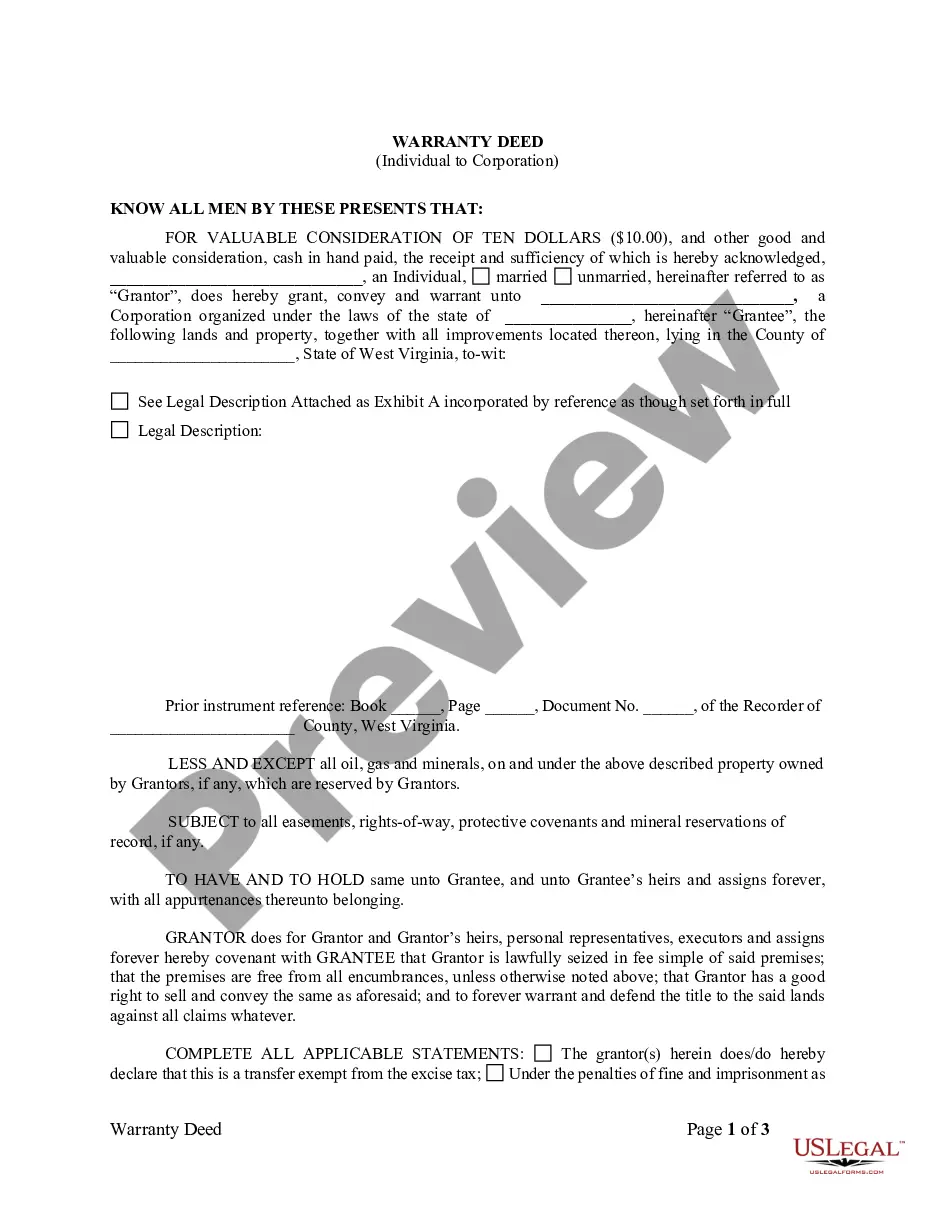

Transfer on Death Deed - Colorado - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals: This deed is used to transfer the ownership or title of a parcel of land, upon the death of the last surviving Grantor, to the Grantees. It does not transfer any present ownership interest in the property and is revocable at any time. Further, it must be recorded prior to death of last Grantor.

