Objection to Calculation of the Amount of Exempt Earnings: This is an official form from the Colorado County Court, which complies with all applicable laws and statutes. USLF amends and updates the Colorado County Court forms as is required by Colorado statutes and law.

Colorado Objection to Calculation of the Amount of Exempt Earnings

Description

How to fill out Colorado Objection To Calculation Of The Amount Of Exempt Earnings?

The greater number of documents you have to prepare - the more stressed you are. You can get a huge number of Colorado Objection to Calculation of the Amount of Exempt Earnings templates online, however, you don't know those to rely on. Remove the headache and make getting samples far more convenient with US Legal Forms. Get skillfully drafted documents that are written to meet state requirements.

If you currently have a US Legal Forms subscribing, log in to the profile, and you'll see the Download option on the Colorado Objection to Calculation of the Amount of Exempt Earnings’s web page.

If you’ve never used our platform before, finish the sign up procedure using these directions:

- Check if the Colorado Objection to Calculation of the Amount of Exempt Earnings is valid in the state you live.

- Re-check your option by reading through the description or by using the Preview mode if they’re available for the chosen file.

- Click Buy Now to begin the registration procedure and choose a pricing plan that suits your requirements.

- Insert the requested information to create your account and pay for your order with the PayPal or credit card.

- Pick a prefered document formatting and acquire your example.

Find every sample you download in the My Forms menu. Simply go there to fill in fresh version of the Colorado Objection to Calculation of the Amount of Exempt Earnings. Even when using professionally drafted templates, it is nevertheless essential that you consider requesting the local legal professional to twice-check filled in sample to make certain that your record is correctly completed. Do much more for less with US Legal Forms!

