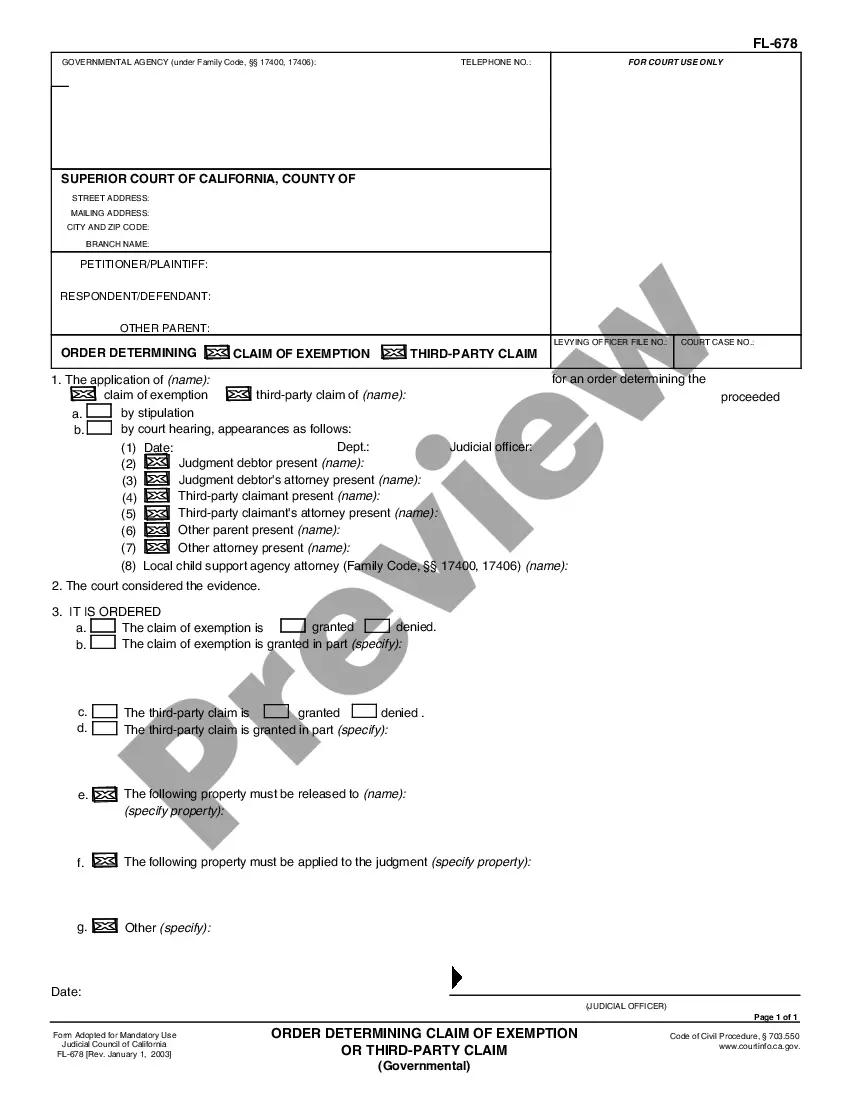

An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order Determining Claim of Exemption, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case.

California Order Determining Claim of Exemption

Description

How to fill out California Order Determining Claim Of Exemption?

If you are looking for accurate California Order Determining Claim of Exemption samples, US Legal Forms is precisely what you require; obtain documents provided and validated by state-authorized legal professionals.

Using US Legal Forms not only saves you from concerns regarding legal documents; you also conserve time, effort, and money! Downloading, printing, and filling out a competent template is genuinely more cost-effective than hiring an attorney to do it on your behalf.

And that's it. In just a few simple clicks, you own an editable California Order Determining Claim of Exemption. Once you create your account, all subsequent orders will be even easier. With a US Legal Forms subscription, just Log In to your account and then click the Download button available on the form’s page. Then, when you need to use this template again, you will always be able to find it in the My documents section. Don’t waste your time comparing countless forms on various online sources. Obtain precise templates from a single reliable service!

- To begin, complete your registration process by entering your email and creating a password.

- Follow the steps below to establish your account and locate the California Order Determining Claim of Exemption template to address your needs.

- Utilize the Preview feature or view the document details (if available) to ensure that the form is the one you require.

- Verify its validity in your jurisdiction.

