Colorado Revocation of Transfer on Death Deed or TOD - Beneficiary Deed

Definition and meaning

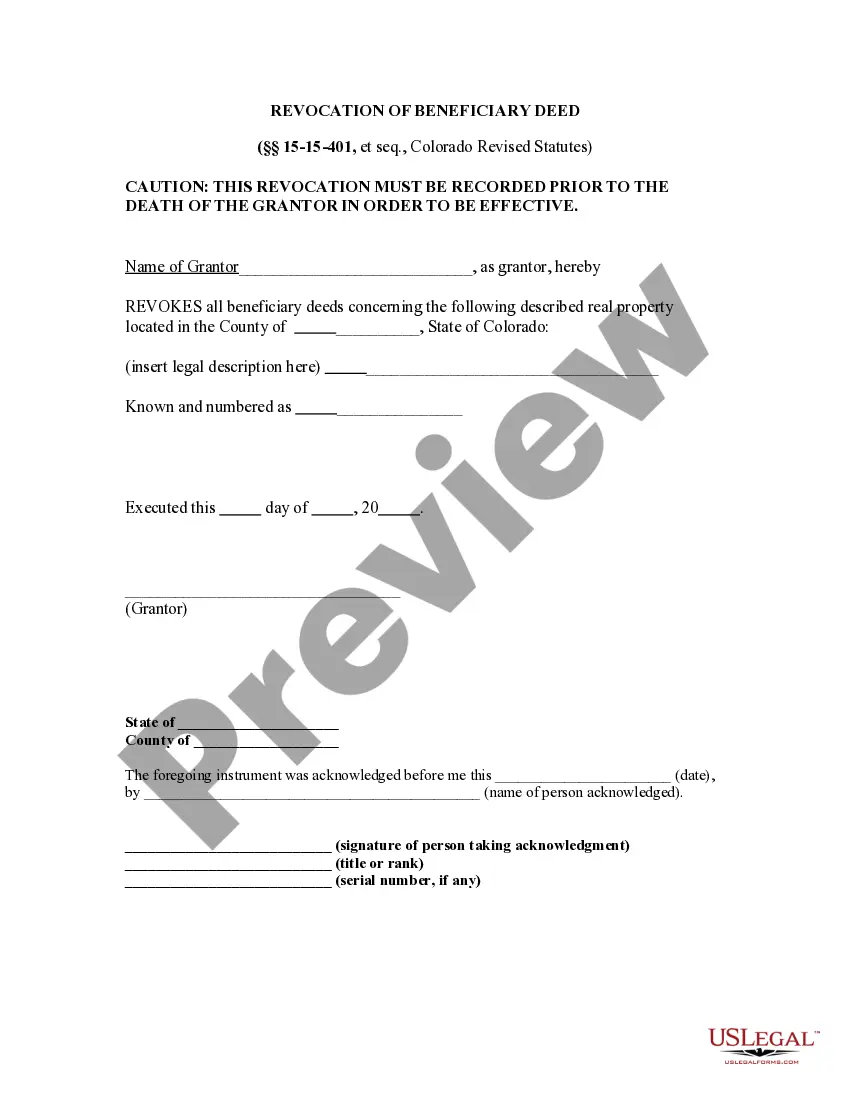

The Colorado Revocation of Transfer on Death Deed, also referred to as a TOD - Beneficiary Deed, is a legal document that allows an individual, known as the grantor, to revoke a previously executed transfer on death deed. This deed is used to designate a beneficiary who will receive real property upon the grantor's death, thereby avoiding probate. By revoking this deed, the grantor eliminates the beneficiary's claim to the property, ensuring that their current wishes regarding property transfer are respected.

How to complete a form

To effectively complete the Colorado Revocation of Transfer on Death Deed, follow these steps:

- Fill in your name as the grantor.

- Provide a clear description of the property that is being revoked.

- Include the county and state where the property is located.

- Sign and date the document on the specified lines.

- Have the form notarized by a licensed notary public.

Ensure that the completed document is recorded with the appropriate county office prior to your death for it to be valid.

Who should use this form

The Colorado Revocation of Transfer on Death Deed is particularly useful for individuals who previously designated a beneficiary for their real property but have since changed their mind. This may apply to individuals in various situations, including:

- Those going through a divorce or separation.

- Individuals who wish to change beneficiaries for personal or financial reasons.

- People who have moved to a different property and want to revoke the deed associated with their previous residence.

It is advisable for any grantor who feels the need to alter their estate planning strategy to consider this revocation.

Legal use and context

This document is vital within the realm of estate planning. In Colorado, the Transfer on Death Deed allows a property owner to designate a beneficiary who will receive the property directly after their passing, thereby streamlining the transfer process. However, should circumstances change, the grantor has the right to revoke this designation with the proper documentation. The legal framework for this revocation is outlined in the Colorado Revised Statutes under sections 15-15-401 and following.

