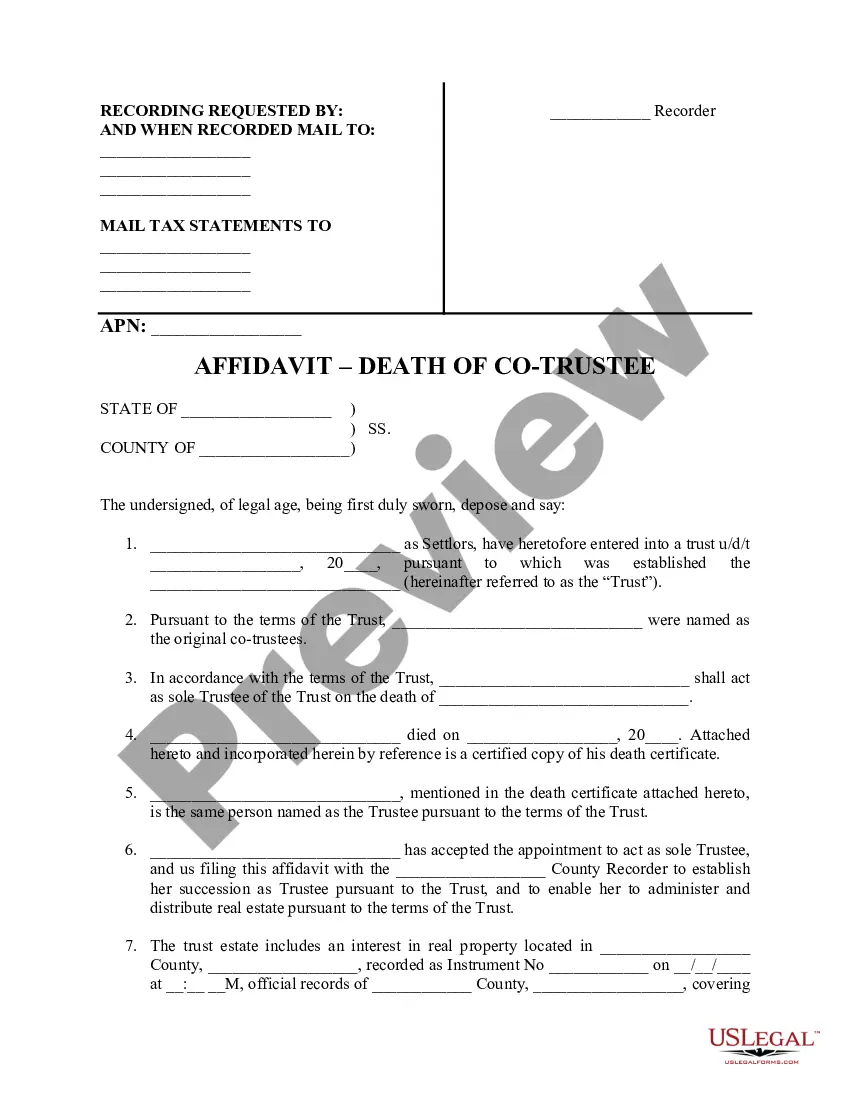

Colorado Affidavit - Death of Co-Trustee

Description

Key Concepts & Definitions

Affidavit Death of Co-Trustee: This document confirms the death of a co-trustee within a trust, allowing the surviving trustee or successor trustee to manage the trust assets effectively. Surviving Spouse: The legally married partner of the deceased. Estate Settlement: Refers to the process of transferring the deceased's assets to the beneficiaries as per the trust or will. Successor Trustee: An individual nominated in the trust to handle trust assets and responsibilities after a trustees death.

Step-by-Step Guide: Filing an Affidavit Death of Co-Trustee

- Gather Required Documents: Obtain a death certificate of the deceased trustee and any accompanying trust documents.

- Fill Out the Affidavit Form: Complete the affidavit ensuring accuracy in details about the deceased trustee, surviving spouse, and trust details.

- Signature and Notarization: The successor trustee may need to sign the affidavit in the presence of a notary.

- File the Affidavit: Submit the affidavit to relevant institutions like banks or real estate entities to update records and continue management of the estate without interruption.

Risk Analysis for Not Properly Handling Affidavit Death of Co-Trustee

- Legal Complications: Failure to promptly and accurately file can lead to potential legal challenges or issues in estate settlement.

- Assets Mismanagement: Delay in updating trustee information can affect the management and distribution of trust assets.

- Financial Delays: Inaccurate or late filings might cause delays in operations involving real estate and other assets, affecting beneficiaries financially.

Best Practices in Managing Estate Settlement

- Ensure all documents, including the death certificate and trust agreements, are readily available.

- Work closely with a legal advisor to understand the implications of the affidavit death on the estate settlement.

- Notify all relevant parties involved, including financial institutions and real estate offices, about the trustee change.

