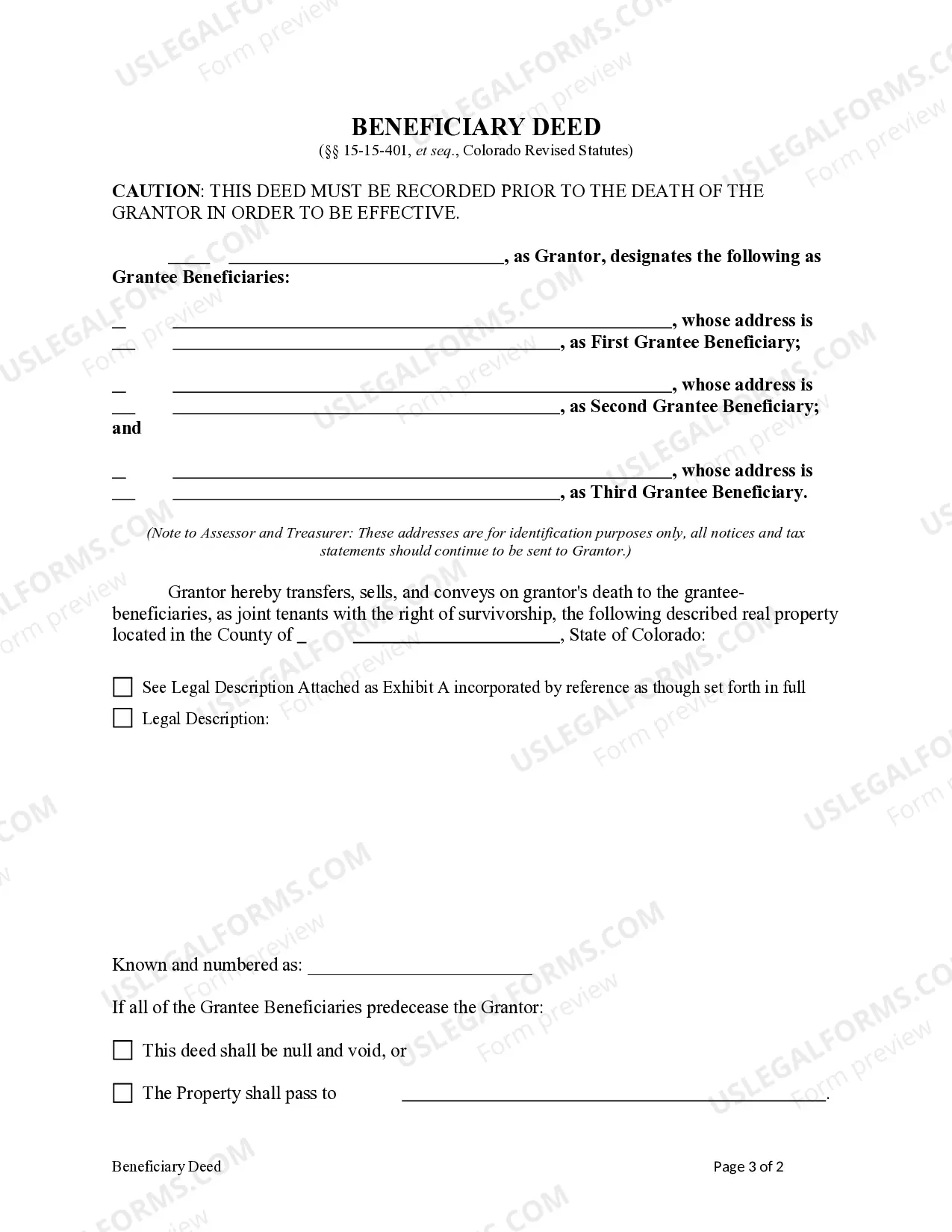

This form is a Beneficiary Deed where the Grantor is an individual and there are three Grantee Beneficiaries. The Grantees take the property as joint tenants with the right of survivorship upon the death of the Grantor. Grantor conveys and transfers, upon Grantor's death, to the surviving Grantee Beneficiaries. This deed complies with all state statutory laws.

Colorado Beneficiary Deed - Individual to Three Individuals

Description

Key Concepts & Definitions

Beneficiary Deed: A legal document used to transfer property ownership upon the death of the property owner, without the need for probate. Real Estate: Refers to land and any permanent improvements attached to it, whether natural or man-made. Estate Planning: The act of preparing for the transfer of a person's wealth and assets after their death. Transfer Ownership: Passing the rights of property from one individual to another. Legal Clarity: The clarity and unambiguity of legal documents and processes.

Step-by-Step Guide: Creating a Beneficiary Deed from an Individual to Three Individuals

- Consult with a real estate or estate planning attorney to understand the legal requirements in your state.

- Determine the property to be transferred and gather the necessary property and ownership documents.