Benefits of using this form online

Using online services for the Colorado Revocation of Transfer on Death Deed offers several advantages:

- Accessibility: Users can complete the form at their convenience from any location.

- Guidance: Online services often provide step-by-step instructions and tips to ensure that the form is filled out correctly.

- Efficiency: Users can quickly download and print the form without the need for an in-person visit, saving time and effort.

Taking advantage of online resources makes the process smoother, especially for those unfamiliar with legal jargon.

Common mistakes to avoid when using this form

When completing the Colorado Revocation of Transfer on Death Deed, be mindful of these common pitfalls:

- Failing to include the legal description of the property.

- Not having the document notarized, which is required for it to be valid.

- Recording the revocation after the grantor’s death, rendering it ineffective.

- Forgetting to sign and date the document properly.

Avoiding these mistakes will ensure that the revocation is honored and implemented as intended.

]]}} }Form popularity

FAQ

One potential problem with transfer on death (TOD) accounts is the risk of disputes among heirs when the account owner passes away. Additionally, if not updated regularly, beneficiaries may be named who no longer reflect the account owner's wishes. It's also important to note that TOD accounts can be subject to creditor claims. To avoid complications, regular reviews of your estate plan using solutions like US Legal Forms can keep your designations aligned with your intentions.

A transfer on death (TOD) deed can be a good idea for simplifying property transfer upon death. It allows for an easy transition of property to beneficiaries while avoiding the complexities of probate. However, it is essential to consider your specific circumstances, including your overall estate plan and family dynamics. Engaging with legal tools from US Legal Forms can clarify if a TOD is suitable for you.

One drawback of a transfer on death (TOD) deed is that it may not cater to all estate planning needs. While it avoids probate, it doesn't address issues like creditor claims against the estate. Additionally, if the beneficiary predeceases the owner, the deed may become void unless designated otherwise. Consequently, it's wise to evaluate your overall estate plan using platforms like US Legal Forms to ensure proper provisions.

A transfer on death (TOD) deed does not inherently avoid capital gains tax in Colorado. Upon the sale of the property, capital gains tax may apply based on the property's appreciated value. It's crucial for beneficiaries to be aware of potential tax implications upon inheriting the property. Consulting with a tax professional can help you understand how the Colorado Revocation of Transfer on Death Deed or TOD - Beneficiary Deed affects your tax situation.

Yes, a beneficiary deed in Colorado allows property to pass directly to the named beneficiary upon the owner's death, thereby avoiding probate. This process simplifies the transfer of property and reduces costs associated with estate settlement. However, ensure the deed is properly drafted and recorded to be effective. Utilizing resources like US Legal Forms can help you create a valid beneficiary deed.

Yes, a beneficiary deed can be contested in Colorado, just like any other part of a will or estate plan. Individuals may challenge the deed on grounds such as lack of capacity or undue influence. It’s essential to understand how the Colorado Revocation of Transfer on Death Deed or TOD - Beneficiary Deed fits within your overall estate strategy, and using a reliable platform like uslegalforms can ease the process of drafting and executing your deed, potentially minimizing disputes.

Removing someone from a deed in Colorado usually requires executing a new deed that specifies the removal. This process often includes drafting a Quitclaim Deed, which effectively transfers any interest the remaining parties may hold. When dealing with the Colorado Revocation of Transfer on Death Deed or TOD - Beneficiary Deed, it’s advisable to consult a legal professional to navigate the nuances of property law and ensure that your updates are legally binding.

To revoke a beneficiary designation, you'll need to follow specific procedures outlined in Colorado's laws regarding the Revocation of Transfer on Death Deed or TOD - Beneficiary Deed. This usually involves creating and executing a new deed that explicitly states the revocation or making written amendments to your original deed. You may also want to consult a legal expert to ensure that all necessary steps are met to avoid confusion in your estate plan.

While both the Colorado Revocation of Transfer on Death Deed or TOD - Beneficiary Deed function to smoothly transfer property ownership, a Transfer on Death Deed typically refers to the direct transfer upon death without a probate process. In contrast, a beneficiary deed, although often interchangeable in common use, generally emphasizes the beneficiary's role in receiving the property's title. Understanding these differences can help you make informed decisions about your estate plan.

A beneficiary deed, including the Colorado Revocation of Transfer on Death Deed or TOD - Beneficiary Deed, does not serve as proof of ownership during the grantor's lifetime. Instead, it ensures that property transfers automatically to the designated beneficiary upon the grantor's death. While it clarifies intentions for inheritance, it is not a title document until that transfer occurs. It's important to understand the deed's role in the broader context of estate planning.