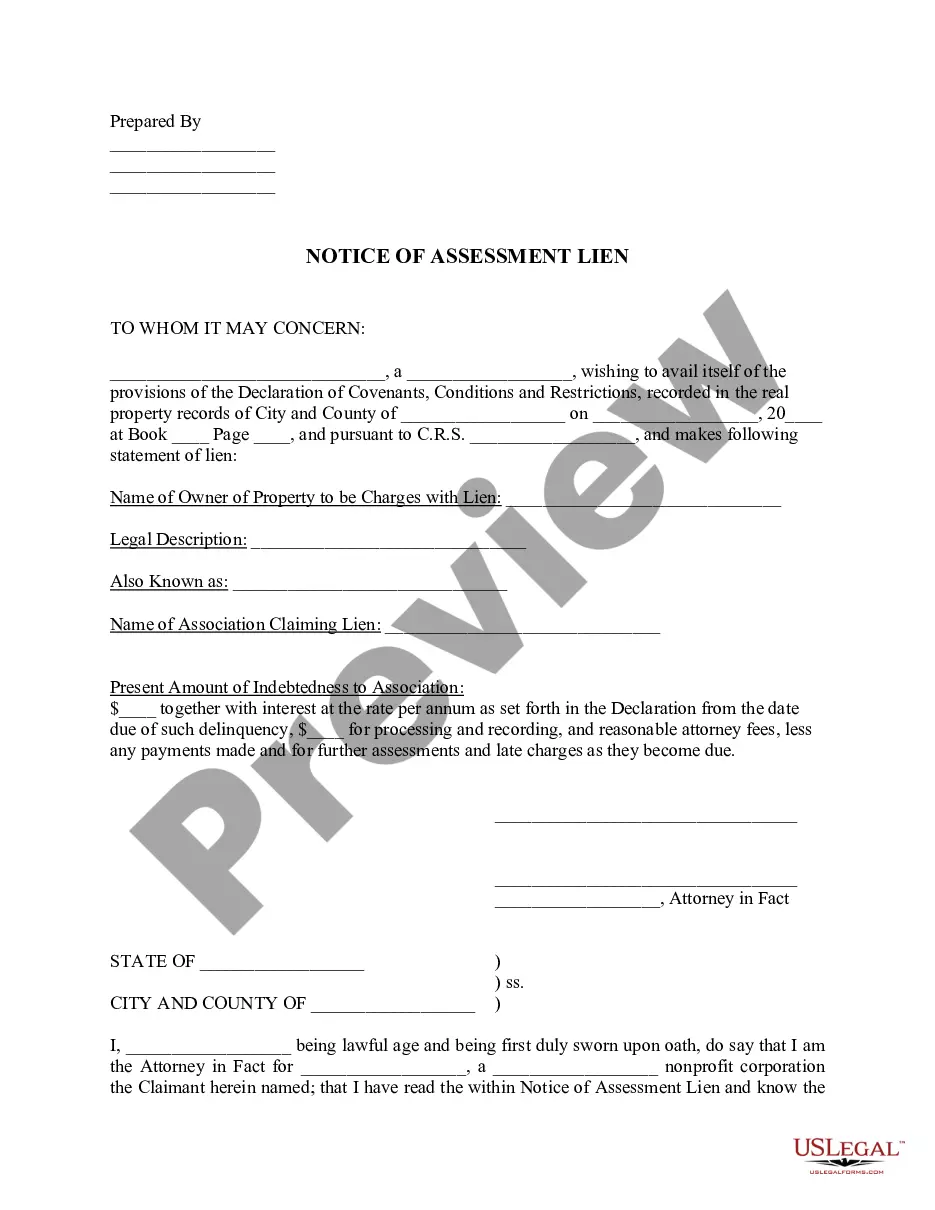

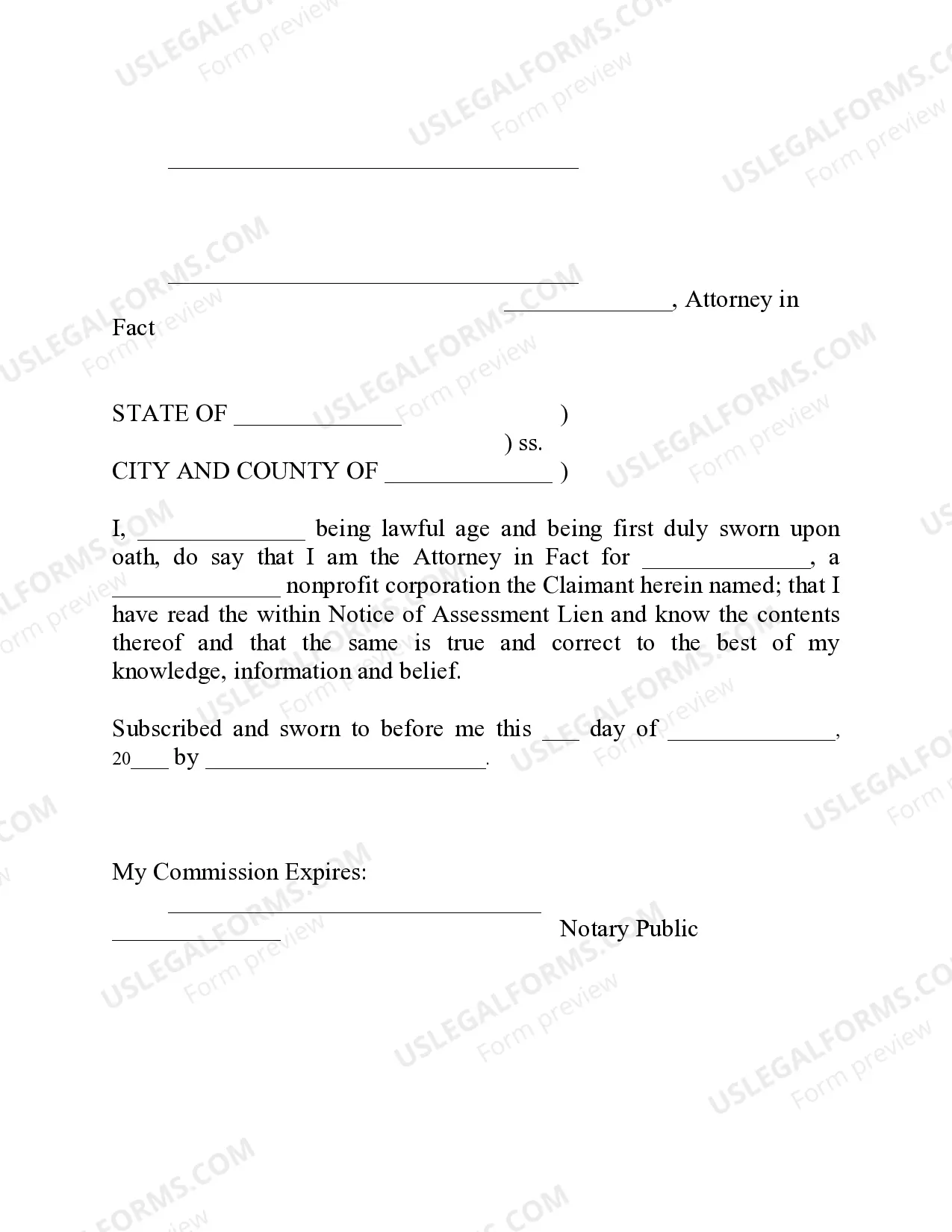

Colorado Notice of Assessment of Lien

Description Assessment Lien

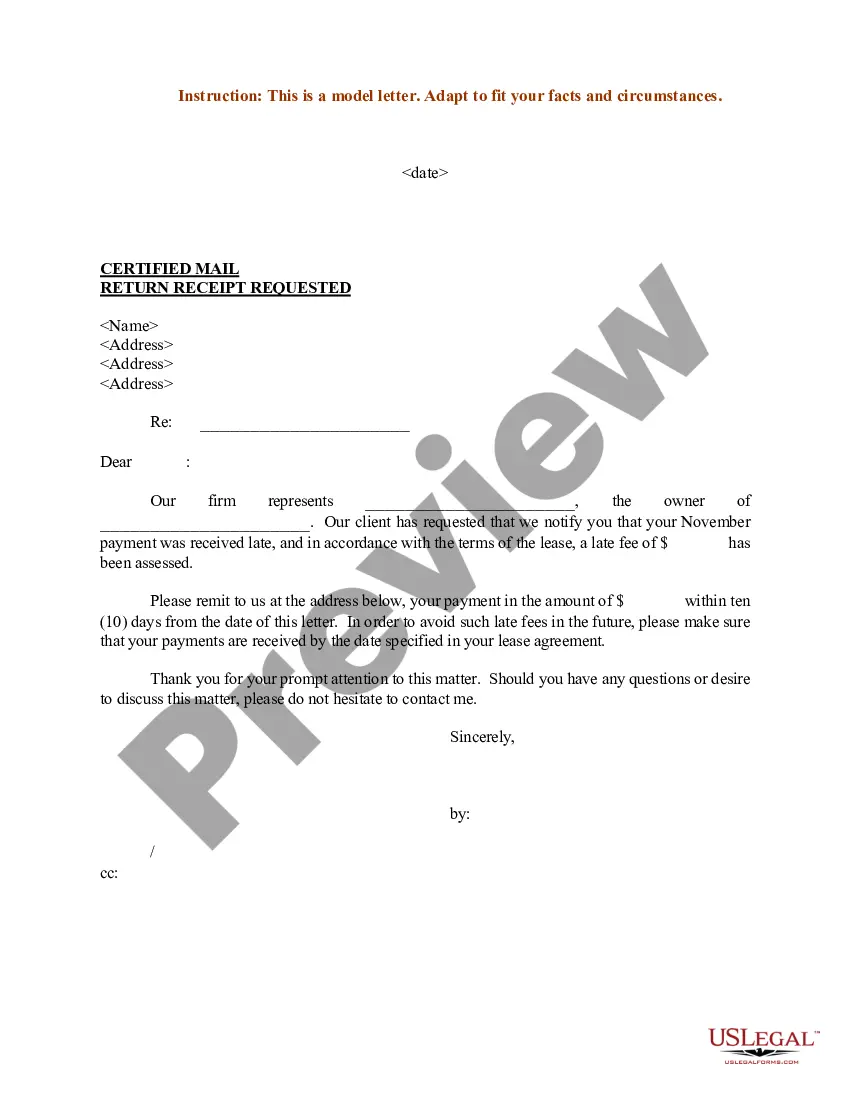

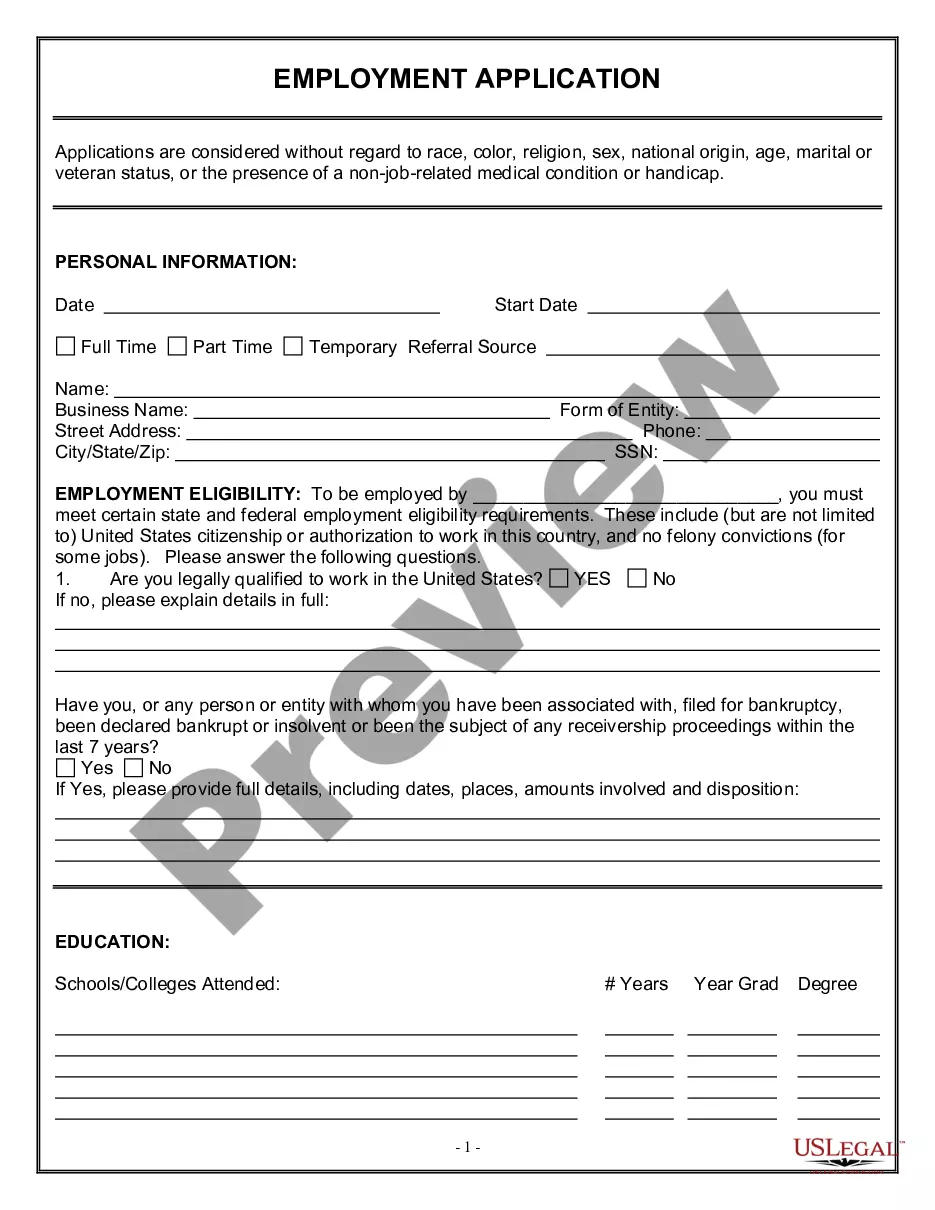

How to fill out Colorado Notice Of Assessment Of Lien?

Utilize US Legal Forms to acquire a downloadable Colorado Notice of Assessment of Lien.

Our court-acceptable forms are crafted and frequently revised by proficient attorneys.

Ours is the most comprehensive Forms catalog available online, offering cost-effective and precise templates for clients, legal experts, and small to medium-sized businesses.

Select Buy Now if it is the document you are seeking. Create your account and process payment via PayPal or card|credit card. Download the template onto your device and feel free to reuse it multiple times. Use the Search bar if you need to locate another document template. US Legal Forms offers thousands of legal and tax examples and packages for both business and personal requirements, including the Colorado Notice of Assessment of Lien. Over three million users have successfully employed our platform. Choose your subscription option and access high-quality forms in just a few clicks.