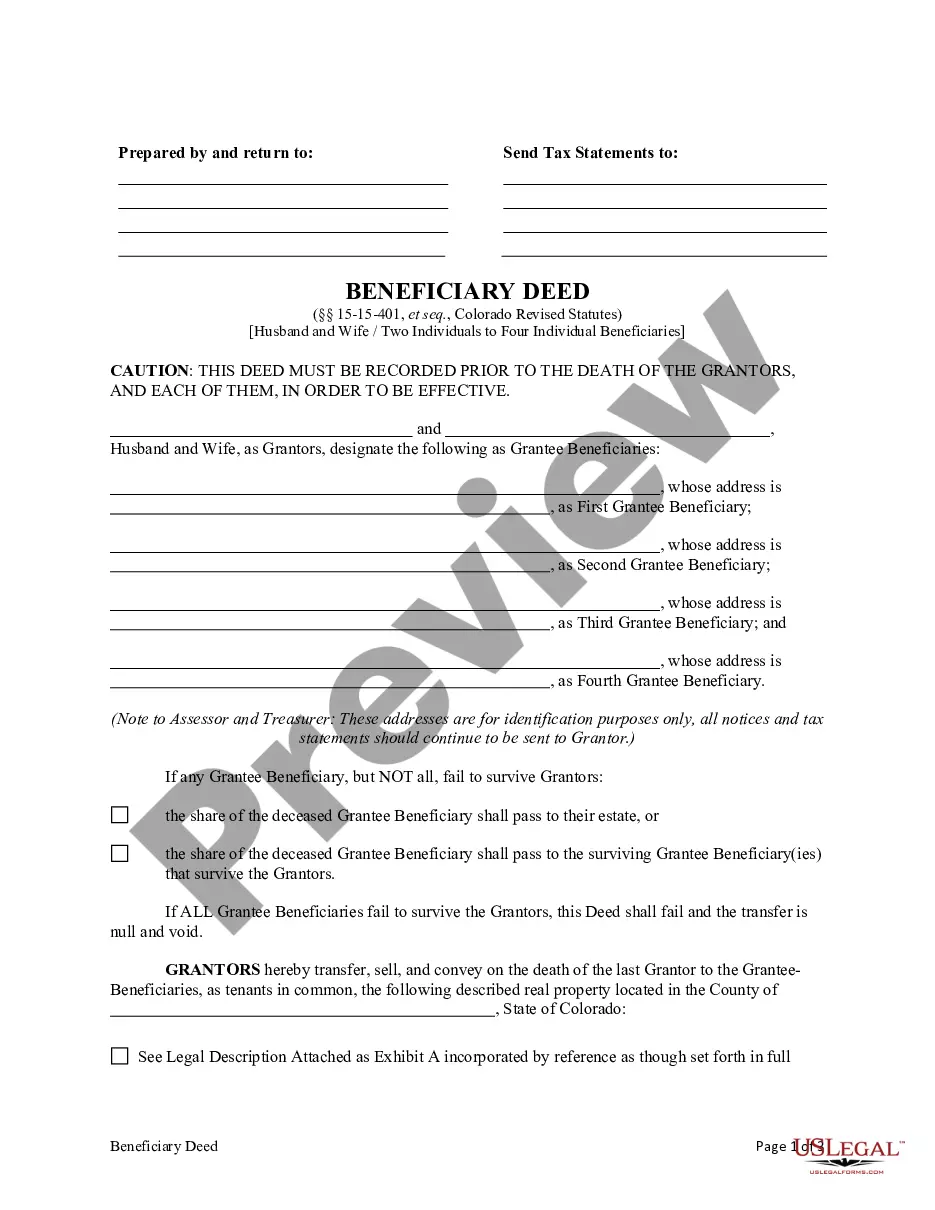

Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries

Description

How to fill out Colorado Beneficiary Deed - Husband And Wife / Two Individuals To Four Individual Beneficiaries Without Successor Beneficiaries?

If you are looking for accurate Colorado Beneficiary Deed - Spouses / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries examples, US Legal Forms is what you require; access files supplied and verified by state-authorized legal professionals.

