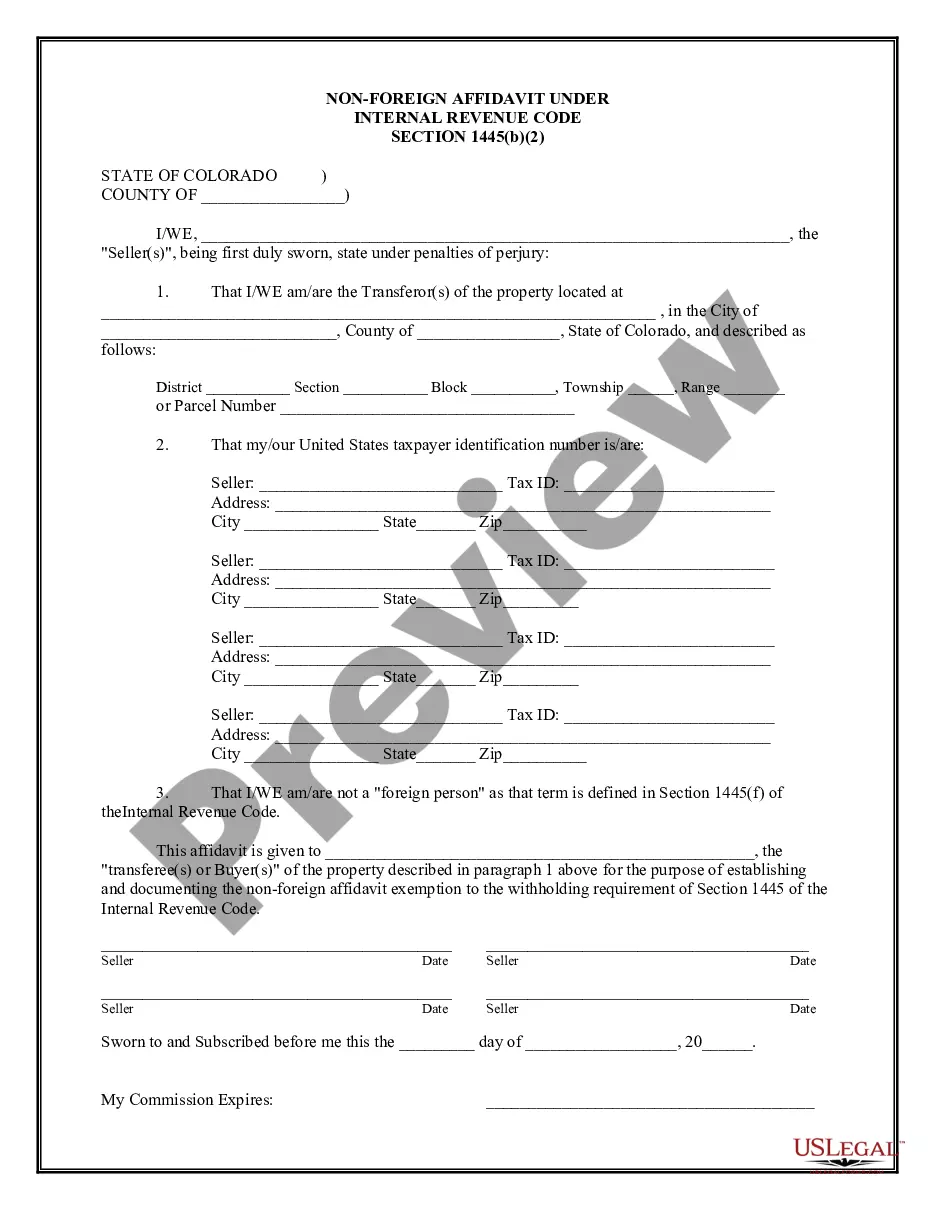

Colorado Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Colorado Non-Foreign Affidavit Under IRC 1445?

The greater number of paperwork you need to create - the more nervous you are. You can find thousands of Colorado Non-Foreign Affidavit Under IRC 1445 blanks on the web, however, you don't know which of them to trust. Eliminate the hassle and make detecting exemplars more convenient using US Legal Forms. Get skillfully drafted forms that are published to satisfy state specifications.