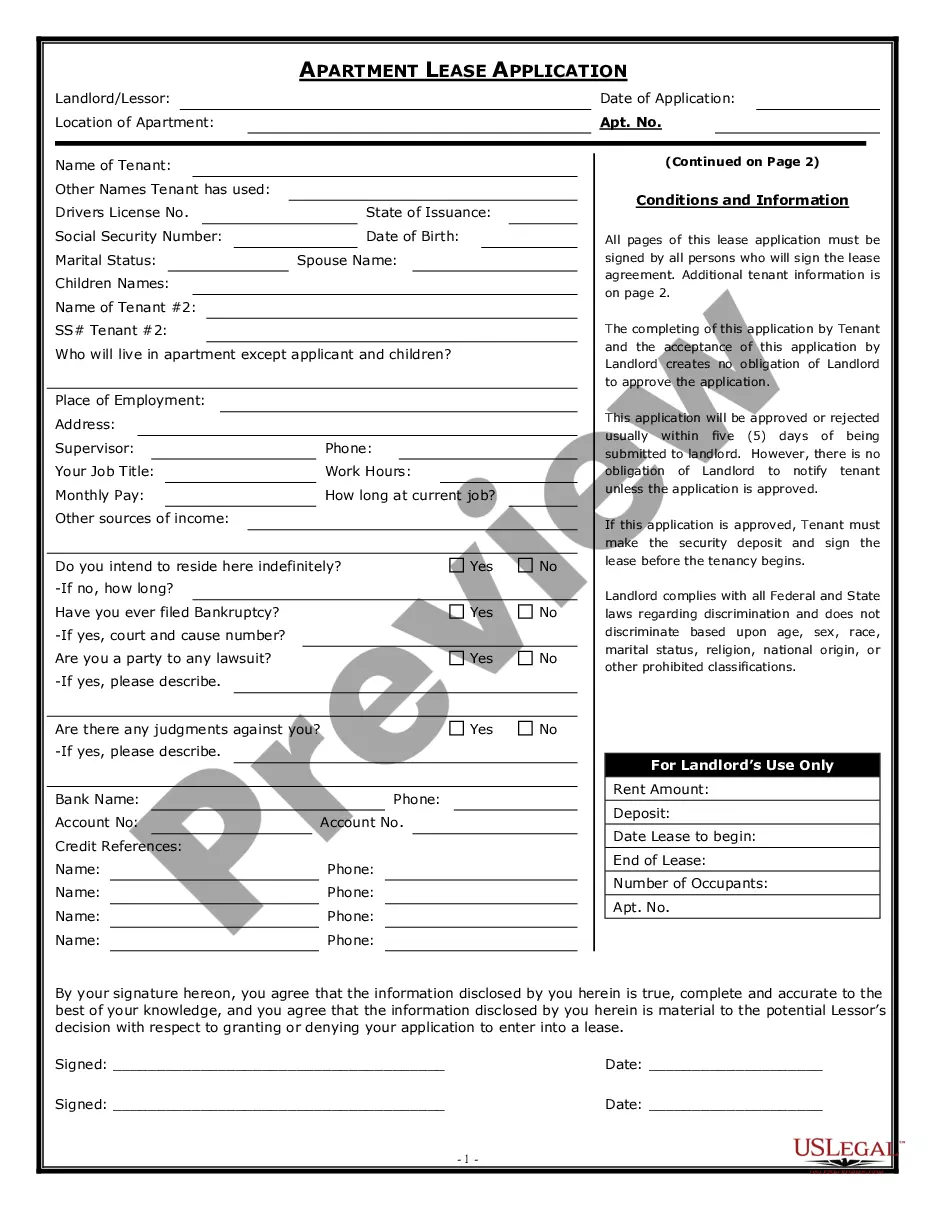

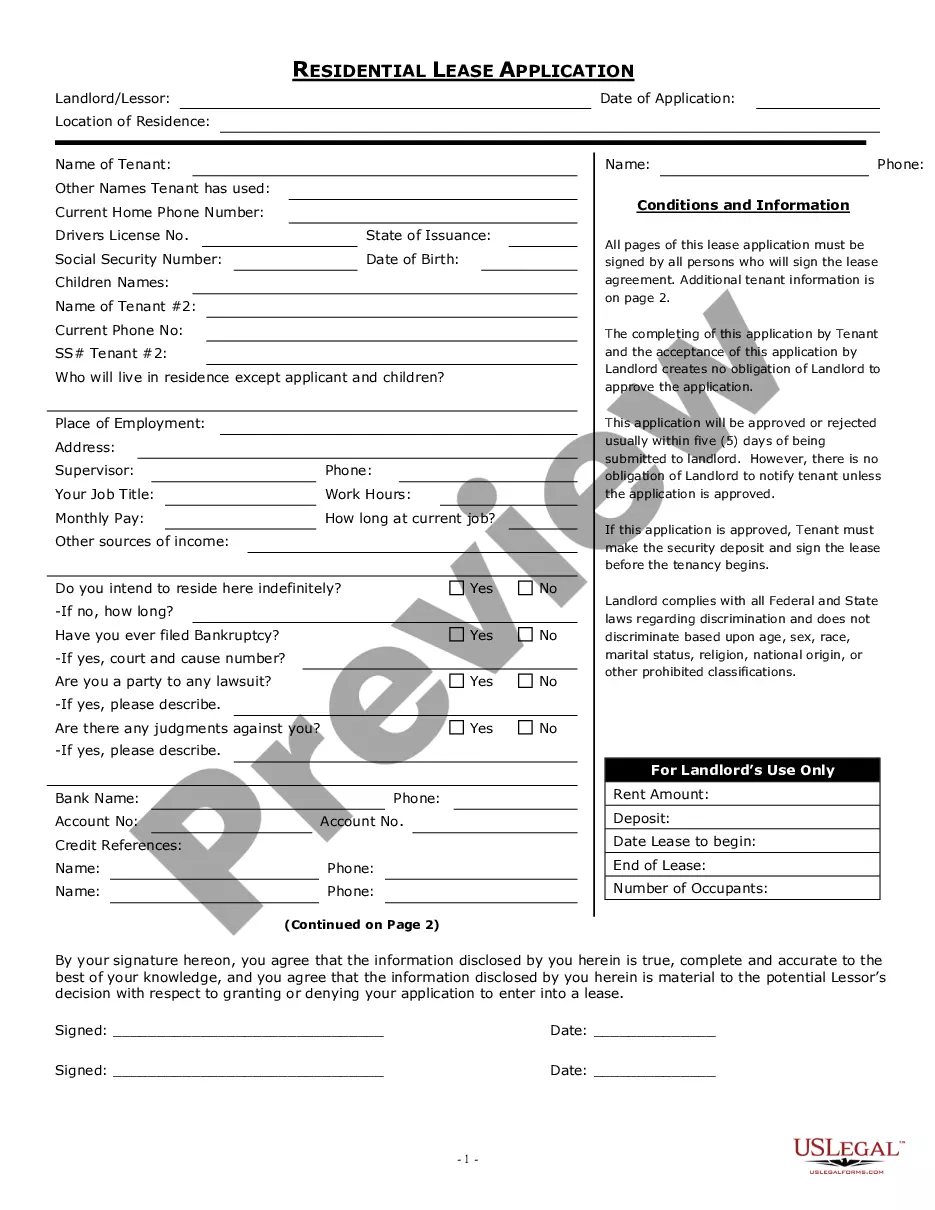

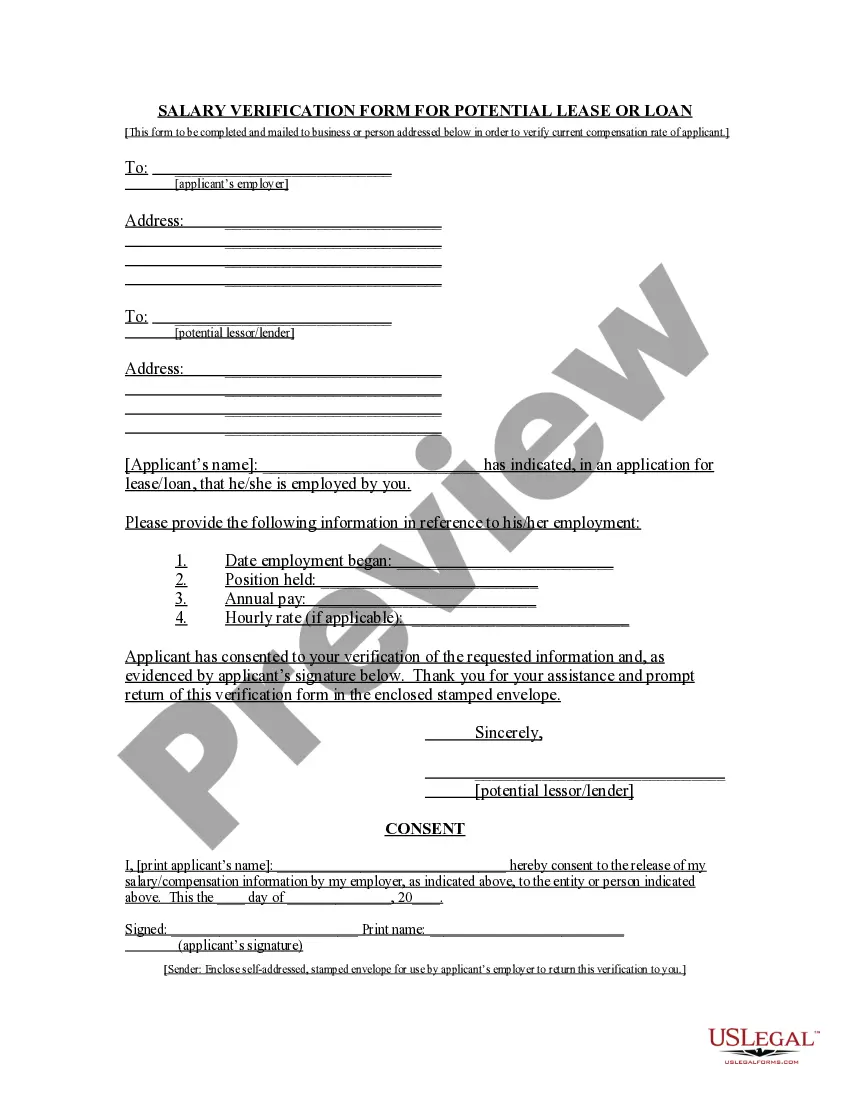

- The templates are classified into state-specific categories, and many can be previewed prior to downloading.

- To access templates, users must have a subscription and Log In to their account.

- Click Download next to any template you desire and locate it in My documents.

- For those without a subscription, adhere to the suggestions below to swiftly find and download the Colorado Notice of Assessment of Lien.

- Ensure that you have the correct template pertinent to the required state.

- Examine the form by reading its description and utilizing the Preview feature.

Hoa Questionnaire Form popularity

Notice Of Assessmnet Other Form Names

FAQ

Unfortunately, it is possible for a lien to be placed on your house without you being aware of it. Unpaid debts, such as contractor fees or taxes, may result in a lien being filed. If you face a Colorado Notice of Assessment of Lien, it is vital to consult with a legal expert to understand your situation and options.

Yes, a lien can be placed on your house without your direct knowledge. For example, unpaid bills or judgments can lead to a lien being filed without you being formally notified. If you receive a Colorado Notice of Assessment of Lien, it is essential to look into the matter immediately and understand the implications.