Using US Legal Forms not only saves you from inconveniences related to legal documents; you also conserve time, effort, and money! Downloading, printing, and submitting a professional template is considerably more cost-effective than hiring an attorney to do it for you.

And that's it. In a few simple clicks, you have an editable Colorado Beneficiary Deed - Spouses / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries. Once you create an account, all future transactions will be even easier. After obtaining a US Legal Forms subscription, simply Log In to your account and click the Download option found on the form’s webpage. Subsequently, when you need to use this template again, you will consistently find it in the My documents section. Don't waste your time and energy searching through numerous forms on multiple websites. Order precise copies from one reliable platform!

- Initiate your enrollment process by entering your email and creating a password.

- Follow the steps outlined below to set up your account and obtain the Colorado Beneficiary Deed - Spouses / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries template to address your situation.

- Utilize the Preview feature or review the document details (if available) to ensure that the template is the one you require.

- Verify its validity in your area.

- Click Buy Now to place an order.

- Select a preferred pricing plan.

- Create an account and pay through credit card or PayPal.

- Choose a suitable format and save the document.

Form popularity

FAQ

You can obtain a beneficiary deed in Colorado from several sources, including your local county clerk's office and online legal service providers like uslegalforms. They offer templates and instructions tailored to the Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries scenario. Alternatively, consulting a qualified attorney can also help you draft and acquire the necessary documentation effectively. Regardless of the route you choose, ensure you have all the necessary details ready.

