and completing a professional form is significantly cheaper than hiring an attorney to do it for you.

And that’s it. In just a few simple clicks, you obtain an editable California Earnings Withholding Order - Wage Garnishment. Once you establish your account, all future orders will be executed even more smoothly. With a US Legal Forms subscription, simply Log In to your account and then click the Download option available on the form’s page. Then, when you need to access this form again, you’ll always find it in the My documents section. Don’t squander your time and effort sifting through numerous forms on various sites. Obtain accurate copies from one reliable platform!

- To begin, complete your registration process by providing your email and creating a password.

- Follow the steps below to set up an account and locate the California Earnings Withholding Order - Wage Garnishment template to fulfill your needs.

- Utilize the Preview feature or examine the file details (if available) to ensure that the sample is the one you desire.

- Verify its legality in your region.

- Click Buy Now to place an order.

- Choose a suggested pricing plan.

- Establish an account and finalize payment with your credit card or PayPal.

- Select a suitable file format and save the document.

Form popularity

FAQ

In California, wage garnishment rules specify that creditors can take a portion of your earnings to repay debts, but there are limits to how much they can withhold. Generally, a creditor can garnish up to 25% of your disposable earnings, or the amount by which your weekly earnings exceed 40 times the minimum wage, whichever is less. Additionally, specific exemptions may apply, so it is essential to be aware of your rights. Familiarizing yourself with the California Earnings Withholding Order - Wage Garnishment can provide insight into how these rules affect you.