- Identify the three individuals (beneficiaries) and obtain their legal information.

- Prepare the beneficiary deed document specifying the transfer of ownership to the three beneficiaries upon your demise.

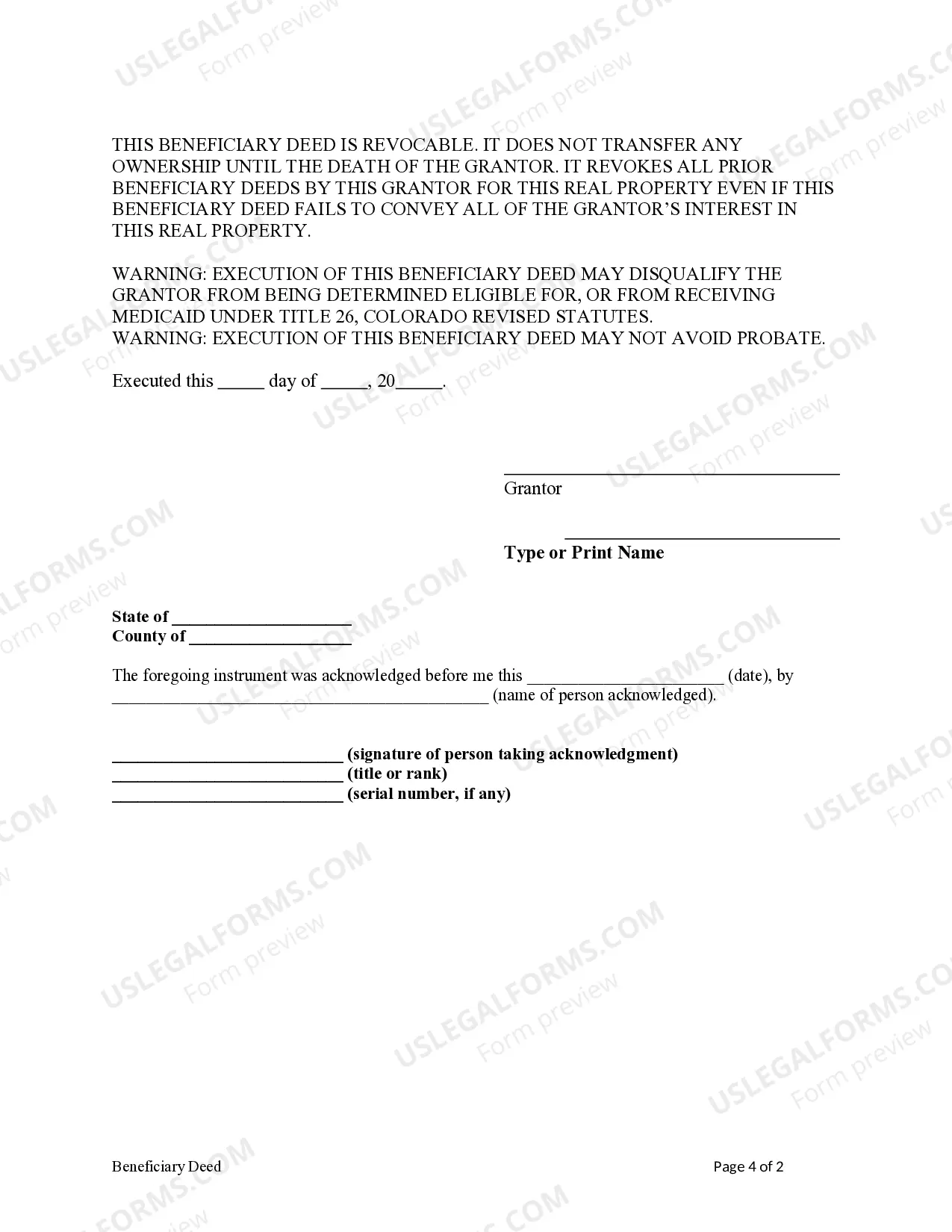

- Ensure all parties, including witnesses or a notary, sign the deed as required by your state laws, particularly if in states like Colorado.

- Complete the recording process by filing the signed deed with the local county recorders office to legally validate the transfer.

Risk Analysis

- Probate Avoidance: Beneficiary deeds are often used to avoid the lengthy and costly probate process.

- Tax Implications: While beneficiary deeds can avoid some taxes, they may not shield against all tax liabilities. Consulting a tax advisor is recommended.

- Dispute Risk: With multiple beneficiaries, the potential for disputes increases. It is crucial to provide clear instructions and legal clarity in the deed.

- Reversal Difficulty: Changing a beneficiary deed can be more complex than altering a will. It requires the same formalities as creating the original deed.

Best Practices

- Ensure the beneficiary deed explicitly states how ownership is divided among the three beneficiaries to avoid ambiguity.

- Regularly review and update the deed as circumstances change (e.g., the death of a beneficiary).