If you have a US Legal Forms subscription, log in to your profile, and you'll find the Download option on the Colorado Non-Foreign Affidavit Under IRC 1445’s web page.

If you’ve never tried our service before, complete the signing up procedure with the following recommendations:

- Make sure the Colorado Non-Foreign Affidavit Under IRC 1445 is valid in your state.

- Re-check your selection by reading through the description or by using the Preview mode if they’re provided for the selected record.

- Click Buy Now to get started on the sign up process and select a rates plan that suits your preferences.

- Insert the requested info to create your account and pay for the order with the PayPal or credit card.

- Choose a hassle-free document type and have your copy.

Access every sample you get in the My Forms menu. Simply go there to fill in new duplicate of the Colorado Non-Foreign Affidavit Under IRC 1445. Even when having professionally drafted templates, it is nevertheless vital that you think about asking the local lawyer to re-check completed form to make certain that your document is accurately completed. Do more for less with US Legal Forms!

Form popularity

FAQ

A FIRPTA statement is a declaration made by the seller regarding their status as a foreign or non-foreign person. This statement is essential for the buyer to determine any withholding taxes. Incorporating a Colorado Non-Foreign Affidavit Under IRC 1445 within this statement ensures that the transaction is clearly defined and compliant with tax regulations.

foreign affidavit is a document that certifies an individual or entity is not a foreign person under U.S. tax law. This affidavit is crucial in real estate transactions to prevent FIRPTA withholding. By submitting a Colorado NonForeign Affidavit Under IRC 1445, you can confirm your status and proceed with your sale smoothly.

Yes, a FIRPTA affidavit generally needs to be notarized to verify the identity of the signer. Notarization adds a layer of trust and authenticity to your document. Using a Colorado Non-Foreign Affidavit Under IRC 1445 can streamline this process, ensuring everything is valid and compliant.

IRS code 1445 defines a foreign person in the context of real estate transactions. Typically, it refers to non-resident aliens and foreign corporations that may be subject to withholding on the sale of U.S. real estate. Understanding this code helps you determine when a Colorado Non-Foreign Affidavit Under IRC 1445 is necessary to clarify your tax status.

A FIRPTA affidavit requires specific information, including the seller's name, tax identification number, and property details. It also needs to state that the seller is not a foreign person, typically verified through a Colorado Non-Foreign Affidavit Under IRC 1445. This documentation prevents unnecessary withholding from the proceeds of the sale.

A FIRPTA statement outlines the seller's status regarding U.S. tax laws. For instance, it states whether the seller is a foreign person or not. By including a Colorado Non-Foreign Affidavit Under IRC 1445 with this statement, you ensure clarity and transparency in your transaction, avoiding potential withholding issues.

Getting around FIRPTA involves obtaining a Colorado Non-Foreign Affidavit Under IRC 1445, which certifies that an individual is not a foreign person. This affidavit can exempt the buyer from withholding taxes on the sale of U.S. property. By using this affidavit, you can simplify your real estate transactions and avoid complex tax situations.

Failing to withhold the required FIRPTA amount can lead to significant penalties for buyers. If a buyer does not withhold from a transaction involving a foreign seller, they may be held liable for the unpaid tax, along with possible interest and penalties from the IRS. Utilizing a Colorado Non-Foreign Affidavit Under IRC 1445 can help avoid these consequences by ensuring proper documentation and compliance during the sale.

To be exempt from FIRPTA withholding, sellers must prove their U.S. residency status. By completing a Colorado Non-Foreign Affidavit Under IRC 1445, sellers affirm they do not fall under foreign status as defined by the IRS. It’s crucial to prepare this affidavit accurately to ensure buyers do not have to withhold any amount during the property transaction.

A section 1445 affidavit serves as a declaration of a seller's non-foreign status under the Foreign Investment in Real Property Tax Act. By submitting this affidavit, sellers can affirm they are U.S. persons, thereby exempting buyers from FIRPTA withholding. Utilizing a Colorado Non-Foreign Affidavit Under IRC 1445 simplifies the selling process and ensures compliance with IRS regulations.