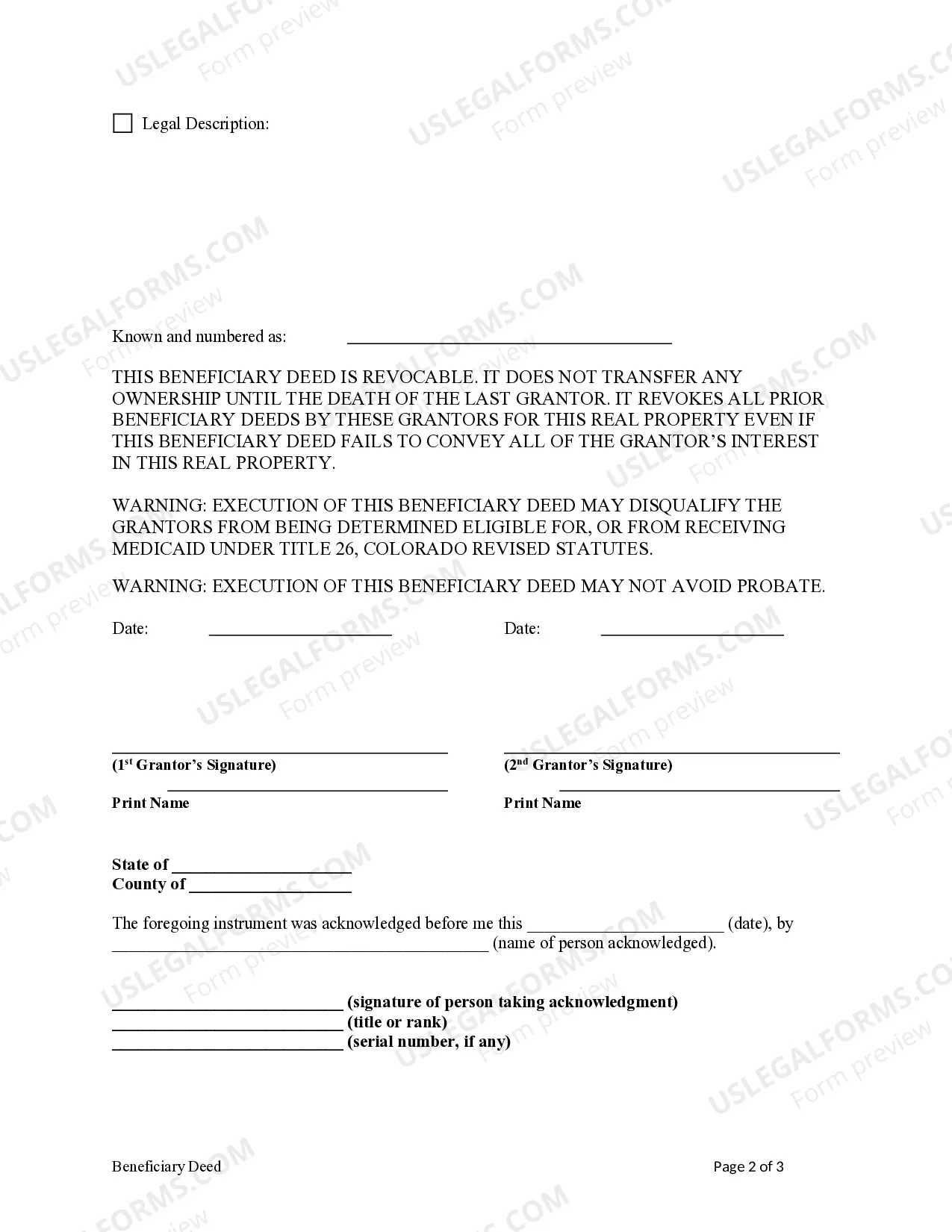

Filing a beneficiary deed in Colorado involves preparing the deed properly, ensuring that it includes the necessary details about the property and beneficiaries. Once ready, you must file it with your local county clerk and recorder's office. This process establishes the transfer of property upon your passing, avoiding probate. Using uslegalforms can simplify this process, as you can find templates and guidance specific to creating a Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries.

To transfer a property deed from a deceased relative in Colorado, you typically need to acquire the death certificate and the existing property deed. Next, execute a Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries if one exists, as this will simplify the transfer process. If a beneficiary deed does not exist, you might need to initiate probate to formally transfer ownership. Don't forget to consult with a legal expert to ensure compliance with local laws.

In general, a transfer on death deed does not directly impact inheritance tax obligations. However, properties transferred using a Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries may not be included in the taxable estate, depending on specific state laws. It is also advisable to consult a tax professional to evaluate your unique situation. For further assistance, using platforms like USLegalForms can provide resources to navigate these tax implications.

One key disadvantage of a transfer on death deed is that it does not offer protection against creditors. If your estate has outstanding debts, creditors may still claim against the property. Additionally, you cannot include successor beneficiaries, limiting flexibility in your estate planning. Understanding these aspects of the Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is crucial to creating a comprehensive estate plan.

Yes, you can designate two beneficiaries on a transfer on death (TOD) deed in Colorado. This allows you to share your property with both individuals, ensuring that ownership transfers directly to them after your passing. The rights of the beneficiaries are established upon your death, which can streamline the distribution process. Implementing a Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries helps maintain clarity in your estate plan.

While it is not mandatory to hire a lawyer for a transfer on death deed, seeking legal advice can be beneficial. Legal professionals can ensure that you correctly fill out the Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries, adhering to state requirements. They can also guide you through any potential pitfalls, making the process smoother and providing you peace of mind. Platforms like USLegalForms offer templates and information that make it easier to proceed on your own.

In Colorado, a beneficiary deed allows you to transfer property to designated individuals upon your death. To create a valid Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries, you must properly execute the deed, including proper witnesses and notary acknowledgment. Additionally, it is vital to record the deed with the county clerk and recorder's office to ensure its legality. Keep in mind that specific rules apply, so consulting a professional can clarify any complexities.

While it is not mandatory to hire a lawyer for a transfer on death (TOD) deed, consulting with one can prevent potential issues. A Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries can be complex, and an attorney can provide valuable guidance on your specific situation. Furthermore, using resources like USLegalForms can help simplify the process by offering templates and instructions tailored to your needs.

To create a valid beneficiary deed in Colorado, you must be the current owner of the property and the deed must meet specific legal criteria. For a Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries, the deed should include the names of the beneficiaries and must be signed and notarized. Additionally, it must be recorded with the county clerk to ensure it is enforceable.