Form popularity

FAQ

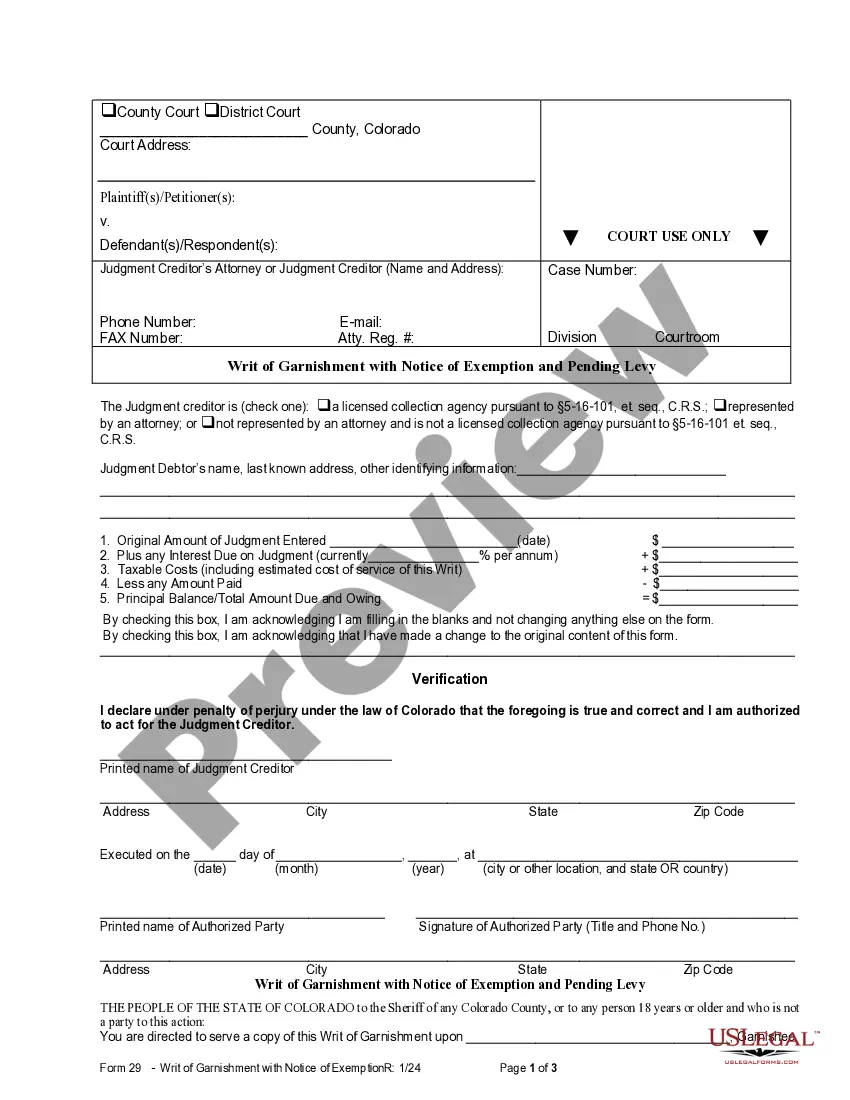

A Writ of garnishment with notice of exemption and pending levy in Colorado is a legal document that informs a debtor about the garnishment process. It outlines the specific amounts that can be taken from the debtor's earnings while also allowing them to claim exemptions. This process helps protect a debtor's essential income, making it vital to understand your rights. If you believe the exemptions calculated are incorrect, you have the option to file a Colorado Objection to Calculation of the Amount of Exempt Earnings through platforms like uslegalforms.

In Colorado, garnishment priority determines the order in which creditors can collect debts. Generally, child support and alimony garnishments take precedence over other types of debts. Understanding the priority of garnishment is crucial because it affects your financial situation and your ability to challenge these actions. If you face issues regarding your earnings, you may consider filing a Colorado Objection to Calculation of the Amount of Exempt Earnings.

In Colorado, exemptions for wage garnishment include a significant portion of your earnings that are protected under state law, ensuring that you retain enough income to meet basic living expenses. Various exemptions apply depending on your financial situation, with specific limitations on how much can be garnished. If your earnings are wrongly calculated, you can file a Colorado Objection to Calculation of the Amount of Exempt Earnings to secure your rightful exemptions.

Stopping wage garnishment in Colorado requires a formal approach, often by filing a motion to contest the garnishment. You can argue that the amount being garnished exceeds your allowable limits, based on the law. Engaging with UsLegalForms will provide you with the necessary templates and guidance to file an effective Colorado Objection to Calculation of the Amount of Exempt Earnings.

Yes, your bank account can be garnished in Colorado, but there are certain protections in place for exempt funds. When a creditor obtains a court order to garnish your account, only non-exempt funds may be seized. If you believe that your exempt earnings are wrongly affected, filing a Colorado Objection to Calculation of the Amount of Exempt Earnings can help protect your assets.

In Colorado, the maximum amount your check can be garnished depends on your disposable earnings and the nature of the debt. Generally, your earnings may be garnished up to 25% if they exceed a specified threshold. Knowing these limits helps you manage your finances better, and if you feel the calculation is incorrect, you can file a Colorado Objection to Calculation of the Amount of Exempt Earnings.

To stop wage garnishment in Colorado, you can request a hearing to challenge the garnishment order. This request allows you to present your case, often related to exemptions. Utilizing resources from UsLegalForms can simplify the process and help you properly file a Colorado Objection to Calculation of the Amount of Exempt Earnings, making it easier to stop garnishment effectively.

The recent changes to garnishment laws in Colorado have aimed to enhance protections for individuals facing financial hardship. The new law adjusts the exempt earnings amount and changes how garnishment calculations are approached. With these updates, debtors obtain more control over their earnings and the ability to file a Colorado Objection to Calculation of the Amount of Exempt Earnings, helping to safeguard their financial stability.

To calculate wage garnishment in Colorado, you begin by determining your disposable income, which is your earnings after tax deductions. The law specifies that creditors can garnish a certain percentage of your disposable earnings. To illustrate, if your disposable earnings exceed a particular threshold, the garnishment will generally be capped at 25%. Understanding this process is crucial, especially when filing a Colorado Objection to Calculation of the Amount of Exempt Earnings.