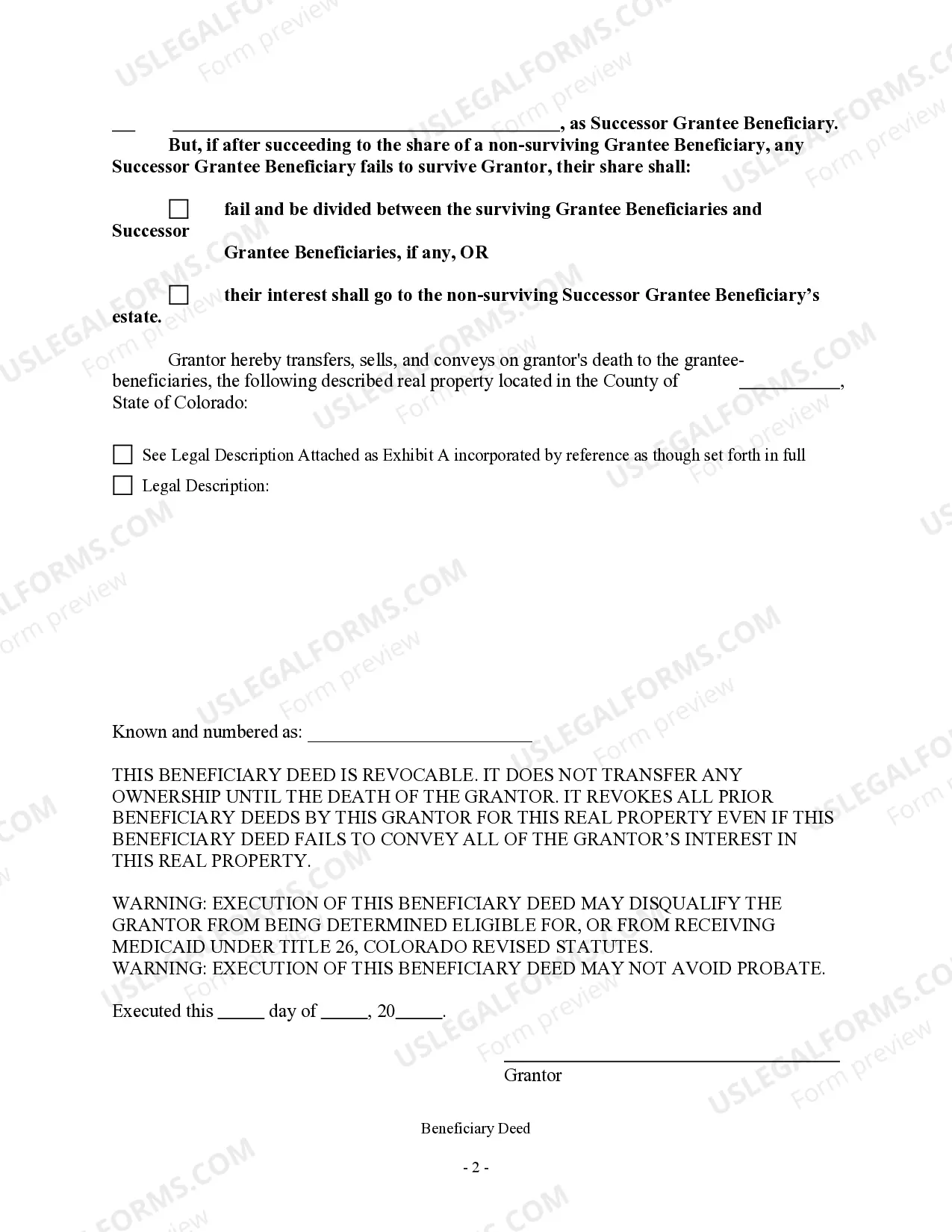

This form is a Beneficiary Deed where the Grantor is an individual and there are five Grantee Beneficiaries. There are also five named Successor Grantee Beneficiaries. Grantor conveys and transfers, upon Grantor's death, to the surviving Grantee Beneficiaries or Successor Grantee Beneficiaries. This deed complies with all state statutory laws.

Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries

Description Transfer Death Beneficiary Form

How to fill out Deed Beneficiary Beneficiaries?

If you're looking for precise Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries samples, US Legal Forms is exactly what you need; obtain documents provided and verified by state-licensed lawyers.