- Use clear and precise language to minimize misunderstandings and legal challenges.

- Consider implications of joint ownership, such as the right of survivorship among the beneficiaries.

Common Mistakes & How to Avoid Them

- Not using a professional: Always involve legal professionals when drafting and filing a beneficiary deed to ensure all local laws are followed and the document is legally binding.

- Failing to record the deed: Ensure the beneficiary deed is recorded properly at the local county recorders office to make it effective. This is part of the key recording process.

- Overlooking tax implications: Consult tax professionals to understand potential tax impacts, especially in estate planning scenarios.

How to fill out Colorado Beneficiary Deed - Individual To Three Individuals?

If you're in search of accurate Colorado Beneficiary Deed - Individual to Three Individuals samples, US Legal Forms is precisely what you require; discover documents created and verified by state-authorized legal experts.

Using US Legal Forms not only relieves you from concerns regarding legal documentation; furthermore, you save time, effort, and finances! Downloading, printing, and completing a professional template is significantly more affordable than hiring a lawyer to do it for you.

And that’s it. With a few simple steps, you receive an editable Colorado Beneficiary Deed - Individual to Three Individuals. Once you establish an account, all future requests will be processed even more seamlessly. When you have a US Legal Forms subscription, just Log In to your account and click the Download button visible on the form's webpage. Subsequently, when you need to access this template again, you'll always be able to locate it in the My documents section. Don’t squander your time and energy sifting through numerous forms on various platforms. Obtain expert templates from a single reliable service!

- To begin, complete your registration process by providing your email address and setting up a password.

- Follow the steps outlined below to create your account and acquire the Colorado Beneficiary Deed - Individual to Three Individuals template to address your requirements.

- Utilize the Preview option or review the document details (if available) to confirm that the form is the one you desire.

- Verify its validity in your jurisdiction.

- Click Buy Now to place an order.

- Select a preferred payment plan.

- Create your account and pay using your credit card or PayPal.

- Choose a suitable file format and save the document.

Form popularity

FAQ

The best way to add someone to a deed is to execute a new deed that names both parties, making it clear who owns the property. You can use a Colorado Beneficiary Deed - Individual to Three Individuals if you plan for the property to transfer to the additional person or persons after your death. It’s advisable to consult with a legal professional to ensure all steps are followed correctly and avoid potential issues down the line.

No, an individual cannot add their name to a deed without the permission of the current property owner. This is critical for maintaining clear title and avoiding potential disputes. In cases where a Colorado Beneficiary Deed - Individual to Three Individuals is involved, ensuring proper consent from all parties is essential to formalize any changes related to property ownership without complications.

In Colorado, a beneficiary deed allows an individual to transfer property to up to three individuals upon their death without going through probate. To be valid, the Colorado Beneficiary Deed - Individual to Three Individuals must be signed by the grantor and recorded with the county clerk and recorder's office where the property is located. Additionally, it’s important for the deed to specify the names of the beneficiaries clearly and ensure they are eligible to receive the property.

To file a Colorado Beneficiary Deed - Individual to Three Individuals, start by preparing the deed according to legal requirements. Once completed, you must sign the document and have it notarized. Then, file it with the county clerk and recorder's office in the area where the property is located. Using platforms like USLegalForms can help you navigate this process easily and efficiently.

Yes, you can add a third person to your deed, but it requires specific actions to update your Colorado Beneficiary Deed - Individual to Three Individuals. You will need to prepare and file an amended deed with the appropriate county clerk and recorder's office. It's advisable to consult with a legal expert to ensure that this process is completed correctly.

You can list multiple individuals on a real estate deed in Colorado. The exact number may vary based on the type of deed, but generally, you can include several names. However, when using a Colorado Beneficiary Deed - Individual to Three Individuals, it is recommended to limit it to three for clarity and ease of processing.

Typically, you can name up to three individuals as beneficiaries on your Colorado Beneficiary Deed - Individual to Three Individuals. This flexibility allows you to include multiple heirs or co-beneficiaries, which can simplify the transfer process. It's essential to communicate with all parties involved to ensure everyone understands their rights and responsibilities.

In Colorado, you can designate up to three individuals on your beneficiary deed. This arrangement helps ensure that all designated parties can benefit from the property upon your passing. However, it is crucial to consider the dynamics among these individuals to prevent potential disputes or complications.

A Colorado Beneficiary Deed - Individual to Three Individuals may have some disadvantages. One issue is that it might not provide creditor protection for the property. Beneficiary deeds also do not allow for control over the property once it is transferred, which can become an issue if the beneficiaries do not agree on how to manage the property.

Yes, you can add someone to your deed without refinancing your mortgage. This process involves submitting a new ownership deed while preserving the current mortgage terms. A Colorado Beneficiary Deed - Individual to Three Individuals allows for this addition efficiently, ensuring your mortgage situation remains intact.