- Click on Buy Now to place your order.

- Select a preferred pricing plan.

- Create an account and make a payment with a credit card or PayPal.

- Choose a suitable file format and save the documents.

Form popularity

FAQ

The number of exemptions you should claim depends on various factors like your personal and financial situation. Claiming more exemptions can reduce your withholding, increasing your paycheck, but might lead to a tax bill later. It is crucial to strike a balance that aligns with your financial goals. For options on managing exemptions effectively, remember that the California Order Determining Claim of Exemption offers clear guidance on how to approach this.

Claiming exemptions means you're officially applying for relief from certain liabilities or for protection of specific assets. This process often involves demonstrating that you meet criteria established by law. In the context of the California Order Determining Claim of Exemption, this involves proving that you qualify for protection against debt claims. For assistance with this process, services like uSlegalforms can provide valuable resources.

Rights of exemption refer to the legal protections that allow certain income or property to be protected from creditors. In California, specific types of income, like wages and social security benefits, may qualify for exemption. Understanding these rights can help you safeguard your assets in case of financial difficulties. It’s advisable to research the California Order Determining Claim of Exemption to understand how these rights apply to your situation.

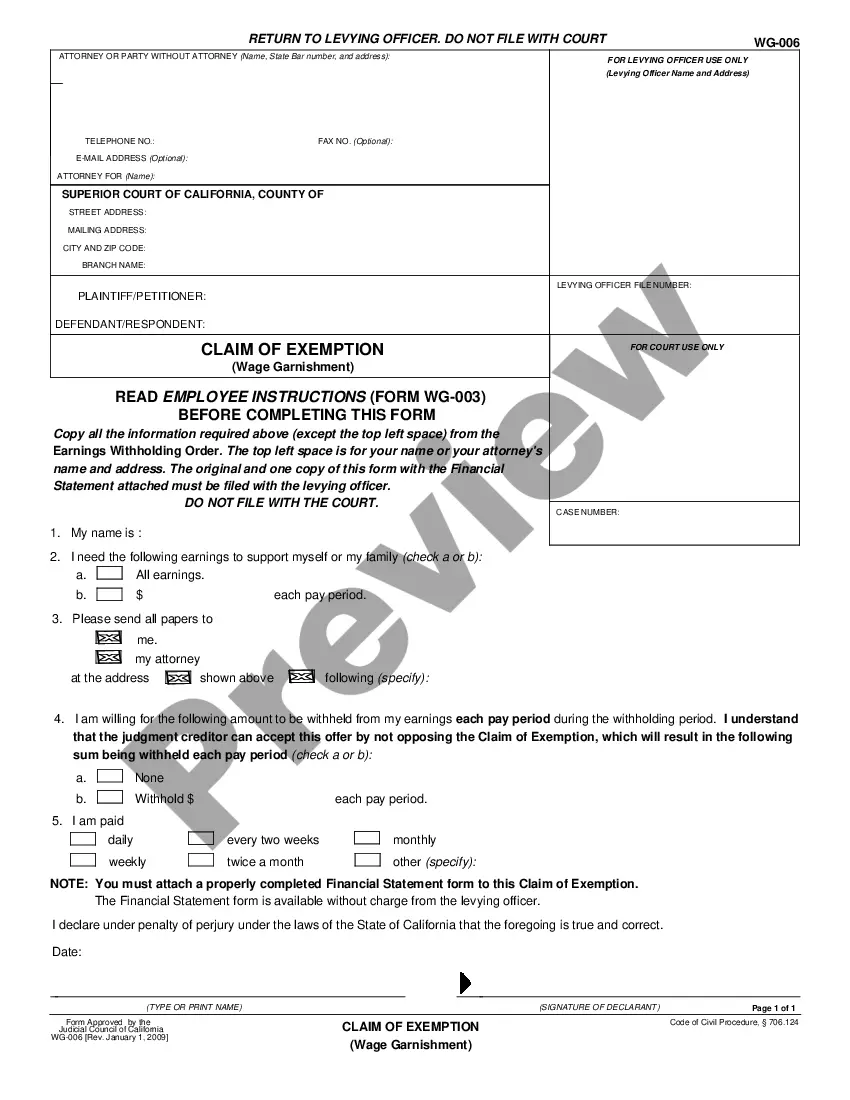

To file a claim of exemption in California, you typically need to complete a specific form such as the Claim of Exemption form. This document outlines your financial situation and the reasons you seek an exemption. Once you fill it out, you must file it with the appropriate court. For detailed steps and assistance, consider using uSlegalforms, which provides templates and guidance on the California Order Determining Claim of Exemption.