To check for liens in Colorado, you can access public records through county clerk offices or online databases. Tools are available to view property records and any associated lien filings. If you receive a Colorado Notice of Assessment of Lien, verifying the information can help you take appropriate action.

In Rhode Island, a lien generally remains on a property for ten years. However, it may be renewed if necessary. If you encounter a Colorado Notice of Assessment of Lien, it's crucial to be aware of its implications and how long it might affect your property rights.

No, a lien cannot be placed on your property without valid grounds. Generally, liens arise from unpaid debts or legal judgments. It’s essential to understand your rights regarding any Colorado Notice of Assessment of Lien to ensure that the claim is legitimate.

A lien filing notice is a legal document that informs the public about a claim or interest against a property. It acts as a public record that someone has a right to the property due to an unpaid debt or obligation. In Colorado, the Notice of Assessment of Lien is an important aspect that outlines the details of such a claim.

Liens in Washington state operate under similar principles as in other states, requiring you to provide formal notice of your claim against a property. When you file a Washington Notice of Lien, you assert your right to seek repayment for debts owed. It is crucial to follow the state's specific rules regarding the filing process and timelines. If you're unsure, uslegalforms can guide you through the complexities of lien procedures in any state.

Yes, a lien can negatively impact your credit score. When a Colorado Notice of Assessment of Lien is filed against your property, it may show up on your credit report, indicating unpaid debts or obligations. This may affect your ability to secure loans or mortgages. It’s advisable to take quick action to resolve any issues leading to the lien to protect your credit standing.

Yes, you can place a lien against your own property in Colorado, but it's essential to follow the legal procedures correctly. By filing a Colorado Notice of Assessment of Lien, you declare your interest in the property, which may arise from unpaid taxes or other financial obligations. However, it’s important to consult with a legal expert to ensure you understand the implications and procedures involved in filing such a lien.

In Colorado, you have to file your intent to lien within a specific timeframe after the work is completed. Generally, this means you should act within four months for residential projects and within six months for commercial projects. Once you file the Colorado Notice of Assessment of Lien, you provide formal notice of your claim against the property. Timeliness is crucial, as delays can jeopardize your lien rights.