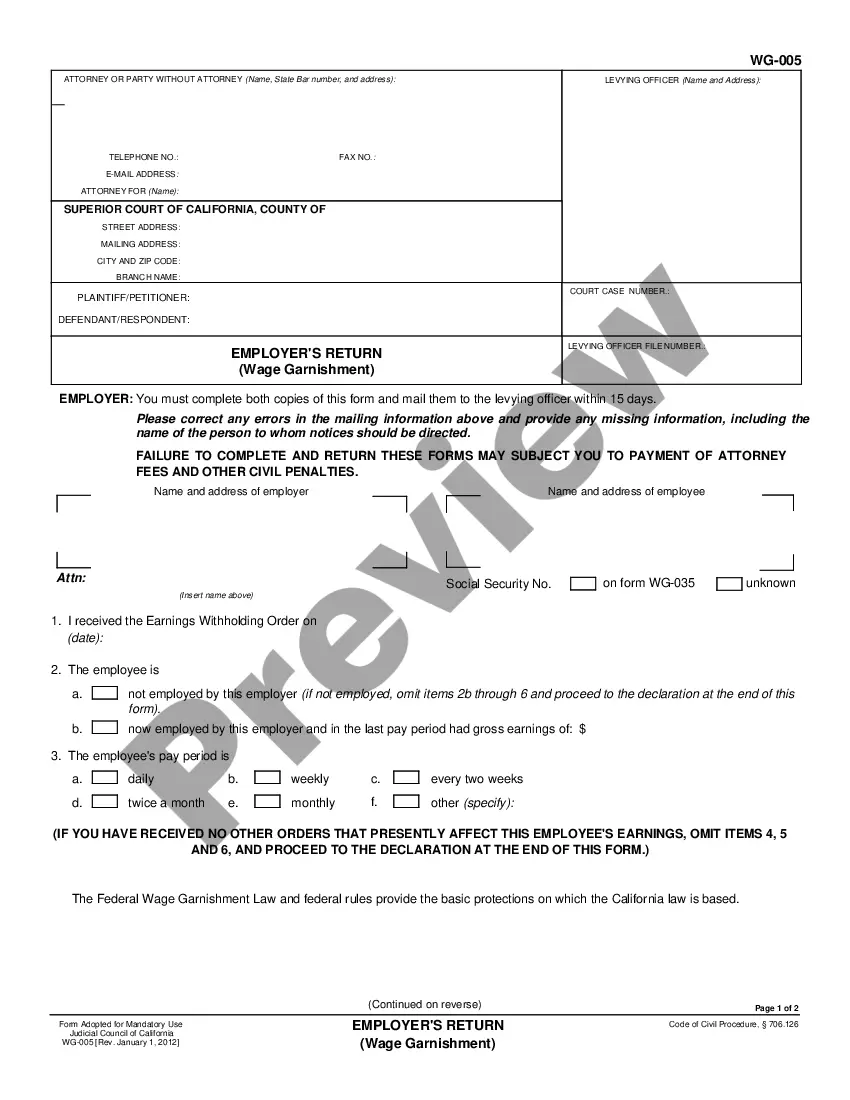

A wage withholding order in California is a legal order that requires an employer to withhold a portion of an employee's earnings for debt payment, often due to court-ordered judgments. This order is initiated through a California Earnings Withholding Order - Wage Garnishment, which allows creditors to collect what is owed directly from your wages. Employers are legally obligated to comply with this order and must send the withheld amount to the appropriate agency. Understanding this process can help you manage your finances better.

To stop a California state tax wage garnishment, you can file for a claim of exemption or negotiate a payment plan with the tax authority. It is crucial to respond promptly to any notices regarding your California Earnings Withholding Order - Wage Garnishment. If you wish to challenge the garnishment, you may consider seeking legal advice to understand your options. Using a platform like USLegalForms can help you navigate the necessary forms and procedures to effectively address this issue.

Yes, someone can garnish your wages without your prior knowledge, provided they follow legal procedures. Typically, the creditor must obtain a court judgment against you before they can initiate wage garnishment. However, you will receive notification once the legal process starts, allowing you to respond. Understanding your rights within the California Earnings Withholding Order - Wage Garnishment framework is essential to protect yourself effectively.

To file a wage garnishment in California, you must first obtain a court judgment against the debtor. Then, complete the appropriate wage garnishment forms, such as the Application for Earnings Withholding Order. Once filed, serve the order to the debtor's employer to initiate the garnishment process. You can simplify this process by accessing the uslegalforms platform for templates and guidance related to the California Earnings Withholding Order - Wage Garnishment.

An earnings order is a court-issued directive that requires your employer to withhold a portion of your wages to satisfy a debt. This order is part of the California Earnings Withholding Order - Wage Garnishment process and is typically issued as part of a legal judgment. The withholding amount often depends on your disposable income and the type of debt owed. Understanding your rights and obligations is crucial when dealing with these orders.

The order of priority for wage garnishments in California follows a specific hierarchy. Generally, child support obligations take precedence, followed by federal tax levies and then other debts like credit card judgments. Familiarizing yourself with these priorities can help you understand how your earnings may be affected by multiple garnishments. Understanding the California Earnings Withholding Order - Wage Garnishment process is essential in managing your financial obligations.

To stop a wage garnishment immediately in California, file a Claim of Exemption with the court handling your case. You may also consider negotiating directly with the creditor to reach a settlement. If your financial circumstances have significantly changed, presenting evidence may help your case. Consulting uslegalforms can provide you with the necessary documents and guidance to navigate the California Earnings Withholding Order - Wage Garnishment effectively.

To fill out a wage garnishment exemption, first identify your exemptions under California law. Use the appropriate forms, such as the Claim of Exemption form, which you can obtain from your local court. Clearly indicate your total income and any allowable deductions, ensuring accuracy to avoid delays. For assistance, you can explore resources on the uslegalforms platform to better understand the process of the California Earnings Withholding Order - Wage Garnishment.

For individuals earning the $7.25 minimum wage, the maximum garnishment is typically limited to the lesser of either 25% of disposable earnings or the amount that exceeds 30 times the minimum wage. This ensures that you retain enough income to meet basic needs. Knowing these figures is important in the context of a California Earnings Withholding Order - Wage Garnishment.