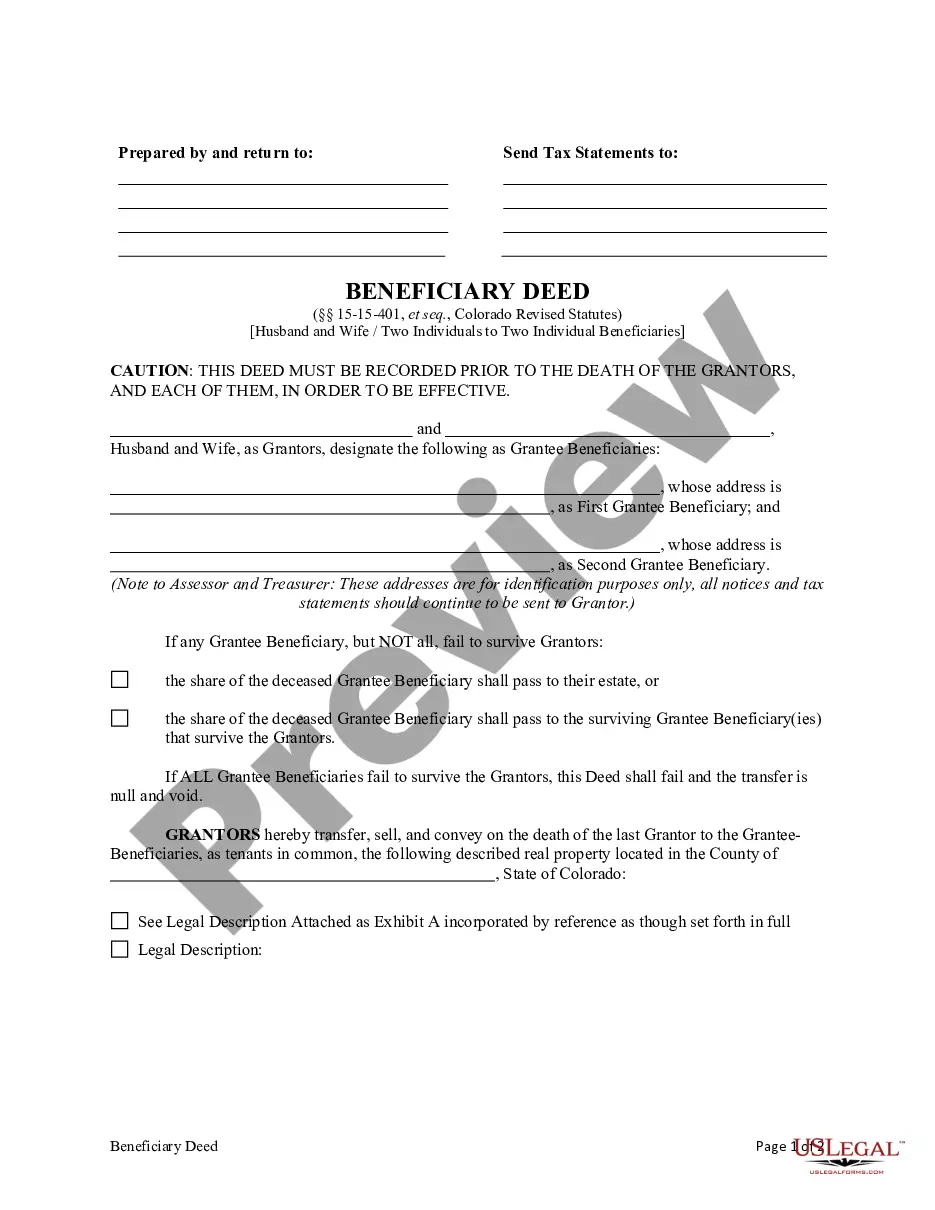

This form is a Beneficiary Deed where the Grantors are two individuals, or husband and wife, and there are two individual Grantee Beneficiaries. There are NO named Successor Grantee Beneficiaries. Grantors convey and transfer, upon the death of the survivor Grantor, to the surviving Grantee Beneficiaries. This Deed is not effective unless recorded prior to either Grantor's death. This deed complies with all state statutory laws.

Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries

Description

How to fill out Colorado Beneficiary Deed - Husband And Wife / Two Individuals To Two Individual Beneficiaries Without Successor Beneficiaries?

If you're seeking precise Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries documents, US Legal Forms is what you require; obtain files formulated and reviewed by state-licensed attorneys.

Utilizing US Legal Forms not only shields you from concerns regarding legitimate paperwork; moreover, you save effort, time, and money!

And that’s it. In just a few easy steps, you have an editable Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries. After setting up your account, all future requests will be even simpler. Once you have a US Legal Forms subscription, just Log In to your account and click the Download button you see on the form’s page. Later, when you need to utilize this template again, you'll always be able to locate it in the My documents section. Do not waste your time searching multiple forms on various sites. Purchase professional documents from one reliable platform!

- Downloading, printing, and filling out a professional document is significantly less expensive than asking a lawyer to handle it for you.

- To commence, complete your registration process by entering your email and creating a secure password.

- Follow the guidelines below to establish your account and obtain the Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries sample to address your situation.

- Utilize the Preview option or check the document details (if available) to confirm that the form is the right one for your needs.

- Assess its relevance in your location.

- Click Buy Now to place an order.

- Choose a suggested payment plan.

- Create an account and settle the payment with your credit card or PayPal.

Form popularity

FAQ

While a Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries offers significant advantages, such as avoiding probate, there are also disadvantages. For instance, it may not protect your assets from creditors, and the beneficiaries may not receive property if the grantor passes away before recording the deed. Furthermore, it brings challenges in certain situations like divorce. Understanding these factors can help you make informed decisions.

Filing a Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries requires you to prepare the deed according to state laws. Once your deed is drafted, you can file it with the county clerk's office in the county where the property is located. It’s advisable to keep a copy for your records. Using US Legal Forms can help streamline this filing process, as they provide resources and templates.

To record a Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries, you need to visit your local county clerk and recorder's office. Bring the completed deed along with any required fees. After the recording, your deed will officially document the transfer of your property to the designated beneficiaries. This step is crucial for ensuring that your wishes are recognized.

You can obtain a Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries from online legal services, local county offices, or law firms. Many people find that using platforms like US Legal Forms simplifies the process. They offer downloadable templates that you can easily fill out and customize. This makes acquiring the deed more accessible for everyone.

While it is not legally required to hire a lawyer for a Colorado Beneficiary Deed - Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries, consulting one can provide you with peace of mind. A lawyer can help ensure that the deed is completed correctly and complies with Colorado laws. Additionally, they can offer guidance on how the deed may affect your estate planning. If you prefer a straightforward approach, using USLegalForms can simplify the process and ensure you meet all legal requirements.

While it is not legally required to hire a lawyer for a transfer on death deed in Colorado, consulting with one can be beneficial. A legal professional can help ensure that all necessary information is included and that the document complies with state law. Using platforms like uslegalforms can also guide you through the process efficiently.

A Colorado Beneficiary Deed can include multiple individuals as beneficiaries, allowing for flexibility in your estate planning. In fact, you can add two individuals or more, as long as their names and shares are clearly detailed in the deed. This ensures a smoother transfer of property according to your wishes.

While a transfer on death deed can streamline property transfer, it has some disadvantages. For instance, it does not protect the property from creditors or claims against the estate. Additionally, it may complicate relationships if beneficiaries have differing views on property use or distribution later.

To create a transfer on death deed for two beneficiaries, you need to complete the deed form with both beneficiaries' names and specify their shares. Once you have signed the document, you should file it with the appropriate county office. This process allows the property to pass directly to the beneficiaries upon your death.

Yes, you can designate two beneficiaries on a transfer on death deed in Colorado. This arrangement allows for a smooth transfer of property to both individuals without the need for probate court involvement. Be sure to outline each beneficiary's rights clearly to avoid future disputes.