Utilizing US Legal Forms not only spares you from frustrations related to legal documents; it also conserves time, effort, and money! Downloading, printing, and completing a professional form is considerably cheaper than hiring an attorney to handle it for you.

And that's it. In just a few easy clicks, you have an editable Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries. Once your account is established, all future requests will be handled even more effortlessly. If you have a US Legal Forms subscription, simply Log Into your profile and click the Download option available on the form’s webpage. Then, when you need to use this template again, you'll always be able to access it in the My documents menu. Don't waste your time and effort scouring numerous forms across various online sources. Acquire professional templates from a single reliable service!

- Start by completing your registration process with your email and creating a secure password.

- Follow the steps below to establish your account and locate the Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries template that meets your requirements.

- Utilize the Preview tool or review the file description (if available) to ensure that the template is the one you require.

- Verify its legal validity in your jurisdiction.

- Click Buy Now to place your order.

- Choose a suitable pricing plan.

- Create your account and pay with a credit card or PayPal.

- Select an appropriate format and save the form.

Transfer Death Tod Form popularity

Transfer Tod Beneficiary Other Form Names

Tod Beneficiaries Contract FAQ

Writing a beneficiary deed requires specific information, including the grantor's name, a legal description of the property, and the beneficiary names. You should structure the deed clearly, specifying how the property will transfer upon your death. It's important to ensure that it meets Colorado state requirements, as mistakes can lead to confusion or legal issues later. Resources like uslegalforms can provide templates and guidance to help you write an effective Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries.

Filling out a Colorado beneficiary deed involves providing key information such as your name, the description of the property, and the names of your chosen beneficiaries. It’s important to use clear and concise language while ensuring compliance with state requirements. Additionally, be mindful of including any necessary witness signatures or notarization, which can validate the document. For a seamless process, you can utilize tools available on uslegalforms to guide you through the details.

To transfer a Colorado Transfer on Death Deed to two beneficiaries, you must clearly list both names in the deed. It is essential to specify how the property will be divided between the beneficiaries—equally or in other proportions. The proper wording in the deed is crucial to ensure that your intentions are carried out as you wish. You may want to consult legal resources or platforms like uslegalforms for assistance in drafting the deed correctly.

Yes, Colorado allows the use of Transfer on Death Deeds. This legal instrument enables you to designate beneficiaries who will inherit your property upon your passing, thus avoiding probate. The state’s acceptance of TOD deeds makes estate planning more straightforward and efficient for individuals and families. If you’re considering this option, ensure that your deed is properly drafted to comply with Colorado laws.

A Colorado Transfer on Death Deed, or TOD deed, and a beneficiary deed serve a similar purpose, but there are key differences. A TOD deed allows you to transfer property ownership to beneficiaries upon your death without going through probate, while a beneficiary deed, specifically named in Colorado law, accomplishes the same goal but might have variations in how it’s structured. Both deeds can name multiple beneficiaries, but the specific language and stipulations may differ. Understanding these distinctions can help you choose the right option based on your needs.

While you can complete a Transfer on Death Deed in Colorado without a lawyer, consulting one can be beneficial for ensuring compliance and accuracy. An attorney can help clarify your options and ensure the Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries meets all legal requirements. If you prefer, platforms like US Legal Forms provide templates and guidance for creating your deed correctly.

Filing a Transfer on Death Deed in Colorado involves several key steps. First, create the deed that complies with state guidelines, ensuring it specifies that it is a Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries. Then, sign the document before a notary public and submit it to your local county clerk and recorder. This simple process allows your chosen beneficiaries to inherit your property directly.

Yes, Colorado is a TOD state, which means it allows property owners to designate beneficiaries who will inherit their real estate automatically upon their death. This process simplifies the transfer of ownership and helps avoid probate, making it easier for your heirs. Utilizing the Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries enhances your estate planning significantly.

To file a Transfer on Death Deed (TOD) in Colorado, you must first create the deed according to state laws. Once you draft the Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries, you need to sign it in front of a notary public. After signing, file the deed with the county clerk and recorder's office in the county where the property is located. This ensures your deed is legally recognized and effective upon your passing.

While a Colorado Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries offers several advantages, one notable disadvantage is that it may delay the full transfer of property until the grantor's death. This could cause complications if there are disagreements among beneficiaries or if any incumbent debts exist. It's vital to weigh these factors before deciding if a TOD is the right choice for your estate planning needs.