Common Mistakes & How to Avoid Them

- Incomplete Documentation: Double-check all forms for completeness before filing. Missing information can delay the process.

- Delay in Filing: File the affidavit death of co-trustee as soon as possible to avoid complications in managing the estate.

- Not Consulting Legal Experts: Its advisable to engage with legal professionals, especially in complex estates, to ensure compliance with all legal requirements.

How to fill out Colorado Affidavit - Death Of Co-Trustee?

Utilize US Legal Forms to acquire a printable Colorado Affidavit - Death of Co-Trustee.

Our court-admissible documents are composed and routinely revised by qualified lawyers.

Our collection comprises the most comprehensive Forms catalog online and provides economical and precise templates for individuals, attorneys, and small to medium-sized businesses.

Examine the document by reading its description and using the Preview feature. Press Buy Now if it’s the document you require. Create your account and complete payment via PayPal or credit card. Download the form to your device and feel free to reuse it multiple times. Employ the Search engine if you need to locate another document template. US Legal Forms provides a vast array of legal and tax samples and packages for both business and personal requirements, including the Colorado Affidavit - Death of Co-Trustee. Over three million users have already successfully employed our service. Choose your subscription plan and obtain high-quality forms in just a few clicks.

- Templates are sorted into state-specific categories.

- Numerous templates can be previewed prior to downloading.

- In order to download samples, users must possess a subscription and Log In to their account.

- Click Download next to any template required and locate it in My documents.

- For those who do not have a subscription, follow these steps to rapidly find and download the Colorado Affidavit - Death of Co-Trustee.

- Ensure you obtain the correct template corresponding to the relevant state.

Form popularity

FAQ

Probate in Colorado is typically triggered when an estate's value exceeds the small estate limit or when the decedent did not leave a valid will. Certain asset types, such as those held in sole ownership without designated beneficiaries, necessitate probate. Understanding these triggers can help you plan effectively, potentially using tools like the Colorado Affidavit - Death of Co-Trustee to streamline the process.

Filling out an affidavit of death and heirship requires accurate information regarding the deceased and their heirs. You will need to include the decedent's full name, date of death, and a list of heirs. It is advisable to use a template or resource to ensure compliance with state laws. Platforms like UsLegalForms can provide you with the necessary documents and guidance, including the Colorado Affidavit - Death of Co-Trustee.

You can avoid probate in Colorado through several strategies. Establishing a living trust allows assets to pass outside of probate. Additionally, designating beneficiaries on accounts or utilizing joint ownership can also prevent probate complications. Implementing a Colorado Affidavit - Death of Co-Trustee can further ease the transfer process without court intervention.

Not all estates require probate in Colorado. If the estate's total value is under the small estate limit, there are alternative processes available. Additionally, assets held in trust, joint ownership, or those with designated beneficiaries typically do not go through probate. Utilizing tools like a Colorado Affidavit - Death of Co-Trustee can facilitate asset transfer without the need for probate.

In Colorado, a small estate affidavit does not require court filing. This document allows you to bypass formal probate proceedings if the estate qualifies under the small estate limit. Instead, you can use the affidavit to transfer assets directly to beneficiaries. Using a Colorado Affidavit - Death of Co-Trustee may simplify matters further after a co-trustee passes.

In Colorado, an estate typically must be worth over $70,000 for it to go through probate. However, this threshold can vary based on the specific circumstances of the estate. It is important to consider the entire value of the assets when determining if probate applies. If the estate is below this value, you may explore options such as filing a Colorado Affidavit - Death of Co-Trustee.

Filling out an affidavit of death of trustee requires you to provide specific details about the deceased trustee and the trust they managed. Begin with the trustee's full name, date of death, and the name of the trust. It is crucial to indicate your role in the trust and how the death affects its management. US Legal Forms offers easy-to-use templates for the Colorado Affidavit - Death of Co-Trustee, simplifying the entire process for you.

To fill out an affidavit of inheritance, start by gathering necessary information about the deceased and their assets. You will need details such as the individual’s full name, date of death, and property information. Ensure you include your relationship to the deceased, as this will establish your right to inherit. For a reliable process, consider using our platform at US Legal Forms, where you can find templates tailored to the Colorado Affidavit - Death of Co-Trustee.

If an affidavit is not notarized, it may lack legal authority and could be challenged in court. For a Colorado Affidavit - Death of Co-Trustee, notarization solidifies its validity and acceptance in legal matters. Therefore, obtaining notarization ensures that the affidavit holds weight and helps facilitate smoother estate management.

The most common use of an affidavit of death is to legally declare an individual deceased, which can facilitate the management of their estate. In the context of trusts, specifically a Colorado Affidavit - Death of Co-Trustee, this document assists in updating trust records and making necessary changes efficiently. It's an important step in ensuring that the estate is handled properly and in accordance with the deceased's wishes.