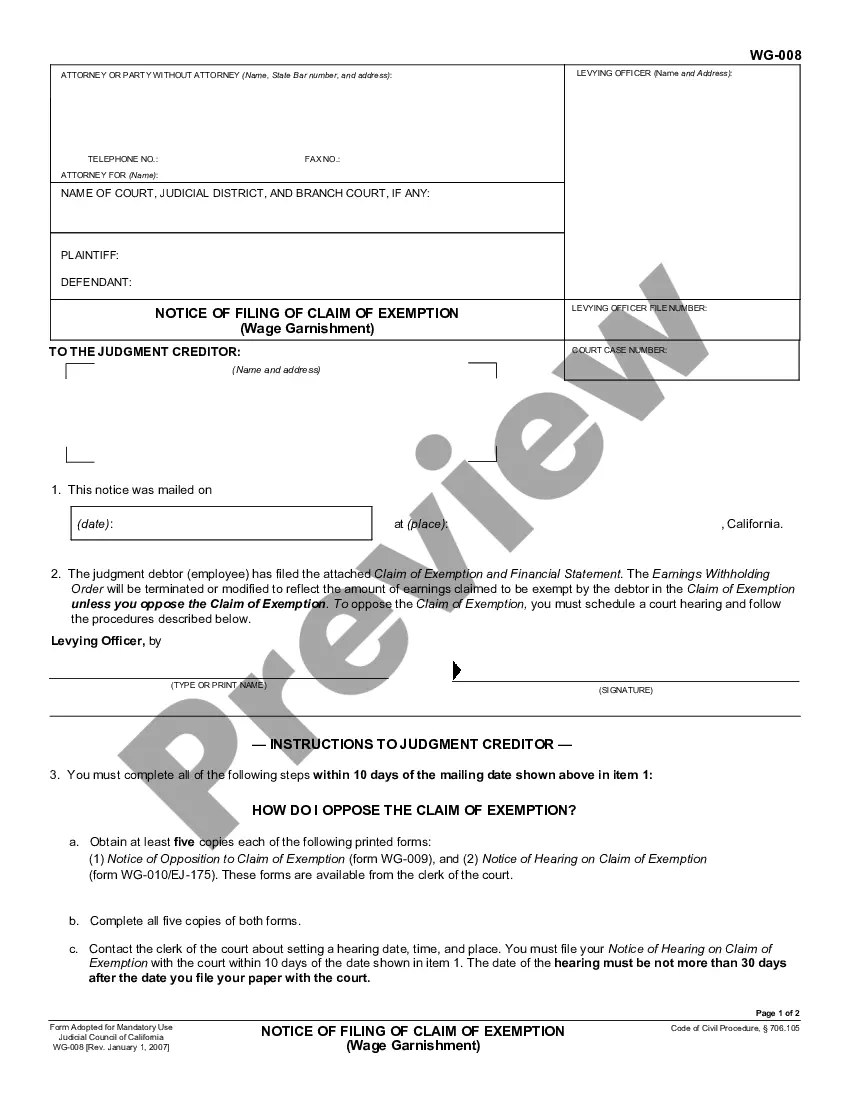

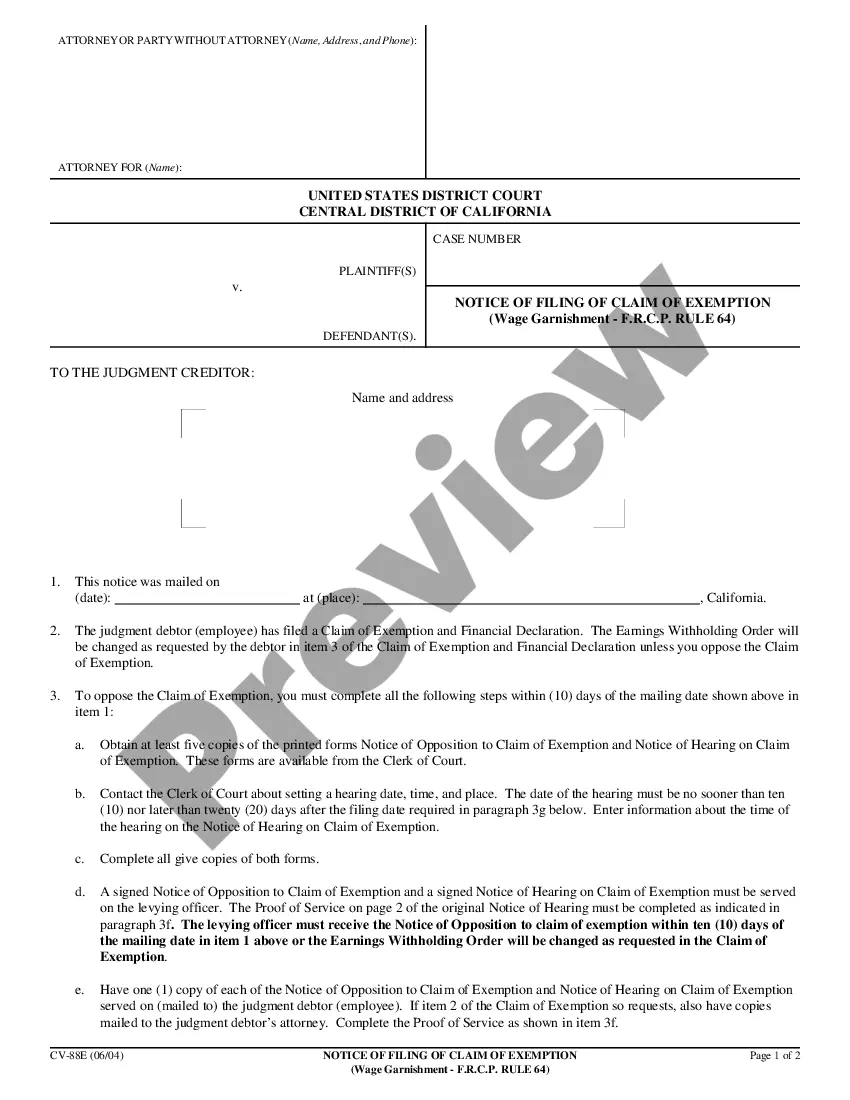

In California, an opposition to a motion generally must be filed and served at least nine court days before the hearing date. This timeline ensures that all parties have the opportunity to review and respond to the motion appropriately. Particularly for matters involving a California Order Determining Claim of Exemption, adhering to these deadlines is crucial for maintaining your legal standing. Consider using resources like uslegalforms to ensure you're meeting all procedural requirements.

An opposition to a claim of exemption in California is a formal response filed by a creditor challenging the debtor's exemption claim. This opposition must articulate why the creditor believes the debtor should not be entitled to the asserted exemptions. In the context of a California Order Determining Claim of Exemption, addressing the opposition effectively is crucial for protecting your rights. Using platforms like uslegalforms can provide the necessary forms and guidance as you face this process.

A claim of exemption in California is a legal assertion made by a debtor to protect specific property from collection actions. This claim typically aims to exempt certain assets or income from being seized, ensuring that the debtor retains essential resources. If you're navigating a California Order Determining Claim of Exemption, understanding the scope and eligibility of these exemptions will be vital for your case. Consulting a professional can also help you effectively prepare your claim.

To respond to an opposition to a motion in California, you should prepare a written reply that addresses the points raised in the opposition. It’s essential to ensure your response is clear, focused, and directly counters the arguments made by the other party. When dealing with a California Order Determining Claim of Exemption, include relevant laws or rules to strengthen your stance. Additionally, file your response with the court by the designated deadline to avoid complications.

The claim of exemption on EJ 160 is a legal document used to contest a wage garnishment in California. It allows you to assert that certain funds or income should be exempt from garnishment due to specific financial circumstances. This form plays a crucial role in the process, as it aids in requesting a California Order Determining Claim of Exemption from the court. Ensure that you fill it out completely and accurately to protect your rights.

Writing a letter to stop wage garnishment involves clearly stating your situation and providing necessary evidence to support your request. Begin with your personal information and the details of the garnishment. Make sure to reference the California Order Determining Claim of Exemption, detailing the reasons why you believe the garnishment should cease. Be polite yet firm in your request.