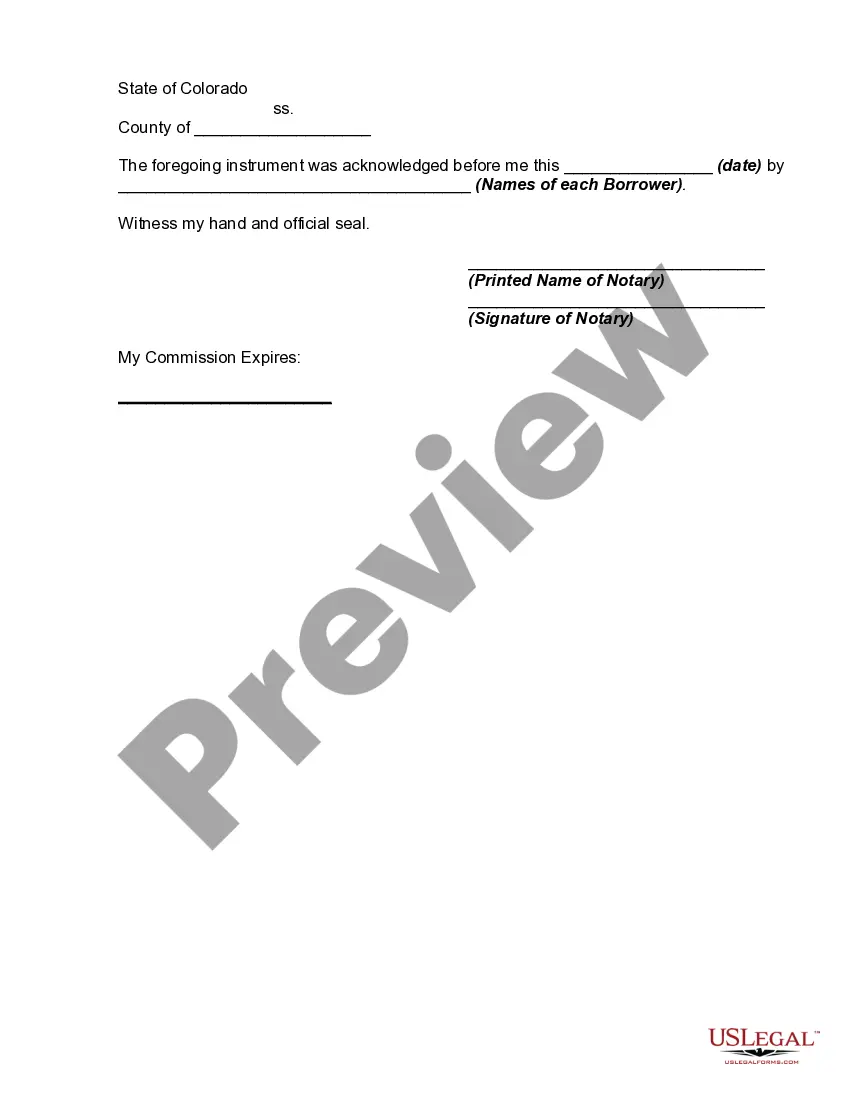

A deed-in-lieu of foreclosure involves the voluntary transfer of title (ownership) from the borrower to a lender in lieu of foreclosure. The advantage for the lender is the cost of acquisition is less than a foreclosure sale and title is gained faster. The advantage for the borrower is the avoidance of a foreclosure and potential deficiency judgment. Lenders are generally reluctant to accept a "deed in lieu" unless the title is free and clear of any other encumbrances junior to theirs and the owners execute an estoppel affidavit acknowledging that they are acting without duress and with informed consent.

The deed in lieu of foreclosure agreement provides the framework of the relationship between the borrower and the lender after the borrower provides the lender with a deed in lieu of foreclosure. The reason for such an agreement is that the borrower frequently receives incentives from the lender for executing such an agreement, including release of personal liability and, possibly, a cash payment. The agreement also describes all of the financial obligations and any other concerns that the lender should have with regard to the property.